Question

Please help me to conduct an NPV analysis (with a table) using the following information: Revenue Growth of 50% for the next 5 years in

Please help me to conduct an NPV analysis (with a table) using the following information:

Revenue Growth of 50% for the next 5 years in all the Revenue Segments

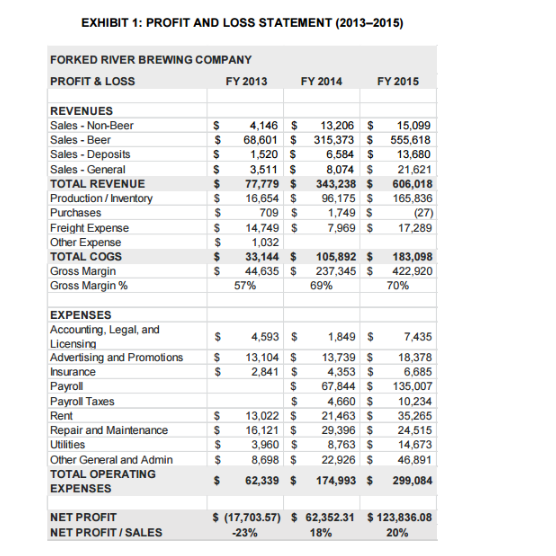

2. COGS increase of 3% in first 3 years and 6% in the remaining 2 years. COGS has been computed as a % of total sales and on that value the increase of 3% for first 3 years and 6% for the next 2 years has been assumed.

3. Since Capital Value and the depreciation value are missing the Repairs and Maintenance has been increased by 50% every year

4. Payroll Tax rate has been increased by 10% consistently over a period of 5 years. This is computed as a % of sales for 2015 and increased by 10% in value terms.

5. All other Expenses have been assumed to be the same % of sales as 2015.

6. For Computation purpose of NPV, Discount Rate of 10% has been taken.

Basis the above assumptions, the NPV comes to $422,950. Please refer the workigns below. Excel can be shared if required.

The COGS in the below working has increased higher than the sales growth and hence the company is not profitable in the long run.

EXHIBIT 1: PROFIT AND LOSS STATEMENT (2013-2015) FORKED RIVER BREWING COMPANY PROFIT& LOSS FY2013 FY2014 FY2015 Sales Non-Beer Sales Beer 68.601 315,373 555,618 S 1,520 6,584 13,680 Sales-Deposits Sales General 3,511 8,074 21.621 TOTAL REVENUE 77,779 343,238 606,018 Production/Inventory 16,654 96,175 165,836 Purchases 709 1,749 (27) Freight Expense 14,749 7,969 17,289 Other Expense 1,032 33,144 105,892 183,098 TOTAL COGS S 44,635 237,345 422.920 Gross Margin 70% Gross Margin% 57% 69% EXPENSES 1 s Accounting, Legal, and 4,593 1,849 7435 Licensing Advertising and Promotions 13,104 13,739 S 18,378 Insurance 2841 4,353 6.685 67,844 135.007 Parol Payroll Taxes 4,660 10,234 Rent 13,022 21,463 35,265 16,121 29,396 24.515 Repair and Maintenance Utilities 3,960 8,763 14,673 Other General and Admin is 8,698 22,926 46.891 s 62339 174993 s 299,084 TOTAL OPERATING EXPENSES NET PROFIT (17,703.57) 62,352.31 $123,836.08 NET PROFIT/SALES 18% 20%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started