Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me to do this project. i am new and i am confused how to do this. and i need all the entry to

please help me to do this project. i am new and i am confused how to do this. and i need all the entry to do this and all the ledgers and cash sale invoice, bank deposit slip, purchase order, receiving report and everything to complet this project. please o would really appriciate.

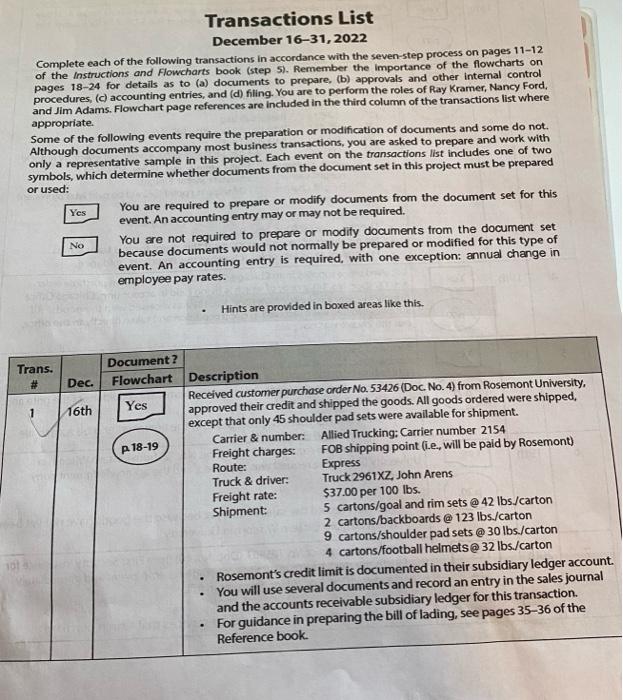

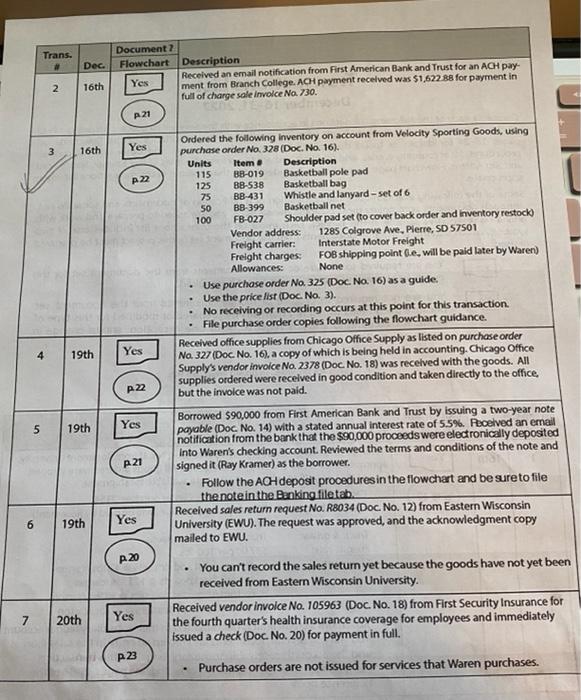

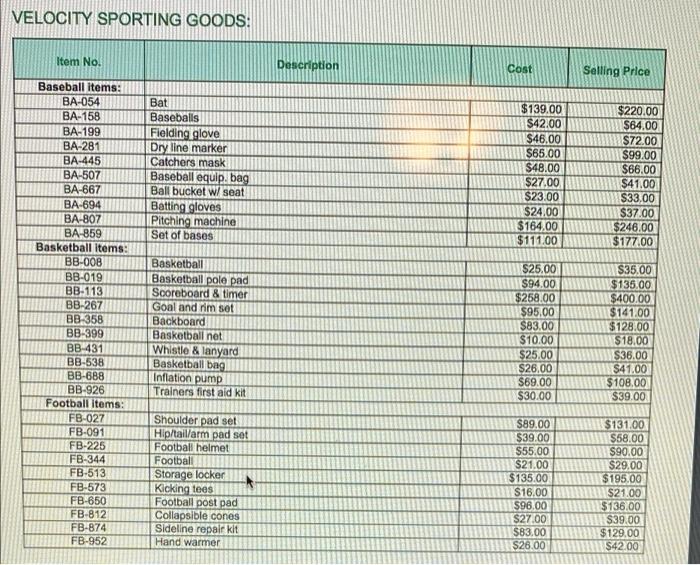

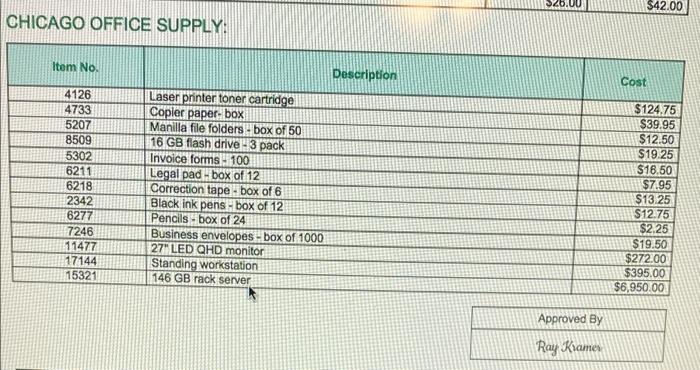

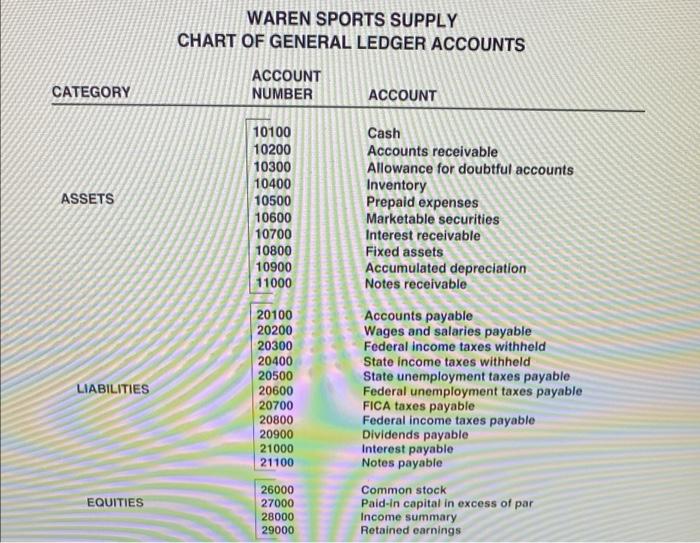

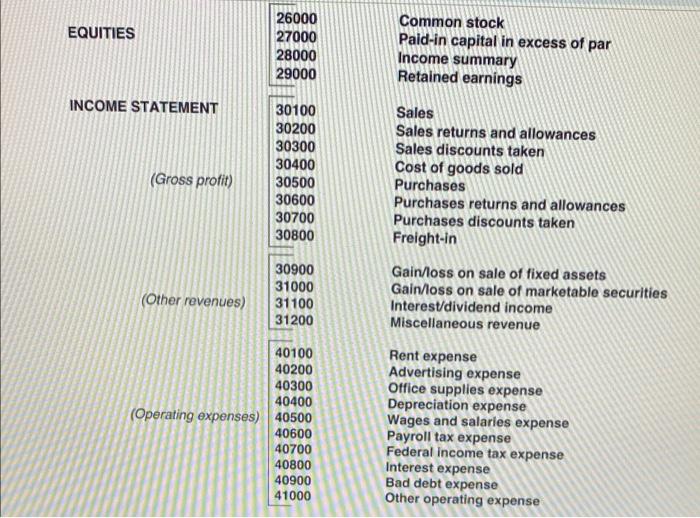

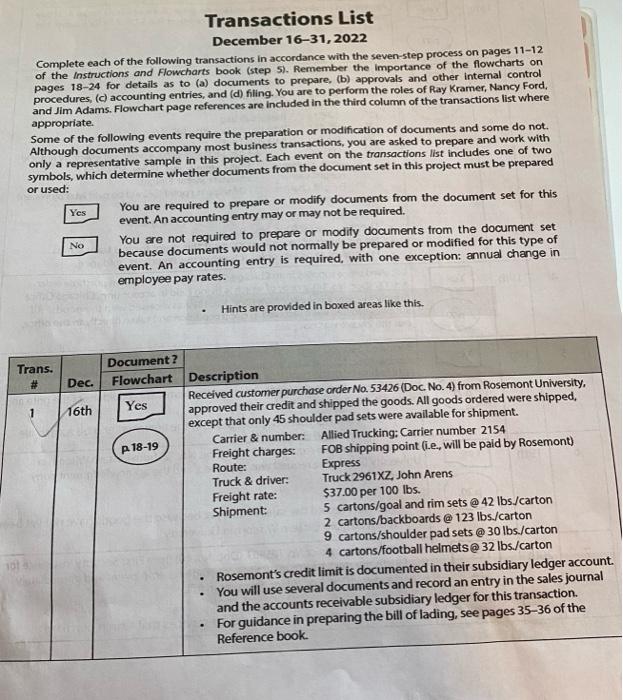

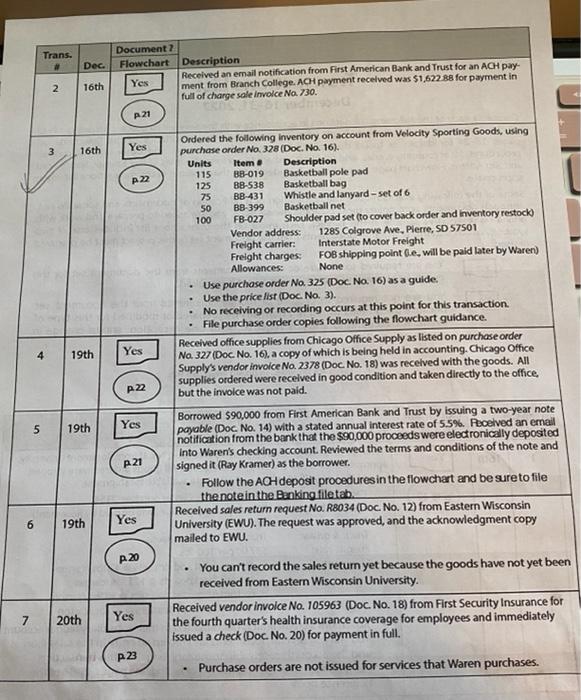

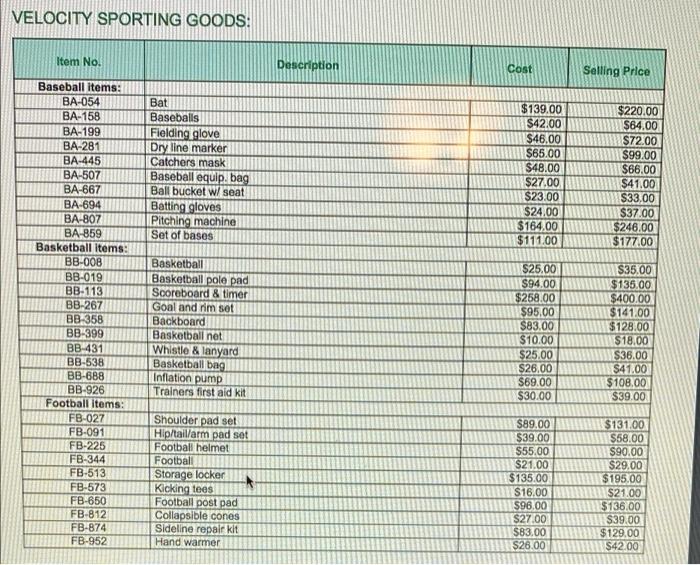

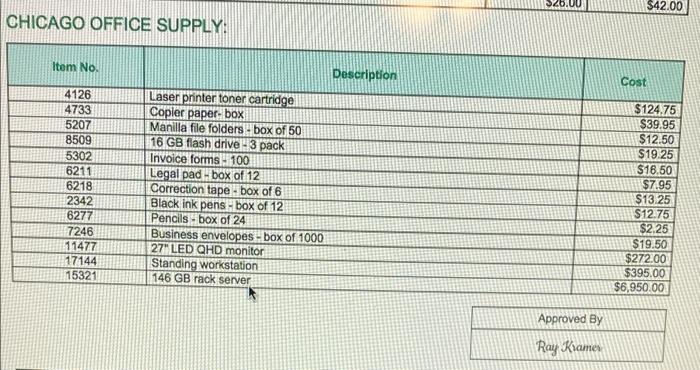

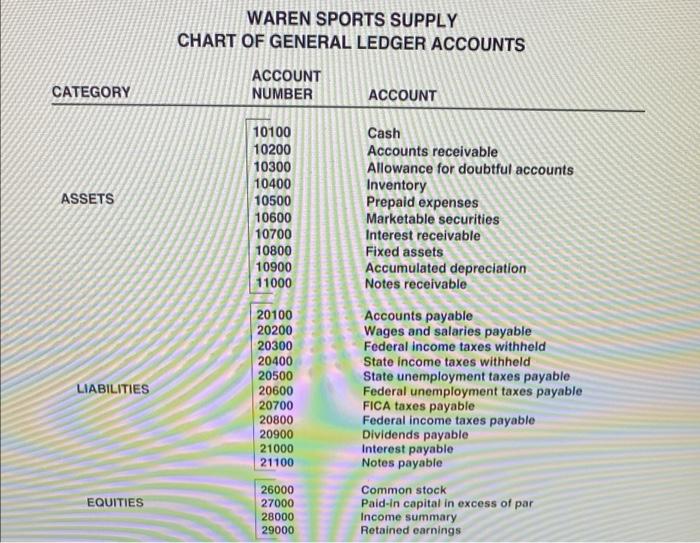

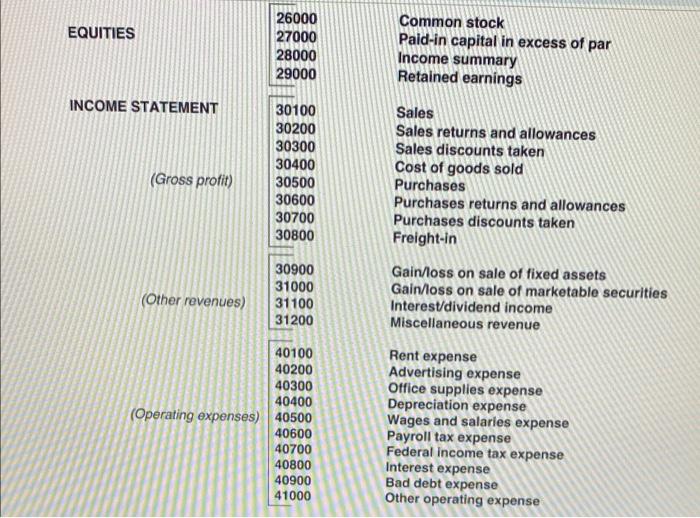

Transactions List December 16-31, 2022 Complete each of the following transactions in accordance with the seven-step process on pages 11-12 of the Instructions and Flowcharts book (step 5). Remember the importance of the flowcharts on pages 18-24 for details as to (a) documents to prepare, (b) approvals and other internal control procedures, accounting entries, and (d) filing. You are to perform the roles of Ray Kramer, Nancy Ford, and Jim Adams. Flowchart page references are included in the third column of the transactions list where appropriate Some of the following events require the preparation or modification of documents and some do not. Although documents accompany most business transactions, you are asked to prepare and work with only a representative sample in this project. Each event on the transactions list includes one of two symbols, which determine whether documents from the document set in this project must be prepared or used: Yes You are required to prepare or modify documents from the document set for this event. An accounting entry may or may not be required. No You are not required to prepare or modify documents from the document set because documents would not normally be prepared or modified for this type of event. An accounting entry is required, with one exception: annual change in employee pay rates. Hints are provided in boxed areas like this. Trans. Dec. 1 16th A 18-19 Document? Flowchart Description Received customer purchase order No. 53426 (Doc No. 4) from Rosemont University, Yes approved their credit and shipped the goods. All goods ordered were shipped, except that only 45 shoulder pad sets were available for shipment. Carrier & number: Allied Trucking: Carrier number 2154 Freight charges: FOB shipping point (ie, will be paid by Rosemont) Route: Express Truck & driver: Truck 2961XZ, John Arens Freight rate: $37.00 per 100 lbs. Shipment: 5 cartons/goal and rim sets @ 42 lbs./carton 2 cartons/backboards @ 123 lbs./carton 9 cartons/shoulder pad sets @ 30 lbs./carton 4 cartons/football helmets@ 32 lbs./carton Rosemont's credit limit is documented in their subsidiary ledger account. You will use several documents and record an entry in the sales journal and the accounts receivable subsidiary ledger for this transaction. For guidance in preparing the bill of lading, see pages 35-36 of the Reference book ol . . Trans. # Dec. 2 16th Document Flowchart Description Yes Received an email notification from First American Bank and Trust for an ACH pay ment from Branch College. ACH payment received was $1,622 88 for payment in full of charge sale involce No. 730. A 21 1000 3 16th Yes A 22 . . Ordered the following inventory on account from Velocity Sporting Goods, using purchase order No. 328 (Doc. No. 16). Units Item Description 115 BB-019 Basketball pole pad 125 BB-538 Basketball bag 75 BB-431 Whistle and lanyard - set of 6 50 BB-399 Basketball net 100 FB-027 Shoulder pad set (to cover back order and inventory restock) Vendor address: 1285 Colgrove Ave, Plerre, SD 57501 Freight carrier: Interstate Motor Freight Freight charges: FOB shipping point e, will be paid later by Waren) Allowances: None Use purchase order No. 325 (Doc. No. 16) as a guide. Use the price list (Doc. No. 3). No receiving or recording occurs at this point for this transaction File purchase order copies following the flowchart guidance. Received office supplies from Chicago Office Supply as listed on purchase order No. 327 (Doc. No. 16). a copy of which is being held in accounting. Chicago Office Supply's vendor invoice No. 2378 (Doc No. 18) was received with the goods. All supplies ordered were received in good condition and taken directly to the office but the invoice was not paid. Borrowed 590,000 from First American Bank and Trust by issuing a two-year note payable (Doc No. 14) with a stated annual interest rate of 5.5%. Pocelved an email notification from the bank that the $90,000 proceeds were electronically deposited Into Waren's checking account. Reviewed the terms and conditions of the note and signed it (Ray Kramer) as the borrower. Follow the ACH deposit procedures in the flowchart and be sure to file the note in the Bunking filetab Received sales return request No. R8034 (Doc No. 12) from Eastern Wisconsin University (EWU). The request was approved, and the acknowledgment copy mailed to EWU. 4 19th Yes P22 A00 5 19th Yes P21 6 19th Yes A 20 You can't record the sales return yet because the goods have not yet been received from Eastern Wisconsin University Received vendor invoice No. 105963 (Doc. No. 18) from First Security Insurance for the fourth quarter's health insurance coverage for employees and immediately issued a check (Doc. No. 20) for payment in full. 7 20th Yes P23 Purchase orders are not issued for services that Waren purchases. VELOCITY SPORTING GOODS: Item No. Description Cost Selling Price Bat Baseballs Fielding glove Dry line marker Catchers mask Baseball equip bag Ball bucket W/ seat Betting gloves Pitching machine Set of bases $139.00 $42.00 $46.00 $65.00 $48.00 $27.00 $23.00 $24.00 $164.00 $111.00 $220.00 $64.00 $72.00 $99.00 $66.00 $41.00 $33,00 $37.00 $246.00 $177.00 Baseball items: BA-054 BA-158 BA-199 BA-281 BA-445 BA-507 BA-667 BA-694 BA-807 BA-859 Basketball items: BB-008 BB-019 BB-113 BB-267 BB-358 BB-399 BB-431 BB-538 BB-688 BB-926 Football Items: FB-027 FB-091 FB-225 FB-344 FB-513 FB-573 FB-650 FB-812 FB-874 FB-952 Basketball Basketball pole pad Scoreboard & timer Goal and im set Backboard Basketball net Whistle & lanyard Basketball bag Inflation pump Trainers first aid kit $25.00 $94.00 $258.00 $95.00 $83.00 $10.00 $25.00 $26.00 $69.00 $30.00 $35.00 $135.00 $400.00 $141.00 $128.00 $18.00 $36.00 $41.00 $108.00 $39.00 Shoulder pad set Hip/taillarm pad set Football helmet Football Storage locker Kicking tees Football post pad Collapsible cones Sideline repair kit Hand warmer $89.00 $39.00 $55.00 $21.00 $135.00 $16.00 $96.00 $27.00 $83.00 $26.00 $131.00 $58.00 $90.00 $29.00 $195.00 $21.00 $136.00 $39.00 $129.00 $4200 SZO $42.00 CHICAGO OFFICE SUPPLY: Item No. Description Cost 4126 4733 5207 8509 5302 6211 6218 2342 6277 72 11477 17144 15321 Laser printer toner cartridge Copler paper.box Manilla file folders - box of 50 16 GB flash drive - 3 pack Invoice forms - 100 Legal pad - box of 12 Correction tape : box of 6 Black ink pens - box of 12 Pencils - box of 24 Business envelopes - box of 1000 27" LED QHD monitor Standing workstation 146 GB rack server $124.75 $39.95 $12.50 $19.25 $16.50 $7.95 $1325 $12.75 $2.25 $19.50 $272.00 $395.00 $6,950.00 Approved By Ray Krames WAREN SPORTS SUPPLY CHART OF GENERAL LEDGER ACCOUNTS ACCOUNT NUMBER ACCOUNT CATEGORY ASSETS 10100 10200 10300 10400 10500 10600 10700 10800 10900 11000 Cash Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Marketable securities Interest receivable Fixed assets Accumulated depreciation Notes receivable LIABILITIES 20100 20200 20300 20400 20500 20600 20700 20800 20900 21000 21100 Accounts payable Wages and salaries payable Federal income taxes withheld State income taxes withheld State unemployment taxes payable Federal unemployment taxes payable FICA taxes payable Federal income taxes payable Dividends payable Interest payable Notes payable EQUITIES 26000 27000 28000 29000 Common stock Paid-in capital in excess of par Income summary Retained earnings EQUITIES 26000 27000 28000 29000 Common stock Paid-in capital in excess of par Income summary Retained earnings INCOME STATEMENT (Gross profit) 30100 30200 30300 30400 30500 30600 30700 30800 Sales Sales returns and allowances Sales discounts taken Cost of goods sold Purchases Purchases returns and allowances Purchases discounts taken Freight-in (Other revenues) 30900 31000 31100 31200 Gain/loss on sale of fixed assets Gain/loss on sale of marketable securities Interest/dividend income Miscellaneous revenue 40100 40200 40300 40400 (Operating expenses) 40500 40600 40700 40800 40900 41000 Rent expense Advertising expense Office supplies expense Depreciation expense Wages and salaries expense Payroll tax expense Federal income tax expense Interest expense Bad debt expense Other operating expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started