Question

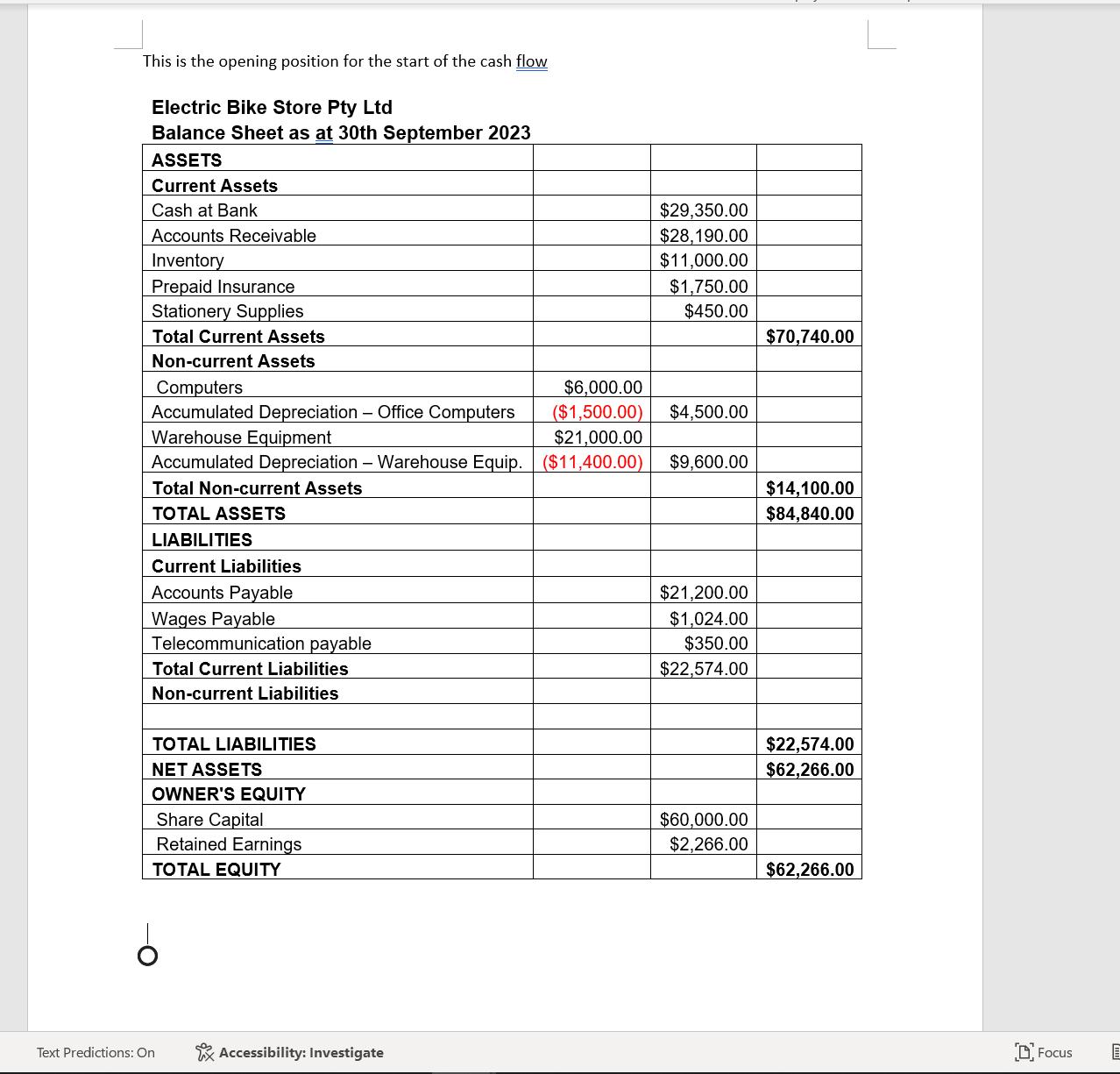

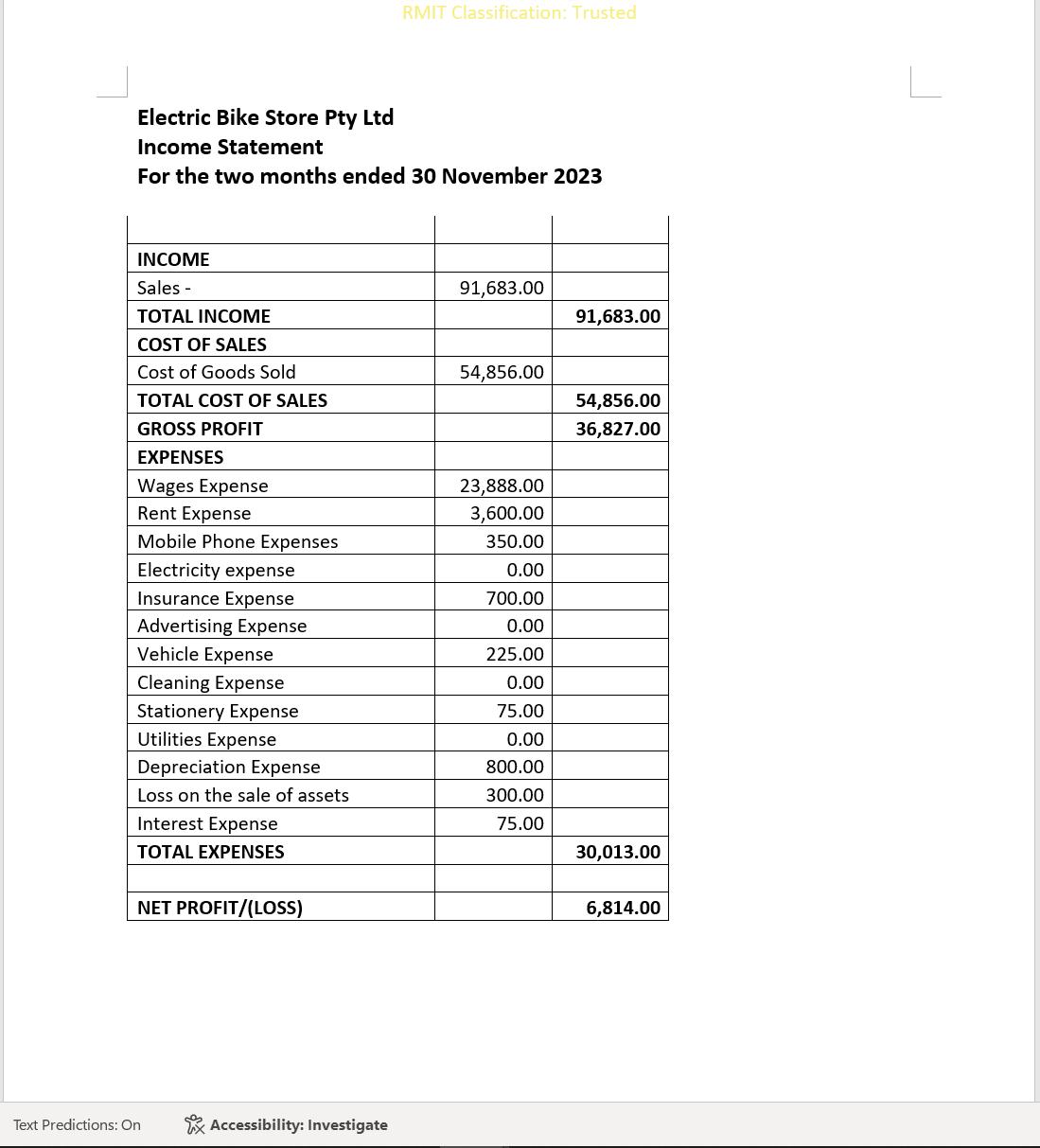

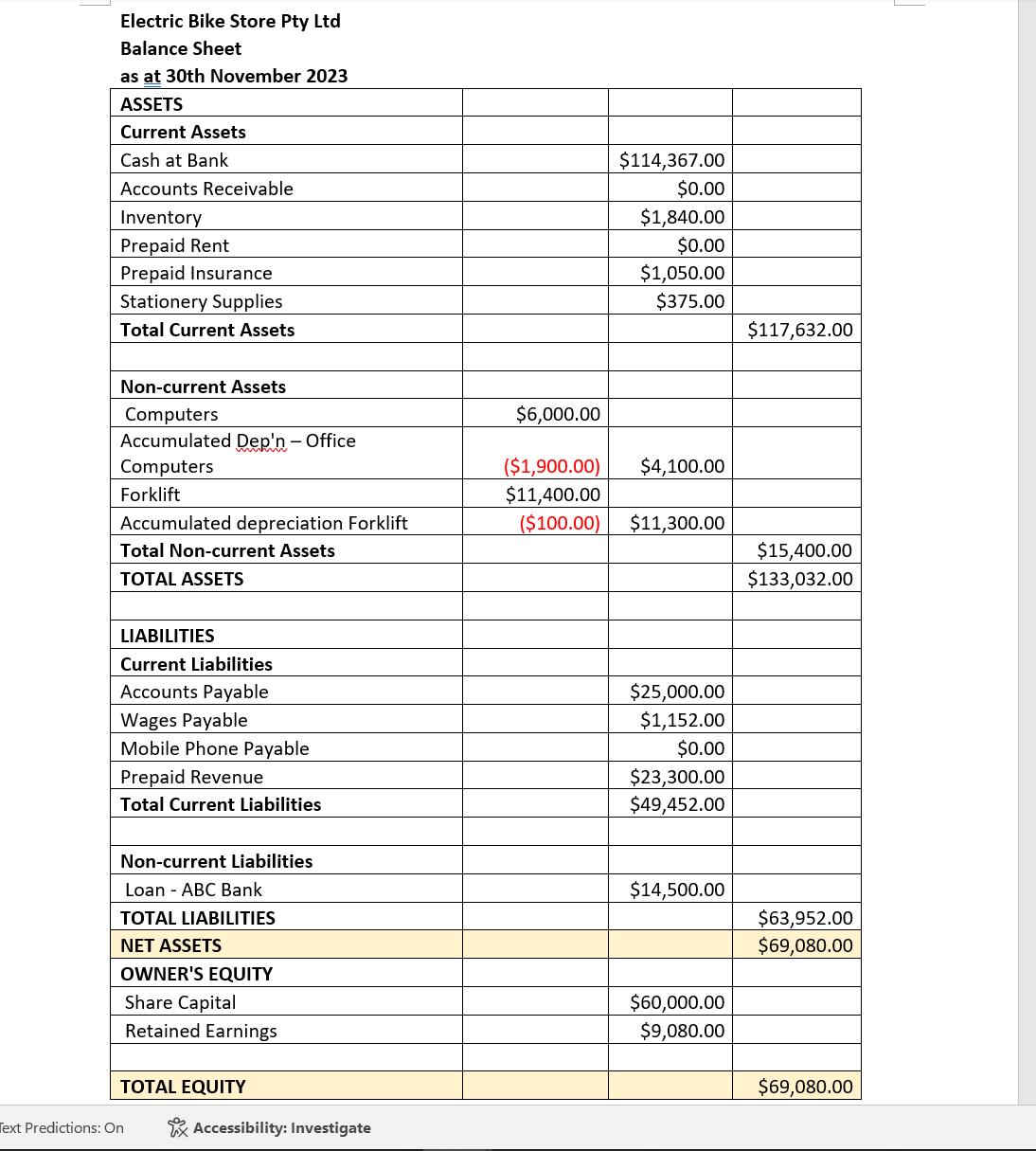

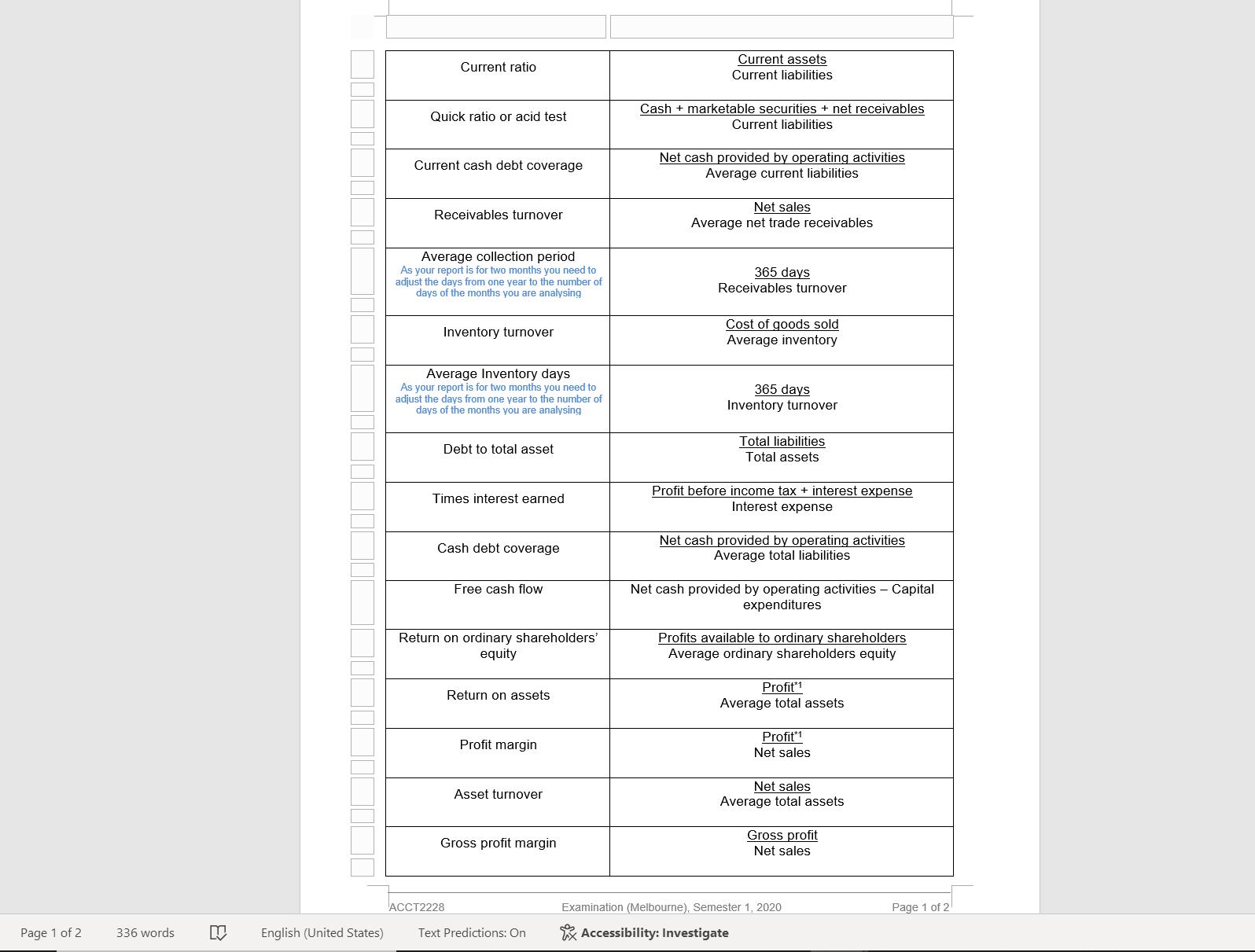

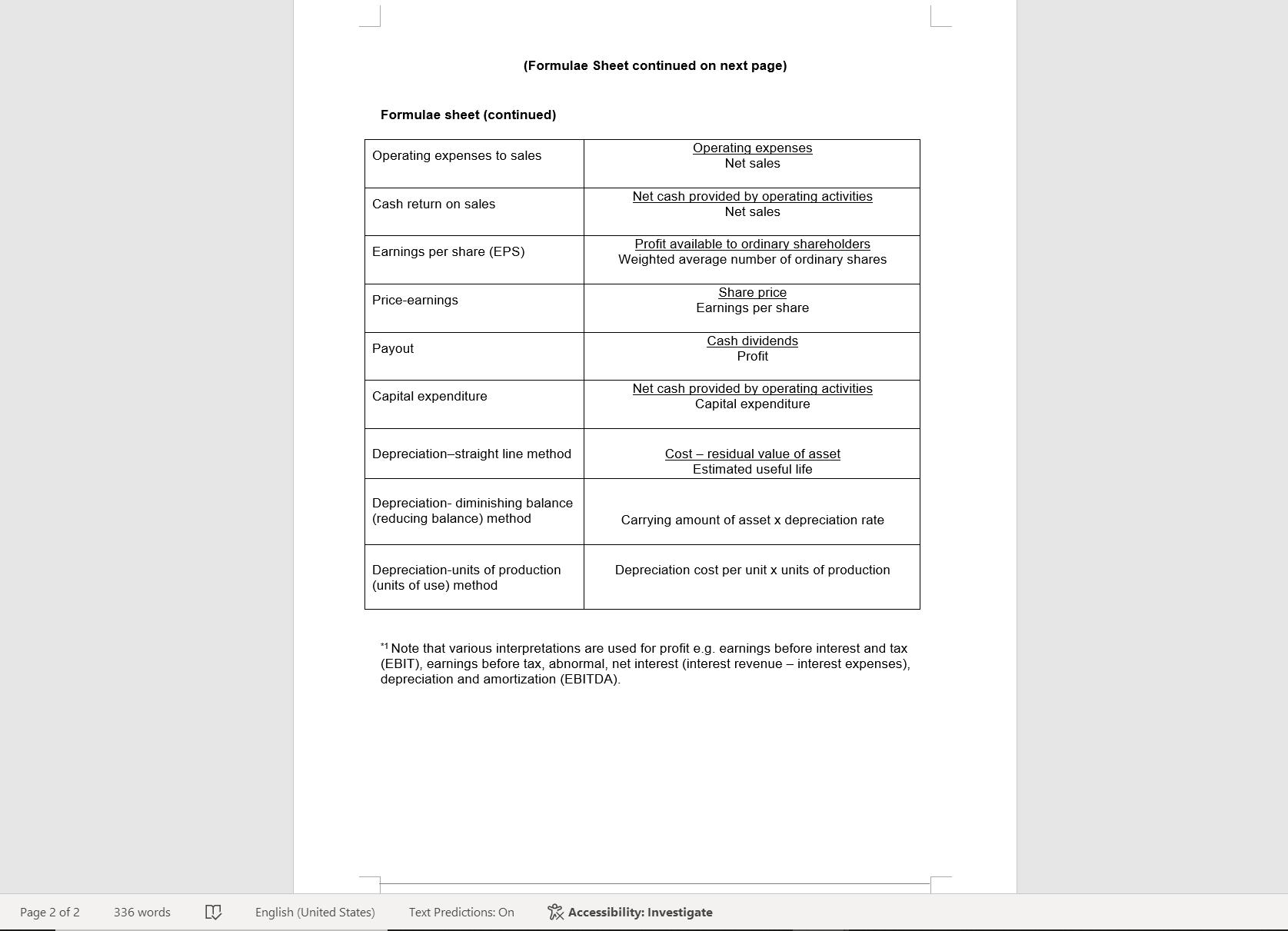

please help me to doing this Ratio analysis. using those statemente data to analysis: Once you have completed the cashflow above, complete the ratio

please help me to doing this Ratio analysis.

using those statemente data to analysis:

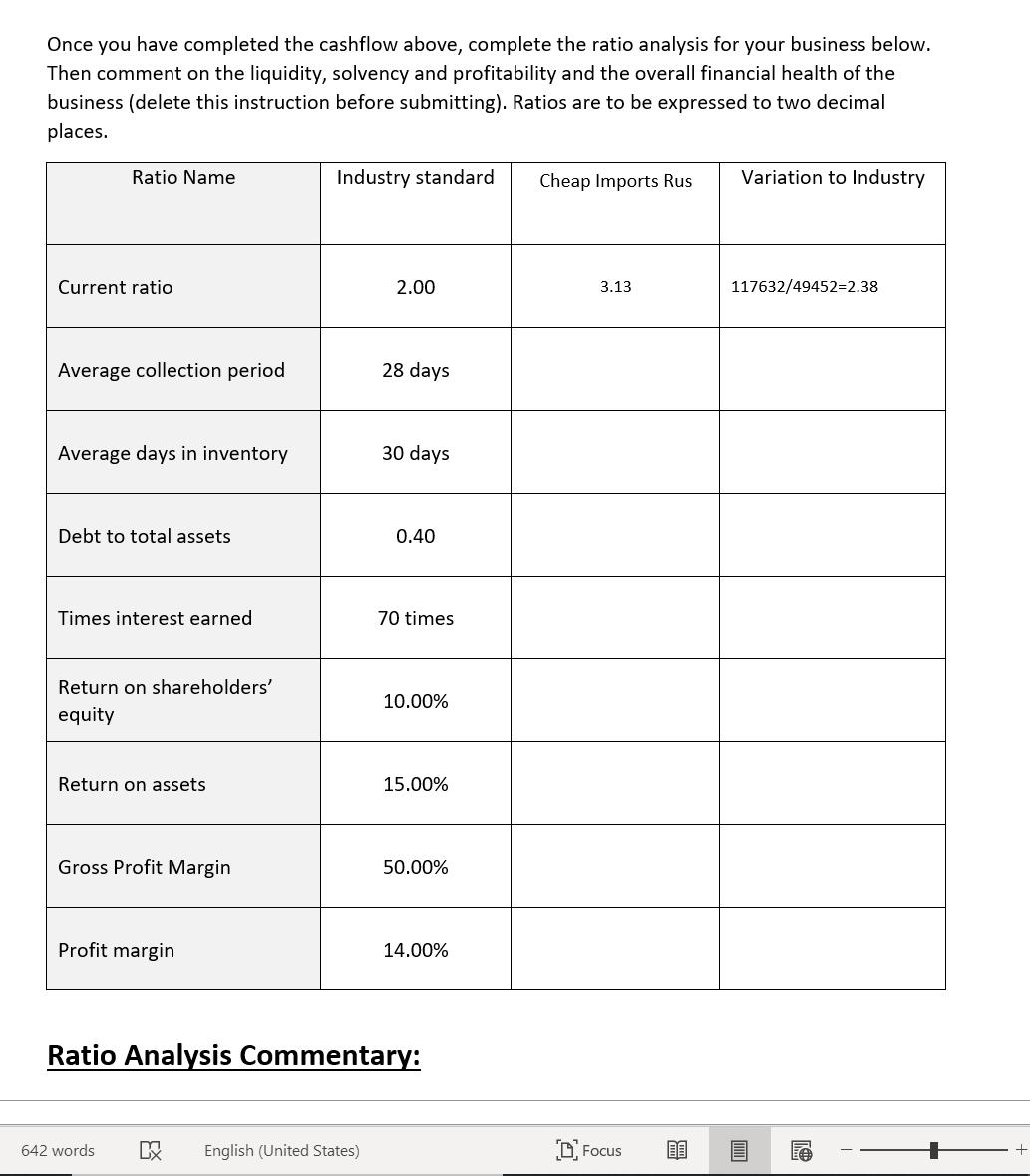

Once you have completed the cashflow above, complete the ratio analysis for your business below. Then comment on the liquidity, solvency and profitability and the overall financial health of the business (delete this instruction before submitting). Ratios are to be expressed to two decimal places. Ratio Name Current ratio Industry standard Cheap Imports Rus Variation to Industry 2.00 3.13 117632/49452=2.38 Average collection period 28 days Average days in inventory 30 days Debt to total assets 0.40 Times interest earned 70 times Return on shareholders' equity 10.00% Return on assets 15.00% Gross Profit Margin 50.00% Profit margin 14.00% Ratio Analysis Commentary: 642 words DX English (United States) Focus +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield.

9th Canadian Edition, Volume 2

470964731, 978-0470964736, 978-0470161012

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App