Please help me to fill out in those boxes using the excel file and save as PDF and send me back please.

You just have to read the first paper the see each picture that i took and help me to fill out.

Thank You so much!

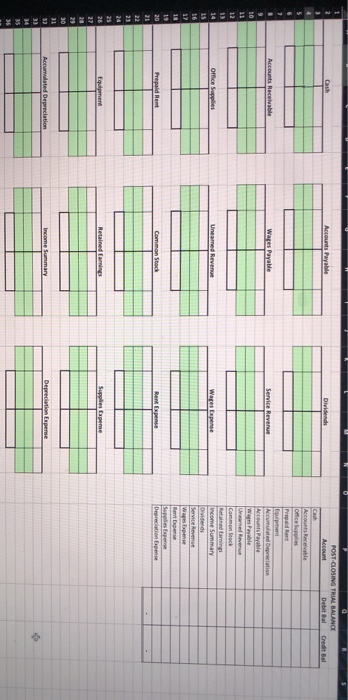

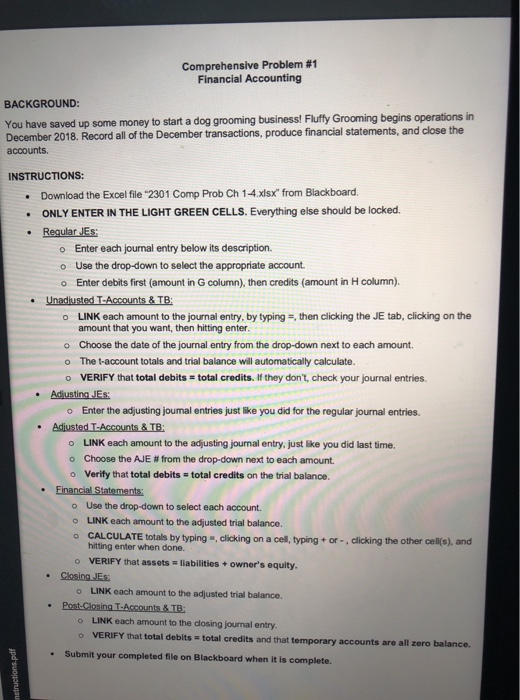

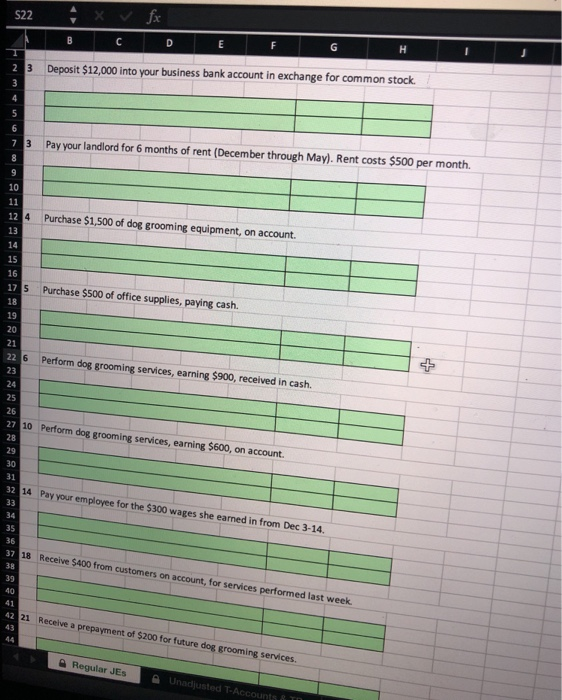

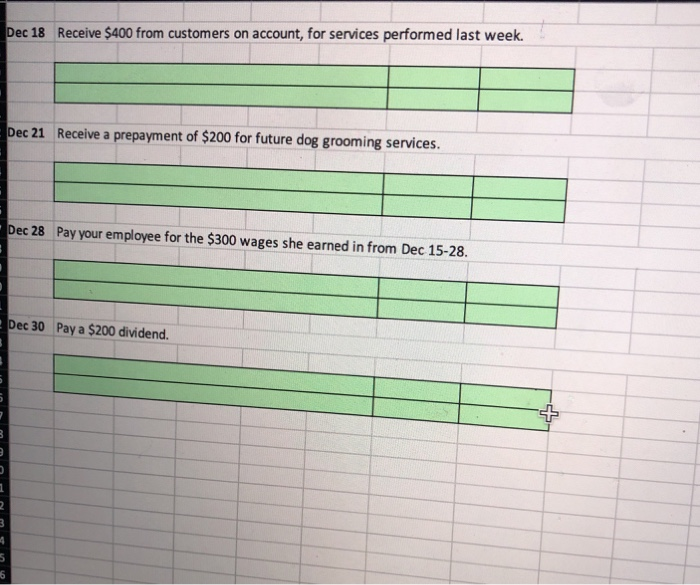

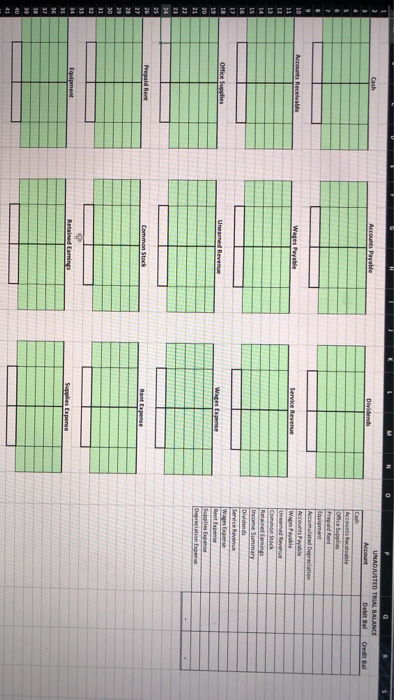

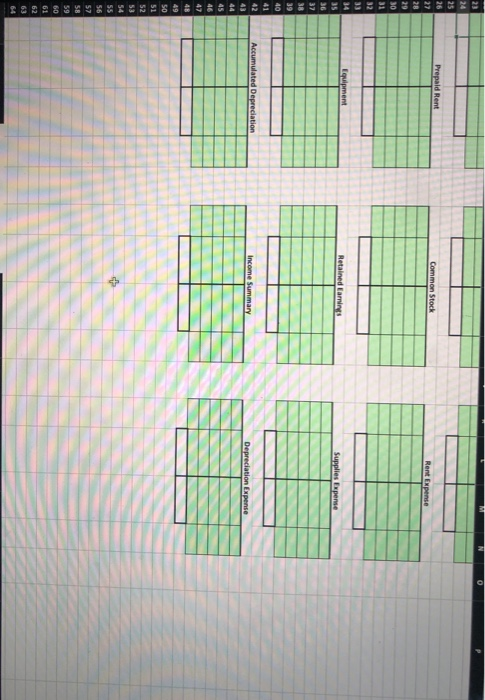

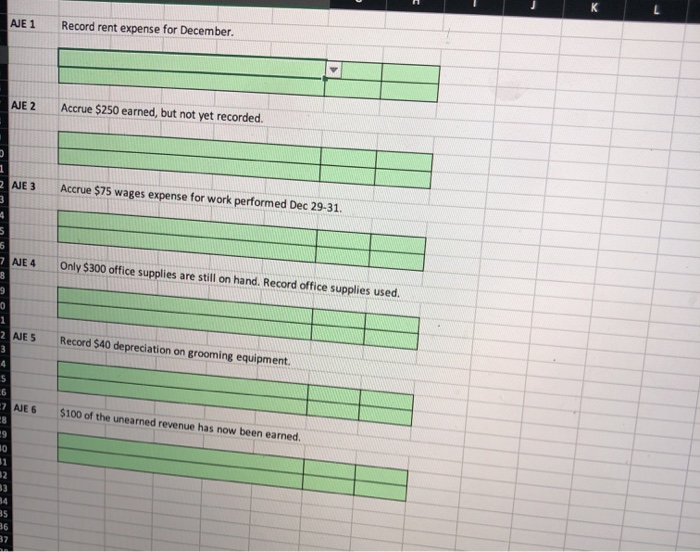

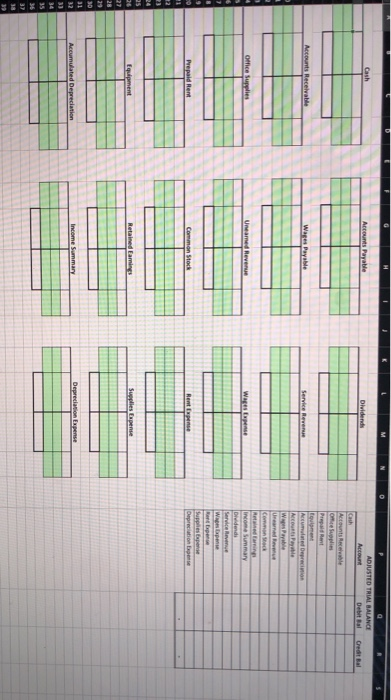

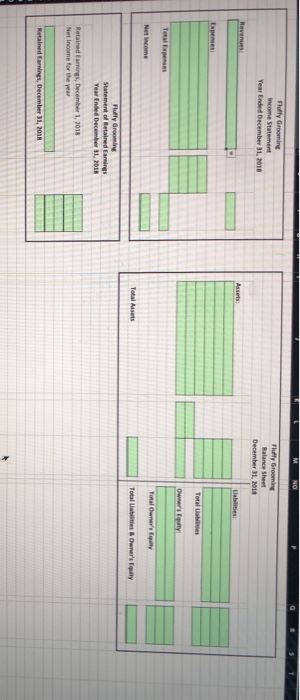

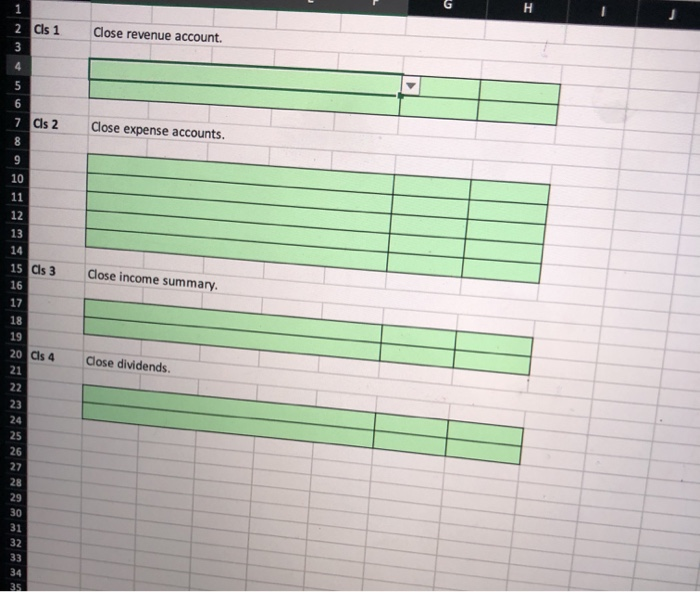

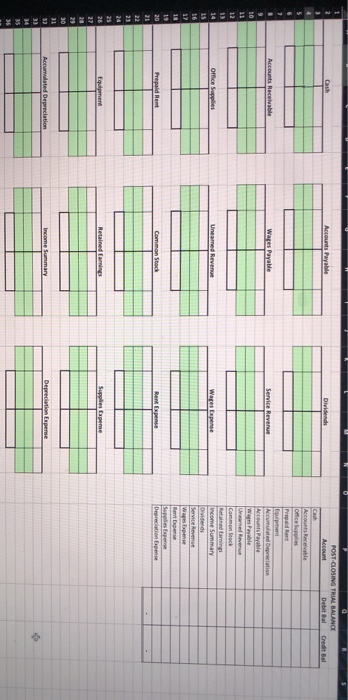

Comprehensive Problem #1 Financial Accounting BACKGROUND: You have saved up some money to start a dog grooming business! Fluffy Grooming begins operations in December 2018. Record all of the December transactions, produce financial statements, and close the accounts . . INSTRUCTIONS: . Download the Excel file "2301 Comp Prob Ch 1-4.xlsx" from Blackboard. ONLY ENTER IN THE LIGHT GREEN CELLS. Everything else should be locked. Regular JES Enter each journal entry below its description. Use the drop-down to select the appropriate account. Enter debits first (amount in G column), then credits (amount in H column). Unadjusted T-Accounts & TB: LINK each amount to the journal entry, by typing - then clicking the JE tab, clicking on the amount that you want, then hitting enter. Choose the date of the journal entry from the drop-down next to each amount. The t-account totals and trial balance will automatically calculate. VERIFY that total debits = total credits. If they don't, check your journal entries. Adjusting JES: Enter the adjusting joumal entries just like you did for the regular journal entries. Adjusted Accounts & TB: LINK each amount to the adjusting journal entry, just like you did last time. Choose the AJE #from the drop-down next to each amount Verify that total debits = total credits on the trial balance. Financial Statements: o Use the drop-down to select each account. LINK each amount to the adjusted trial balance. o CALCULATE totals by typing, clicking on a cell, typing + or clicking the other cell(s), and hitting enter when done. OVERIFY that assets - liabilities + owner's equity. Closing JES LINK each amount to the adjusted trial balance. Post-Closing T-Accounts & TB LINK each amount to the closing journal entry. VERIFY that total debits = total credits and that temporary accounts are all zero balance. Submit your completed file on Blackboard when it is complete. instructions.pdf S22 fx B C D E H 2 3 3 Deposit $12,000 into your business bank account in exchange for common stock. 4 5 6 7 3 Pay your landlord for 6 months of rent (December through May). Rent costs $500 per month. 8 9 10 11 12 4 13 14 Purchase $1,500 of dog grooming equipment, on account. 15 16 Purchase $500 of office supplies, paying cash. 17 5 18 19 20 21 22 6 23 24 25 Perform dog grooming services, earning $900, received in cash. 27 10 Perform dog grooming services, earning $600, on account. 28 29 30 31 32 14 Pay your employee for the $300 wages she earned in from Dec 3-14. 33 35 37 18 Receive $400 from customers on account, for services performed last week 38 39 40 42 21 Receive a prepayment of $200 for future dog grooming services. Regular JES Unadjusted T-Accounts 8 m Dec 18 Receive $400 from customers on account, for services performed last week. Dec 21 Receive a prepayment of $200 for future dog grooming services. Dec 28 Pay your employee for the $300 wages she earned in from Dec 15-28. 2 Dec 30 Pay a $200 dividend. 3 5 6 N 0 Cash Accounts Payable Dividende UNADJUSTED TRIAL BALANCE Account Debetal Credit Bal Accounts Receivabile 9 90 1 12 Wares Payable Servke Revenue Account acele once Supplies Prepaldo Equipment Accumulated Depreciation ACCOUNT Payable Wapewable Urared Revenue Commons Benedig Income Summary Dividende Service Revenue Wagens Rent Expense Supplies de 14 15 17 Office Supplies Uneamed Revenue Wages Expense 19 20 21 22 23 24 25 26 27 28 29 30 Prepaid Rent Common Stock 31 32 13 34 Equipment Retained Earnings Supplies Expense 15 16 17 18 29 40 O 23 Prepaid Rent Common Stock Rent Expense 25 26 27 28 29 30 31 32 33 14 Equipment Retained Earning 35 Supplies Expense 30 39 40 41 42 Accumulated Depreciation Income Summary Depreciation Expense 44 45 46 48 49 SO 51 52 53 54 55 56 57 58 59 60 61 62 64 AJE 1 Record rent expense for December. AJE 2 Accrue $250 earned, but not yet recorded. 1 2 AJE 3 3 Accrue $75 wages expense for work performed Dec 29-31. 4 Only $300 office supplies are still on hand. Record office supplies used. 16 7 AJE 4 8 9 0 1 2 AJE 5 3 4 5 Record $40 depreciation on grooming equipment. E7 AJE 6 $100 of the unearned revenue has now been earned. 10 32 34 35 37 N Cash Accounts Payable Dividends Credit Bal ADJUSTED TRIAL BALANCE Accue Deal Icash Accounts Receivable Om Supplies Prepaid Rent Accounts Receivable Wages Payable Service Revenue Acceder Wapes Patie Commons Office Supplies Uneamed Revenue co Summary Didendi Service Wp Rent Expense Supplies Export Depreciation pense 9 Prepaid Rent Common Stock Rente 1 25 Equipment Retained Eaming Supplies Expense 25 30 31 32 Accumulated Depreciation Income Summary Depreciation Expense 35 36 37 30 NO Fully Grooming Income Statement Year Ended December 11, 2018 Fully Grooming Balance Sheet December 11, 2018 Revenues Assets Lalities: Expenses Total Owner's Equity Total Expenses Total Owner's Equity Net Income Total Assets Total & Owner's quity Fully Grooming Statement of Retained Earnings Year Ended December 31, 2018 Retained Earnings, December 1, 2018 Net Income for the year Retained Earnings, December 31, 2018 H 1 2 als 1 3 Close revenue account. 4 ou 7 als 2 8 Close expense accounts. 9 10 11 12 13 14 15 als 3 16 17 18 19 Close income summary. Close dividends. 20 als 4 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Cash Accounts Payable Dividends Credit Bal 7 Accounts Receivable Wares Payable Service Revende 9 10 POST CLOSING TRIAL BALANCE Debit Bal Icah Account cevable Once upons Prepada Event Accumulated Depreciation Rus Payable wable Unred Revenue Common Stock daring Income Summary viends Service Revenue Wapens Rent Supplies Expense Depreciation Expense 11 12 14 Office Supplies Uneamed Revenue Wages Expense 15 16 17 18 19 Prepaid Rent Common Stock Rent pense 20 21 22 23 24 25 26 27 20 Equipment Retained Earning Supplies Expense Accumulated Depreciation Income Summary Depreciation Rupee 30 11 12 33 14 15 36

Please help me to fill out in those boxes using the excel file and save as PDF and send me back please.

Please help me to fill out in those boxes using the excel file and save as PDF and send me back please.