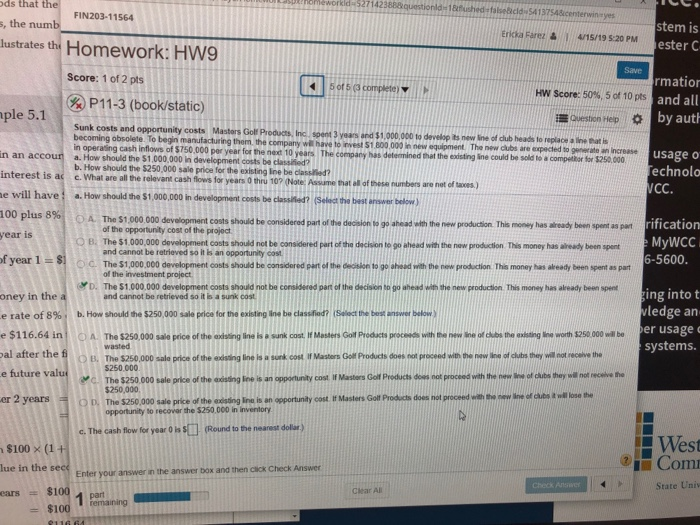

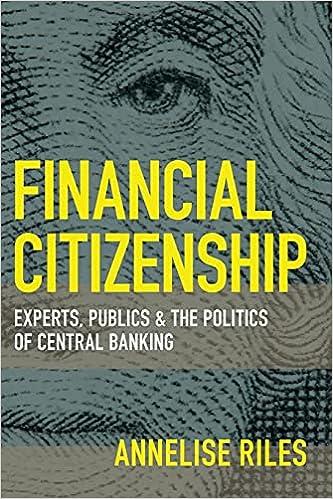

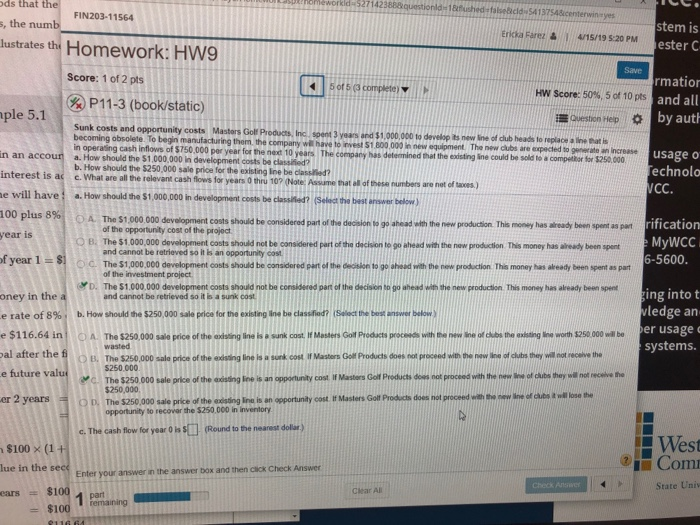

please help me to find the cash flow for year 0 is $?

ds that th FIN203-11564 s, the num stem is ester C Ericka Farez 4/15/19 s:20 PM ustrates thi Homework: HW9 Save Score: 1 of 2 pts mation and all by auth 50f 5 (3 complete) Hw score: 50% 5 of 10 pts %) P 11-3 (book/static) ple 5.1 Question Hep * Sunk costs and opportunity costs Mastors Golf Products, Inc. spent 3 years and $1,000,000 to develop its new line of dlub heads to replace a ine ats becoming obsolete. To begin manufacturing them the company will have to invest $1.800,000 in new equipment. The new clubs are in operating cash inflows of $750,000 per year for the next 10 years The company has determined that the expected to generate an increase usage o echnolo n an accou a. How should the $1,000,000 in development costs be classhed? interest is ac c. What are all the relevant e will have a. How should the $1,000,000 in development costs be existing line could be sold to a compesitor for $250,000 b. How should the $250,000 sale price for the existing Ine be classied cash flows for years 0 thru 10? (Note: Assame that all of these numbers are not of taces) be classied? (Select the best answer below) OA. The $1.000.000 development costs should be considered part of the decision to go ahead wth the new production. This money has aready been spent as pat of the opportunity cost of the project The $1 000,000 development costs should not be considered part of tho decision to go ahead with the new prod rification MyWCC 6-5600. ear is o tion This money has aheady been spent and cannot be retrieved so it is an opportunity cost ofl the investment project and cannot be retrieved so it is a sunk cost f year The $1,000.000 development costs should be considered part of the isin to go ohead with the new prodection. This money has akeady been spent as part D. The $1.000.000 development costs should not be considered part of the decision to go ahead with the new production This money has already been spent oney in the a e rate of 8% , b. How should the S250.000 sale price for the existing ane be classfiod? (Select the best answer below ) e $116.64 in OA The $250,000 sale price of the exdsting ine is a sunk cost If Masters Golt Prodacts proc with thenew ine of cubs the sxihding ne worth $250 000 wll be ing into t ledge an er usage c systems. wasted $250.000 $250,000 opportunity to recover the $250,000 in inventory al after the fo B. The $250,000 sale price of the edsting line is a sork cost $358.0o Masters Golt Products does not procend with the noew ine of clubs they will ot recnivwe the e future valu 000 sale price of the aisting ee is an opportunity cost If Masters Golf Products doss oot proceed with the new of clubs they wall not neceive the D The S250.000 sale price of the edsting ine ie an opportunity cost ir Masters Got Proticts doses not proceed tnw iho ot chuesa c. The cash flow for year 0hS (Round to the nearest dollar.) $100 x (1+ lue in the sece ears $100 Com Enter your answer in the answer box and then click Check Answer State Univ Cear Al