Please help me to learn this with full description if possible

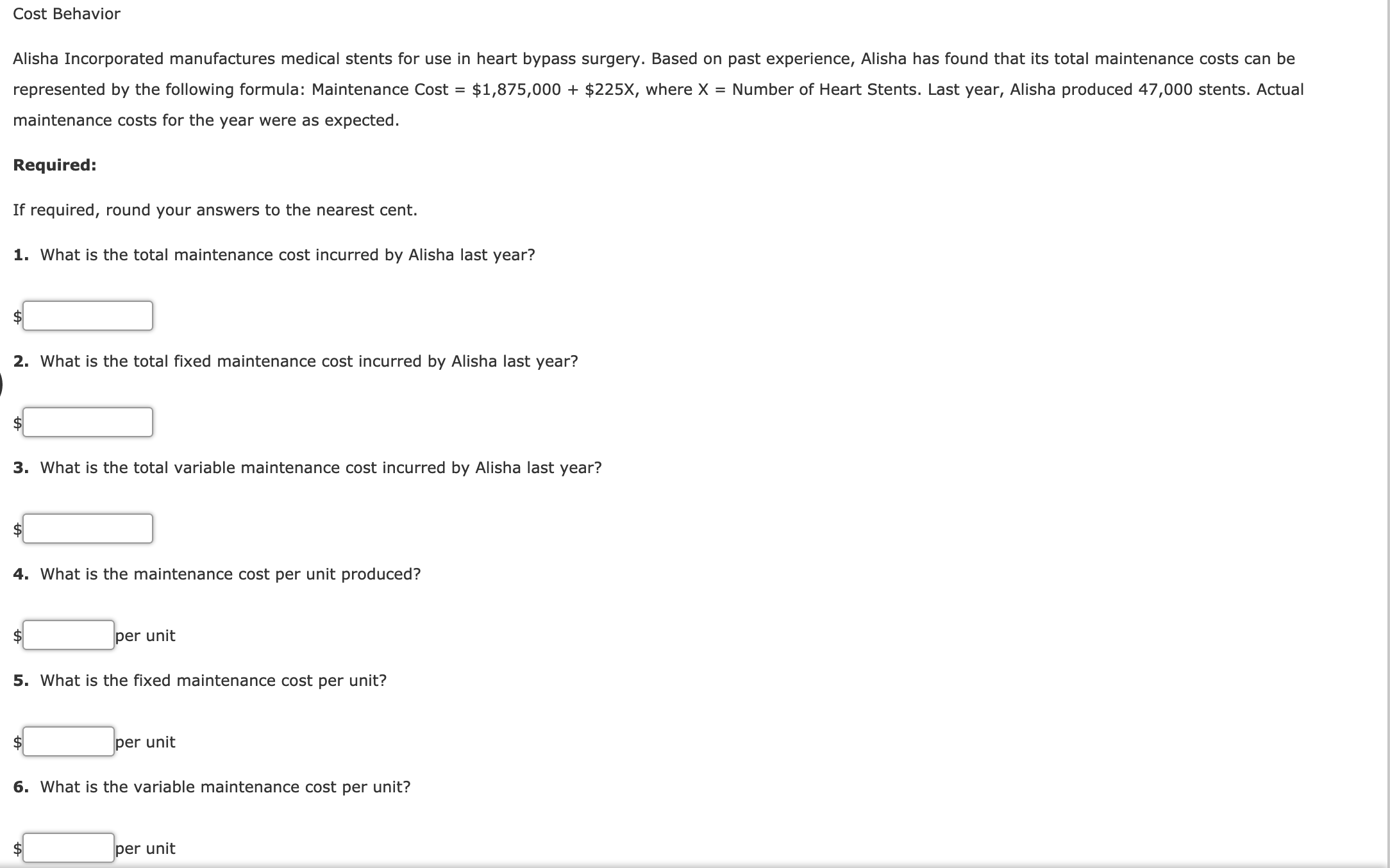

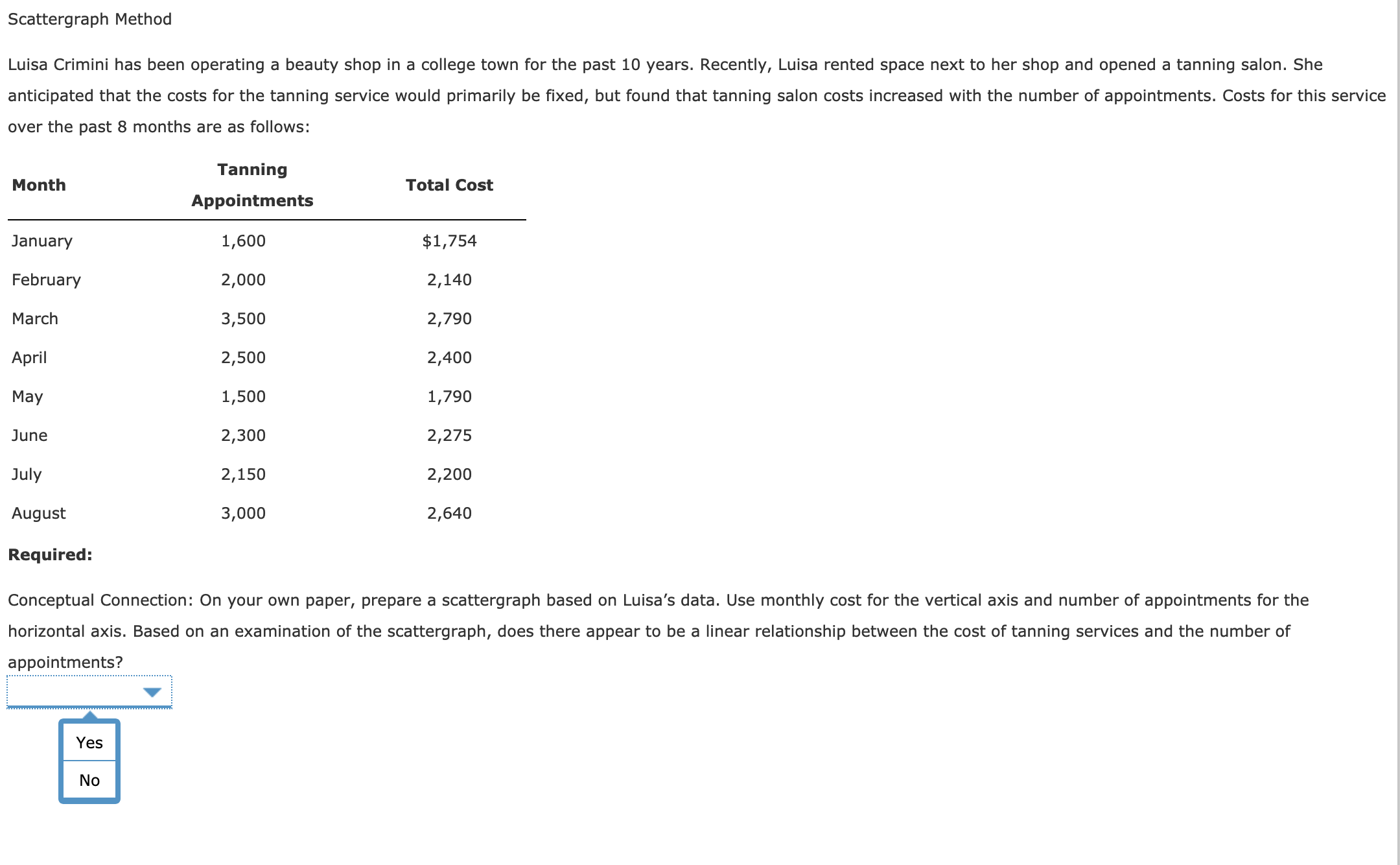

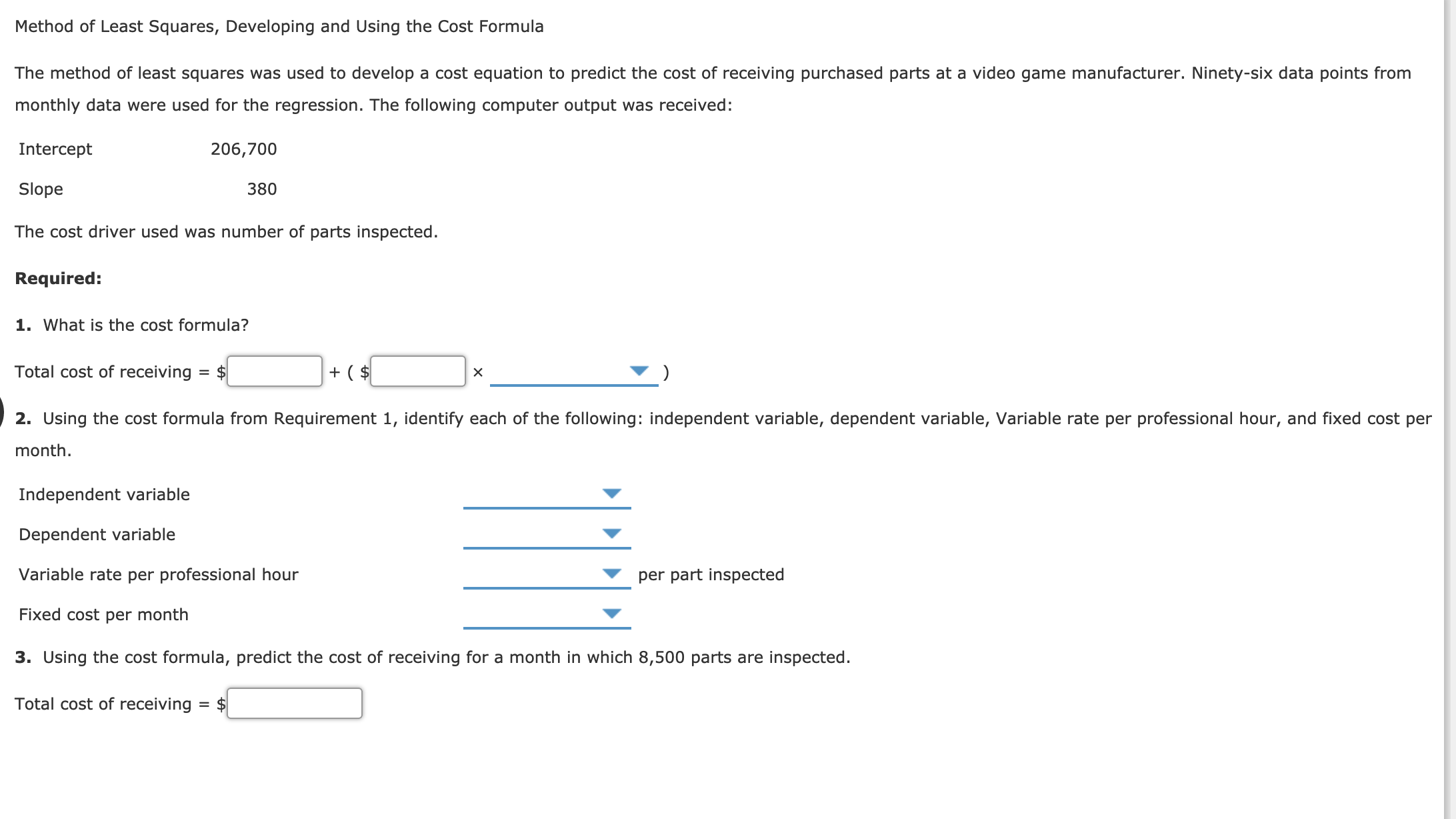

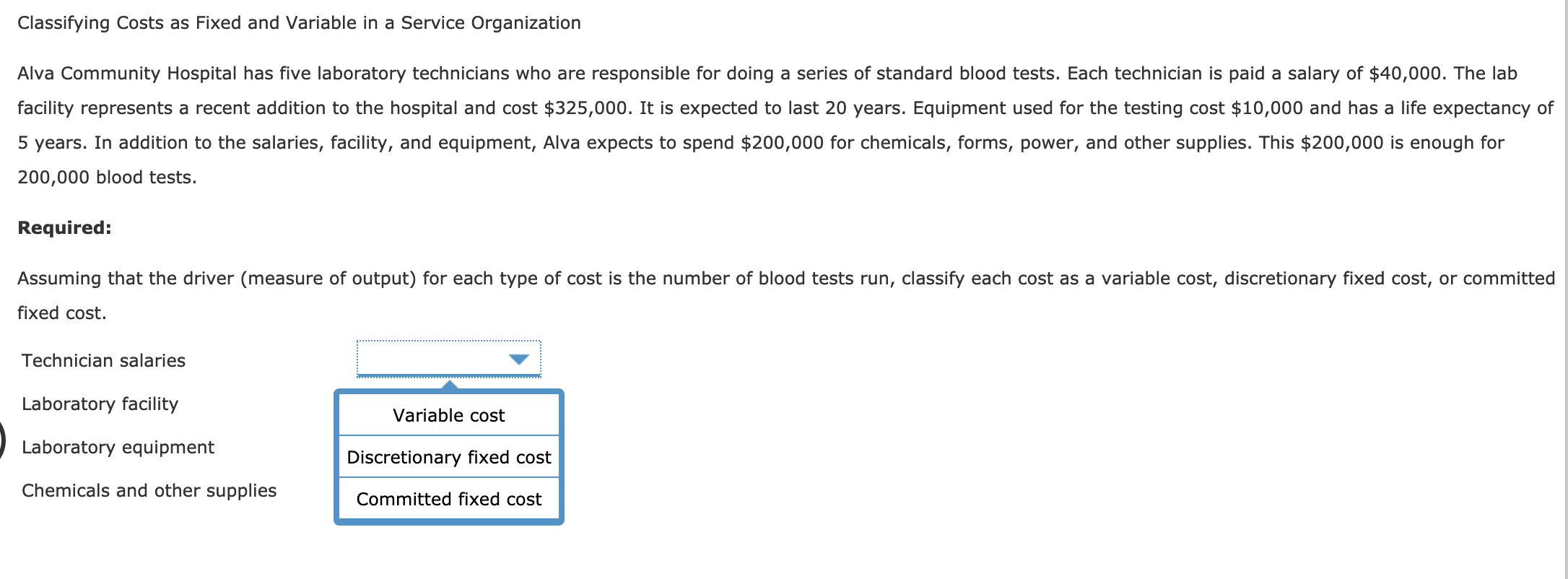

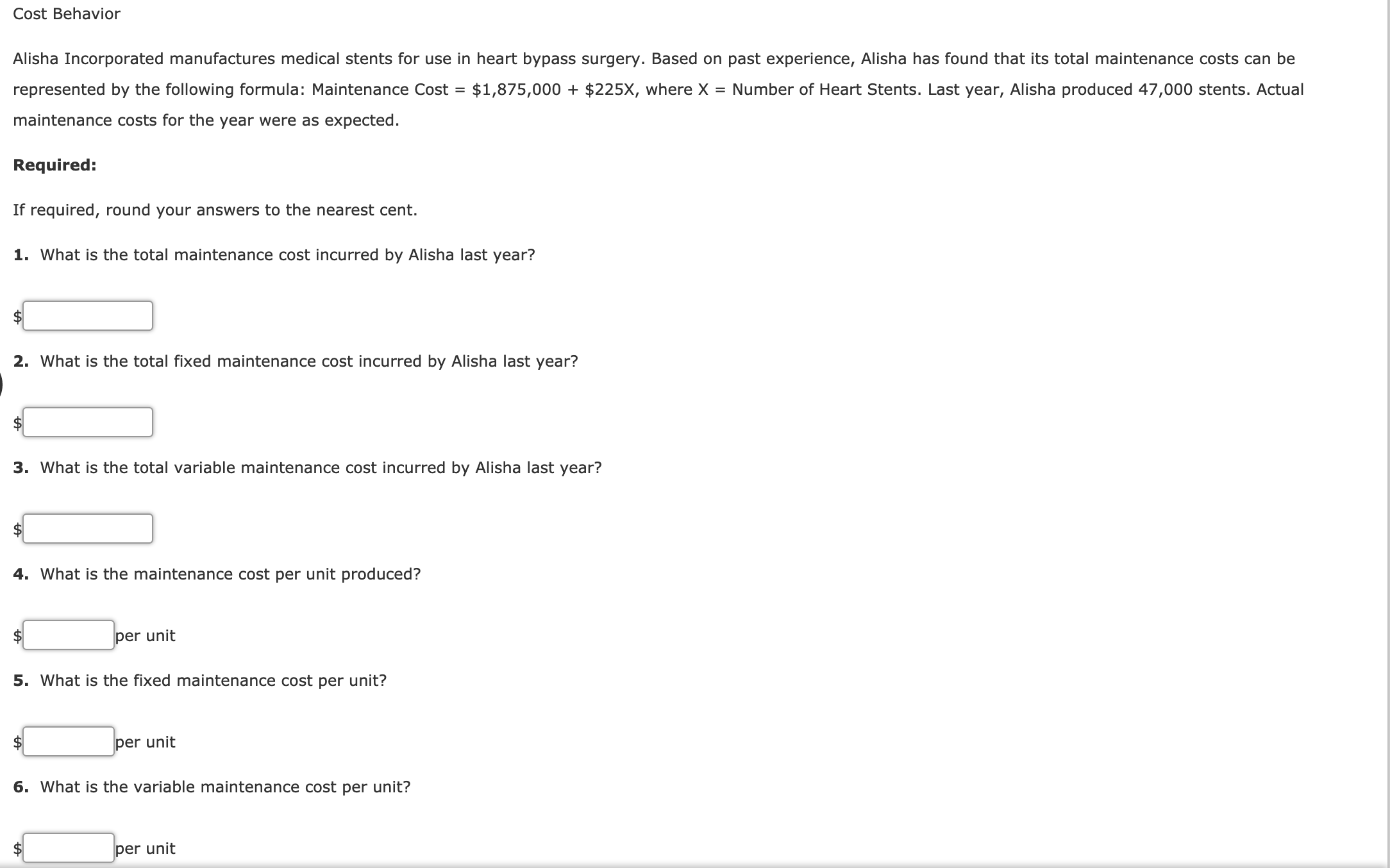

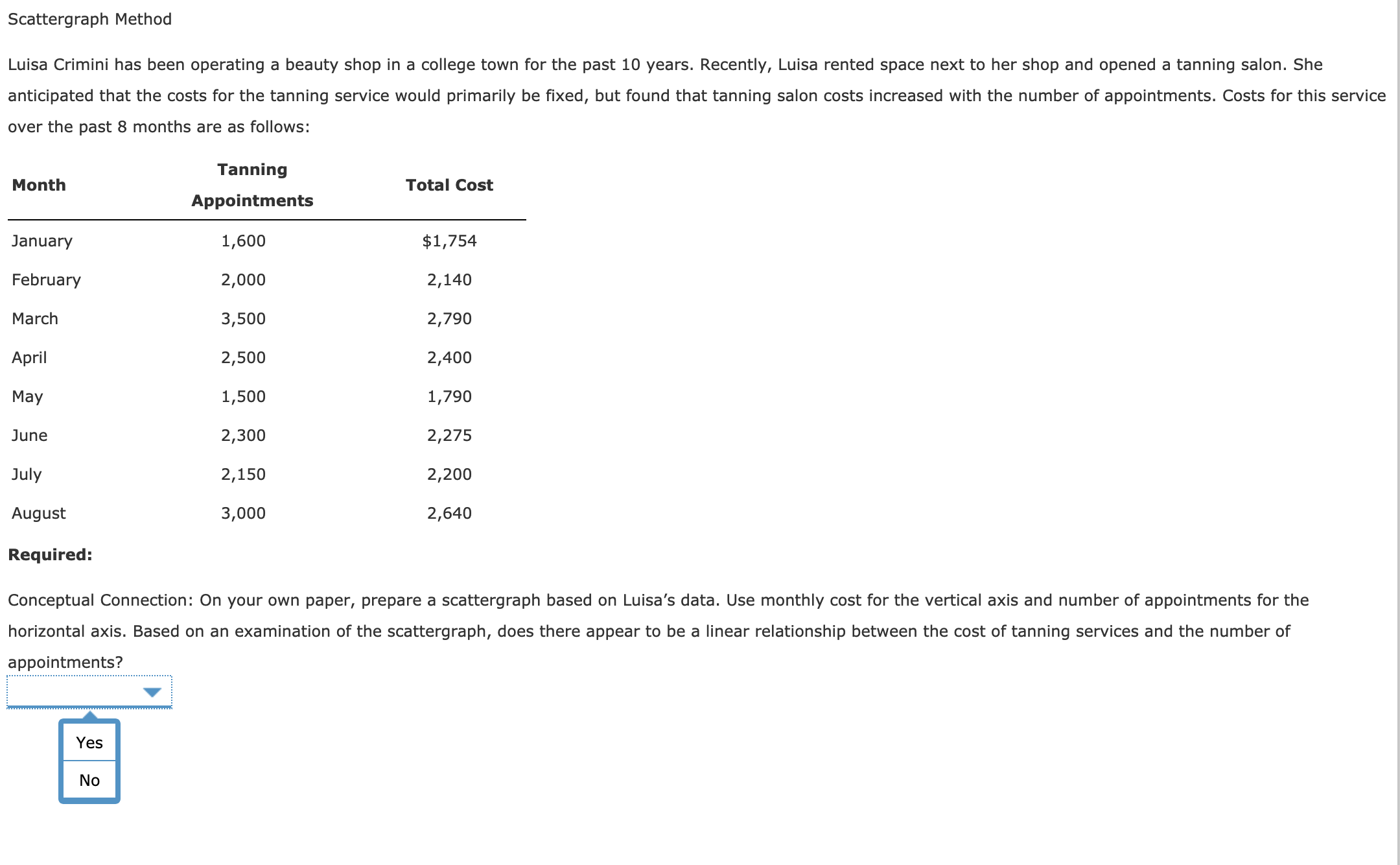

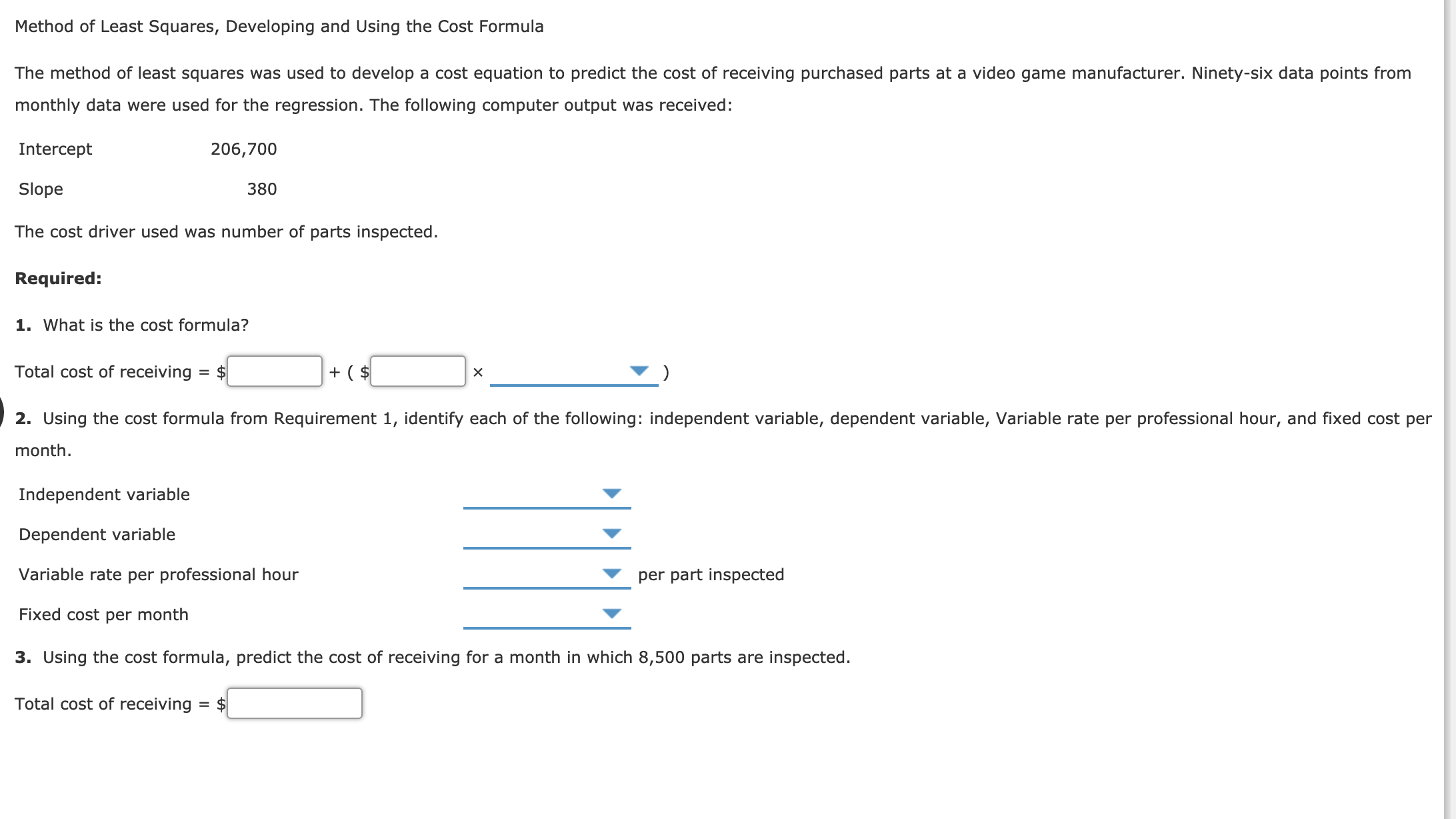

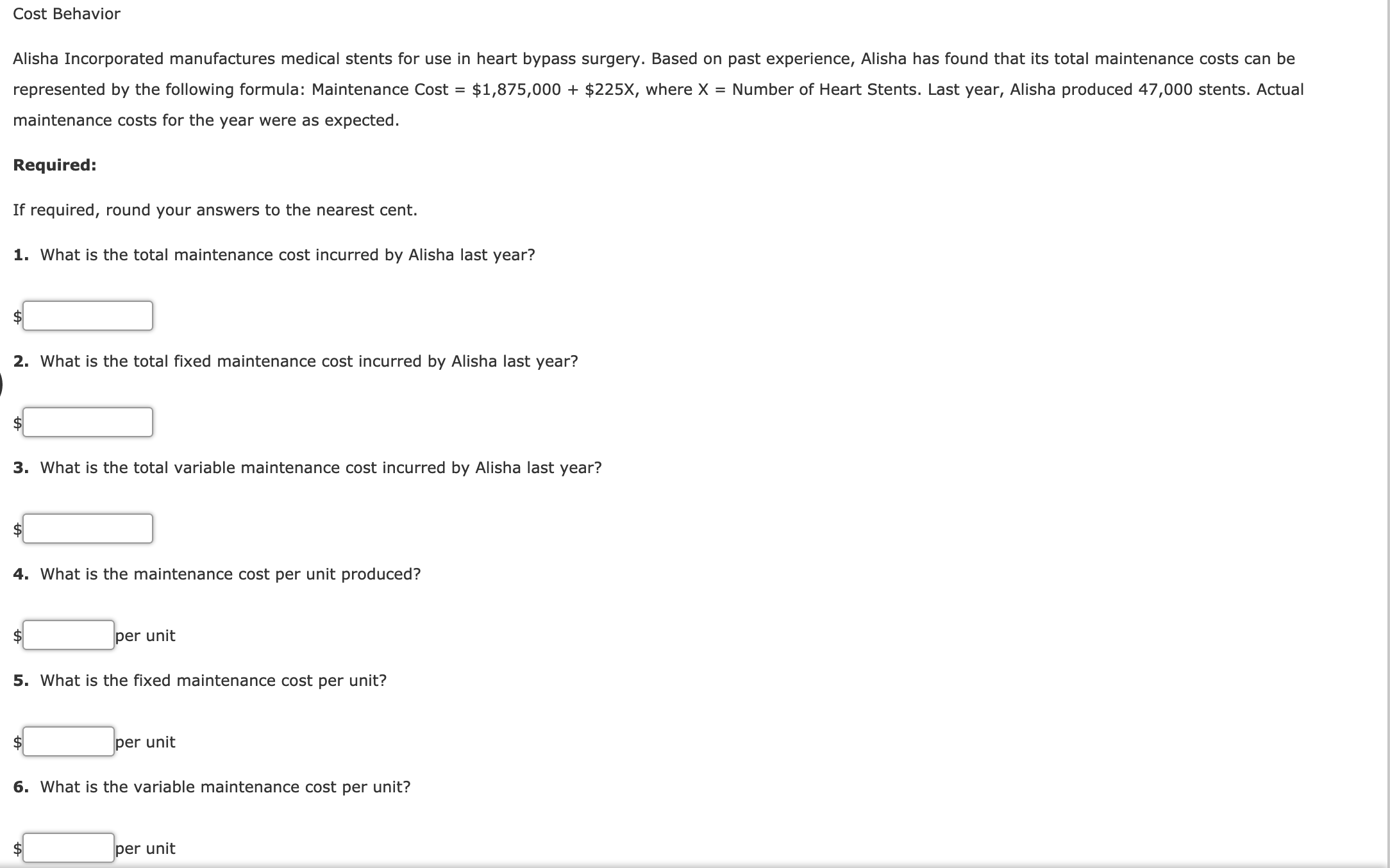

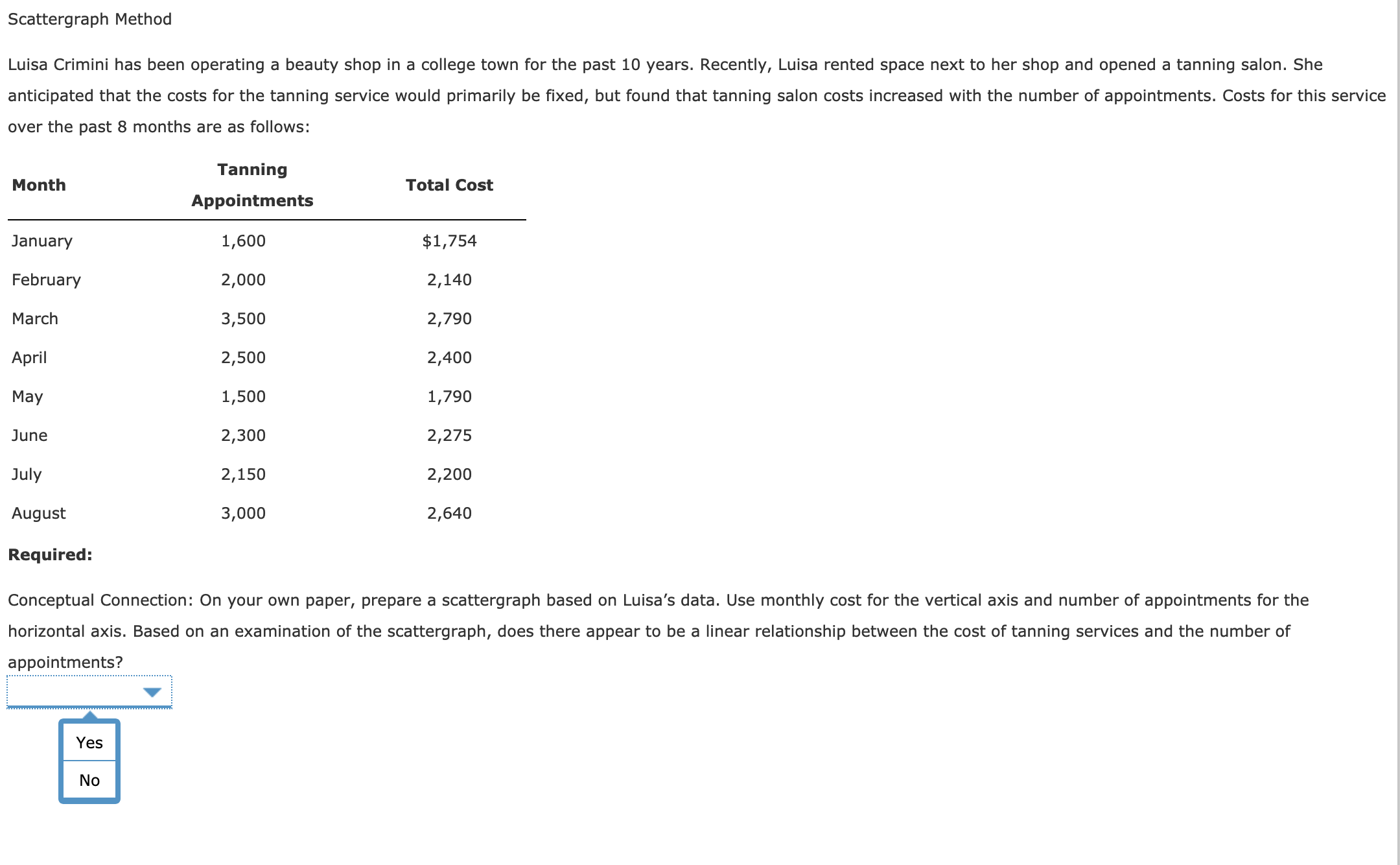

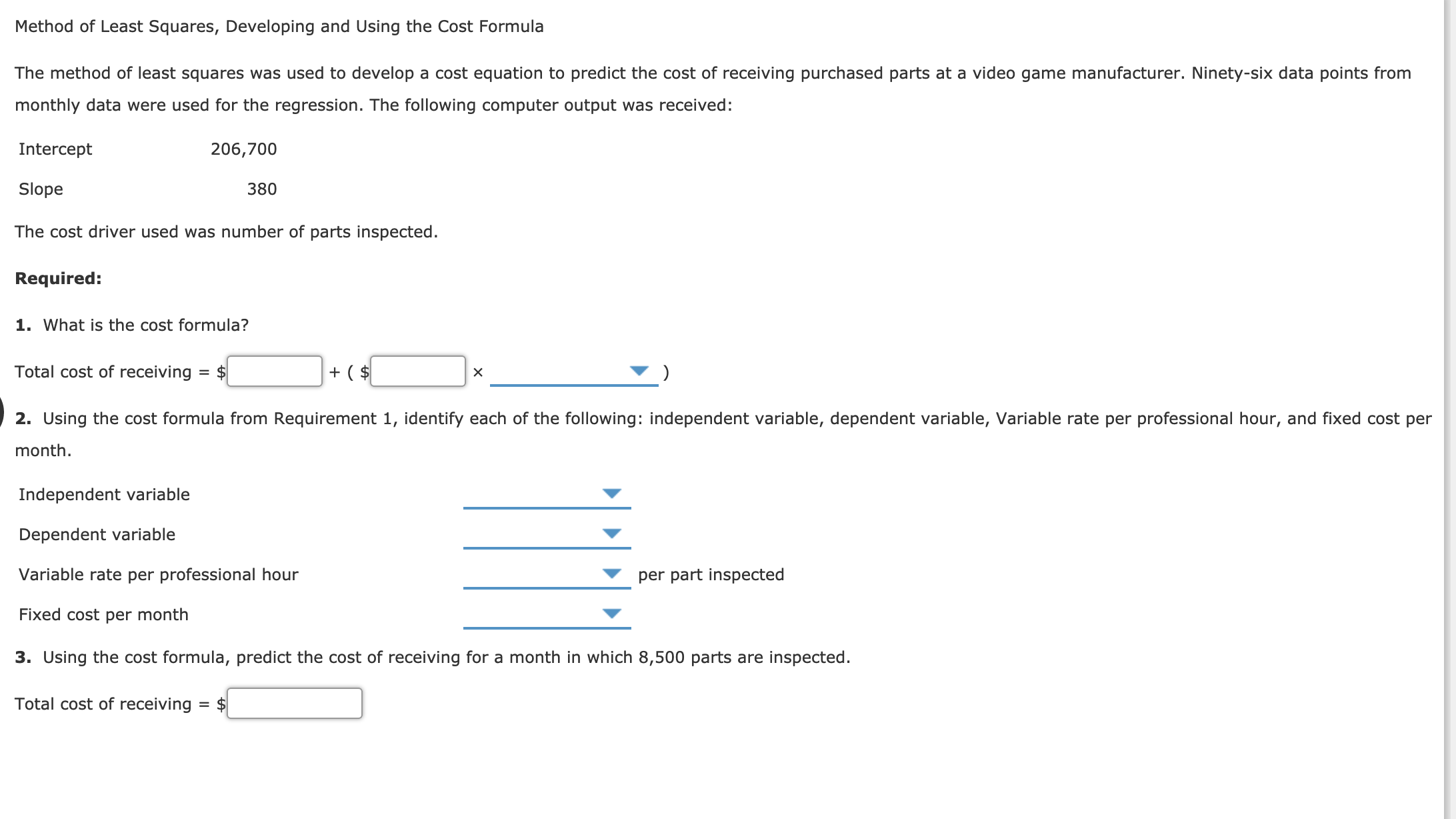

Classifying Costs as Fixed and Variable in a Service Organization Alva Community Hospital has ve laboratory technicians who are responsible for doing a series of standard blood tests. Each technician is paid a salary of $40,000. The lab facility represents a recent addition to the hospital and cost $325,000. It is expected to last 20 years. Equipment used for the testing cost $10,000 and has a life expectancy of 5 years. In addition to the salaries, facility, and equipment, Alva expects to spend $200,000 for chemicals, forms, power, and other supplies. This $200,000 is enough for 200,000 blood tests. Required: Assuming that the driver (measure of output) for each type of cost is the number of blood tests run, classify each cost as a variable cost, discretionary xed cost, or committed xed cost. Technician salaries Laboratory facility Variable cost Laboratory equipment Discretionary xed cost Chemicals and other supplies Committed fixed cost Cost Behavior Alisha Incorporated manufactures medical stents for use in heart bypass surgery. Based on past experience, Alisha has found that its total maintenance costs can be represented by the following formula: Maintenance Cost = $1,875,000 + $225X, where X = Number of Heart Stents. Last year, Alisha produced 47,000 stents. Actual maintenance costs for the year were as expected. Required: If required, round your answers to the nearest cent. 1. What is the total maintenance cost incurred by Alisha last year? H 2. What is the total xed maintenance cost incurred by Alisha last year? H 3. What is the total variable maintenance cost incurred by Alisha last year? H 4. What is the maintenance cost per unit produced? U per unit 5. What is the xed maintenance cost per unit? per unit U 6. What is the variable maintenance cost per unit? D per unit Scattergraph Method Luisa Crimini has been operating a beauty shop in a college town for the past 10 years. Recently, Luisa rented space next to her shop and opened a tanning salon. She anticipated that the costs for the tanning service would primarily be xed, but found that tanning salon costs increased with the number of appointments. Costs for this service over the past 8 months are as follows: Month Tanning Total Cost Appointments January 1,600 $1,754 February 2,000 2,140 March 3,500 2,790 April 2,500 2,400 May 1,500 1,790 June 2,300 2,275 July 2,150 2,200 August 3,000 2,640 Required: Conceptual Connection: On your own paper, prepare a scattergraph based on Luisa's data. Use monthly cost for the vertical axis and number of appointments for the horizontal axis. Based on an examination of the scattergraph, does there appear to be a linear relationship between the cost of tanning services and the number of appointments? Method of Least Squares, Developing and Using the Cost Formula The method of least squares was used to develop a cost equation to predict the cost of receiving purchased parts at a video game manufacturer. Ninety-six data points from monthly data were used for the regression. The following computer output was received: Intercept 206,700 Slope 380 The cost driver used was number of parts inspected. Required: 1. What is the cost formula? Total cost of receiving = $:] + ( $:] X V ) 2. Using the cost formula from Requirement 1, identify each of the following: independent variable, dependent variable, Variable rate per professional hour, and fixed cost per month. Independent variable V Dependent variable V Variable rate per professional hour V per part inspected v Fixed cost per month 3. Using the cost formula, predict the cost of receiving for a month in which 8,500 parts are inspected. Total cost of receiving = $:]