Answered step by step

Verified Expert Solution

Question

1 Approved Answer

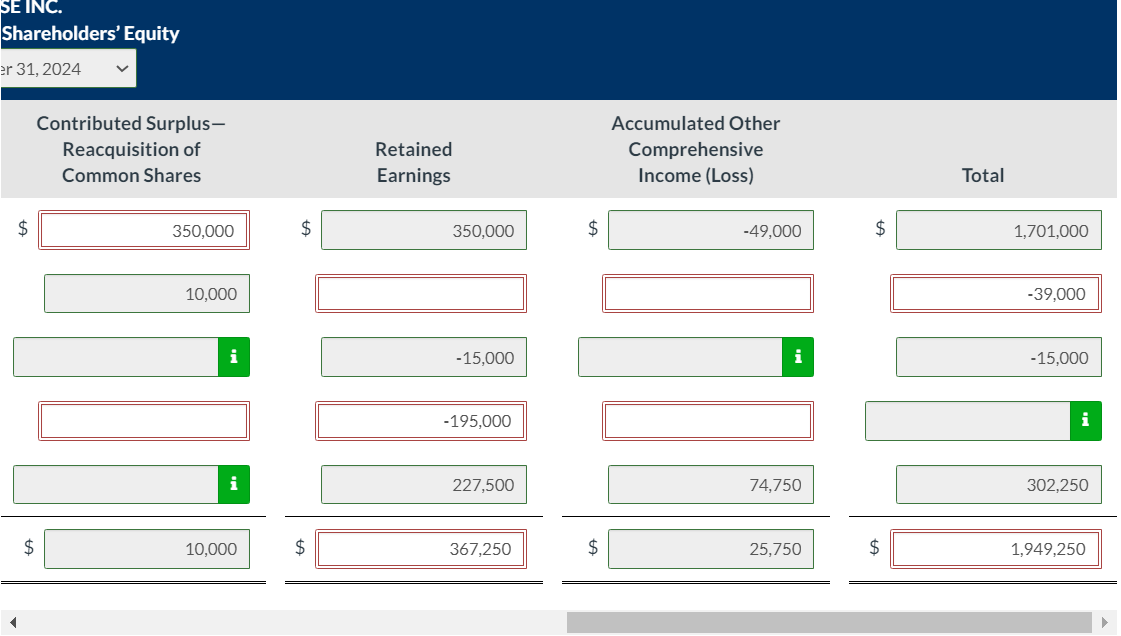

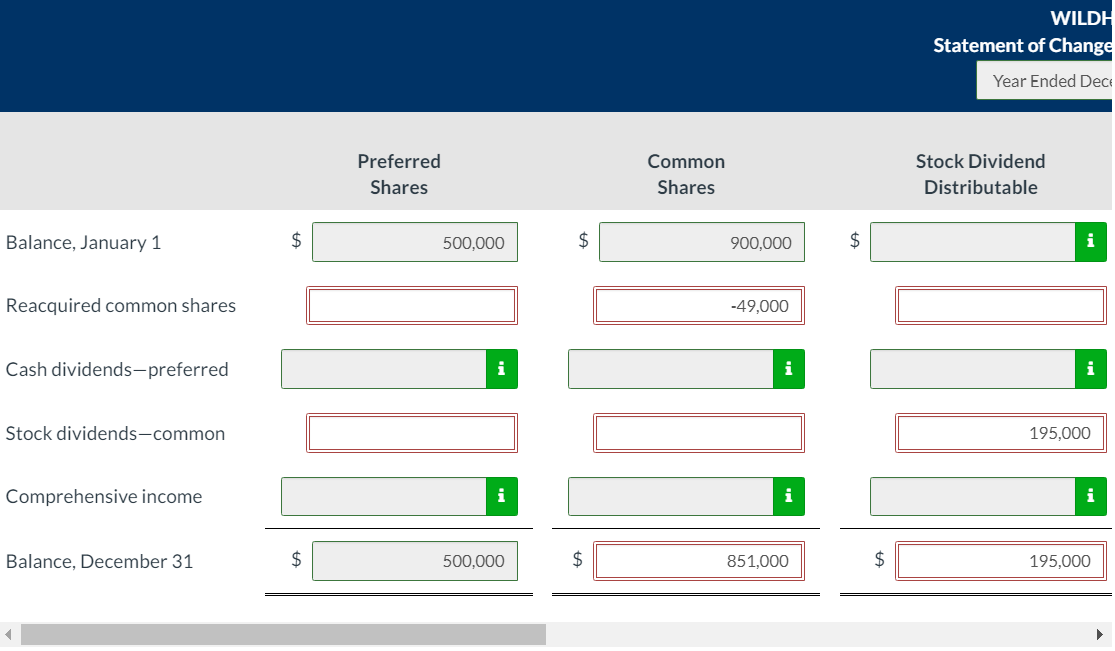

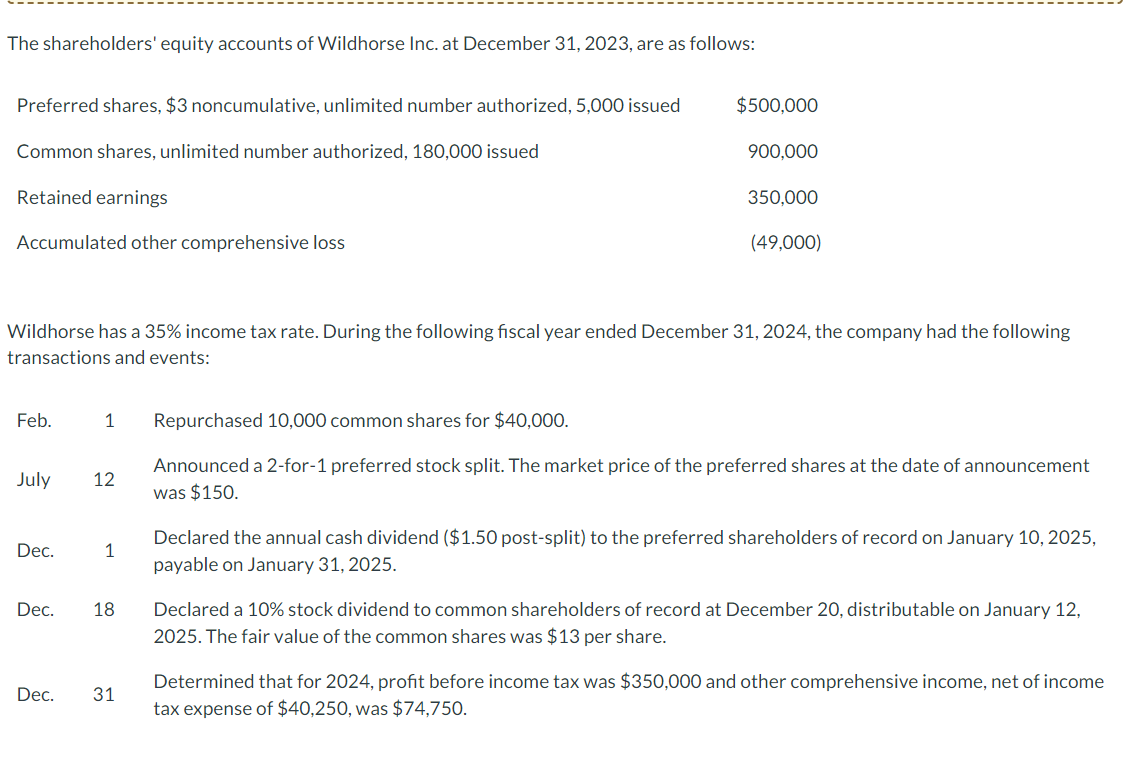

Please help me to solve it. It's urgent. SE INC. Shareholders' Equity Accumulated Other Comprehensive Income (Loss) $ Total The shareholders' equity accounts of Wildhorse

Please help me to solve it. It's urgent.

SE INC. Shareholders' Equity Accumulated Other Comprehensive Income (Loss) $ Total The shareholders' equity accounts of Wildhorse Inc. at December 31, 2023, are as follows: Wildhorse has a 35% income tax rate. During the following fiscal year ended December 31, 2024, the company had the following transactions and events: Feb. 1 Repurchased 10,000 common shares for $40,000. July 12 Announced a 2 -for-1 preferred stock split. The market price of the preferred shares at the date of announcement was $150. Dec. 1 Declared the annual cash dividend (\$1.50 post-split) to the preferred shareholders of record on January 10, 2025, payable on January 31, 2025. Dec. 18 Declared a 10\% stock dividend to common shareholders of record at December 20, distributable on January 12 , 2025. The fair value of the common shares was $13 per share. Dec. 31 Determined that for 2024 , profit before income tax was $350,000 and other comprehensive income, net of income tax expense of $40,250, was $74,750. \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{PreferredShares} & \multicolumn{2}{|c|}{CommonShares} & \multicolumn{2}{|r|}{StockDividendDistributable} \\ \hline Balance, January 1 & $ & 500,000 & $ & 900,000 & $ & i \\ \hline Reacquired common shares & & & & 49,000 & & \\ \hline Cash dividends-preferred & & i & & i & & i \\ \hline Stock dividends-common & & & & & & 195,000 \\ \hline Comprehensive income & & i & & i & & i \\ \hline Balance, December 31 & $ & 500,000 & $ & 851,000 & $ & 195,000 \\ \hline \end{tabular} SE INC. Shareholders' Equity Accumulated Other Comprehensive Income (Loss) $ Total The shareholders' equity accounts of Wildhorse Inc. at December 31, 2023, are as follows: Wildhorse has a 35% income tax rate. During the following fiscal year ended December 31, 2024, the company had the following transactions and events: Feb. 1 Repurchased 10,000 common shares for $40,000. July 12 Announced a 2 -for-1 preferred stock split. The market price of the preferred shares at the date of announcement was $150. Dec. 1 Declared the annual cash dividend (\$1.50 post-split) to the preferred shareholders of record on January 10, 2025, payable on January 31, 2025. Dec. 18 Declared a 10\% stock dividend to common shareholders of record at December 20, distributable on January 12 , 2025. The fair value of the common shares was $13 per share. Dec. 31 Determined that for 2024 , profit before income tax was $350,000 and other comprehensive income, net of income tax expense of $40,250, was $74,750. \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \multicolumn{2}{|c|}{PreferredShares} & \multicolumn{2}{|c|}{CommonShares} & \multicolumn{2}{|r|}{StockDividendDistributable} \\ \hline Balance, January 1 & $ & 500,000 & $ & 900,000 & $ & i \\ \hline Reacquired common shares & & & & 49,000 & & \\ \hline Cash dividends-preferred & & i & & i & & i \\ \hline Stock dividends-common & & & & & & 195,000 \\ \hline Comprehensive income & & i & & i & & i \\ \hline Balance, December 31 & $ & 500,000 & $ & 851,000 & $ & 195,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started