Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me to solve parts a,b,c,and d of this problem with detailed solutions. 8-1, you formed a portfolio that ? nsisted of 50%, Bartman

Please help me to solve parts a,b,c,and d of this problem with detailed solutions.

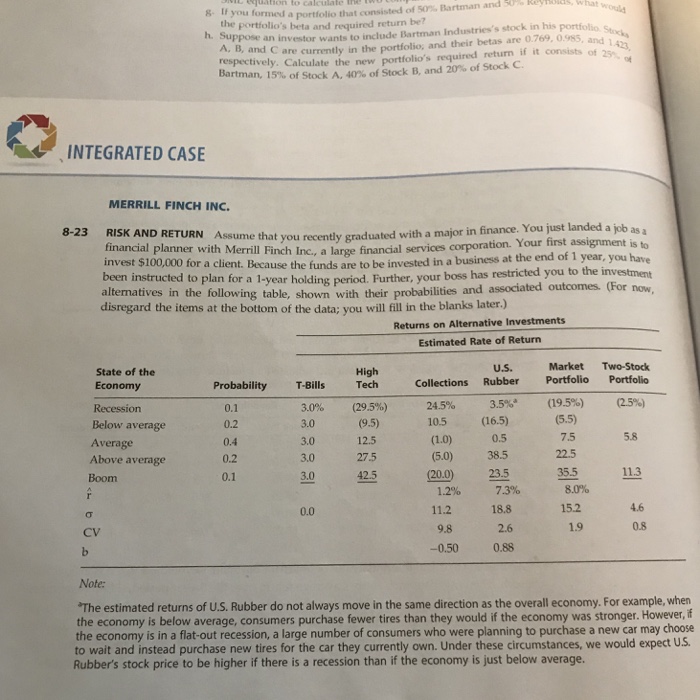

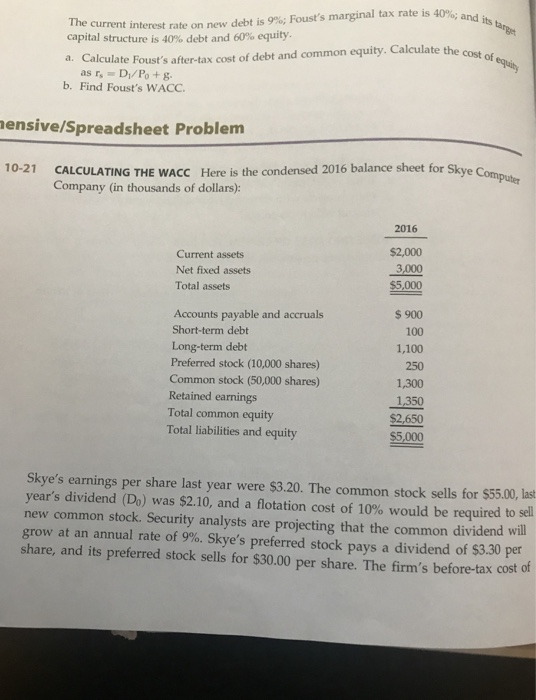

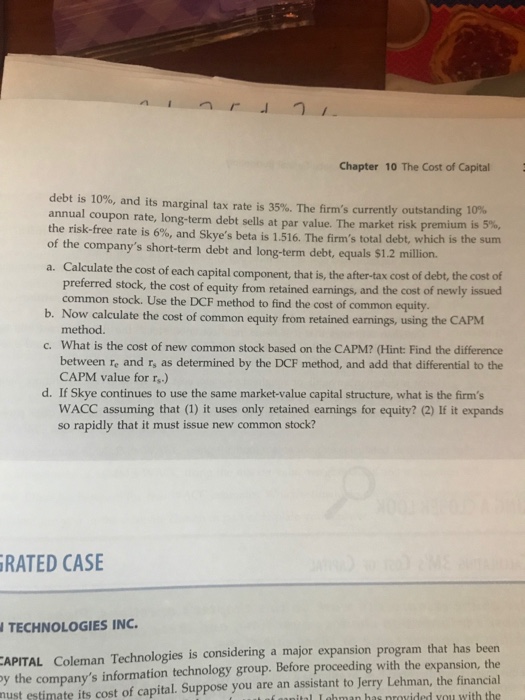

8-1, you formed a portfolio that ? nsisted of 50%, Bartman and 9% Keym ppose an investor wants to include Bartman Industries's stock in his portfolio A, B, and C are currently in the portfolio, a the portiolio's beta and required return be? 0.985, and 1423, , B, and C are currently in the portfolio; and their betas are 0.769, 0.985 spctivel Calculate the new portfolio's required return if it consists of 25 Bartman, 15% of Stock A, 40% of Stock B, and 20% of Stock C. INTEGRATED CASE MERRILL FINCH INC. SK AND RETURN Assume that you recently graduated financial planner with Merrill invest $100,000 for a client. Because the funds are to be invested in a business at with a major in finance. You just landed a job as a Finch Inc., a large financial services corporation. Your first assignment is to 8-23 RI the end of 1 year, you have your boss has restricted you to the investment tcomes. (For now, been instructed to plan for a l-year holding period rFurthoables and assocated outcomes. (For now, alternatives in the following table, shown with their probabilities and associated ou disregard the items at the bottom of the data; you will fill in the blanks later.) Returns on Alternative Investments Estimated Rate of Return Two-Stock Portfolio (25%) Market State of the Economy U.S. Rubber High Tech (29.5%) (9.5) 12.5 27.5 Collections Portfolio Probability T-Bills (19.5%) (5.5) 7.5 22.5 3.5%" 24.5% 10.5 0.1 0.2 0.4 0.2 0.1 3.0% 3.0 3.0 3.0 (16.5) Below average Average Above average Boom (5.0) 38.5 3.0 425 (20.0) 23.5 355 113 7.3% 80o 46 1.2% 15.2 11.2 18.8 2.6 -0.500.88 0.0 CV 9.8 0.8 The estimated returns of U.S. Rubber do not always move in the same direction as the overall economy. For example, when the economy is below average, consumers purchase fewer tires than they would if the economy was stronger. However, f the economy is in a flat-out recession, a large number of consumers who were planning to purchase a new car may choose to wait and instead purchase new tires for the car they currently own. Under these circumstances, we would expect U.S Rubber's stock price to be higher if there is a recession than if the economy is just below average Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started