Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me to solve this question 1. Fast Future Berhad (FFB) needs to expand its production line in order to fulfill the orders from

Please help me to solve this question

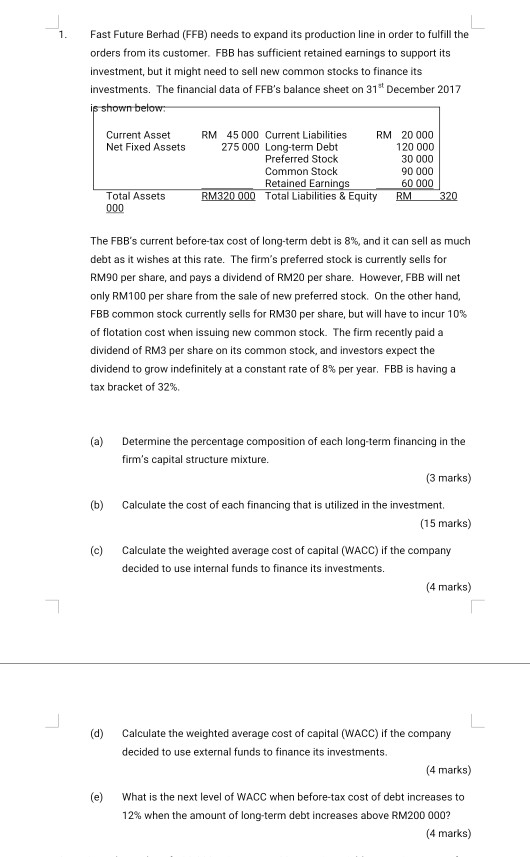

1. Fast Future Berhad (FFB) needs to expand its production line in order to fulfill the orders from its customer. FBB has sufficient retained earnings to support its investment, but it might need to sell new common stocks to finance its investments. The financial data of FFB's balance sheet on 31" December 2017 is shown below: Current Asset RM 45 000 Current Liabilities RM 20 000 Net Fixed Assets 275 000 Long-term Debt 120 000 Preferred Stock 30 000 Common Stock 90 000 Retained Earnings 60 000 Total Assets RM320 000 Total Liabilities & Equity RM 320 000 The FBB's current before-tax cost of long-term debt is 8%, and it can sell as much debt as it wishes at this rate. The firm's preferred stock is currently sells for RM90 per share, and pays a dividend of RM20 per share. However, FBB will net only RM100 per share from the sale of new preferred stock. On the other hand, FBB common stock currently sells for RM30 per share, but will have to incur 10% of flotation cost when issuing new common stock. The firm recently paid a dividend of RM3 per share on its common stock, and investors expect the dividend to grow indefinitely at a constant rate of 8% per year. FBB is having a tax bracket of 32% (a) Determine the percentage composition of each long-term financing in the firm's capital structure mixture. (3 marks) (b) Calculate the cost of each financing that is utilized in the investment (15 marks) (c) Calculate the weighted average cost of capital (WACC) if the company decided to use internal funds to finance its investments. (4 marks) (d) Calculate the weighted average cost of capital (WACC) if the company decided to use external funds to finance its investments. (4 marks) What is the next level of WACC when before-tax cost of debt increases to 12% when the amount of long-term debt increases above RM200 000? (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started