Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me to solve this within an hour. thank you QUESTION 3 Mesti Untung Insurance Bhd., a Malaysian resident company engaging in insurance industry

Please help me to solve this within an hour. thank you

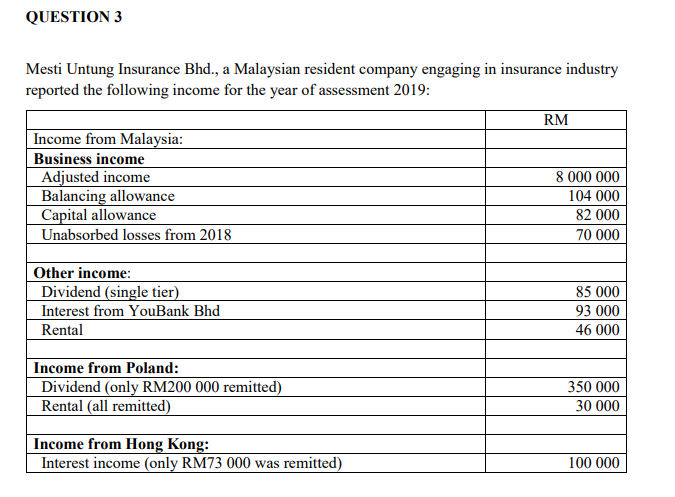

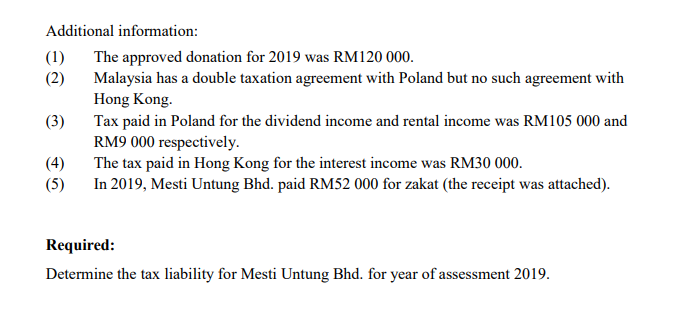

QUESTION 3 Mesti Untung Insurance Bhd., a Malaysian resident company engaging in insurance industry reported the following income for the year of assessment 2019: RM Income from Malaysia: Business income Adjusted income 8 000 000 Balancing allowance 104 000 Capital allowance 82 000 Unabsorbed losses from 2018 70 000 Other income: Dividend (single tier) Interest from YouBank Bhd Rental 85 000 93 000 46 000 Income from Poland: Dividend (only RM200 000 remitted) Rental (all remitted) 350 000 30 000 Income from Hong Kong: Interest income (only RM73 000 was remitted) 100 000 Additional information: (1) The approved donation for 2019 was RM120 000. (2) Malaysia has a double taxation agreement with Poland but no such agreement with Hong Kong (3) Tax paid in Poland for the dividend income and rental income was RM105 000 and RM9 000 respectively. (4) The tax paid in Hong Kong for the interest income was RM30 000. (5) In 2019, Mesti Untung Bhd. paid RM52 000 for zakat (the receipt was attached). Required: Determine the tax liability for Mesti Untung Bhd. for year of assessment 2019. QUESTION 3 Mesti Untung Insurance Bhd., a Malaysian resident company engaging in insurance industry reported the following income for the year of assessment 2019: RM Income from Malaysia: Business income Adjusted income 8 000 000 Balancing allowance 104 000 Capital allowance 82 000 Unabsorbed losses from 2018 70 000 Other income: Dividend (single tier) Interest from YouBank Bhd Rental 85 000 93 000 46 000 Income from Poland: Dividend (only RM200 000 remitted) Rental (all remitted) 350 000 30 000 Income from Hong Kong: Interest income (only RM73 000 was remitted) 100 000 Additional information: (1) The approved donation for 2019 was RM120 000. (2) Malaysia has a double taxation agreement with Poland but no such agreement with Hong Kong (3) Tax paid in Poland for the dividend income and rental income was RM105 000 and RM9 000 respectively. (4) The tax paid in Hong Kong for the interest income was RM30 000. (5) In 2019, Mesti Untung Bhd. paid RM52 000 for zakat (the receipt was attached). Required: Determine the tax liability for Mesti Untung Bhd. for year of assessment 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started