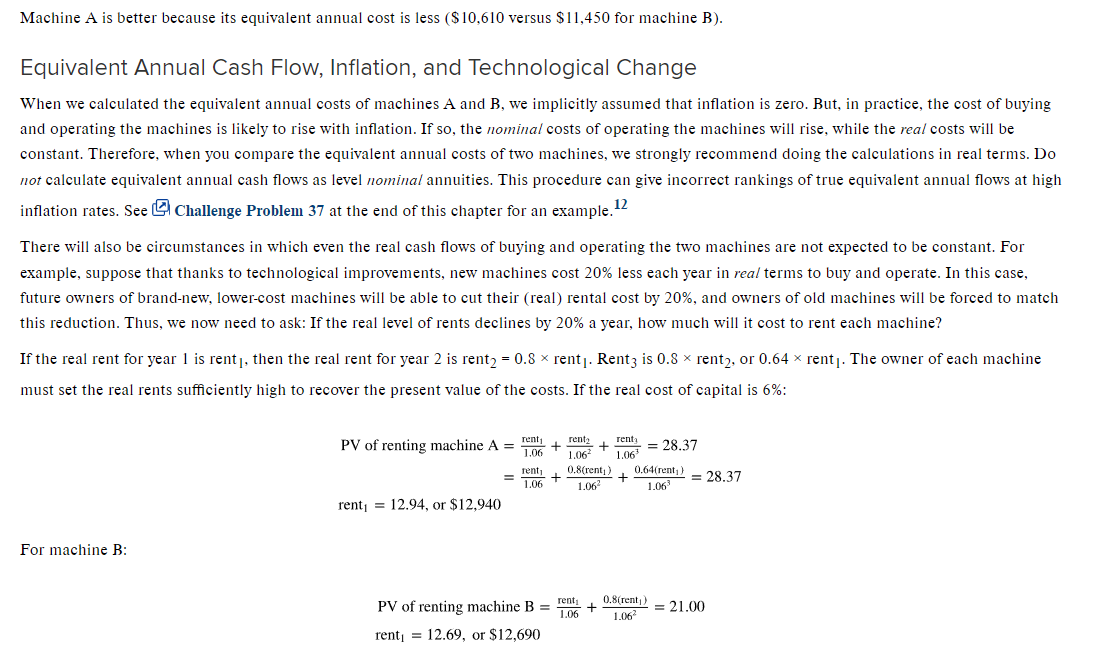

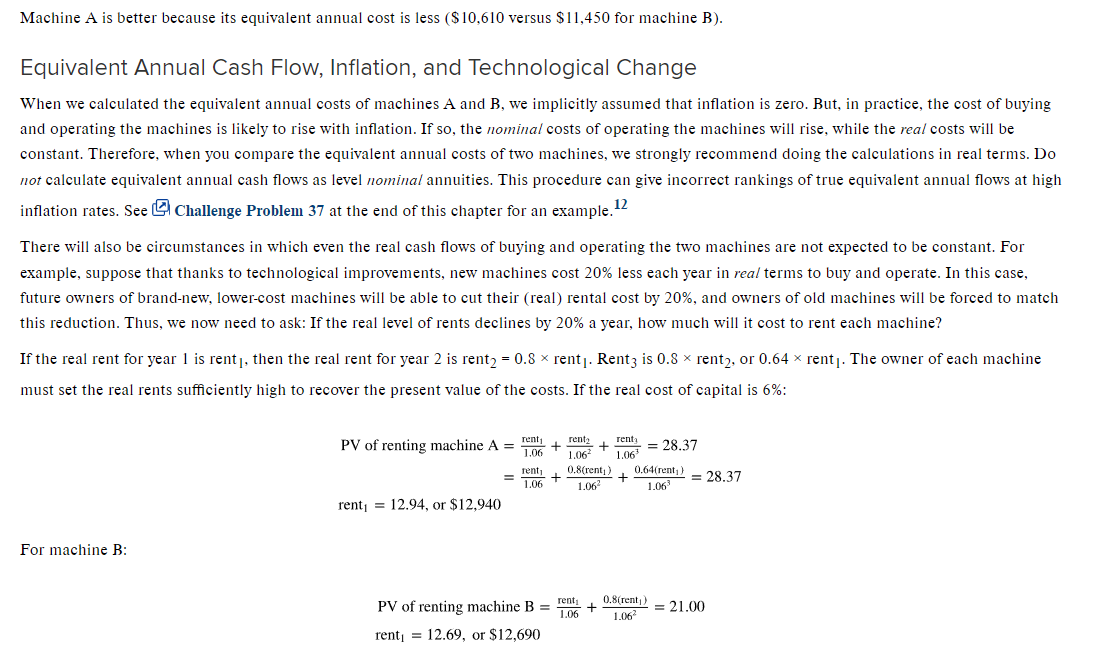

Please help me to understand how to solve the two equations below by hand. How were the 12.94 & 12.69 calculated?

Machine A is better because its equivalent annual cost is less ($10,610 versus $11,450 for machine B). Equivalent Annual Cash Flow, Inflation, and Technological Change When we calculated the equivalent annual costs of machines A and B, we implicitly assumed that inflation is zero. But, in practice, the cost of buying and operating the machines is likely to rise with inflation. If so, the nominal costs of operating the machines will rise, while the real costs will be constant. Therefore, when you compare the equivalent annual costs of two machines, we strongly recommend doing the calculations in real terms. Do not calculate equivalent annual cash flows as level nominal annuities. This procedure can give incorrect rankings of true equivalent annual flows at high inflation rates. See Challenge Problem 37 at the end of this chapter for an example. 12 There will also be circumstances in which even the real cash flows of buying and operating the two machines are not expected to be constant. For example, suppose that thanks to technological improvements, new machines cost 20% less each year in real terms to buy and operate. In this case, future owners of brand-new, lower-cost machines will be able to cut their (real) rental cost by 20%, and owners of old machines will be forced to match this reduction. Thus, we now need to ask: If the real level of rents declines by 20% a year, how much will it cost to rent each machine? If the real rent for year 1 is rent], then the real rent for year 2 is rent2 = 0.8 x rent]. Rentz is 0.8 x rent2, or 0.64 x rent]. The owner of each machine must set the real rents sufficiently high to recover the present value of the costs. If the real cost of capital is 6%: + = 28.37 0.64(rent, PV of renting machine A = rent rente + rent: 1.06 1.062 1.06 rent 0.8(rent) + 1.06 + 1.06 rent = 12.94, or $12.940 = 28.37 1.06 For machine B: rent 0.Brent) = 21.00 1.06 1.06 PV of renting machine B = 40 + rent; = 12.69, or $12,690 Machine A is better because its equivalent annual cost is less ($10,610 versus $11,450 for machine B). Equivalent Annual Cash Flow, Inflation, and Technological Change When we calculated the equivalent annual costs of machines A and B, we implicitly assumed that inflation is zero. But, in practice, the cost of buying and operating the machines is likely to rise with inflation. If so, the nominal costs of operating the machines will rise, while the real costs will be constant. Therefore, when you compare the equivalent annual costs of two machines, we strongly recommend doing the calculations in real terms. Do not calculate equivalent annual cash flows as level nominal annuities. This procedure can give incorrect rankings of true equivalent annual flows at high inflation rates. See Challenge Problem 37 at the end of this chapter for an example. 12 There will also be circumstances in which even the real cash flows of buying and operating the two machines are not expected to be constant. For example, suppose that thanks to technological improvements, new machines cost 20% less each year in real terms to buy and operate. In this case, future owners of brand-new, lower-cost machines will be able to cut their (real) rental cost by 20%, and owners of old machines will be forced to match this reduction. Thus, we now need to ask: If the real level of rents declines by 20% a year, how much will it cost to rent each machine? If the real rent for year 1 is rent], then the real rent for year 2 is rent2 = 0.8 x rent]. Rentz is 0.8 x rent2, or 0.64 x rent]. The owner of each machine must set the real rents sufficiently high to recover the present value of the costs. If the real cost of capital is 6%: + = 28.37 0.64(rent, PV of renting machine A = rent rente + rent: 1.06 1.062 1.06 rent 0.8(rent) + 1.06 + 1.06 rent = 12.94, or $12.940 = 28.37 1.06 For machine B: rent 0.Brent) = 21.00 1.06 1.06 PV of renting machine B = 40 + rent; = 12.69, or $12,690