Question

PLEASE HELP ME ( to view the images clearer, right click on it and click view image on new tab) Checklist . Review the information

PLEASE HELP ME ( to view the images clearer, right click on it and click view image on new tab)

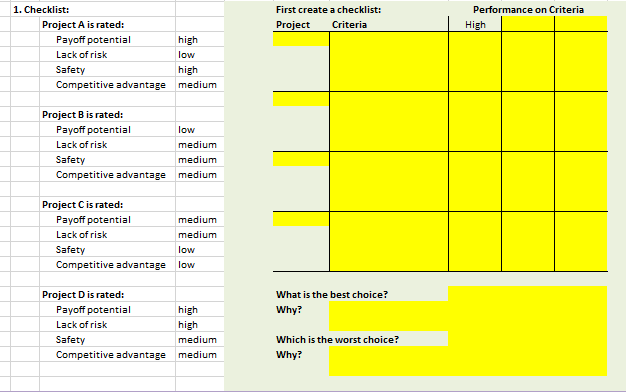

Checklist. Review the information provided in the Excel spreadsheet for choosing among the four project alternatives (labeled A, B, C, and D). Each has been assessed according to four criteria:

Payoff potential

Lack of risk

Safety

Competitive advantage

Construct a project checklist model, using the Excel template, for screening these four alternatives. Based on your model, which project is the best choice for selection? Why? Which is the worst? Why?

=======================================================================================================================================

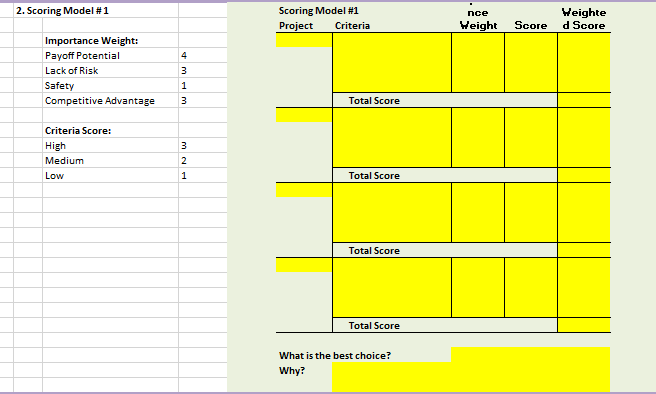

Scoring Model #1. Suppose the same information from the checklist in the first problem was supplemented by importance weights for each of the four assessment criteria, where 1 = low importance and 4 = high importance (see weights in the template). Assume, too, that evaluations of high received a score of 3, medium 2, and low 1. Create a scoring model (using the Excel template) and reassess the four project choices (A, B, C, and D). Now which project alternative is the best? Why?

=======================================================================================================================================

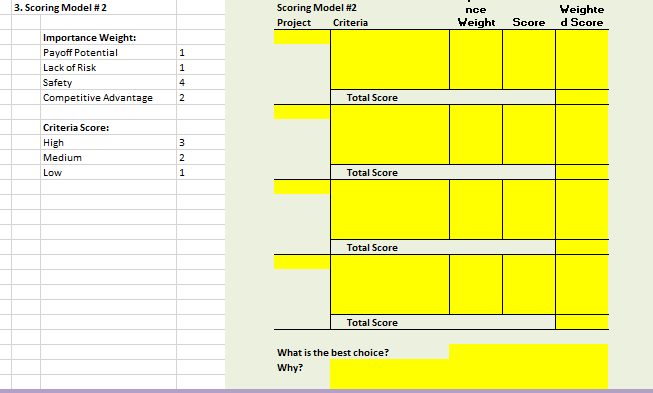

Scoring Model #2. Now assume that for Problem 3, the importance weight is altered (see weights in the template). How does this new information alter your decision? Which project now looks most attractive? Why? Base your response by filling in the graph within the Excel template.

=======================================================================================================================================

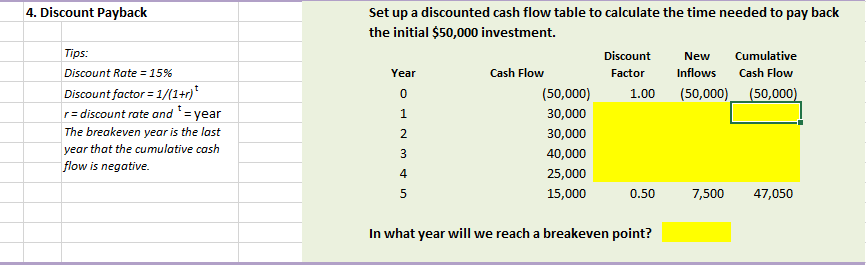

Discount Payback. Your company is seriously considering investing in a new project opportunity, but cash flow is tight. Top management is concerned about how long it will take for this new project to pay back the initial investment of $50,000. You have determined that the project should generate inflows of $30,000, $30,000, $40,000, $25,000, and $15,000 for the next five years. Your firms required rate of return (or discount rate) is 15%. In what year are we able to pay back the initial investment? Respond based on filling in the graph within the Excel template.

=======================================================================================================================================

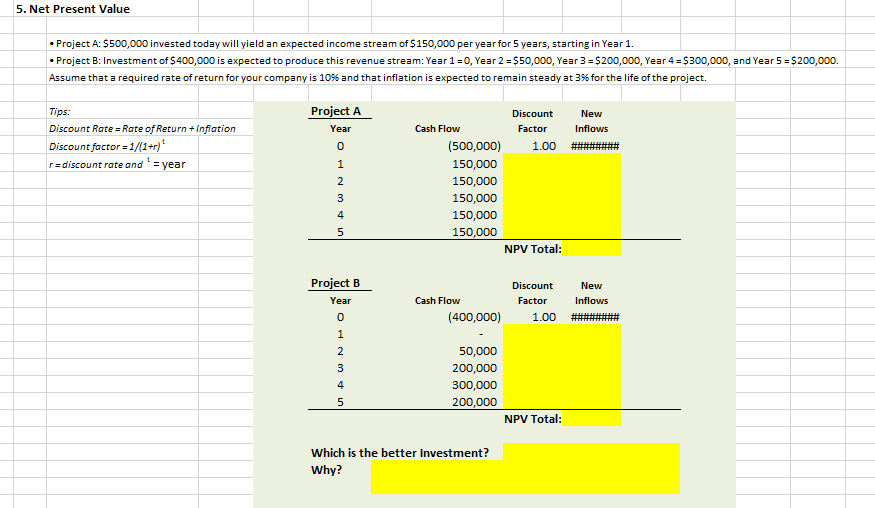

Net Present Value. Assume that your firm wants to choose between two project options:

Project A: $500,000 invested today will yield an expected income stream of $150,000 per year for 5 years, starting in Year 1.

Project B: an initial investment of $400,000 is expected to produce this revenue stream: Year 1 = 0, Year 2 = $50,000, Year 3 = $200,000, Year 4 = $300,000, and Year 5 = $200,000.

Assume that a required rate of return for your company is 10% and that inflation is expected to remain steady at 3% for the life of the project. Which is the better investment? Why? Respond based on filling in the graph within the Excel template.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started