please help me to write the answer below

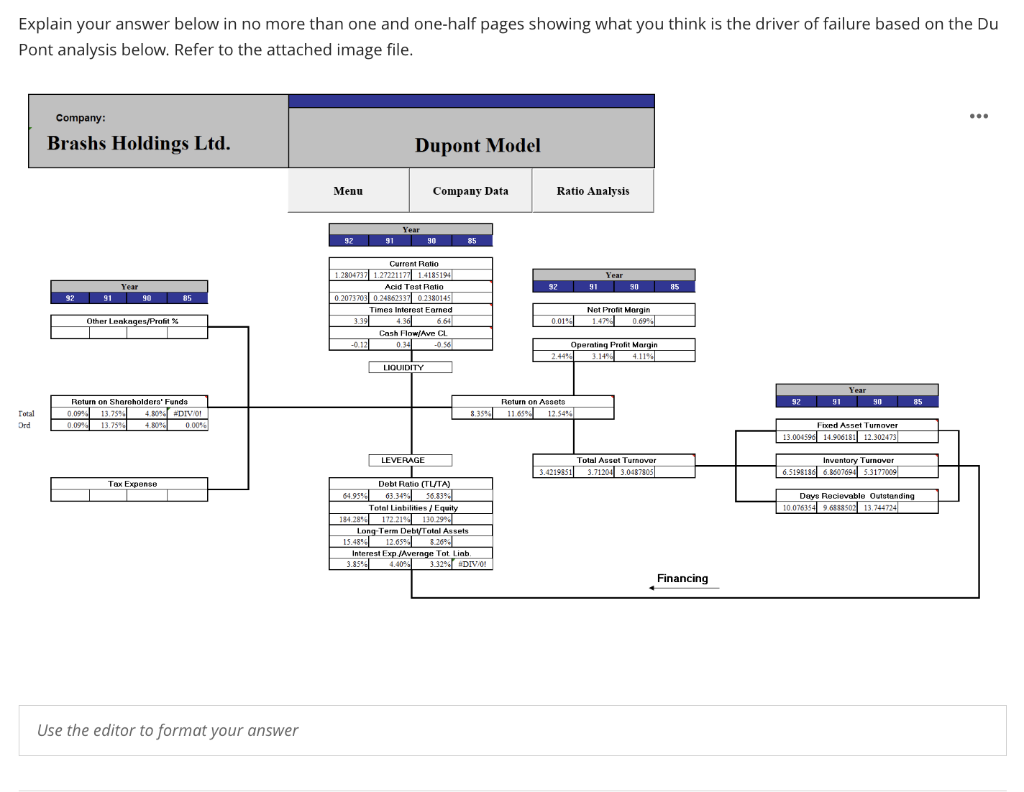

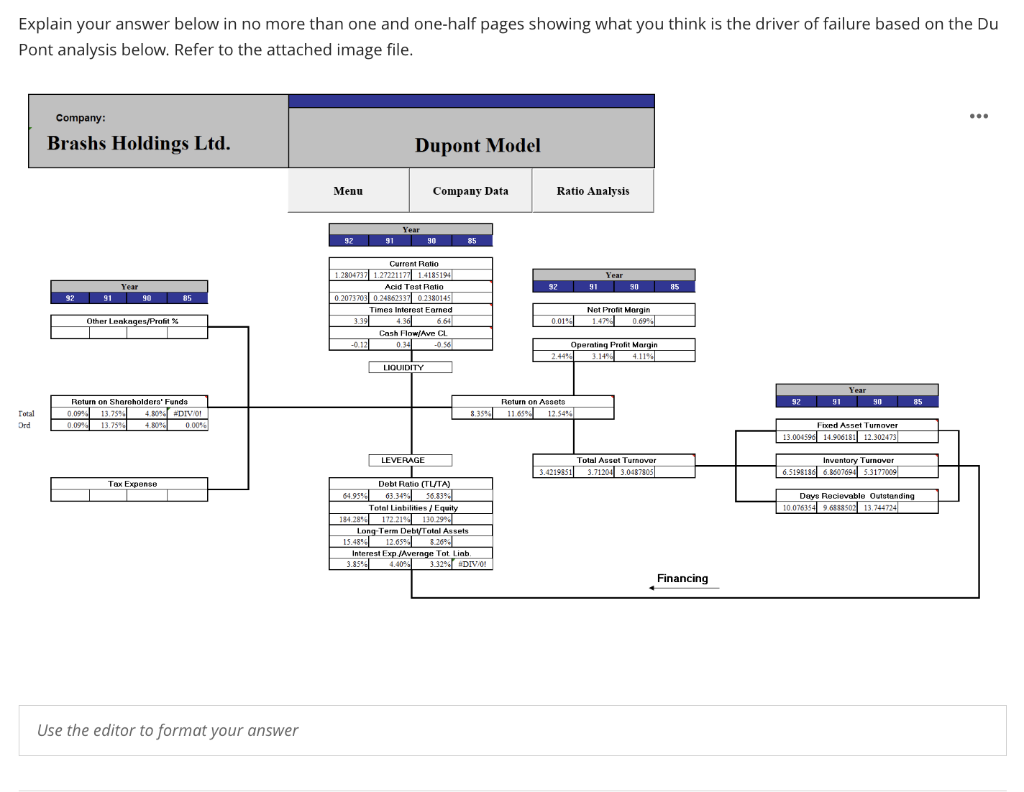

Explain your answer below in no more than one and one-half pages showing what you think is the driver of failure based on the Du Pont analysis below. Refer to the attached image file. Company: Brashs Holdings Ltd. Dupont Model Menu Company Data Ratio Analysis Year 92 91 90 85 32 Year 91 9085 Year 92 91 90 85 Current Ratio 1.280477 1.27221171 1.4185194 Acid Test Ratio 0.2073703 0.24862337 02380145 Times interent Earned 3.39 4.30 664 Cash Flow/Ave CL -0.12 0.341 056 Net Profit Margin 1.47921 Other Leakages/Profit % 0.019 06994 Operating Profit Margin 2.4481 4.11% LIQUIDITY Year 92 91 90 85 Return on Shareholders' Funda 0.09 13.7594 480 NDIV/01 0.09% 13,75% 4.8096 0.00% Return on Assets 8.35 11.65 12.54% Total Ord Fixed Asset Turnover 13.004596 14.90618: 12.902473 LEVERAGE Total Asset Turnover 3.4219051 3.71204 3.0487805 Inventory Turnover 6.5198186 6.8607694 5.3177009 Tax Expense Days Recievable Outstanding 10.07635496338502 13.744724 Debt Ratio (TUTA) 64.95 63.3494 63.344.56.83 Total Liabilities / Equity 184.289 172.219130.29% Long Term Debt/Total Assets 15.48 12.05 8.269 Interest Exp Average Tot Linb. 3.8591 4.40 3.3294DIV/0! 0 Financing Use the editor to format your answer Explain your answer below in no more than one and one-half pages showing what you think is the driver of failure based on the Du Pont analysis below. Refer to the attached image file. Company: Brashs Holdings Ltd. Dupont Model Menu Company Data Ratio Analysis Year 92 91 90 85 32 Year 91 9085 Year 92 91 90 85 Current Ratio 1.280477 1.27221171 1.4185194 Acid Test Ratio 0.2073703 0.24862337 02380145 Times interent Earned 3.39 4.30 664 Cash Flow/Ave CL -0.12 0.341 056 Net Profit Margin 1.47921 Other Leakages/Profit % 0.019 06994 Operating Profit Margin 2.4481 4.11% LIQUIDITY Year 92 91 90 85 Return on Shareholders' Funda 0.09 13.7594 480 NDIV/01 0.09% 13,75% 4.8096 0.00% Return on Assets 8.35 11.65 12.54% Total Ord Fixed Asset Turnover 13.004596 14.90618: 12.902473 LEVERAGE Total Asset Turnover 3.4219051 3.71204 3.0487805 Inventory Turnover 6.5198186 6.8607694 5.3177009 Tax Expense Days Recievable Outstanding 10.07635496338502 13.744724 Debt Ratio (TUTA) 64.95 63.3494 63.344.56.83 Total Liabilities / Equity 184.289 172.219130.29% Long Term Debt/Total Assets 15.48 12.05 8.269 Interest Exp Average Tot Linb. 3.8591 4.40 3.3294DIV/0! 0 Financing Use the editor to format your