Please help me understand this assignment. It is due today.. Also please let me know what the values of the balance sheet are going to be used for.

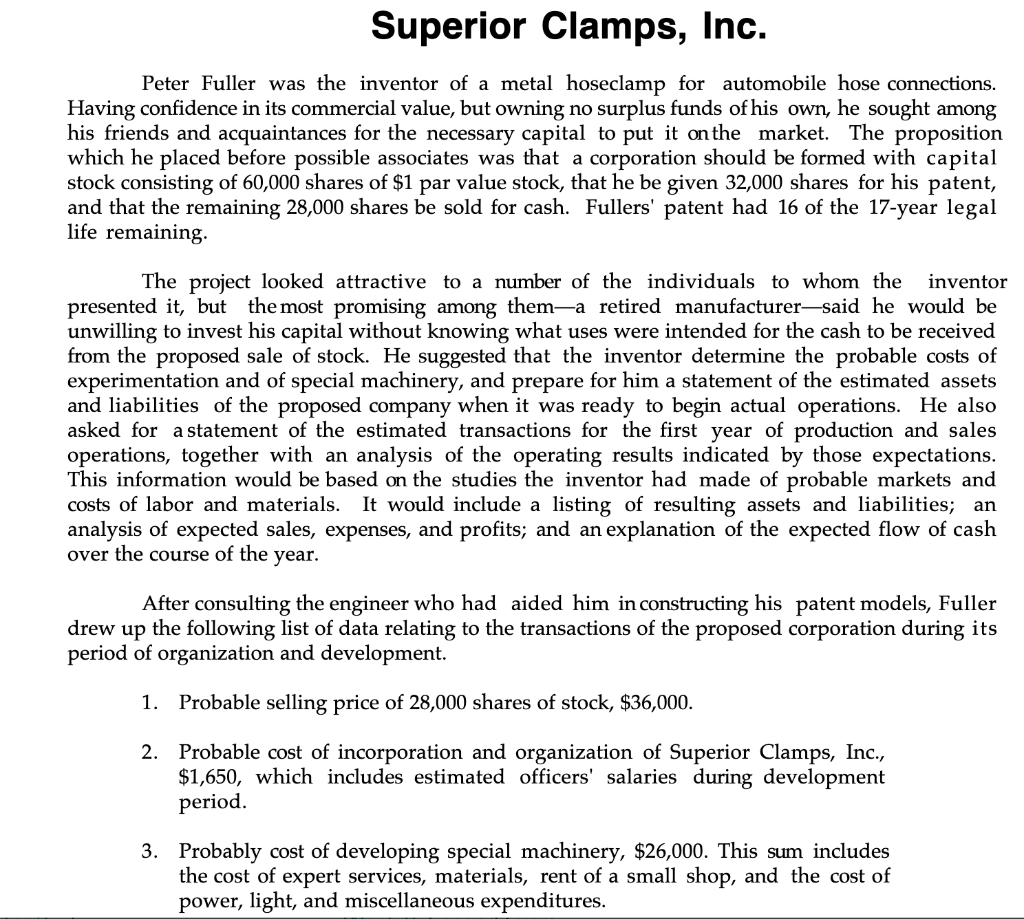

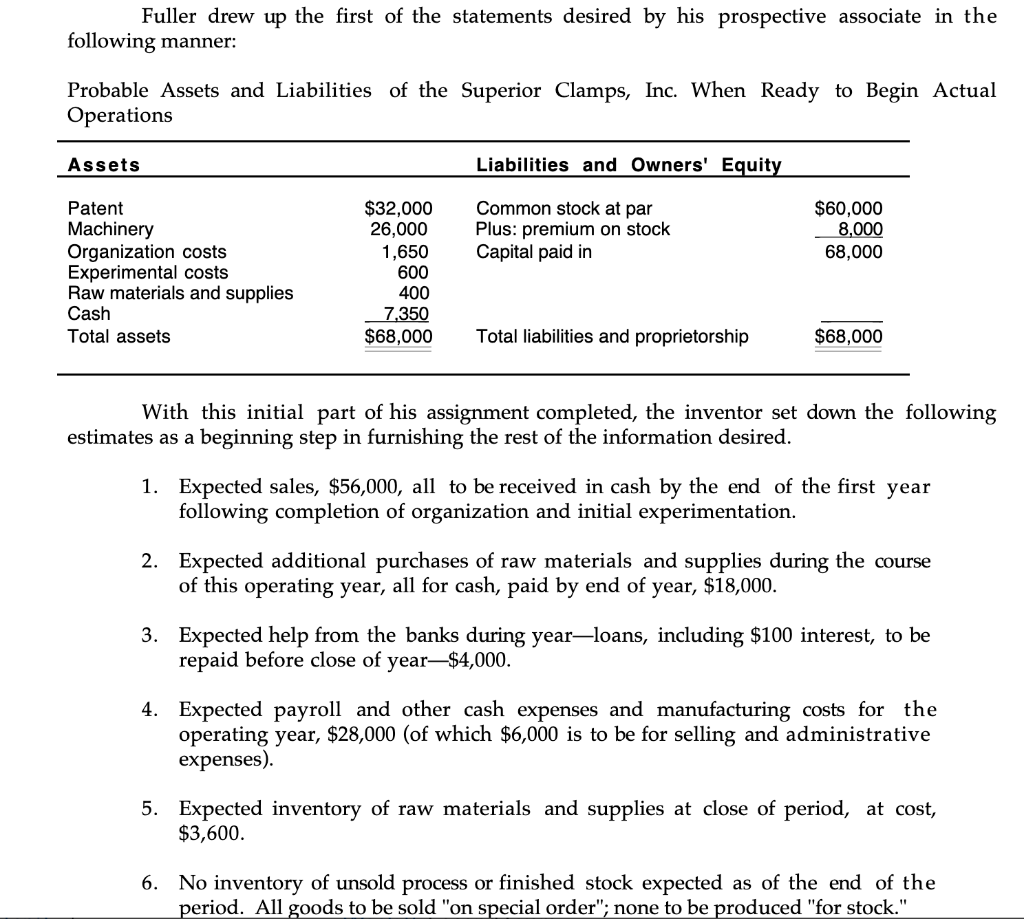

Superior Clamps, Inc. Peter Fuller was the inventor of a metal hoseclamp for automobile hose connections. Having confidence in its commercial value, but owning no surplus funds of his own, he sought among his friends and acquaintances for the necessary capital to put it on the market. The proposition which he placed before possible associates was that a corporation should be formed with capital stock consisting of 60,000 shares of $1 par value stock, that he be given 32,000 shares for his patent, and that the remaining 28,000 shares be sold for cash. Fullers' patent had 16 of the 17-year legal life remaining The project looked attractive to a number of the individuals to whom the inventor presented it, but the most promising among thema retired manufacturersaid he would be unwilling to invest his capital without knowing what uses were intended for the cash to be received from the proposed sale of stock. He suggested that the inventor determine the probable costs of experimentation and of special machinery, and prepare for him a statement of the estimated assets and liabilities of the proposed company when it was ready to begin actual operations. He also asked for a statement of the estimated transactions for the first year of production and sales operations, together with an analysis of the operating results indicated by those expectations. This information would be based on the studies the inventor had made of probable markets and costs of labor and materials. It would include a listing of resulting assets and liabilities; an analysis of expected sales, expenses, and profits; and an explanation of the expected flow of cash over the course of the year. After consulting the engineer who had aided him in constructing his patent models, Fuller drew up the following list of data relating to the transactions of the proposed corporation during its period of organization and development. 1. Probable selling price of 28,000 shares of stock, $36,000. 2. Probable cost of incorporation and organization of Superior Clamps, Inc., $1,650, which includes estimated officers' salaries during development period. 3. Probably cost of developing special machinery, $26,000. This sum includes the cost of expert services, materials, rent of a small shop, and the cost of power, light, and miscellaneous expenditures. Fuller drew up the first of the statements desired by his prospective associate in the following manner: Probable Assets and Liabilities of the Superior Clamps, Inc. When Ready to Begin Actual Operations Assets Liabilities and Owners' Equity Common stock at par Plus: premium on stock Capital paid in $60,000 8,000 68,000 Patent Machinery Organization costs Experimental costs Raw materials and supplies Cash Total assets $32,000 26,000 1,650 600 400 7,350 $68,000 Total liabilities and proprietorship $68,000 With this initial part of his assignment completed, the inventor set down the following estimates as a beginning step in furnishing the rest of the information desired. 1. Expected sales, $56,000, all to be received in cash by the end of the first year following completion of organization and initial experimentation. 2. Expected additional purchases of raw materials and supplies during the course of this operating year, all for cash, paid by end of year, $18,000. 3. Expected help from the banks during year-loans, including $100 interest, to be repaid before close of year$4,000. 4. Expected payroll and other cash expenses and manufacturing costs for the operating year, $28,000 (of which $6,000 is to be for selling and administrative expenses). 5. Expected inventory of raw materials and supplies at close of period, at cost, $3,600. 6. No inventory of unsold process or finished stock expected as of the end of the period. All goods to be sold "on special order"; none to be produced "for stock." 7. All experimental and organization costs, previously capitalized to be charged against income of the operating year. 8. Estimated depreciation of machinery on hand at start of operations, $2,600, based on a 10-year life. (However, Fuller was aware of a plastic hoseclamp being developed by a major corporation that might make his product and the equipment used to produce it obsolete in about four years' time. If this occurred, Fuller thought that it might be possible to convert the special machinery into general-purpose equipment at a cost of several thousand dollars.) 9. Machinery maintenance, cash, $150. 10. New machinery and equipment to be purchased very near the end of the operating year for cash, $2,000. 11. Profit distributions in the form of dividends, $6,000. The above transaction data were for the most part cumulative totals, and should not be interpreted to mean that the events described were to take place in the precise order or sequence indicated. Question 1. Prepare the information wanted by the retired manufacturer. Superior Clamps, Inc. Peter Fuller was the inventor of a metal hoseclamp for automobile hose connections. Having confidence in its commercial value, but owning no surplus funds of his own, he sought among his friends and acquaintances for the necessary capital to put it on the market. The proposition which he placed before possible associates was that a corporation should be formed with capital stock consisting of 60,000 shares of $1 par value stock, that he be given 32,000 shares for his patent, and that the remaining 28,000 shares be sold for cash. Fullers' patent had 16 of the 17-year legal life remaining The project looked attractive to a number of the individuals to whom the inventor presented it, but the most promising among thema retired manufacturersaid he would be unwilling to invest his capital without knowing what uses were intended for the cash to be received from the proposed sale of stock. He suggested that the inventor determine the probable costs of experimentation and of special machinery, and prepare for him a statement of the estimated assets and liabilities of the proposed company when it was ready to begin actual operations. He also asked for a statement of the estimated transactions for the first year of production and sales operations, together with an analysis of the operating results indicated by those expectations. This information would be based on the studies the inventor had made of probable markets and costs of labor and materials. It would include a listing of resulting assets and liabilities; an analysis of expected sales, expenses, and profits; and an explanation of the expected flow of cash over the course of the year. After consulting the engineer who had aided him in constructing his patent models, Fuller drew up the following list of data relating to the transactions of the proposed corporation during its period of organization and development. 1. Probable selling price of 28,000 shares of stock, $36,000. 2. Probable cost of incorporation and organization of Superior Clamps, Inc., $1,650, which includes estimated officers' salaries during development period. 3. Probably cost of developing special machinery, $26,000. This sum includes the cost of expert services, materials, rent of a small shop, and the cost of power, light, and miscellaneous expenditures. Fuller drew up the first of the statements desired by his prospective associate in the following manner: Probable Assets and Liabilities of the Superior Clamps, Inc. When Ready to Begin Actual Operations Assets Liabilities and Owners' Equity Common stock at par Plus: premium on stock Capital paid in $60,000 8,000 68,000 Patent Machinery Organization costs Experimental costs Raw materials and supplies Cash Total assets $32,000 26,000 1,650 600 400 7,350 $68,000 Total liabilities and proprietorship $68,000 With this initial part of his assignment completed, the inventor set down the following estimates as a beginning step in furnishing the rest of the information desired. 1. Expected sales, $56,000, all to be received in cash by the end of the first year following completion of organization and initial experimentation. 2. Expected additional purchases of raw materials and supplies during the course of this operating year, all for cash, paid by end of year, $18,000. 3. Expected help from the banks during year-loans, including $100 interest, to be repaid before close of year$4,000. 4. Expected payroll and other cash expenses and manufacturing costs for the operating year, $28,000 (of which $6,000 is to be for selling and administrative expenses). 5. Expected inventory of raw materials and supplies at close of period, at cost, $3,600. 6. No inventory of unsold process or finished stock expected as of the end of the period. All goods to be sold "on special order"; none to be produced "for stock." 7. All experimental and organization costs, previously capitalized to be charged against income of the operating year. 8. Estimated depreciation of machinery on hand at start of operations, $2,600, based on a 10-year life. (However, Fuller was aware of a plastic hoseclamp being developed by a major corporation that might make his product and the equipment used to produce it obsolete in about four years' time. If this occurred, Fuller thought that it might be possible to convert the special machinery into general-purpose equipment at a cost of several thousand dollars.) 9. Machinery maintenance, cash, $150. 10. New machinery and equipment to be purchased very near the end of the operating year for cash, $2,000. 11. Profit distributions in the form of dividends, $6,000. The above transaction data were for the most part cumulative totals, and should not be interpreted to mean that the events described were to take place in the precise order or sequence indicated. Question 1. Prepare the information wanted by the retired manufacturer