Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME WITH 17-32. THANK YOU! process costing should the company choose and why? 17-31 Transferred-in costs, weighted-average method. Trendy Clothing, Inc. is a

PLEASE HELP ME WITH 17-32. THANK YOU!

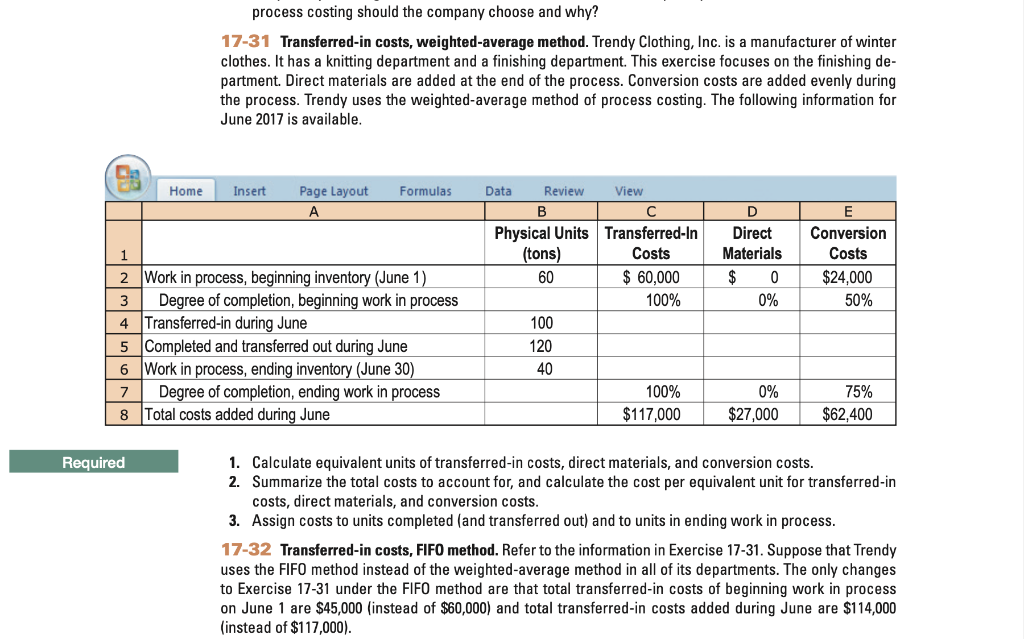

process costing should the company choose and why? 17-31 Transferred-in costs, weighted-average method. Trendy Clothing, Inc. is a manufacturer of winter clothes. It has a knitting department and a finishing department. This exercise focuses on the finishing de- partment. Direct materials are added at the end of the process. Conversion costs are added evenly during the process. Trendy uses the weighted average method of process costing. The following information for June 2017 is available. Home Insert Formulas Page Layout D Data Review View B Physical Units Transferred-In (tons) Costs 60 $ 60,000 100% 100 120 40 100% $117,000 Direct Materials $ 0 0% E Conversion Costs $24,000 50% 1 2 Work in process, beginning inventory (June 1) 3 Degree of completion, beginning work in process 4 Transferred-in during June 5 Completed and transferred out during June 6 Work in process, ending inventory (June 30) 7 Degree of completion, ending work in process 8 Total costs added during June 0% $27,000 75% $62,400 Required 1. Calculate equivalent units of transfe d-in costs, direct mat and cons sion costs. 2. Summarize the total costs to account for, and calculate the cost per equivalent unit for transferred-in costs, direct materials, and conversion costs. 3. Assign costs to units completed (and transferred out) and to units in ending work in process. 17-32 Transferred-in costs, FIFO method. Refer to the information in Exercise 17-31. Suppose that Trendy uses the FIFO method instead of the weighted average method in all of its departments. The only changes to Exercise 17-31 under the FIFO method are that total transferred-in costs of beginning work in process on June 1 are $45,000 (instead of $60,000) and total transferred-in costs added during June are $114,000 (instead of $117,000)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started