Answered step by step

Verified Expert Solution

Question

1 Approved Answer

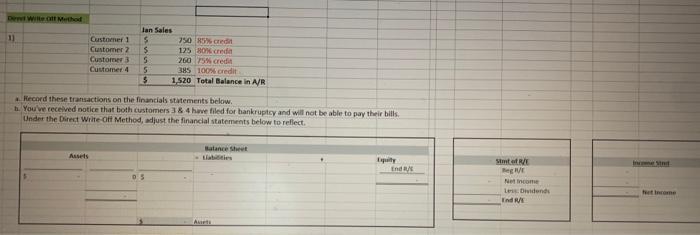

De Witte Off Method 11 Customer 1 Customer 2 Customer 3 Customer 4 Assets Jan Sales $ $ 5 5 $ 750 85% credit

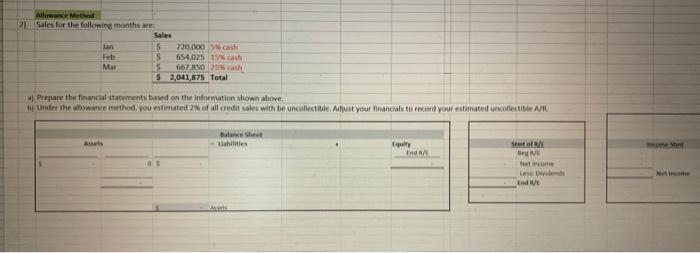

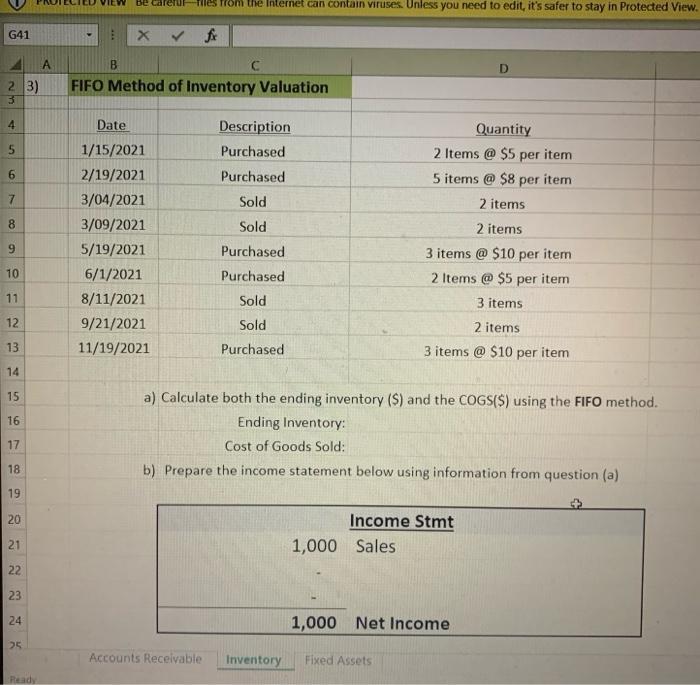

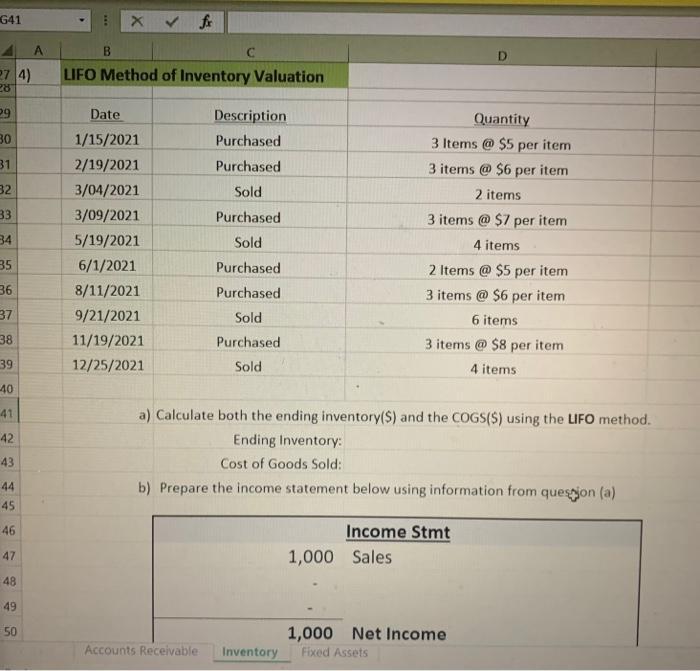

De Witte Off Method 11 Customer 1 Customer 2 Customer 3 Customer 4 Assets Jan Sales $ $ 5 5 $ 750 85% credit 125 80% cred 260 75% credit 385 100% credit 1,520 Total Balance in A/R a Record these transactions on the financials statements below. b. You've received notice that both customers 3 & 4 have filed for bankruptcy and will not be able to pay their bills. Under the Direct Write-Off Method, adjust the financial statements below to reflect. Balance Sheet Liabilities Assets Lipuity End / Stof / Beg / Net Income Less Dividends End R/ Incomend Net Income Allowance Method 21 Sales for the following months are: lan Feb Mar Assets Sales 5 $ S 720,000 5% cash 654,025 15% cash 667,850 25% cash $ 2,041,875 Total a) Prepare the financial statements based on the information shown above. by Under the allowance method, you estimated 2% of all credit sales with be uncollectible. Adjust your financials to record your estimated uncollectible A/R. Balance Sheet Liabilities Aviets Equity End / Stof / Beg/ Net me Less Dividends End R/t ome Stot Net Income G41 23) 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Ready A Y Be B X files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. fx B FIFO Method of Inventory Valuation Date 1/15/2021 2/19/2021 3/04/2021 3/09/2021 5/19/2021 6/1/2021 8/11/2021 9/21/2021 11/19/2021 Accounts Receivable Description Purchased Purchased Sold Sold Purchased Purchased Sold Sold Purchased Inventory a) Calculate both the ending inventory (S) and the COGS($) using the FIFO method. Ending Inventory: Cost of Goods Sold: b) Prepare the income statement below using information from question (a) 1,000 Sales Quantity 2 Items @ $5 per item 5 items @ $8 per item 2 items 2 items 3 items @ $10 per item 2 Items @ $5 per item 3 items Income Stmt D 2 items 3 items @ $10 per item Fixed Assets 1,000 Net Income G41 A A 27 4) 28 29 30 31 32 33 34 35 36 37 38 39 -40 41 42 43 44 45 46 47 48 49 50 B X fx C LIFO Method of Inventory Valuation Date 1/15/2021 2/19/2021 3/04/2021 3/09/2021 5/19/2021 6/1/2021 8/11/2021 9/21/2021 11/19/2021 12/25/2021 Description Purchased Purchased Sold Purchased Sold Purchased Purchased Sold Purchased Sold a) Calculate both the ending inventory($) and the COGS($) using the LIFO method. Ending Inventory: Cost of Goods Sold: b) Prepare the income statement below using information from question (a) Accounts Receivable Inventory Quantity 3 Items @ $5 per item 3 items @ $6 per item 2 items 3 items @ $7 per item 4 items 2 Items @ $5 per item 3 items @ $6 per item 6 items 3 items @ $8 per item 4 items Income Stmt 1,000 Sales 1,000 Net Income Fixed Assets

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Direct Write Off Method Under the direct write off method any un collect ible debts would be written off directly in the period the rece ivable beco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started