Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with B and C for both the income statement and balance sheet!! MINI CASE: SCANDI HOME FURNISHINGS, INC. Kaj Rasmussen founded Scandi

Please help me with B and C for both the income statement and balance sheet!!

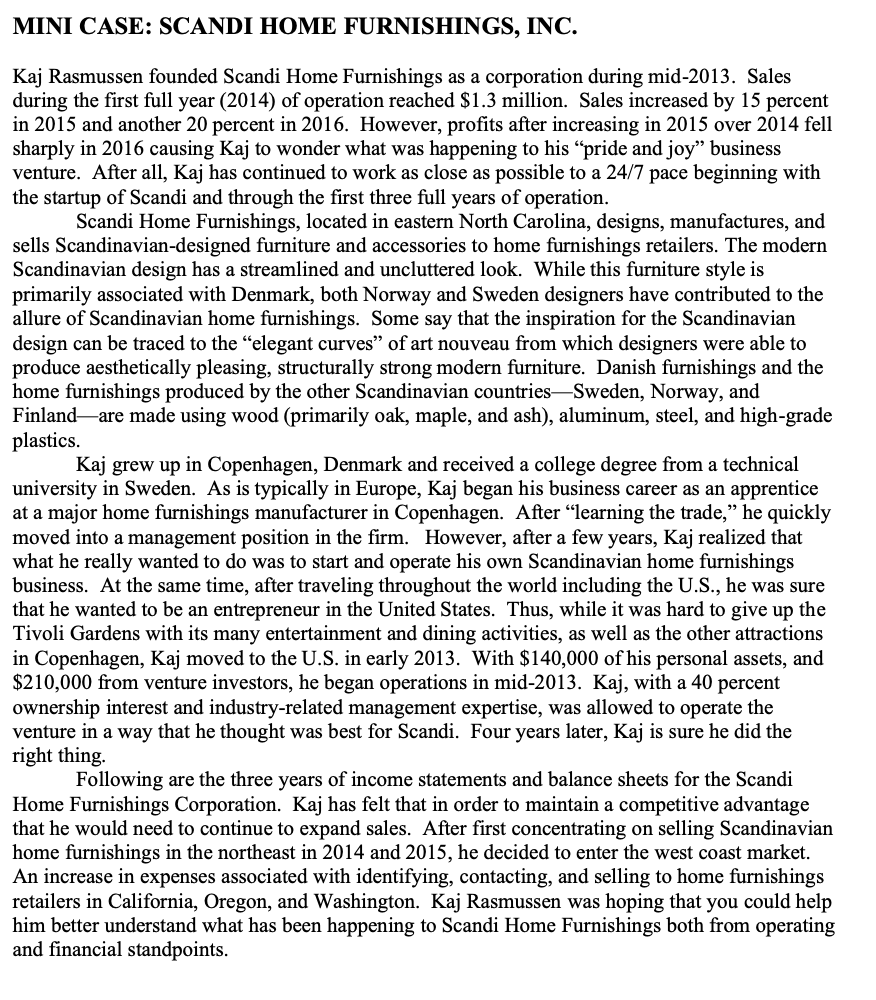

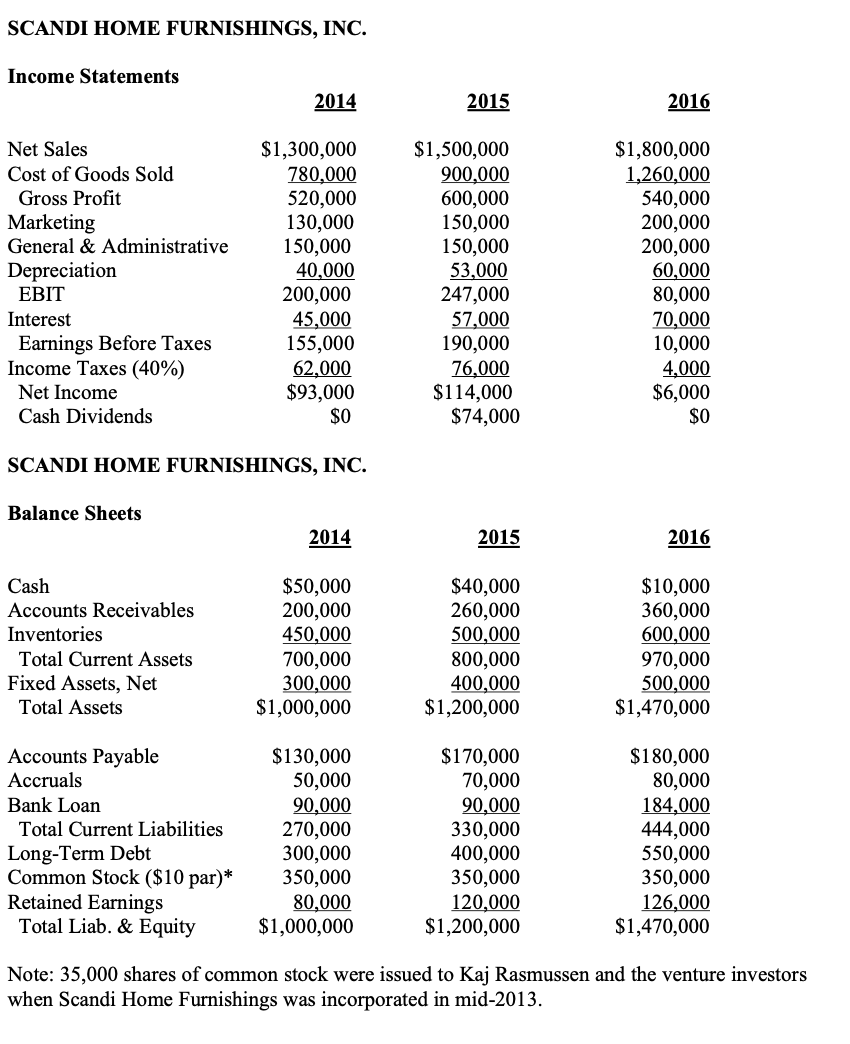

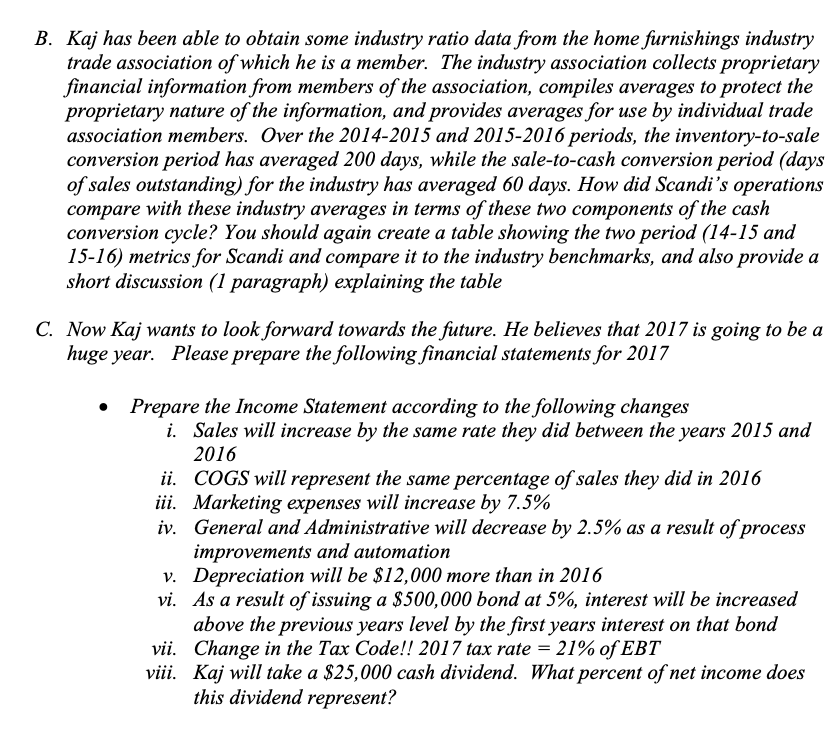

MINI CASE: SCANDI HOME FURNISHINGS, INC. Kaj Rasmussen founded Scandi Home Furnishings as a corporation during mid-2013. Sales during the first full year (2014) of operation reached $1.3 million. Sales increased by 15 percent in 2015 and another 20 percent in 2016. However, profits after increasing in 2015 over 2014 fell sharply in 2016 causing Kaj to wonder what was happening to his "pride and joy" business venture. After all, Kaj has continued to work as close as possible to a 24/7 pace beginning with the startup of Scandi and through the first three full years of operation. Scandi Home Furnishings, located in eastern North Carolina, designs, manufactures, and sells Scandinavian-designed furniture and accessories to home furnishings retailers. The modern Scandinavian design has a streamlined and uncluttered look. While this furniture style is primarily associated with Denmark, both Norway and Sweden designers have contributed to the allure of Scandinavian home furnishings. Some say that the inspiration for the Scandinavian design can be traced to the "elegant curves of art nouveau from which designers were able to produce aesthetically pleasing, structurally strong modern furniture. Danish furnishings and the home furnishings produced by the other Scandinavian countriesSweden, Norway, and Finlandare made using wood (primarily oak, maple, and ash), aluminum, steel, and high-grade plastics. Kaj grew up in Copenhagen, Denmark and received a college degree from a technical university in Sweden. As is typically in Europe, Kaj began his business career as an apprentice at a major home furnishings manufacturer in Copenhagen. After "learning the trade," he quickly moved into a management position in the firm. However, after a few years, Kaj realized that what he really wanted to do was to start and operate his own Scandinavian home furnishings business. At the same time, after traveling throughout the world including the U.S., he was sure that he wanted to be an entrepreneur in the United States. Thus, while it was hard to give up the Tivoli Gardens with its many entertainment and dining activities, as well as the other attractions in Copenhagen, Kaj moved to the U.S. in early 2013. With $140,000 of his personal assets, and $210,000 from venture investors, he began operations in mid-2013. Kaj, with a 40 percent ownership interest and industry-related management expertise, was allowed to operate the venture in a way that he thought was best for Scandi. Four years later, Kaj is sure he did the right thing. Following are the three years of income statements and balance sheets for the Scandi Home Furnishings Corporation. Kaj has felt that in order to maintain a competitive advantage that he would need to continue to expand sales. After first concentrating on selling Scandinavian home furnishings in the northeast in 2014 and 2015, he decided to enter the west coast market. An increase in expenses associated with identifying, contacting, and selling to home furnishings retailers in California, Oregon, and Washington. Kaj Rasmussen was hoping that you could help him better understand what has been happening to Scandi Home Furnishings both from operating and financial standpoints. SCANDI HOME FURNISHINGS, INC. Income Statements 2014 2015 2016 Net Sales Cost of Goods Sold Gross Profit Marketing General & Administrative Depreciation EBIT Interest Earnings Before Taxes Income Taxes (40%) Net Income Cash Dividends $1,300,000 780,000 520,000 130,000 150,000 40,000 200,000 45,000 155,000 62,000 $93,000 $0 $1,500,000 900,000 600,000 150,000 150,000 53,000 247,000 57,000 190,000 76,000 $114,000 $74,000 $1,800,000 1,260,000 540,000 200,000 200,000 60,000 80,000 70,000 10,000 4,000 $6,000 $0 SCANDI HOME FURNISHINGS, INC. Balance Sheets 2014 2015 2016 Cash Accounts Receivables Inventories Total Current Assets Fixed Assets, Net Total Assets $50,000 200,000 450,000 700,000 300,000 $1,000,000 $40,000 260,000 500,000 800,000 400,000 $1,200,000 $10,000 360,000 600,000 970,000 500,000 $1,470,000 Accounts Payable Accruals Bank Loan Total Current Liabilities Long-Term Debt Common Stock ($10 par)* Retained Earnings Total Liab. & Equity $130,000 50,000 90,000 270,000 300,000 350,000 80,000 $1,000,000 $170,000 70,000 90,000 330,000 400,000 350,000 120,000 $1,200,000 $180,000 80,000 184,000 444,000 550,000 350,000 126,000 $1,470,000 Note: 35,000 shares of common stock were issued to Kaj Rasmussen and the venture investors when Scandi Home Furnishings was incorporated in mid-2013. B. Kaj has been able to obtain some industry ratio data from the home furnishings industry trade association of which he is a member. The industry association collects proprietary financial information from members of the association, compiles averages to protect the proprietary nature of the information, and provides averages for use by individual trade association members. Over the 2014-2015 and 2015-2016 periods, the inventory-to-sale conversion period has averaged 200 days, while the sale-to-cash conversion period (days of sales outstanding) for the industry has averaged 60 days. How did Scandi's operations compare with these industry averages in terms of these two components of the cash conversion cycle? You should again create a table showing the two period (14-15 and 15-16) metrics for Scandi and compare it to the industry benchmarks, and also provide a short discussion (1 paragraph) explaining the table C. Now Kaj wants to look forward towards the future. He believes that 2017 is going to be a huge year. Please prepare the following financial statements for 2017 Prepare the Income Statement according to the following changes i. Sales will increase by the same rate they did between the years 2015 and 2016 ii. COGS will represent the same percentage of sales they did in 2016 iii. Marketing expenses will increase by 7.5% iv. General and Administrative will decrease by 2.5% as a result of process improvements and automation v. Depreciation will be $12,000 more than in 2016 vi. As a result of issuing a $500,000 bond at 5%, interest will be increased above the previous years level by the first years interest on that bond vii. Change in the Tax Code!! 2017 tax rate = 21% of EBT viii. Kaj will take a $25,000 cash dividend. What percent of net income does this dividend represent? Project the Balance Sheet according to the following changes i. Cash Increase to $25,000 ii. A/R and Inventories increase by 25% and 22.5% respectively iii. Fixed Assets increases to $752,090 iv. A/P increases by 20% and Accruals increase by 25% v. Reduce Bank Loan to $89,000 vi. Increase Long Term Debt by amount of new bond issue noted in Income Statement Notes vii. Common Stock and Capital Surplus Remain the Same viii. Retained Earnings increase to $157,090 ix. Remember to make sure that your balance sheet balances! - Net Income and you D. Finally, solve for the Profitability Ratio (ROE) for each of the three historical years and the projected year. Put your answers in a table. Remember ROE = ? Equity do have an equity number for each year. Please state your answer as a percentage. Please provide a brief narrative (2-3 sentences) describing the YOY (year over year) change and your explanation E. CONCLUSION: Write a brief memo to Kaj with your thoughts on the future of Scandia. (does it look promising? Do you have any concerns? Note - I don't expect Wall Street Journal analyses here. A few sentences with your thoughts will suffice). Finally, write a few sentences on your impressions of this assignment most interesting aspects, most challenging, etcStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started