Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with detailed answer 2) US bonds often have semi-annual interest payments. Consider such a bond with a time to maturity of four-years,

please help me with detailed answer

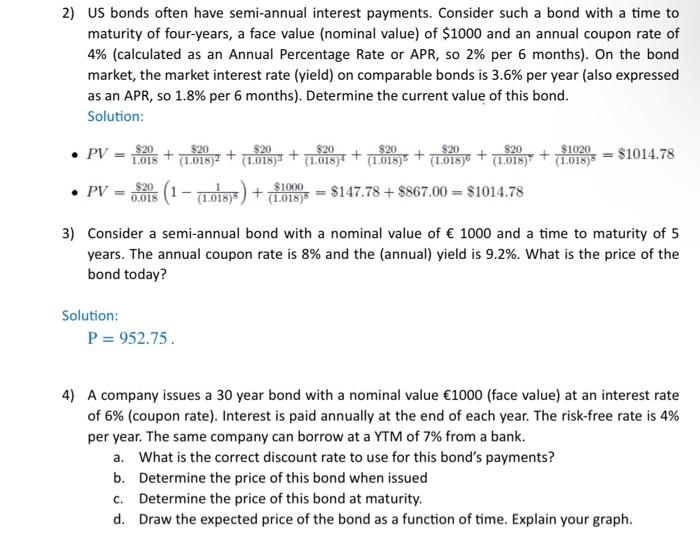

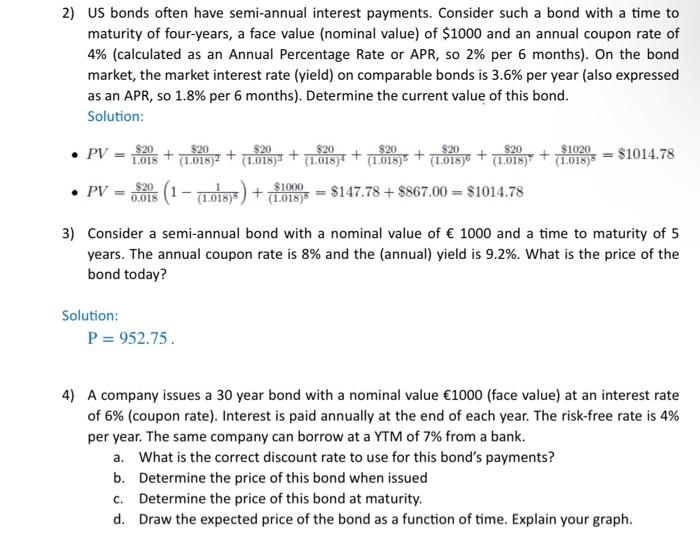

2) US bonds often have semi-annual interest payments. Consider such a bond with a time to maturity of four-years, a face value (nominal value) of $1000 and an annual coupon rate of 4% (calculated as an Annual Percentage Rate or APR, so 2% per 6 months). On the bond market, the market interest rate (yield) on comparable bonds is 3.6% per year (also expressed as an APR, so 1.8% per 6 months). Determine the current value of this bond. Solution: - PV=1.018$20+(1.018)2$20+(1.018)3$20+(1.018)4$20+(1.018)5$20+(1.018)6$20+(1.018)7$20+(1.018)8$1020=$1014.78 - PV=0.018$20(1(1.018)81)+(1.018)8$1000=$147.78+$867.00=$1014.78 3) Consider a semi-annual bond with a nominal value of 1000 and a time to maturity of 5 years. The annual coupon rate is 8% and the (annual) yield is 9.2%. What is the price of the bond today? Solution: P=952.75 4) A company issues a 30 year bond with a nominal value 1000 (face value) at an interest rate of 6% (coupon rate). Interest is paid annually at the end of each year. The risk-free rate is 4% per year. The same company can borrow at a VTM of 7% from a bank. a. What is the correct discount rate to use for this bond's payments? b. Determine the price of this bond when issued c. Determine the price of this bond at maturity. d. Draw the expected price of the bond as a function of time. Explain your graph

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started