please help me with my finance

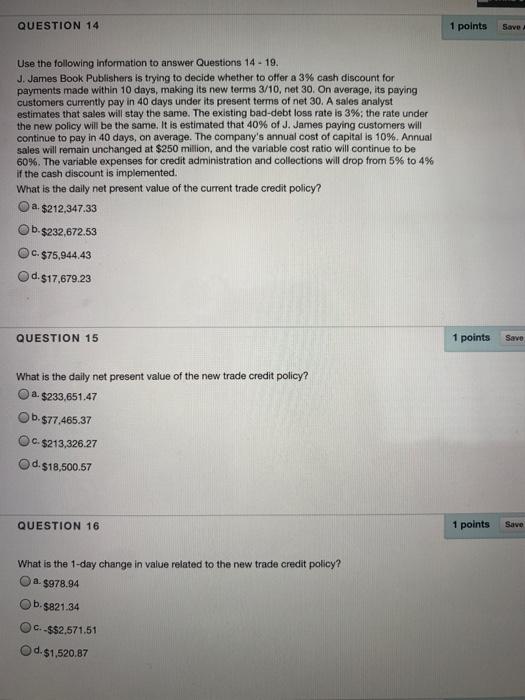

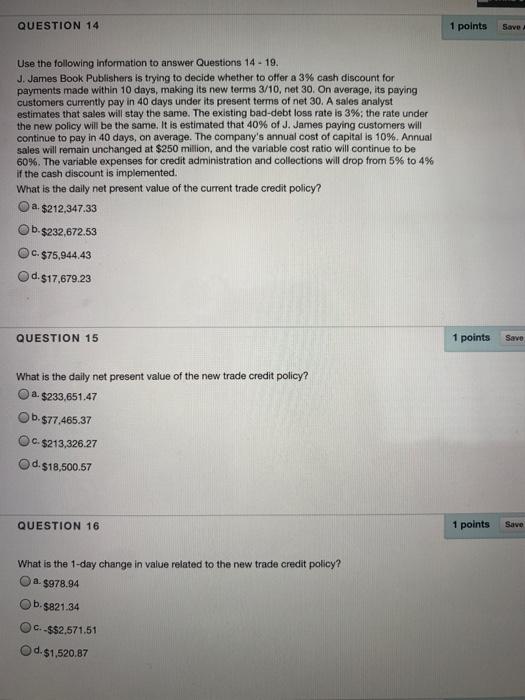

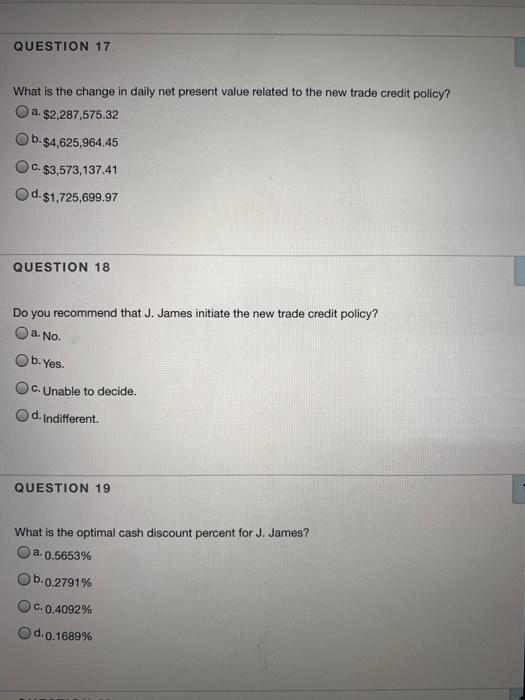

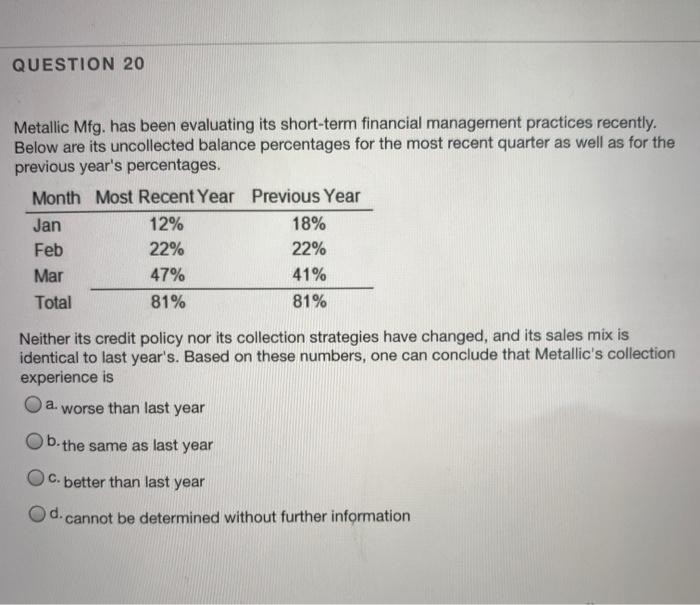

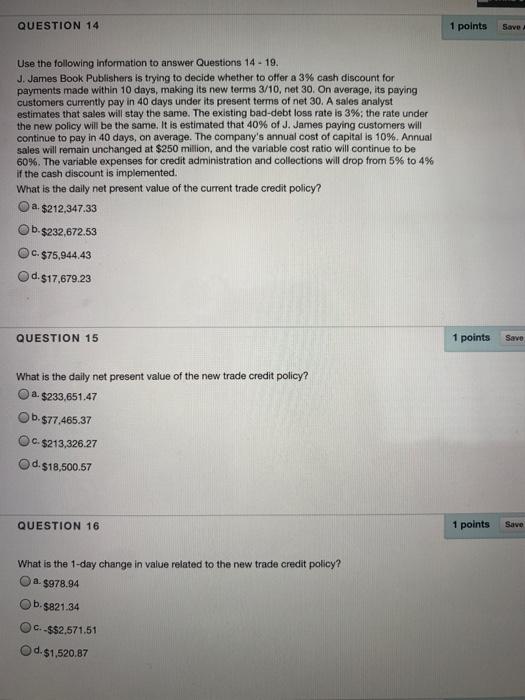

QUESTION 14 1 points Save Use the following information to answer Questions 14 - 19. J. James Book Publishers is trying to decide whether to offer a 3% cash discount for payments made within 10 days, making its new terms 3/10, net 30. On average, its paying customers currently pay in 40 days under its present terms of net 30. A sales analyst estimates that sales will stay the same. The existing bad-debt loss rate is 3%; the rate under the new policy will be the same. It is estimated that 40% of J. James paying customers will continue to pay in 40 days, on average. The company's annual cost of capital is 10%. Annual sales will remain unchanged at $250 million, and the variable cost ratio will continue to be 60%. The variable expenses for credit administration and collections will drop from 5% to 4% if the cash discount is implemented. What is the daily net present value of the current trade credit policy? a. $212.347.33 b. $232,672.53 c. $75,944.43 d. $17.679.23 QUESTION 15 1 points Save What is the daily net present value of the new trade credit policy? . $233,651.47 $77.465.37 C. $213,326 27 d. $18,500.57 QUESTION 16 1 points Save What is the 1-day change in value related to the new trade credit policy? a. $978.94 b. $821.34 c.-$$2.571.51 d. $1,520.87 QUESTION 17 What is the change in daily net present value related to the new trade credit policy? a $2,287,575.32 b. $4,625,964.45 C. $3,573,137.41 d. $1,725,699.97 Oc QUESTION 18 Do you recommend that J. James initiate the new trade credit policy? a.No. b. Yes. C. Unable to decide. d. Indifferent QUESTION 19 What is the optimal cash discount percent for J. James? a. 0.5653% -0.2791% C.0.4092% Od.0.1689% QUESTION 20 Metallic Mfg. has been evaluating its short-term financial management practices recently. Below are its uncollected balance percentages for the most recent quarter as well as for the previous year's percentages. Month Most Recent Year Previous Year Jan 12% 18% Feb 22% 22% Mar 47% 41% Total 81% 81% Neither its credit policy nor its collection strategies have changed, and its sales mix is identical to last year's. Based on these numbers, one can conclude that Metallic's collection experience is Oa. worse than last year b.the same as last year C. better than last year Od.cannot be determined without further information QUESTION 14 1 points Save Use the following information to answer Questions 14 - 19. J. James Book Publishers is trying to decide whether to offer a 3% cash discount for payments made within 10 days, making its new terms 3/10, net 30. On average, its paying customers currently pay in 40 days under its present terms of net 30. A sales analyst estimates that sales will stay the same. The existing bad-debt loss rate is 3%; the rate under the new policy will be the same. It is estimated that 40% of J. James paying customers will continue to pay in 40 days, on average. The company's annual cost of capital is 10%. Annual sales will remain unchanged at $250 million, and the variable cost ratio will continue to be 60%. The variable expenses for credit administration and collections will drop from 5% to 4% if the cash discount is implemented. What is the daily net present value of the current trade credit policy? a. $212.347.33 b. $232,672.53 c. $75,944.43 d. $17.679.23 QUESTION 15 1 points Save What is the daily net present value of the new trade credit policy? . $233,651.47 $77.465.37 C. $213,326 27 d. $18,500.57 QUESTION 16 1 points Save What is the 1-day change in value related to the new trade credit policy? a. $978.94 b. $821.34 c.-$$2.571.51 d. $1,520.87 QUESTION 17 What is the change in daily net present value related to the new trade credit policy? a $2,287,575.32 b. $4,625,964.45 C. $3,573,137.41 d. $1,725,699.97 Oc QUESTION 18 Do you recommend that J. James initiate the new trade credit policy? a.No. b. Yes. C. Unable to decide. d. Indifferent QUESTION 19 What is the optimal cash discount percent for J. James? a. 0.5653% -0.2791% C.0.4092% Od.0.1689% QUESTION 20 Metallic Mfg. has been evaluating its short-term financial management practices recently. Below are its uncollected balance percentages for the most recent quarter as well as for the previous year's percentages. Month Most Recent Year Previous Year Jan 12% 18% Feb 22% 22% Mar 47% 41% Total 81% 81% Neither its credit policy nor its collection strategies have changed, and its sales mix is identical to last year's. Based on these numbers, one can conclude that Metallic's collection experience is Oa. worse than last year b.the same as last year C. better than last year Od.cannot be determined without further information