Answered step by step

Verified Expert Solution

Question

1 Approved Answer

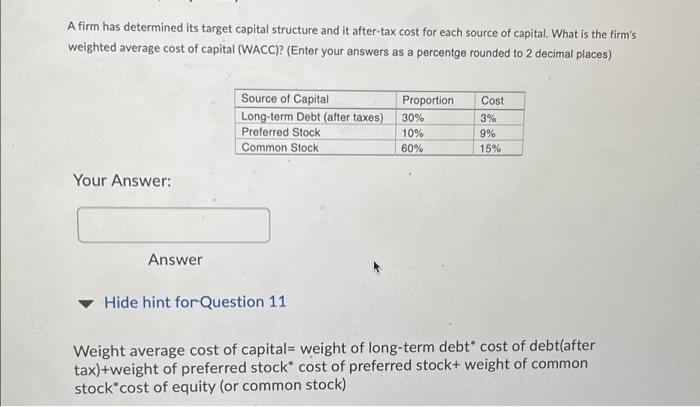

please help me with Question 11, 12, and 13 please and thank you! A firm has determined its target capital structure and it after-tax cost

please help me with Question 11, 12, and 13 please and thank you!

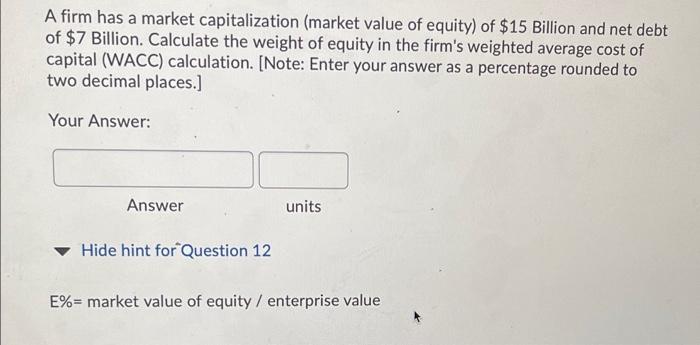

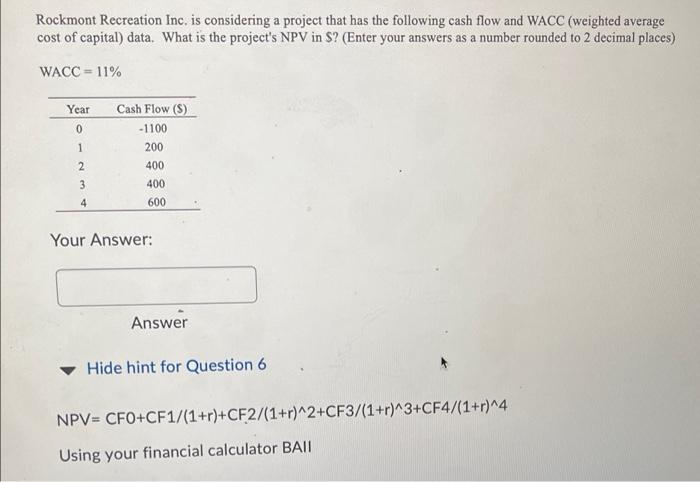

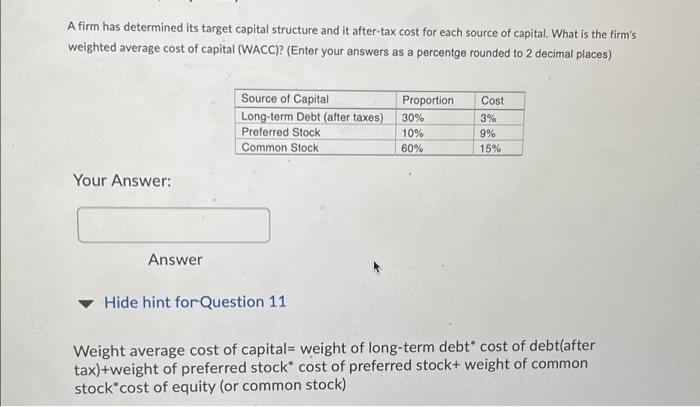

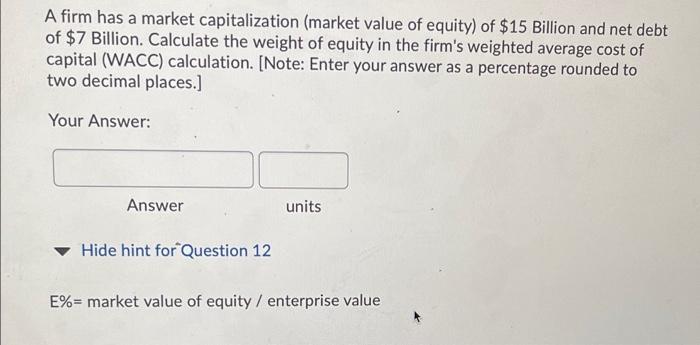

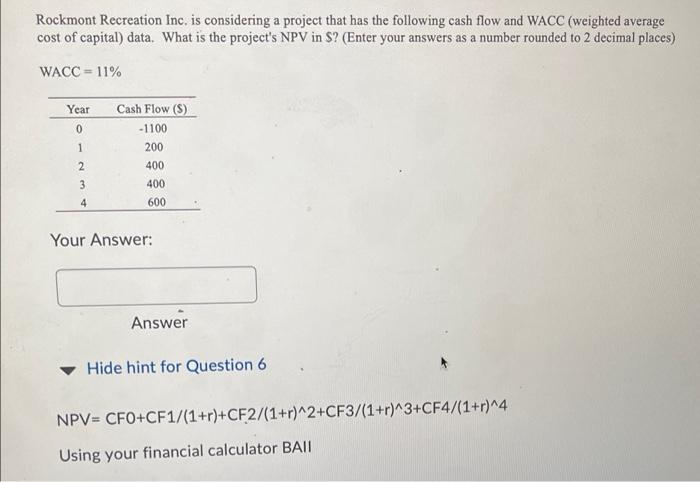

A firm has determined its target capital structure and it after-tax cost for each source of capital. What is the firm's weighted average cost of capital (WACC)? (Enter your answers as a percentge rounded to 2 decimal places) Source of Capital Long-term Debt (after taxes) Preferred Stock Common Stock Proportion 30% 10% 60% Cost 3% 9% 15% Your Answer: Answer Hide hint for Question 11 Weight average cost of capital= weight of long-term debt cost of debt(after tax)+weight of preferred stock cost of preferred stock+ weight of common stock cost of equity (or common stock) A firm has a market capitalization (market value of equity) of $15 Billion and net debt of $7 Billion. Calculate the weight of equity in the firm's weighted average cost of capital (WACC) calculation. [Note: Enter your answer as a percentage rounded to two decimal places.) Your Answer: Answer units Hide hint for Question 12 E%= market value of equity / enterprise value Rockmont Recreation Inc. is considering a project that has the following cash flow and WACC (weighted average cost of capital) data. What is the project's NPV in $? (Enter your answers as a number rounded to 2 decimal places) WACC = 11% Year 0 Cash Flow (S) -1100 200 1 2 400 400 3 4 600 Your Answer: Answer Hide hint for Question 6 NPV=CFO+CF1/(1+r)+CF2/(1+r)^2+CF3/(1+r)^3+CF4/(1+r)^4 Using your financial calculator BALI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started