Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE HELP ME WITH QUESTION 3 PLEASE Please help me with question 3 please Prepare the journal entries to record the original invest :ent stated

PLEASE HELP ME WITH QUESTION 3 PLEASE

Please help me with question 3 please

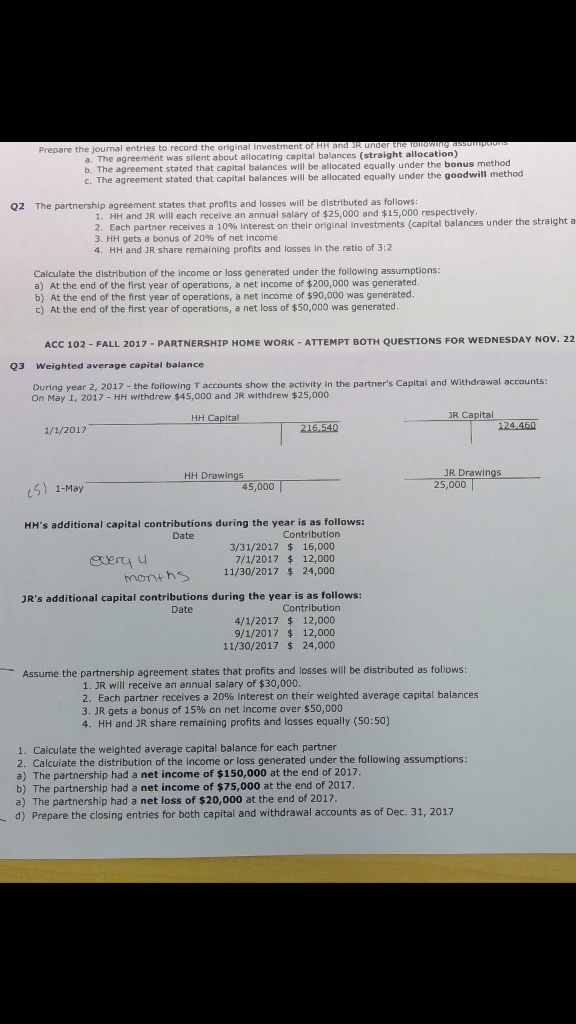

Prepare the journal entries to record the original invest :ent stated chat capia a. The agreement was silent about allocating capital balances (straight allocation) b. The agreement stated that capital balances will be allocated equally under the bonus method c. The agreement stated that capital balances will be allocated equally under the goodwill method will be allocated equaly Q2 The partnership agreement states that profits and losses will be distributed as follows 1. HH and JR will each receive an annual salary of $25,000 and $15,000 respectively. 2. Each partner receives a 10% interes 3. HH gets a bonus of 20% of net income 4. HH and JR share remaining profits and losses in the ratio of 3:2 t on their original investments (capital balances under the straig ,rsof 20% Calculate the distribution of the income or loss generated under the following assumptions: a) At the end of the first year of operations, a net income of $200,000 was generated b) At the end of the first year of operations, a net income of $90,000 was generated c) At the end of the first year of operations, a net loss of $50,000 was generated. ACC 102- FALL 2017-PARTNERSHIP HOME WORK ATTEMPT BOTH QUESTIONS FOR WEDNESDAY NOV. 22 Weighted average capital balance During year 2, 2017 - the following T accounts show the activity in the partner's Capital and Withdrawal accounts 23 al account on May 1, 2017-HH withdrew $45,000 and JR withdrew 25,000 HH Ca R Capital 1/1/2017 216.540 124.460 Drawings A5,00 JR Drawings 25,000 S) 1-May HH's additional capital contributions during the year is as follows: Date Contribution 3/31/2017 16,000 7/1/2017 12,000 moth 11/30/2017 24,000 EXer JR's additional capital contributions during the year is as follows: Date Contribution 4/1/2017 12,000 9/1/2017 $ 12,000 11/30/201724,000 Assume the partnership agreement states that profits and losses wil be distributed as follows 1. JR will receive an annual salary of $30,000 2. Each partner receives a 20% interest on their weighted average capital balances 3, JR gets a bonus of 15% on net income over $50,000 4. HH and JR share remaining profits and losses equally (50:50) 1. Calculate the weighted average capital balance for each partner 2. Calcuiate the distribution of the income or loss generated under the following assumptions a) The partnership had a net income of $150,000 at the end of 2017. b) The partnership had a net income of $75,000 at the end of 2017. a) The partnership had a net loss of $20,000 at the end of 2017. d) Prepare the closing entries for both capital and withdrawal accounts as of Dec. 31, 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started