Answered step by step

Verified Expert Solution

Question

1 Approved Answer

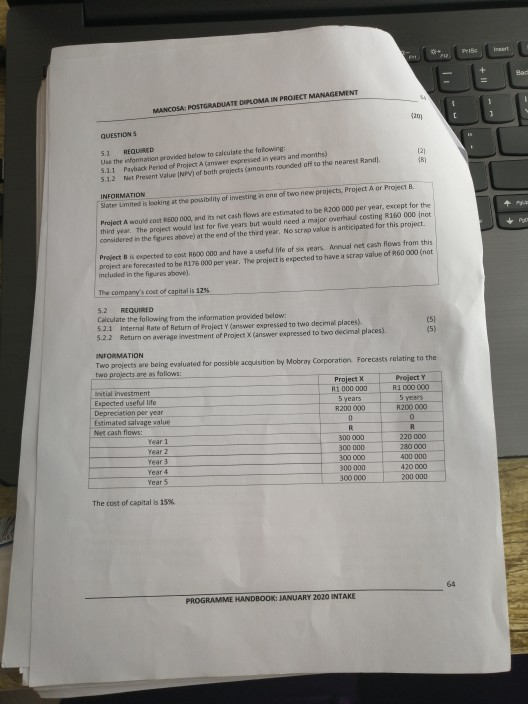

Please help me with question 5. Thank you. Inent 13 + Bad 1 MANCOSA POSTGRADUATE DIPLOMA IN PROJECT MANAGEMENT 1 1 20 QUESTIONS 121 16

Please help me with question 5. Thank you.

Inent 13 + Bad 1 MANCOSA POSTGRADUATE DIPLOMA IN PROJECT MANAGEMENT 1 1 20 QUESTIONS 121 16 5.1 REQUIRED Use the information provided below to calculate the following 511 Payback period of Project Answer expressed in years and months) 512 Net Present Value NPV) of both projects (amounts rounded off to the nearest Rand INFORMATION Slate Limited is looking at the possibility of investing in one of two new projects, Project A or Proxect B. Project A would cost R600 000, and its net cash flows are estimated to be R200 000 per year, except for the third year. The project would last for five years but would need a major overhaul cesting R150 000 not considered in the figures above) at the end of the third year. No scrap value is anticipated for this project. Por Project is expected to cost ROO000 and have a useful life of six years. Annual net cash flows from this project are forecasted to be R176 000 per year. The project is expected to have a scrap value of R60 000 (not included in the figures above). The company's cost of capitalis 125 5.2 REQUIRED Calculate the following from the information provided below: 52.1 Internal Rate of Return of Project answer expressed to two decimal places) 5.2.2 Return on average investment of Project X Canswer expressed to two decimal places) (5) (5) INFORMATION Two projects are being evaluated for possible acquisition by Mobray Corporation Forecasts relating to the two projects are as follows: Project Project Initial investment R1 000 000 R1 000 000 Expected useful life 5 years 5 years Depreciation per year R200 000 R200 000 0 0 Estimated salvage value Net cash flows: R R Year 1 300 000 220 000 Year 2 300 000 280 000 Year 3 300 000 400 000 300 000 420 DOO Years 300 000 200 000 Year 4 The cost of capital is 15% 64 PROGRAMME HANDBOOK: JANUARY 2020 INTAKE Inent 13 + Bad 1 MANCOSA POSTGRADUATE DIPLOMA IN PROJECT MANAGEMENT 1 1 20 QUESTIONS 121 16 5.1 REQUIRED Use the information provided below to calculate the following 511 Payback period of Project Answer expressed in years and months) 512 Net Present Value NPV) of both projects (amounts rounded off to the nearest Rand INFORMATION Slate Limited is looking at the possibility of investing in one of two new projects, Project A or Proxect B. Project A would cost R600 000, and its net cash flows are estimated to be R200 000 per year, except for the third year. The project would last for five years but would need a major overhaul cesting R150 000 not considered in the figures above) at the end of the third year. No scrap value is anticipated for this project. Por Project is expected to cost ROO000 and have a useful life of six years. Annual net cash flows from this project are forecasted to be R176 000 per year. The project is expected to have a scrap value of R60 000 (not included in the figures above). The company's cost of capitalis 125 5.2 REQUIRED Calculate the following from the information provided below: 52.1 Internal Rate of Return of Project answer expressed to two decimal places) 5.2.2 Return on average investment of Project X Canswer expressed to two decimal places) (5) (5) INFORMATION Two projects are being evaluated for possible acquisition by Mobray Corporation Forecasts relating to the two projects are as follows: Project Project Initial investment R1 000 000 R1 000 000 Expected useful life 5 years 5 years Depreciation per year R200 000 R200 000 0 0 Estimated salvage value Net cash flows: R R Year 1 300 000 220 000 Year 2 300 000 280 000 Year 3 300 000 400 000 300 000 420 DOO Years 300 000 200 000 Year 4 The cost of capital is 15% 64 PROGRAMME HANDBOOK: JANUARY 2020 INTAKEStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started