Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with question two. thank you ID 1 1 LAG. 36% 13:15 Assignment 03 (... DEPARTMENT OF ECONOMICS ISSUES IN DEVELOPMENT FINANCE (EDF5982)

Please help me with question two. thank you

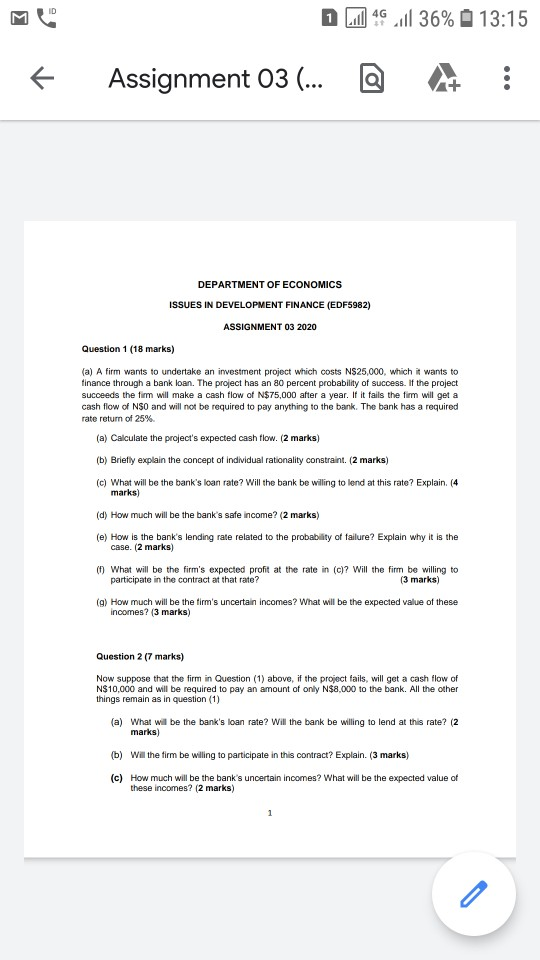

ID 1 1 LAG. 36% 13:15 Assignment 03 (... DEPARTMENT OF ECONOMICS ISSUES IN DEVELOPMENT FINANCE (EDF5982) ASSIGNMENT 03 2020 Question 1 (18 marks) (a) A firm wants to undertake an investment project which costs NS25,000, which it wants to finance through a bank loan. The project has an 80 percent probability of success. If the project succeeds the fim will make a cash flow of N$75,000 after a year. If it fails the firm will get a cash flow of NO and will not be required to pay anything to the bank. The bank has a required rate return of 25% (a) Calculate the project's expected cash flow. (2 marks) (b) Briefly explain the concept of individual rationality constraint. (2 marks) (c) What will be the bank's loan rate? Will the bank be willing to lend at this rate? Explain. (4 marks) (d) How much will be the bank's safe income? (2 marks) (e) How is the bank's lending rate related to the probability of failure? Explain why It is the case. (2 marks) What will be the firm's expected profit at the rate in (c)? Will the firm be willing to participate in the contract at that rate? (3 marks) (g) How much will be the firm's uncertain incomes? What will be the expected value of these incomes? (3 marks) Question 2 (7 marks) Now suppose that the firm in Question (1) above, if the project fails, will get a cash flow of N$10,000 and will be required to pay an amount of only N$8,000 to the bank. All the other things remain as in question (1) (a) What will be the bank's loan rate? Will the bank be willing to lend at this rate? (2 marks) (b) Will the firm be willing to participate in this contract? Explain. (3 marks) (c) How much will be the bank's uncertain incomes? What will be the expected value of these incomes? (2 marks) 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started