please help me with statement of net postion and statement of cash flows. i have completed all the journal entries and the statement of revenues, expenses and changes in net postion. please help me with the last two stameents. please:) thank u:)

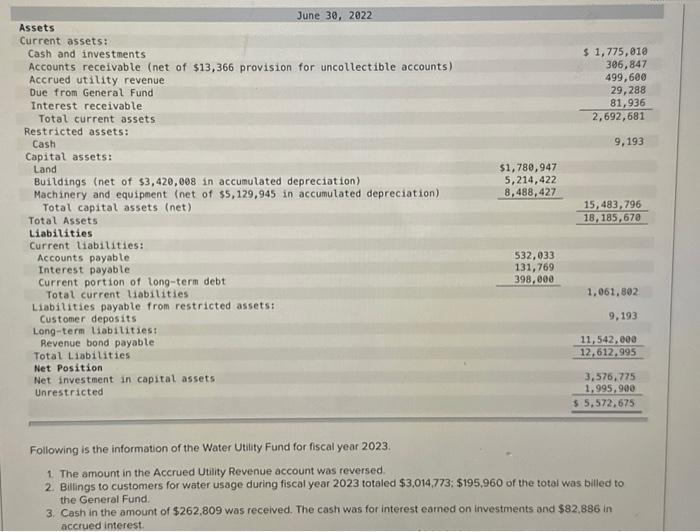

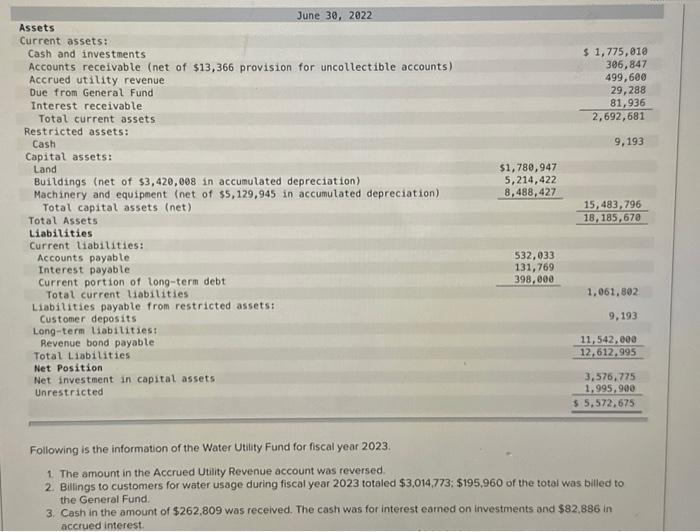

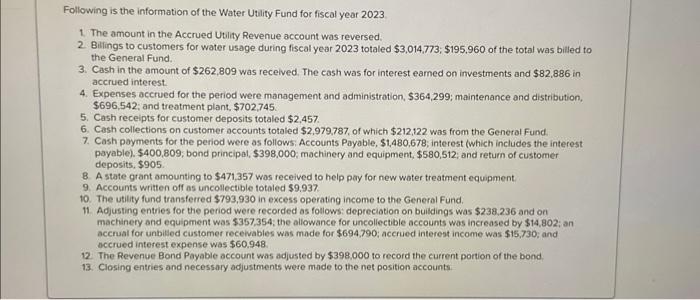

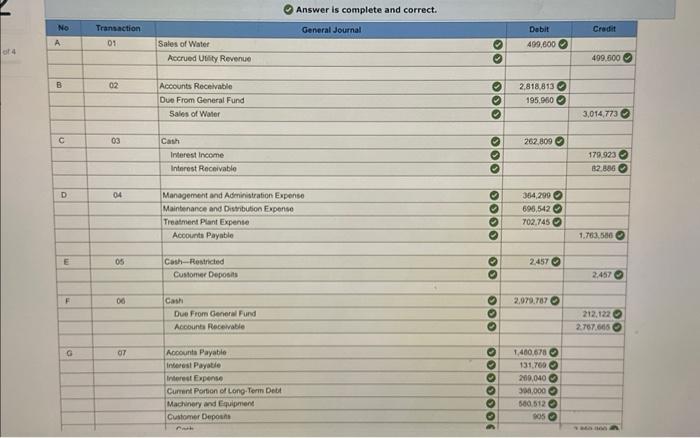

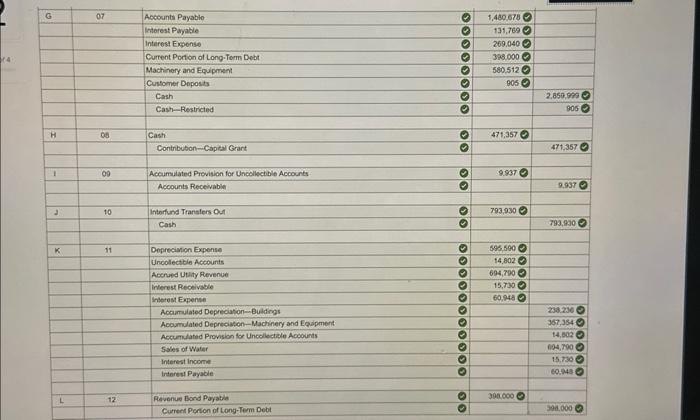

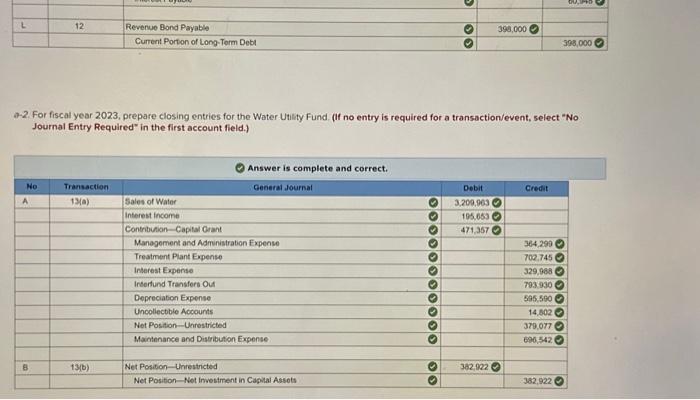

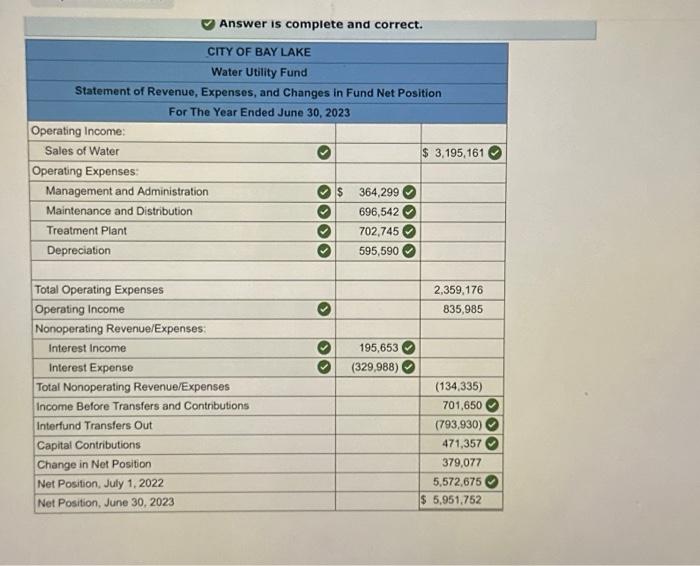

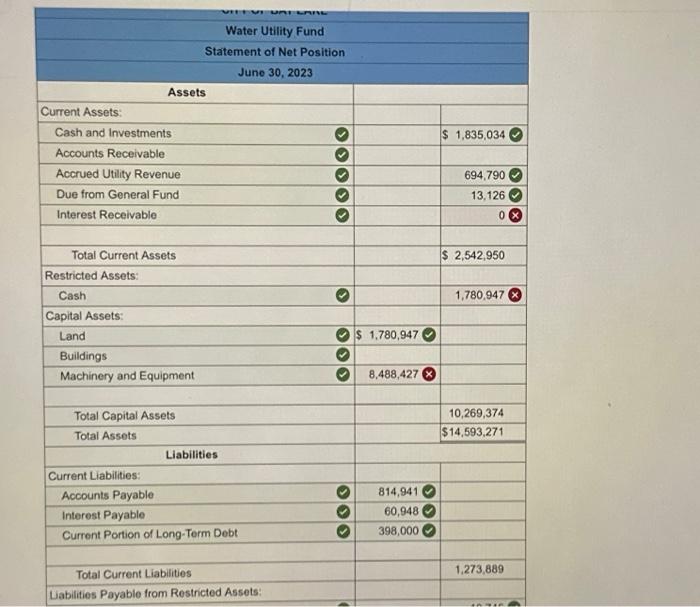

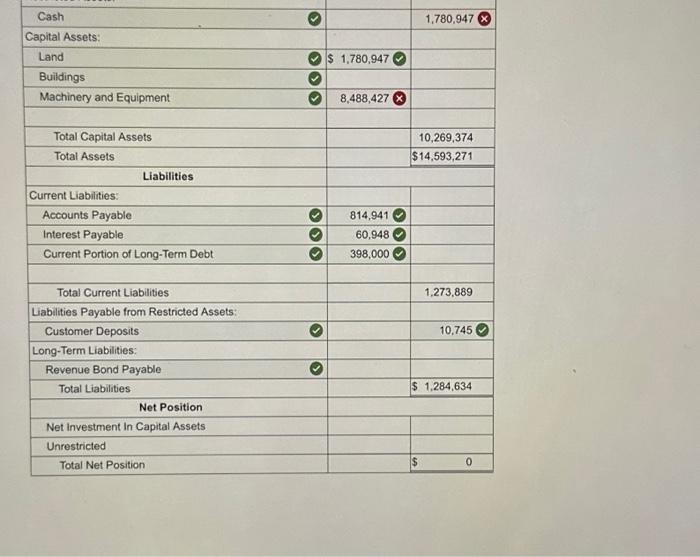

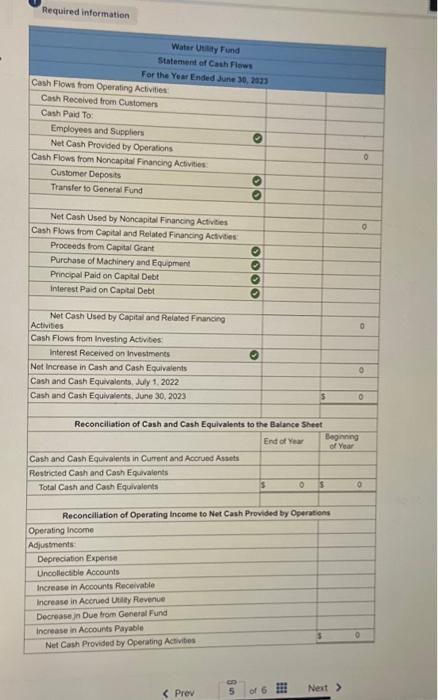

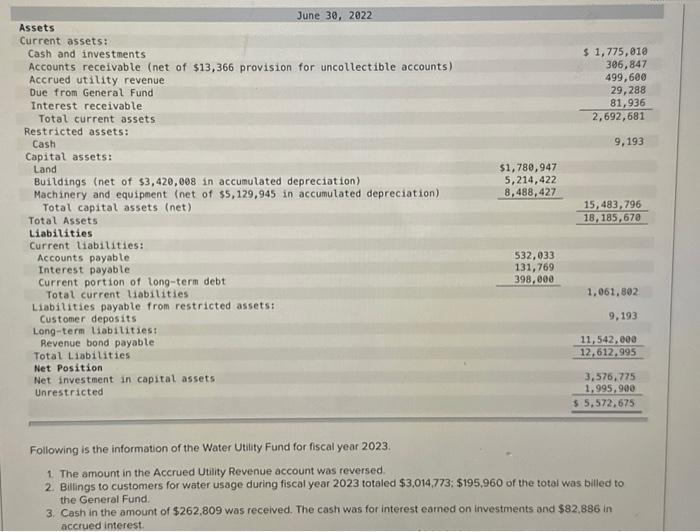

0-2. For fiscal year 2023, prepare closing entries for the Water Utility Fund. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Water Utility Fund } \\ \hline \multicolumn{4}{|c|}{ Statement of Net Position } \\ \hline \multicolumn{4}{|c|}{ June 30,2023} \\ \hline \multicolumn{4}{|l|}{ Assets } \\ \hline \multicolumn{4}{|l|}{ Current Assets: } \\ \hline Cash and investments & ( & & $1,835,034 \\ \hline Accounts Receivable & ( & & \\ \hline Accrued Utility Revenue & 0 & & 694,790 \\ \hline Due from General Fund & (2) & & 13,126 \\ \hline Interest Receivable & ( & & 0 \\ \hline Total Current Assets & & & $2,542,950 \\ \hline \multicolumn{4}{|l|}{ Restricted Assets: } \\ \hline Cash & Q & & 1,780,947 \\ \hline \multicolumn{4}{|l|}{ Capital Assets: } \\ \hline Land & 2 & $1,780,947 & \\ \hline Buildings & 2 & & \\ \hline Machinery and Equipment & 2 & 8,488,427 & \\ \hline Total Capital Assets & & & 10,269,374 \\ \hline Total Assets & & & $14,593,271 \\ \hline \multicolumn{4}{|l|}{ Liabilities } \\ \hline \multicolumn{4}{|l|}{ Current Liabilities: } \\ \hline Accounts Payable & 0 & 814,941 & \\ \hline Interest Payable & 0 & 60,948 & \\ \hline Current Portion of Long-Term Debt & 0 & 398,000 & \\ \hline Total Current Liabilities & & & 1,273,889 \\ \hline Labilities Payable from Restricted Ass & & & \\ \hline \end{tabular} Reauitant Lat. Answer is complete and correct. CITY OF BAY LAKE Water Utility Fund Statement of Revenue, Expenses, and Changes in Fund Net Position For The Year Ended June 30, 2023 \begin{tabular}{|l|c|c|c|} \hline Operating Income: & & & $3,195,161 \\ \hline Sales of Water & & \\ \hline Operating Expenses: & & & \\ \hline Management and Administration & 364,299 & \\ \hline Maintenance and Distribution & 696,542 & \\ \hline Treatment Plant & 702,745 & \\ \hline Depreciation & 595,590 & \\ \hline & & & \\ \hline Total Operating Expenses & & 2,359,176 \\ \hline Operating Income & 195,653 & \\ \hline Nonoperating Revenue/Expenses: & (329,988) & \\ \hline Interest Income & & 835,985 \\ \hline Interest Expense & & (134,335) \\ \hline Total Nonoperating Revenue/Expenses & & 701,650 \\ \hline Income Before Transfers and Contributions & & (793,930) \\ \hline Interfund Transfers Out & & 471,357 \\ \hline Capital Contributions & & 379,077 \\ \hline Change in Net Position & & 5,572,675 \\ \hline Net Position, July 1,2022 & & \\ \hline Net Position, June 30, 2023 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Cash & ( & & 1,780,947 \\ \hline \multicolumn{4}{|l|}{ Capital Assets: } \\ \hline Land & (2) $ & $1,780,947 & \\ \hline Buildings & (2) & & \\ \hline Machinery and Equipment & (2) & 8,488,427 & \\ \hline Total Capital Assets & & & 10,269,374 \\ \hline Total Assets & & & $14,593,271 \\ \hline \multicolumn{4}{|l|}{ Liabilities } \\ \hline \multicolumn{4}{|l|}{ Current Liabilities: } \\ \hline Accounts Payable & (2) & 814,941 & \\ \hline Interest Payable & ( ) & 60,948 & \\ \hline Current Portion of Long-Term Debt & (2) & 398,000 & \\ \hline Total Current Liabilities & & & 1,273,889 \\ \hline \multicolumn{4}{|l|}{ Liabilities Payable from Restricted Assets: } \\ \hline Customer Deposits & 2 & & 10,745 \\ \hline \multicolumn{4}{|l|}{ Long-Term Liabilities: } \\ \hline Revenue Bond Payable & 2 & & \\ \hline Total Liabilities & & & $1,284,634 \\ \hline \multicolumn{4}{|l|}{ Net Position } \\ \hline \multicolumn{4}{|l|}{ Net investment In Capital Assets } \\ \hline \multicolumn{4}{|l|}{ Unrestricted } \\ \hline Total Net Position & & & $ \\ \hline \end{tabular} Answer is complete and correct. Following is the information of the Water Utility Fund for fiscal year 2023 1. The amount in the Accrued Utility Revenue account was reversed. 2. Billings to customers for water usage during fiscal year 2023 totaled $3,014,773;$195,960 of the total was billed to the General Fund. 3. Cash in the amount of $262,809 was recelved. The cash was for interest eamed on investments and $82,886 in accrued interest. 4. Expenses accrued for the period were management and administration, $364,299; maintenance and distribution, $696,542; and treatment plant, \$702,745. 5. Cash receipts for customer deposits totaled $2,457. 6. Cash collections on customer accounts totaled $2,979,787, of which $212,122 was from the General Fund. 7. Cash payments for the period were as follows; Accounts Payable, $1,480,678; interest (which includes the interest payable) $400,809; bond principal, $398,000; machinery and equipment, $580,512; and retum of customer deposits, $905. 8. A state grant amounting to $471,357 was received to help pary for new water treatment equipment. 9. Accounts written off as uncollectible totaled $9.937. 10. The utility fund transferred $793,930 in excess operating income to the Generol Fund. 11. Adjusting entries for the period were recorded as follows: depreciotion on buildings was $238,236 and on machinery and equipment was $357,354; the allowance for uncollectible accounts was increased by $14,802; an accrual for unbilled customer recelvables was made for $694,790; accrued interest income was $15,730; and occrued interest expense was $60.948. 12. The Revenue Bond Payabie account was adjusted by $398.000 to record the current portion of the bond, 13. Closing entries and necessary adjustments were made to the net position accounts. 1. The amount in the Accrued Utility Revenue account was reversed 2. Billings to customers for water usage during fiscal year 2023 totaled $3,014,773;$195,960 of the total was billed to the General Fund. 3. Cash in the amount of $262,809 was received. The cash was for interest eamed on investments and $82,886 in accrued interest. \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[t]{8}{*}{ G } & 07 & Actounts Payablo. & 0 & 1,480,6780 & \\ \hline & & Interest Payabie & 0 & 131,7690 & \\ \hline & & Interest Exponse & 0 & 269,0400 & \\ \hline & & Current Portion of Long-Form Debt & 0 & 35,0000 & \\ \hline & & Machinery and Equpment & 0 & 580,5120 & \\ \hline & & Customer Deposts & 0 & 9050 & \\ \hline & & Cash & & & 2.850 .9000 \\ \hline & & Cass-Pestricted & 0 & & 9050 \\ \hline \multirow[t]{2}{*}{H} & & Cash & 0 & 471,3570 & \\ \hline & & Contribubon-Capial Grart & 0 & & 471,3570 \\ \hline \multirow[t]{2}{*}{1} & 9 & Accumulated Provision for Uncollectibie Accounts & 0 & 9.9370 & \\ \hline & & Accounts Receivabin & 0 & & 9.9370 \\ \hline \multirow[t]{2}{*}{2} & 10 & Intorfund Transfen oM & 0 & 793,9300 & \\ \hline & & Cash & 0 & & 793,9300 \\ \hline \multirow[t]{11}{*}{ K } & 11 & Deprecimion Expense & 0 & 596,5000 & \\ \hline & & Uncolectibie Accounts & 0 & 14,8020 & \\ \hline & & Aconed Utlity Revenue & 0 & 694,7900 & \\ \hline & & interest Receivadie & 0 & 15,7300 & \\ \hline & & Interest Expense & 0 & 60,940 & \\ \hline & & Accamulated Depreciation-Buldings & 0 & & 230.2300 \\ \hline & & Acoumulated Deprecision - Machinery and Equipment & 0 & & 367,3840 \\ \hline & & Accumulated Pronsion for Uncollectele Acoounts & 0 & & 14,8020 \\ \hline & & Sales of Water & 0 & & 104,7000 \\ \hline & & Interest income & 0 & & 15,7300 \\ \hline & & Interesi Payabie & 0 & & 60.430 \\ \hline \multirow[t]{2}{*}{L} & 12 & Revenue Bond Paratie & 0 & 300,0000 & \\ \hline & & Cument Porton of Long-Tem Debt & 0 & & 301,0000 \\ \hline \end{tabular} 0-2. For fiscal year 2023, prepare closing entries for the Water Utility Fund. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Water Utility Fund } \\ \hline \multicolumn{4}{|c|}{ Statement of Net Position } \\ \hline \multicolumn{4}{|c|}{ June 30,2023} \\ \hline \multicolumn{4}{|l|}{ Assets } \\ \hline \multicolumn{4}{|l|}{ Current Assets: } \\ \hline Cash and investments & ( & & $1,835,034 \\ \hline Accounts Receivable & ( & & \\ \hline Accrued Utility Revenue & 0 & & 694,790 \\ \hline Due from General Fund & (2) & & 13,126 \\ \hline Interest Receivable & ( & & 0 \\ \hline Total Current Assets & & & $2,542,950 \\ \hline \multicolumn{4}{|l|}{ Restricted Assets: } \\ \hline Cash & Q & & 1,780,947 \\ \hline \multicolumn{4}{|l|}{ Capital Assets: } \\ \hline Land & 2 & $1,780,947 & \\ \hline Buildings & 2 & & \\ \hline Machinery and Equipment & 2 & 8,488,427 & \\ \hline Total Capital Assets & & & 10,269,374 \\ \hline Total Assets & & & $14,593,271 \\ \hline \multicolumn{4}{|l|}{ Liabilities } \\ \hline \multicolumn{4}{|l|}{ Current Liabilities: } \\ \hline Accounts Payable & 0 & 814,941 & \\ \hline Interest Payable & 0 & 60,948 & \\ \hline Current Portion of Long-Term Debt & 0 & 398,000 & \\ \hline Total Current Liabilities & & & 1,273,889 \\ \hline Labilities Payable from Restricted Ass & & & \\ \hline \end{tabular} Reauitant Lat. Answer is complete and correct. CITY OF BAY LAKE Water Utility Fund Statement of Revenue, Expenses, and Changes in Fund Net Position For The Year Ended June 30, 2023 \begin{tabular}{|l|c|c|c|} \hline Operating Income: & & & $3,195,161 \\ \hline Sales of Water & & \\ \hline Operating Expenses: & & & \\ \hline Management and Administration & 364,299 & \\ \hline Maintenance and Distribution & 696,542 & \\ \hline Treatment Plant & 702,745 & \\ \hline Depreciation & 595,590 & \\ \hline & & & \\ \hline Total Operating Expenses & & 2,359,176 \\ \hline Operating Income & 195,653 & \\ \hline Nonoperating Revenue/Expenses: & (329,988) & \\ \hline Interest Income & & 835,985 \\ \hline Interest Expense & & (134,335) \\ \hline Total Nonoperating Revenue/Expenses & & 701,650 \\ \hline Income Before Transfers and Contributions & & (793,930) \\ \hline Interfund Transfers Out & & 471,357 \\ \hline Capital Contributions & & 379,077 \\ \hline Change in Net Position & & 5,572,675 \\ \hline Net Position, July 1,2022 & & \\ \hline Net Position, June 30, 2023 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Cash & ( & & 1,780,947 \\ \hline \multicolumn{4}{|l|}{ Capital Assets: } \\ \hline Land & (2) $ & $1,780,947 & \\ \hline Buildings & (2) & & \\ \hline Machinery and Equipment & (2) & 8,488,427 & \\ \hline Total Capital Assets & & & 10,269,374 \\ \hline Total Assets & & & $14,593,271 \\ \hline \multicolumn{4}{|l|}{ Liabilities } \\ \hline \multicolumn{4}{|l|}{ Current Liabilities: } \\ \hline Accounts Payable & (2) & 814,941 & \\ \hline Interest Payable & ( ) & 60,948 & \\ \hline Current Portion of Long-Term Debt & (2) & 398,000 & \\ \hline Total Current Liabilities & & & 1,273,889 \\ \hline \multicolumn{4}{|l|}{ Liabilities Payable from Restricted Assets: } \\ \hline Customer Deposits & 2 & & 10,745 \\ \hline \multicolumn{4}{|l|}{ Long-Term Liabilities: } \\ \hline Revenue Bond Payable & 2 & & \\ \hline Total Liabilities & & & $1,284,634 \\ \hline \multicolumn{4}{|l|}{ Net Position } \\ \hline \multicolumn{4}{|l|}{ Net investment In Capital Assets } \\ \hline \multicolumn{4}{|l|}{ Unrestricted } \\ \hline Total Net Position & & & $ \\ \hline \end{tabular} Answer is complete and correct. Following is the information of the Water Utility Fund for fiscal year 2023 1. The amount in the Accrued Utility Revenue account was reversed. 2. Billings to customers for water usage during fiscal year 2023 totaled $3,014,773;$195,960 of the total was billed to the General Fund. 3. Cash in the amount of $262,809 was recelved. The cash was for interest eamed on investments and $82,886 in accrued interest. 4. Expenses accrued for the period were management and administration, $364,299; maintenance and distribution, $696,542; and treatment plant, \$702,745. 5. Cash receipts for customer deposits totaled $2,457. 6. Cash collections on customer accounts totaled $2,979,787, of which $212,122 was from the General Fund. 7. Cash payments for the period were as follows; Accounts Payable, $1,480,678; interest (which includes the interest payable) $400,809; bond principal, $398,000; machinery and equipment, $580,512; and retum of customer deposits, $905. 8. A state grant amounting to $471,357 was received to help pary for new water treatment equipment. 9. Accounts written off as uncollectible totaled $9.937. 10. The utility fund transferred $793,930 in excess operating income to the Generol Fund. 11. Adjusting entries for the period were recorded as follows: depreciotion on buildings was $238,236 and on machinery and equipment was $357,354; the allowance for uncollectible accounts was increased by $14,802; an accrual for unbilled customer recelvables was made for $694,790; accrued interest income was $15,730; and occrued interest expense was $60.948. 12. The Revenue Bond Payabie account was adjusted by $398.000 to record the current portion of the bond, 13. Closing entries and necessary adjustments were made to the net position accounts. 1. The amount in the Accrued Utility Revenue account was reversed 2. Billings to customers for water usage during fiscal year 2023 totaled $3,014,773;$195,960 of the total was billed to the General Fund. 3. Cash in the amount of $262,809 was received. The cash was for interest eamed on investments and $82,886 in accrued interest. \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[t]{8}{*}{ G } & 07 & Actounts Payablo. & 0 & 1,480,6780 & \\ \hline & & Interest Payabie & 0 & 131,7690 & \\ \hline & & Interest Exponse & 0 & 269,0400 & \\ \hline & & Current Portion of Long-Form Debt & 0 & 35,0000 & \\ \hline & & Machinery and Equpment & 0 & 580,5120 & \\ \hline & & Customer Deposts & 0 & 9050 & \\ \hline & & Cash & & & 2.850 .9000 \\ \hline & & Cass-Pestricted & 0 & & 9050 \\ \hline \multirow[t]{2}{*}{H} & & Cash & 0 & 471,3570 & \\ \hline & & Contribubon-Capial Grart & 0 & & 471,3570 \\ \hline \multirow[t]{2}{*}{1} & 9 & Accumulated Provision for Uncollectibie Accounts & 0 & 9.9370 & \\ \hline & & Accounts Receivabin & 0 & & 9.9370 \\ \hline \multirow[t]{2}{*}{2} & 10 & Intorfund Transfen oM & 0 & 793,9300 & \\ \hline & & Cash & 0 & & 793,9300 \\ \hline \multirow[t]{11}{*}{ K } & 11 & Deprecimion Expense & 0 & 596,5000 & \\ \hline & & Uncolectibie Accounts & 0 & 14,8020 & \\ \hline & & Aconed Utlity Revenue & 0 & 694,7900 & \\ \hline & & interest Receivadie & 0 & 15,7300 & \\ \hline & & Interest Expense & 0 & 60,940 & \\ \hline & & Accamulated Depreciation-Buldings & 0 & & 230.2300 \\ \hline & & Acoumulated Deprecision - Machinery and Equipment & 0 & & 367,3840 \\ \hline & & Accumulated Pronsion for Uncollectele Acoounts & 0 & & 14,8020 \\ \hline & & Sales of Water & 0 & & 104,7000 \\ \hline & & Interest income & 0 & & 15,7300 \\ \hline & & Interesi Payabie & 0 & & 60.430 \\ \hline \multirow[t]{2}{*}{L} & 12 & Revenue Bond Paratie & 0 & 300,0000 & \\ \hline & & Cument Porton of Long-Tem Debt & 0 & & 301,0000 \\ \hline \end{tabular}