Please help me with the answer to Part 1 in its entirety. I really need a fundamental breakdown of how you answer Part 1. Thank you.

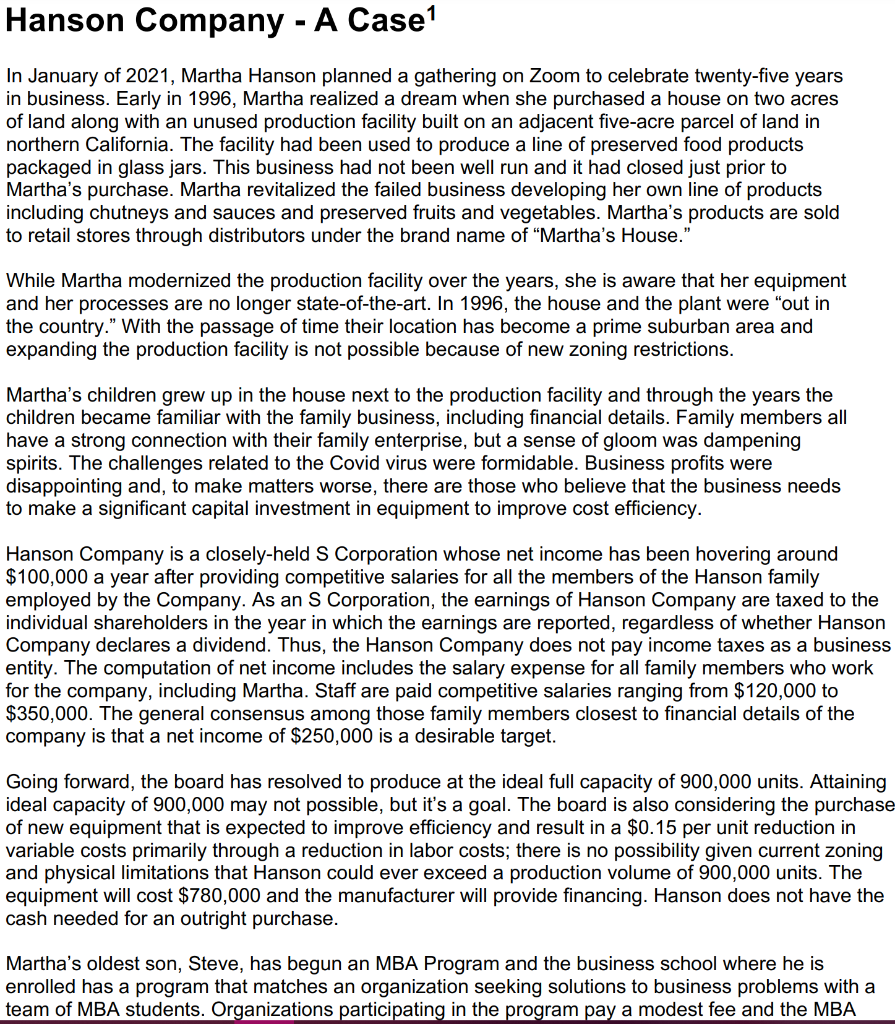

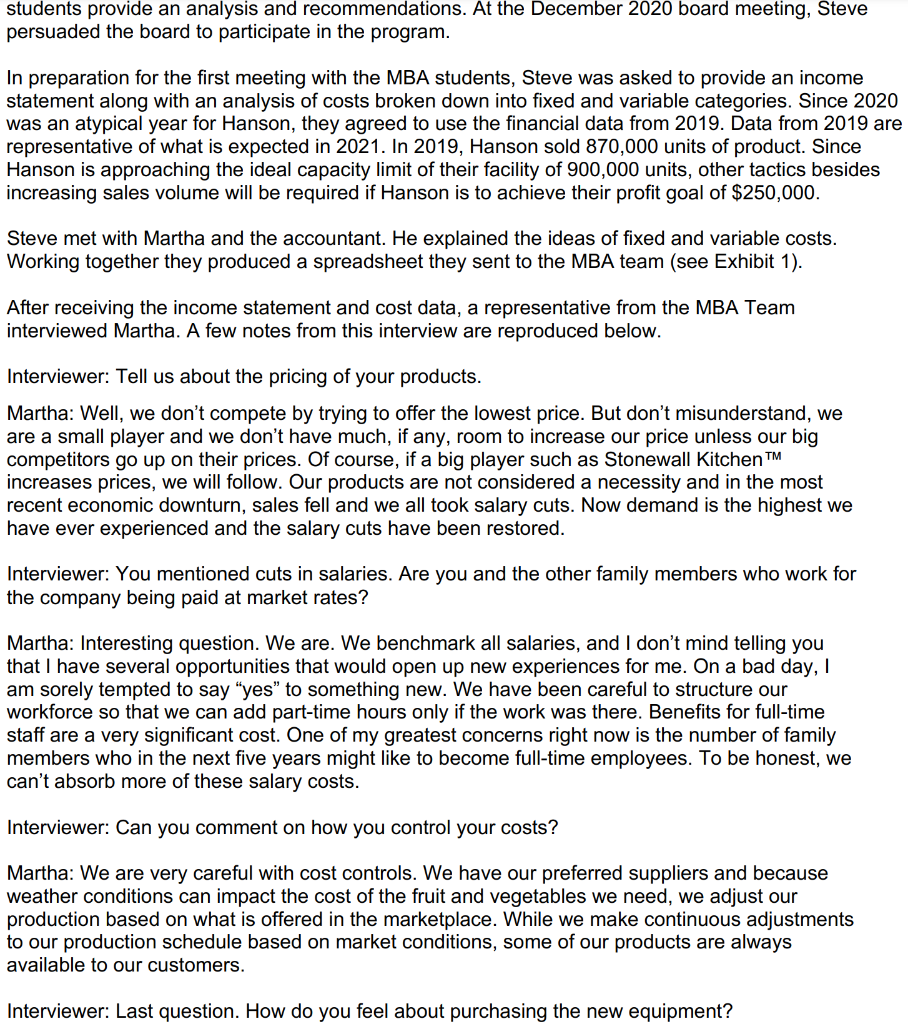

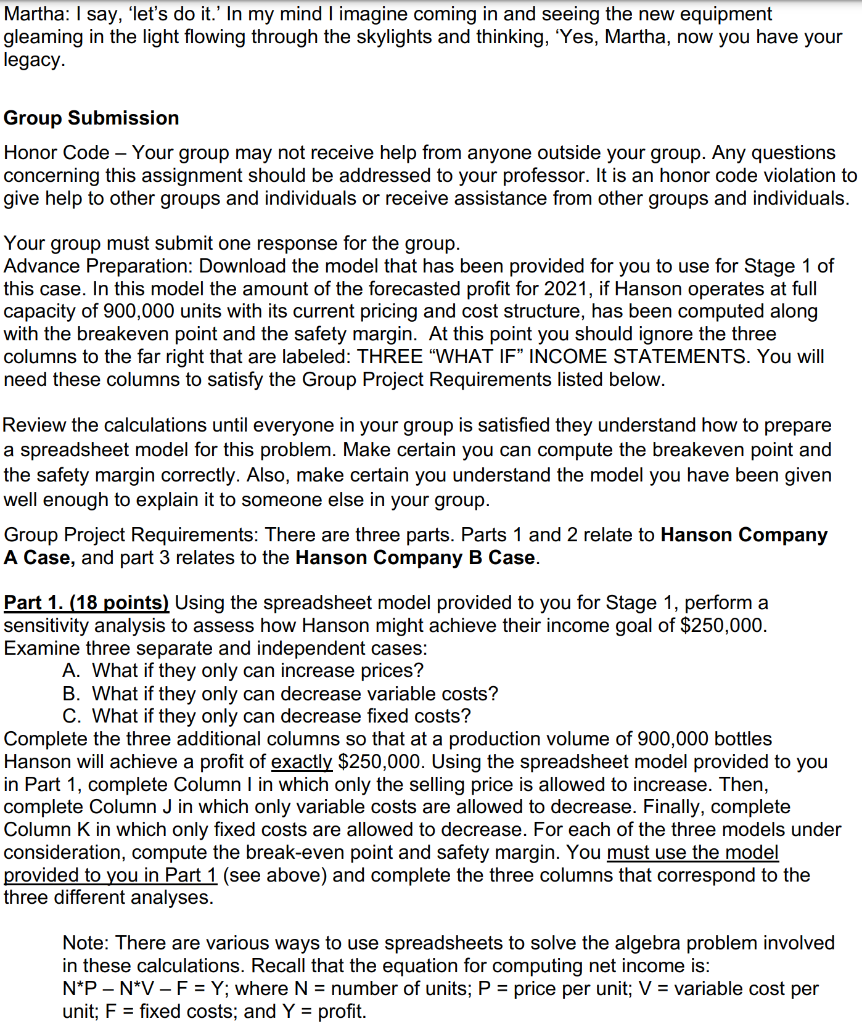

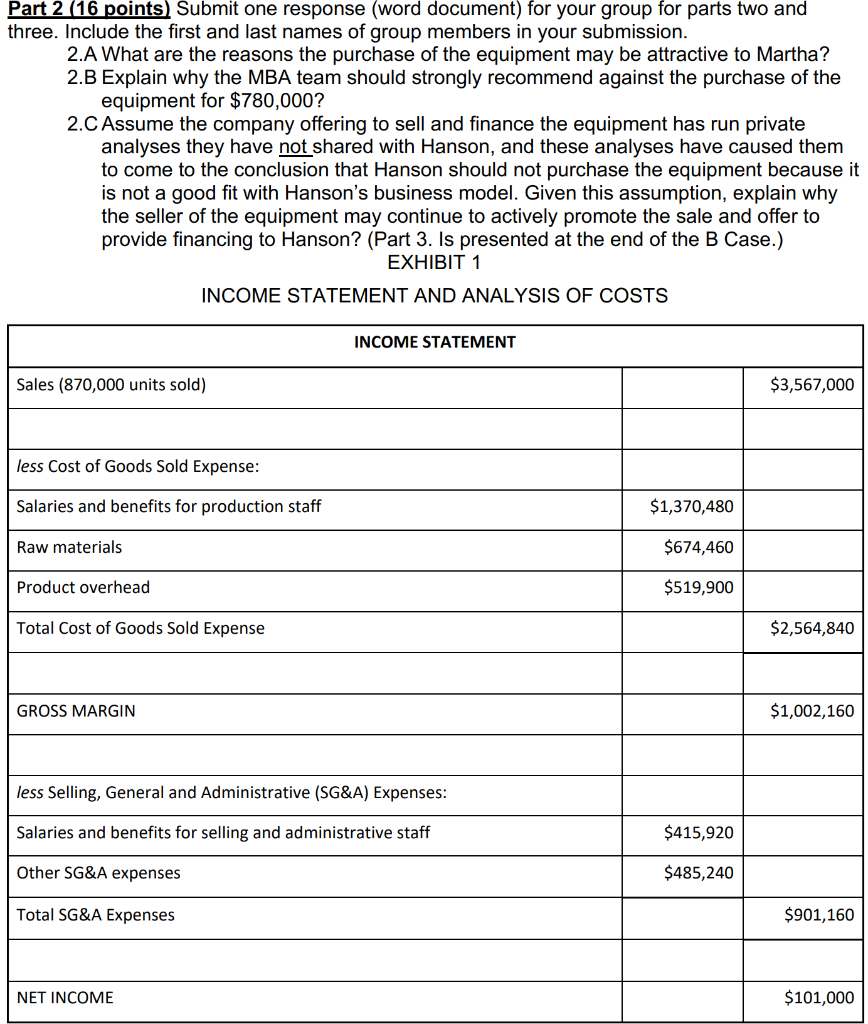

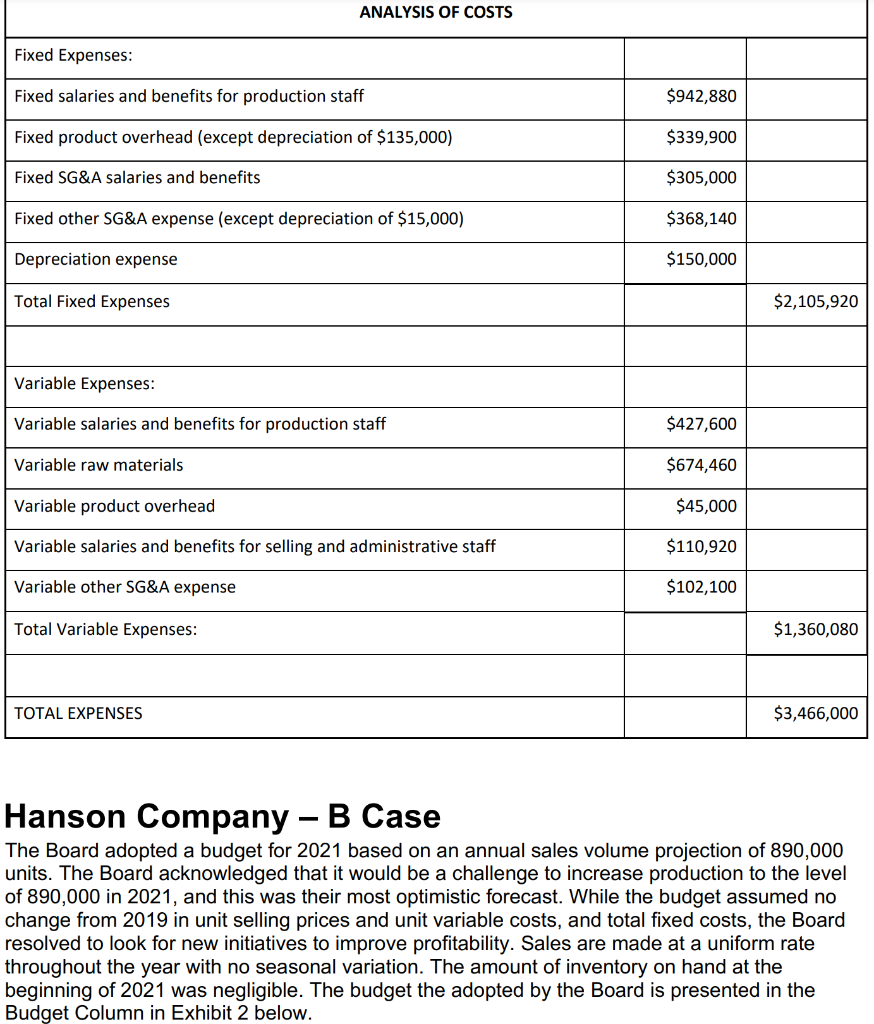

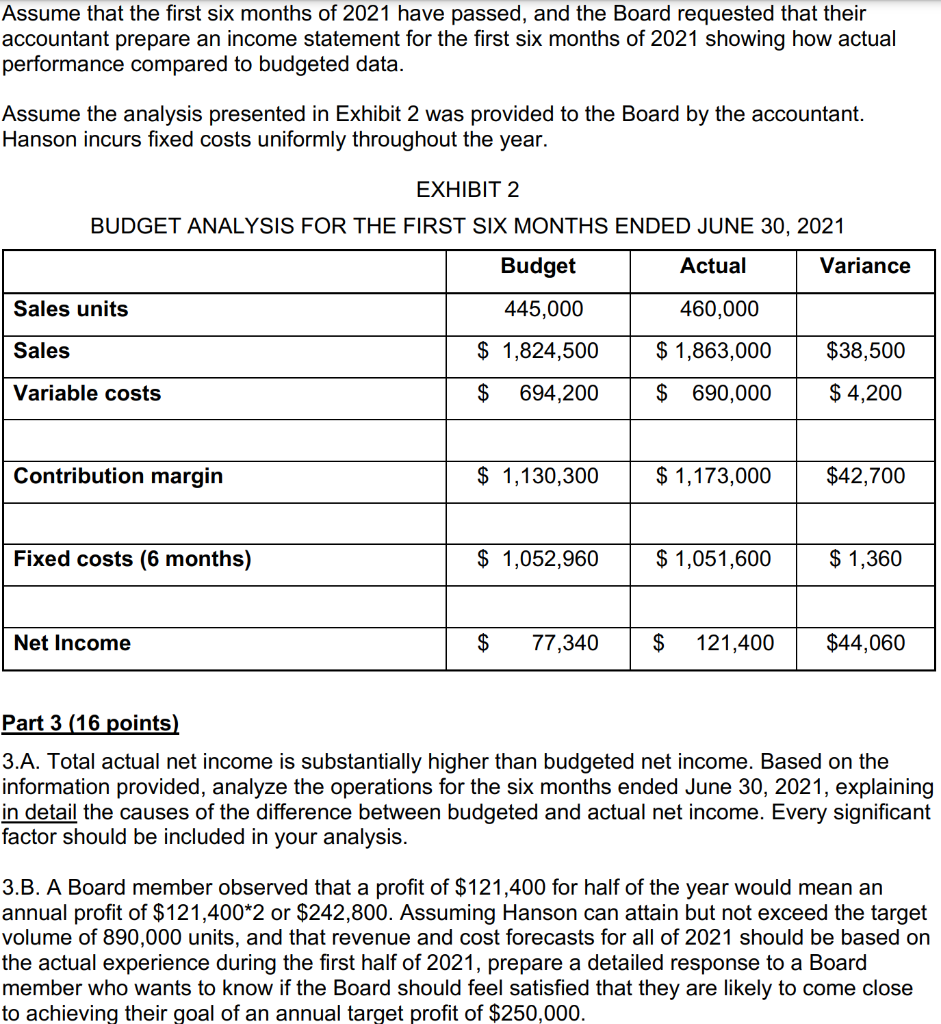

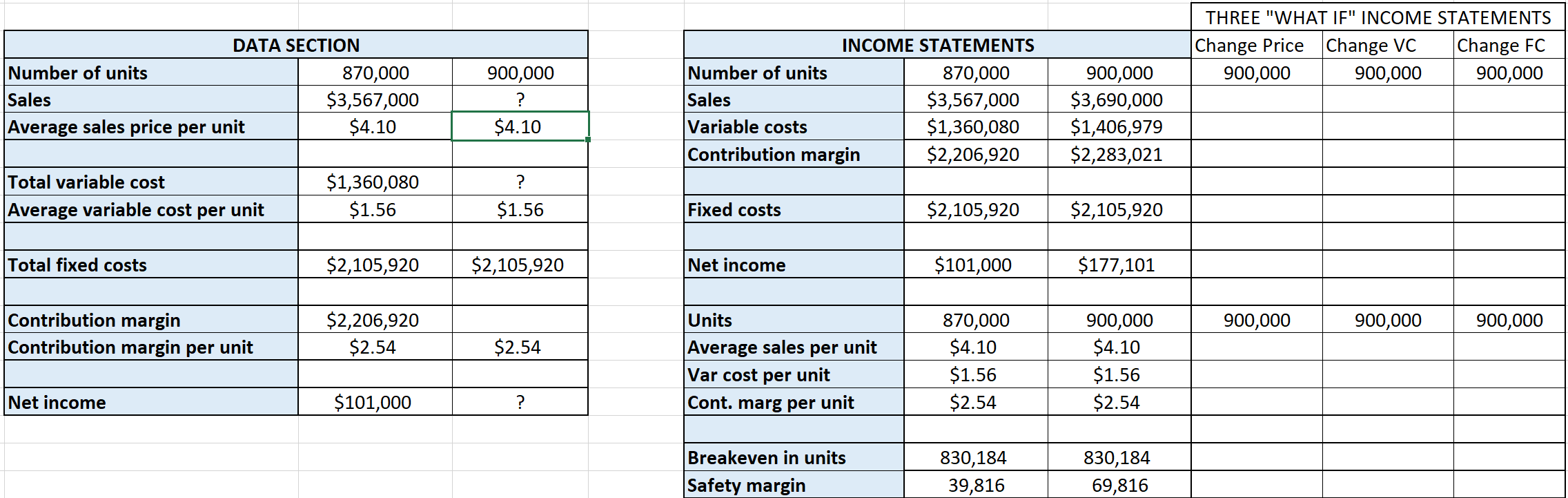

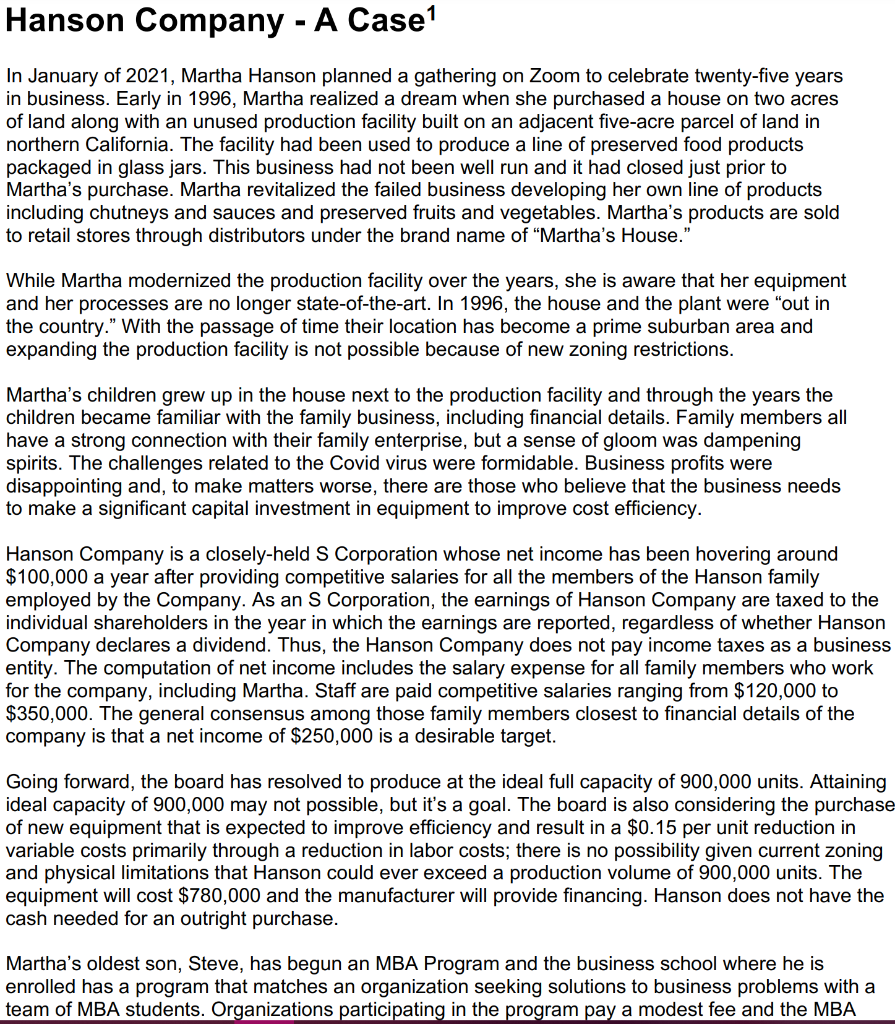

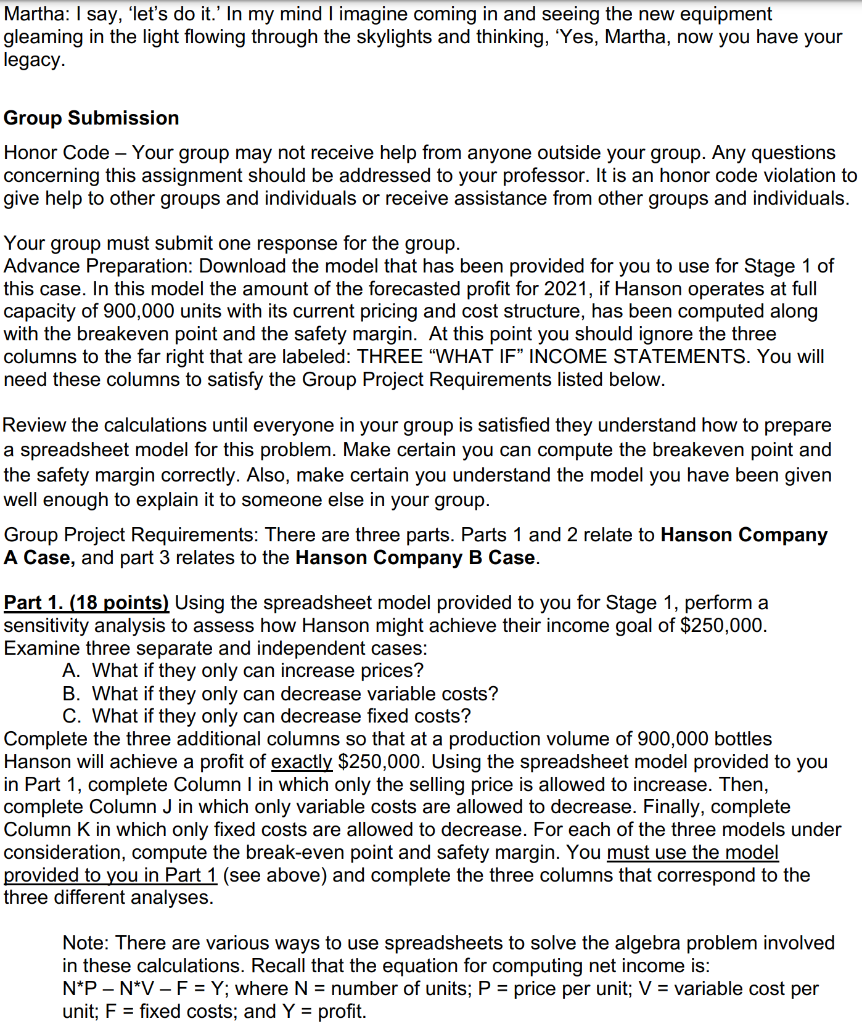

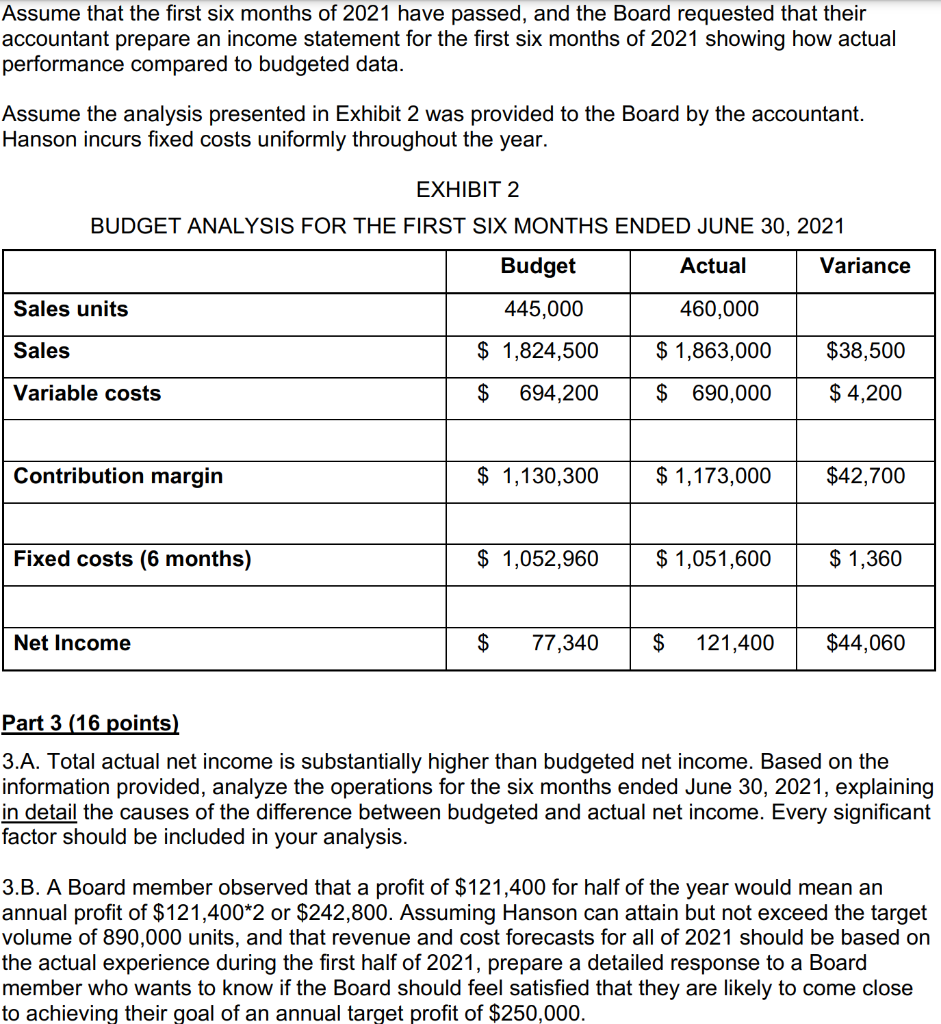

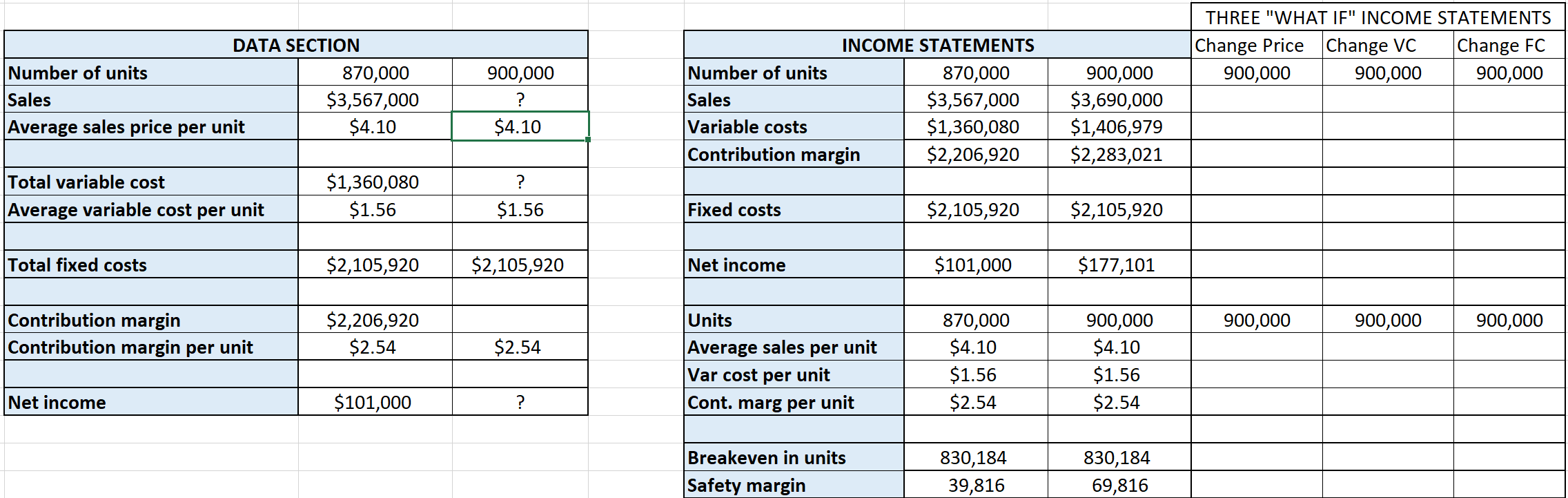

Hanson Company - A Case 1 In January of 2021, Martha Hanson planned a gathering on Zoom to celebrate twenty-five years in business. Early in 1996, Martha realized a dream when she purchased a house on two acres of land along with an unused production facility built on an adjacent five-acre parcel of land in northern California. The facility had been used to produce a line of preserved food products packaged in glass jars. This business had not been well run and it had closed just prior to Martha's purchase. Martha revitalized the failed business developing her own line of products including chutneys and sauces and preserved fruits and vegetables. Martha's products are sold to retail stores through distributors under the brand name of "Martha's House." While Martha modernized the production facility over the years, she is aware that her equipment and her processes are no longer state-of-the-art. In 1996, the house and the plant were "out in the country." With the passage of time their location has become a prime suburban area and expanding the production facility is not possible because of new zoning restrictions. Martha's children grew up in the house next to the production facility and through the years the children became familiar with the family business, including financial details. Family members all have a strong connection with their family enterprise, but a sense of gloom was dampening spirits. The challenges related to the Covid virus were formidable. Business profits were disappointing and, to make matters worse, there are those who believe that the business needs to make a significant capital investment in equipment to improve cost efficiency. Hanson Company is a closely-held S Corporation whose net income has been hovering around $100,000 a year after providing competitive salaries for all the members of the Hanson family employed by the Company. As an S Corporation, the earnings of Hanson Company are taxed to the individual shareholders in the year in which the earnings are reported, regardless of whether Hanson Company declares a dividend. Thus, the Hanson Company does not pay income taxes as a business entity. The computation of net income includes the salary expense for all family members who work for the company, including Martha. Staff are paid competitive salaries ranging from $120,000 to $350,000. The general consensus among those family members closest to financial details of the company is that a net income of $250,000 is a desirable target. Going forward, the board has resolved to produce at the ideal full capacity of 900,000 units. Attaining ideal capacity of 900,000 may not possible, but it's a goal. The board is also considering the purchase of new equipment that is expected to improve efficiency and result in a $0.15 per unit reduction in variable costs primarily through a reduction in labor costs; there is no possibility given current zoning and physical limitations that Hanson could ever exceed a production volume of 900,000 units. The equipment will cost $780,000 and the manufacturer will provide financing. Hanson does not have the cash needed for an outright purchase. Martha's oldest son, Steve, has begun an MBA Program and the business school where he is enrolled has a program that matches an organization seeking solutions to business problems with a team of MBA students. Organizations participating in the program pay a modest fee and the MBA students provide an analysis and recommendations. At the December 2020 board meeting, Steve persuaded the board to participate in the program. In preparation for the first meeting with the MBA students, Steve was asked to provide an income statement along with an analysis of costs broken down into fixed and variable categories. Since 202 was an atypical year for Hanson, they agreed to use the financial data from 2019. Data from 2019 a representative of what is expected in 2021. In 2019, Hanson sold 870,000 units of product. Since Hanson is approaching the ideal capacity limit of their facility of 900,000 units, other tactics besides increasing sales volume will be required if Hanson is to achieve their profit goal of $250,000. Steve met with Martha and the accountant. He explained the ideas of fixed and variable costs. Working together they produced a spreadsheet they sent to the MBA team (see Exhibit 1). After receiving the income statement and cost data, a representative from the MBA Team interviewed Martha. A few notes from this interview are reproduced below. Interviewer: Tell us about the pricing of your products. Martha: Well, we don't compete by trying to offer the lowest price. But don't misunderstand, we are a small player and we don't have much, if any, room to increase our price unless our big competitors go up on their prices. Of course, if a big player such as Stonewall Kitchen TM increases prices, we will follow. Our products are not considered a necessity and in the most recent economic downturn, sales fell and we all took salary cuts. Now demand is the highest we have ever experienced and the salary cuts have been restored. Interviewer: You mentioned cuts in salaries. Are you and the other family members who work for the company being paid at market rates? Martha: Interesting question. We are. We benchmark all salaries, and I don't mind telling you that I have several opportunities that would open up new experiences for me. On a bad day, I am sorely tempted to say "yes" to something new. We have been careful to structure our workforce so that we can add part-time hours only if the work was there. Benefits for full-time staff are a very significant cost. One of my greatest concerns right now is the number of family members who in the next five years might like to become full-time employees. To be honest, we can't absorb more of these salary costs. Interviewer: Can you comment on how you control your costs? Martha: We are very careful with cost controls. We have our preferred suppliers and because weather conditions can impact the cost of the fruit and vegetables we need, we adjust our production based on what is offered in the marketplace. While we make continuous adjustments to our production schedule based on market conditions, some of our products are always available to our customers. Interviewer: Last question. How do you feel about purchasing the new equipment? Martha: I say, 'let's do it.' In my mind I imagine coming in and seeing the new equipment gleaming in the light flowing through the skylights and thinking, 'Yes, Martha, now you have your legacy. Group Submission Honor Code - Your group may not receive help from anyone outside your group. Any questions concerning this assignment should be addressed to your professor. It is an honor code violation to give help to other groups and individuals or receive assistance from other groups and individuals. Your group must submit one response for the group. Advance Preparation: Download the model that has been provided for you to use for Stage 1 of this case. In this model the amount of the forecasted profit for 2021 , if Hanson operates at full capacity of 900,000 units with its current pricing and cost structure, has been computed along with the breakeven point and the safety margin. At this point you should ignore the three columns to the far right that are labeled: THREE "WHAT IF" INCOME STATEMENTS. You will need these columns to satisfy the Group Project Requirements listed below. Review the calculations until everyone in your group is satisfied they understand how to prepare a spreadsheet model for this problem. Make certain you can compute the breakeven point and the safety margin correctly. Also, make certain you understand the model you have been given well enough to explain it to someone else in your group. Group Project Requirements: There are three parts. Parts 1 and 2 relate to Hanson Company A Case, and part 3 relates to the Hanson Company B Case. Part 1. (18 points) Using the spreadsheet model provided to you for Stage 1, perform a sensitivity analysis to assess how Hanson might achieve their income goal of $250,000. Examine three separate and independent cases: A. What if they only can increase prices? B. What if they only can decrease variable costs? C. What if they only can decrease fixed costs? Complete the three additional columns so that at a production volume of 900,000 bottles Hanson will achieve a profit of exactly $250,000. Using the spreadsheet model provided to you in Part 1, complete Column I in which only the selling price is allowed to increase. Then, complete Column J in which only variable costs are allowed to decrease. Finally, complete Column K in which only fixed costs are allowed to decrease. For each of the three models under consideration, compute the break-even point and safety margin. You must use the model provided to you in Part 1 (see above) and complete the three columns that correspond to the three different analyses. Note: There are various ways to use spreadsheets to solve the algebra problem involved in these calculations. Recall that the equation for computing net income is: NPNVF=Y; where N= number of units; P= price per unit; V= variable cost per unit; F= fixed costs; and Y= profit. Part 2 (16 points) Submit one response (word document) for your group for parts two and three. Include the first and last names of group members in your submission. 2.A What are the reasons the purchase of the equipment may be attractive to Martha? 2.B Explain why the MBA team should strongly recommend against the purchase of the equipment for $780,000 ? 2.C Assume the company offering to sell and finance the equipment has run private analyses they have not shared with Hanson, and these analyses have caused them to come to the conclusion that Hanson should not purchase the equipment because it is not a good fit with Hanson's business model. Given this assumption, explain why the seller of the equipment may continue to actively promote the sale and offer to provide financing to Hanson? (Part 3. Is presented at the end of the B Case.) EXHIBIT 1 Hanson Company - B Case The Board adopted a budget for 2021 based on an annual sales volume projection of 890,000 units. The Board acknowledged that it would be a challenge to increase production to the level of 890,000 in 2021 , and this was their most optimistic forecast. While the budget assumed no change from 2019 in unit selling prices and unit variable costs, and total fixed costs, the Board resolved to look for new initiatives to improve profitability. Sales are made at a uniform rate throughout the year with no seasonal variation. The amount of inventory on hand at the beginning of 2021 was negligible. The budget the adopted by the Board is presented in the Budget Column in Exhibit 2 below. Assume that the first six months of 2021 have passed, and the Board requested that their accountant prepare an income statement for the first six months of 2021 showing how actual performance compared to budgeted data. Assume the analysis presented in Exhibit 2 was provided to the Board by the accountant. Hanson incurs fixed costs uniformly throughout the year. EXHIBIT 2 BUDGET ANALYSIS FOR THE FIRST SIX MONTHS ENDED JUNE 30, 2021 Part 3 (16 points) 3.A. Total actual net income is substantially higher than budgeted net income. Based on the information provided, analyze the operations for the six months ended June 30, 2021, explaining in detail the causes of the difference between budgeted and actual net income. Every significant factor should be included in your analysis. 3.B. A Board member observed that a profit of $121,400 for half of the year would mean an annual profit of $121,4002 or $242,800. Assuming Hanson can attain but not exceed the target volume of 890,000 units, and that revenue and cost forecasts for all of 2021 should be based on the actual experience during the first half of 2021, prepare a detailed response to a Board member who wants to know if the Board should feel satisfied that they are likely to come close to achieving their goal of an annual target profit of $250,000. Hanson Company - A Case 1 In January of 2021, Martha Hanson planned a gathering on Zoom to celebrate twenty-five years in business. Early in 1996, Martha realized a dream when she purchased a house on two acres of land along with an unused production facility built on an adjacent five-acre parcel of land in northern California. The facility had been used to produce a line of preserved food products packaged in glass jars. This business had not been well run and it had closed just prior to Martha's purchase. Martha revitalized the failed business developing her own line of products including chutneys and sauces and preserved fruits and vegetables. Martha's products are sold to retail stores through distributors under the brand name of "Martha's House." While Martha modernized the production facility over the years, she is aware that her equipment and her processes are no longer state-of-the-art. In 1996, the house and the plant were "out in the country." With the passage of time their location has become a prime suburban area and expanding the production facility is not possible because of new zoning restrictions. Martha's children grew up in the house next to the production facility and through the years the children became familiar with the family business, including financial details. Family members all have a strong connection with their family enterprise, but a sense of gloom was dampening spirits. The challenges related to the Covid virus were formidable. Business profits were disappointing and, to make matters worse, there are those who believe that the business needs to make a significant capital investment in equipment to improve cost efficiency. Hanson Company is a closely-held S Corporation whose net income has been hovering around $100,000 a year after providing competitive salaries for all the members of the Hanson family employed by the Company. As an S Corporation, the earnings of Hanson Company are taxed to the individual shareholders in the year in which the earnings are reported, regardless of whether Hanson Company declares a dividend. Thus, the Hanson Company does not pay income taxes as a business entity. The computation of net income includes the salary expense for all family members who work for the company, including Martha. Staff are paid competitive salaries ranging from $120,000 to $350,000. The general consensus among those family members closest to financial details of the company is that a net income of $250,000 is a desirable target. Going forward, the board has resolved to produce at the ideal full capacity of 900,000 units. Attaining ideal capacity of 900,000 may not possible, but it's a goal. The board is also considering the purchase of new equipment that is expected to improve efficiency and result in a $0.15 per unit reduction in variable costs primarily through a reduction in labor costs; there is no possibility given current zoning and physical limitations that Hanson could ever exceed a production volume of 900,000 units. The equipment will cost $780,000 and the manufacturer will provide financing. Hanson does not have the cash needed for an outright purchase. Martha's oldest son, Steve, has begun an MBA Program and the business school where he is enrolled has a program that matches an organization seeking solutions to business problems with a team of MBA students. Organizations participating in the program pay a modest fee and the MBA students provide an analysis and recommendations. At the December 2020 board meeting, Steve persuaded the board to participate in the program. In preparation for the first meeting with the MBA students, Steve was asked to provide an income statement along with an analysis of costs broken down into fixed and variable categories. Since 202 was an atypical year for Hanson, they agreed to use the financial data from 2019. Data from 2019 a representative of what is expected in 2021. In 2019, Hanson sold 870,000 units of product. Since Hanson is approaching the ideal capacity limit of their facility of 900,000 units, other tactics besides increasing sales volume will be required if Hanson is to achieve their profit goal of $250,000. Steve met with Martha and the accountant. He explained the ideas of fixed and variable costs. Working together they produced a spreadsheet they sent to the MBA team (see Exhibit 1). After receiving the income statement and cost data, a representative from the MBA Team interviewed Martha. A few notes from this interview are reproduced below. Interviewer: Tell us about the pricing of your products. Martha: Well, we don't compete by trying to offer the lowest price. But don't misunderstand, we are a small player and we don't have much, if any, room to increase our price unless our big competitors go up on their prices. Of course, if a big player such as Stonewall Kitchen TM increases prices, we will follow. Our products are not considered a necessity and in the most recent economic downturn, sales fell and we all took salary cuts. Now demand is the highest we have ever experienced and the salary cuts have been restored. Interviewer: You mentioned cuts in salaries. Are you and the other family members who work for the company being paid at market rates? Martha: Interesting question. We are. We benchmark all salaries, and I don't mind telling you that I have several opportunities that would open up new experiences for me. On a bad day, I am sorely tempted to say "yes" to something new. We have been careful to structure our workforce so that we can add part-time hours only if the work was there. Benefits for full-time staff are a very significant cost. One of my greatest concerns right now is the number of family members who in the next five years might like to become full-time employees. To be honest, we can't absorb more of these salary costs. Interviewer: Can you comment on how you control your costs? Martha: We are very careful with cost controls. We have our preferred suppliers and because weather conditions can impact the cost of the fruit and vegetables we need, we adjust our production based on what is offered in the marketplace. While we make continuous adjustments to our production schedule based on market conditions, some of our products are always available to our customers. Interviewer: Last question. How do you feel about purchasing the new equipment? Martha: I say, 'let's do it.' In my mind I imagine coming in and seeing the new equipment gleaming in the light flowing through the skylights and thinking, 'Yes, Martha, now you have your legacy. Group Submission Honor Code - Your group may not receive help from anyone outside your group. Any questions concerning this assignment should be addressed to your professor. It is an honor code violation to give help to other groups and individuals or receive assistance from other groups and individuals. Your group must submit one response for the group. Advance Preparation: Download the model that has been provided for you to use for Stage 1 of this case. In this model the amount of the forecasted profit for 2021 , if Hanson operates at full capacity of 900,000 units with its current pricing and cost structure, has been computed along with the breakeven point and the safety margin. At this point you should ignore the three columns to the far right that are labeled: THREE "WHAT IF" INCOME STATEMENTS. You will need these columns to satisfy the Group Project Requirements listed below. Review the calculations until everyone in your group is satisfied they understand how to prepare a spreadsheet model for this problem. Make certain you can compute the breakeven point and the safety margin correctly. Also, make certain you understand the model you have been given well enough to explain it to someone else in your group. Group Project Requirements: There are three parts. Parts 1 and 2 relate to Hanson Company A Case, and part 3 relates to the Hanson Company B Case. Part 1. (18 points) Using the spreadsheet model provided to you for Stage 1, perform a sensitivity analysis to assess how Hanson might achieve their income goal of $250,000. Examine three separate and independent cases: A. What if they only can increase prices? B. What if they only can decrease variable costs? C. What if they only can decrease fixed costs? Complete the three additional columns so that at a production volume of 900,000 bottles Hanson will achieve a profit of exactly $250,000. Using the spreadsheet model provided to you in Part 1, complete Column I in which only the selling price is allowed to increase. Then, complete Column J in which only variable costs are allowed to decrease. Finally, complete Column K in which only fixed costs are allowed to decrease. For each of the three models under consideration, compute the break-even point and safety margin. You must use the model provided to you in Part 1 (see above) and complete the three columns that correspond to the three different analyses. Note: There are various ways to use spreadsheets to solve the algebra problem involved in these calculations. Recall that the equation for computing net income is: NPNVF=Y; where N= number of units; P= price per unit; V= variable cost per unit; F= fixed costs; and Y= profit. Part 2 (16 points) Submit one response (word document) for your group for parts two and three. Include the first and last names of group members in your submission. 2.A What are the reasons the purchase of the equipment may be attractive to Martha? 2.B Explain why the MBA team should strongly recommend against the purchase of the equipment for $780,000 ? 2.C Assume the company offering to sell and finance the equipment has run private analyses they have not shared with Hanson, and these analyses have caused them to come to the conclusion that Hanson should not purchase the equipment because it is not a good fit with Hanson's business model. Given this assumption, explain why the seller of the equipment may continue to actively promote the sale and offer to provide financing to Hanson? (Part 3. Is presented at the end of the B Case.) EXHIBIT 1 Hanson Company - B Case The Board adopted a budget for 2021 based on an annual sales volume projection of 890,000 units. The Board acknowledged that it would be a challenge to increase production to the level of 890,000 in 2021 , and this was their most optimistic forecast. While the budget assumed no change from 2019 in unit selling prices and unit variable costs, and total fixed costs, the Board resolved to look for new initiatives to improve profitability. Sales are made at a uniform rate throughout the year with no seasonal variation. The amount of inventory on hand at the beginning of 2021 was negligible. The budget the adopted by the Board is presented in the Budget Column in Exhibit 2 below. Assume that the first six months of 2021 have passed, and the Board requested that their accountant prepare an income statement for the first six months of 2021 showing how actual performance compared to budgeted data. Assume the analysis presented in Exhibit 2 was provided to the Board by the accountant. Hanson incurs fixed costs uniformly throughout the year. EXHIBIT 2 BUDGET ANALYSIS FOR THE FIRST SIX MONTHS ENDED JUNE 30, 2021 Part 3 (16 points) 3.A. Total actual net income is substantially higher than budgeted net income. Based on the information provided, analyze the operations for the six months ended June 30, 2021, explaining in detail the causes of the difference between budgeted and actual net income. Every significant factor should be included in your analysis. 3.B. A Board member observed that a profit of $121,400 for half of the year would mean an annual profit of $121,4002 or $242,800. Assuming Hanson can attain but not exceed the target volume of 890,000 units, and that revenue and cost forecasts for all of 2021 should be based on the actual experience during the first half of 2021, prepare a detailed response to a Board member who wants to know if the Board should feel satisfied that they are likely to come close to achieving their goal of an annual target profit of $250,000