Answered step by step

Verified Expert Solution

Question

1 Approved Answer

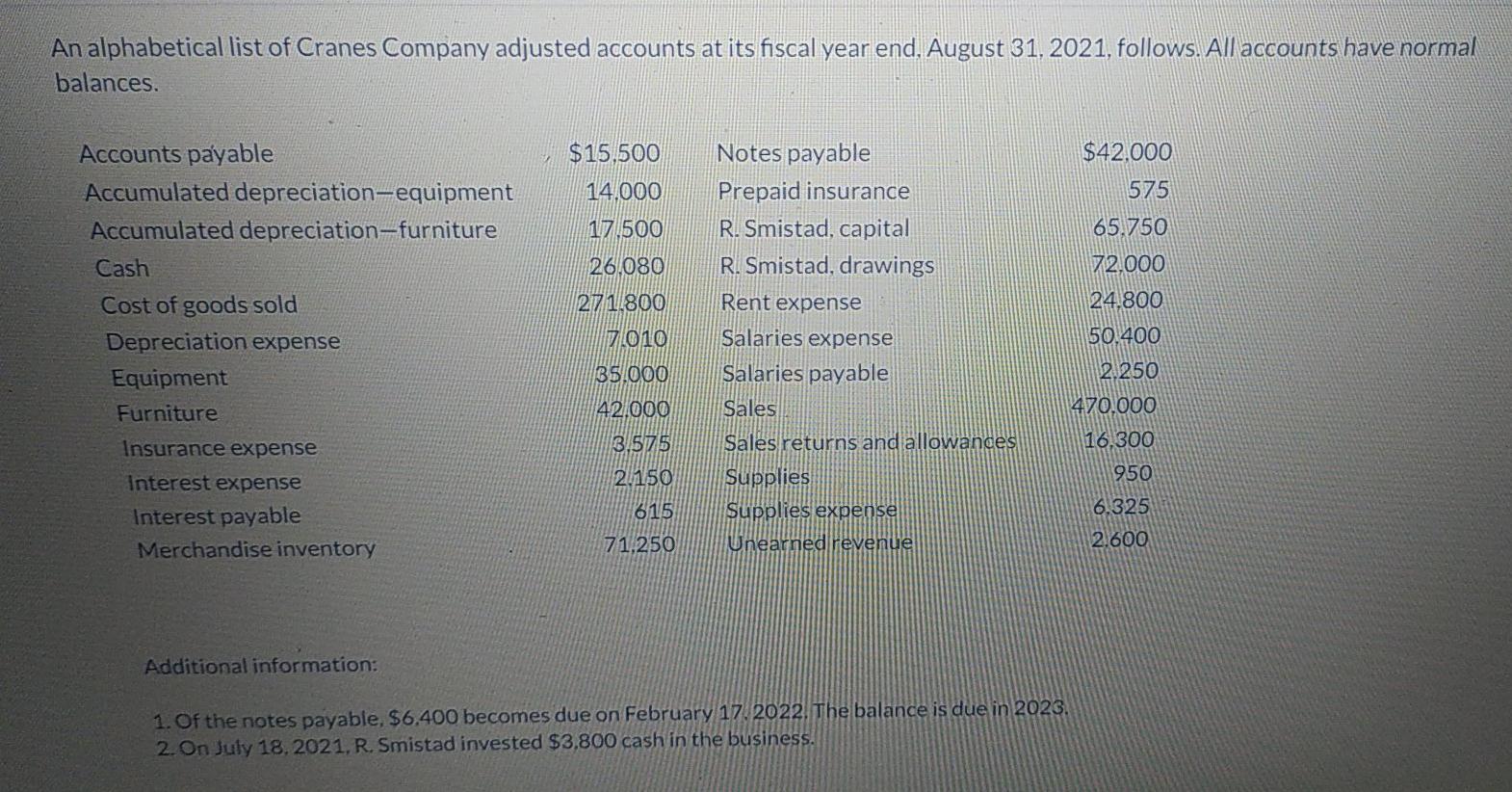

Please help me with the (b) part An alphabetical list of Cranes Company adjusted accounts at its fiscal year end. August 31, 2021, follows. All

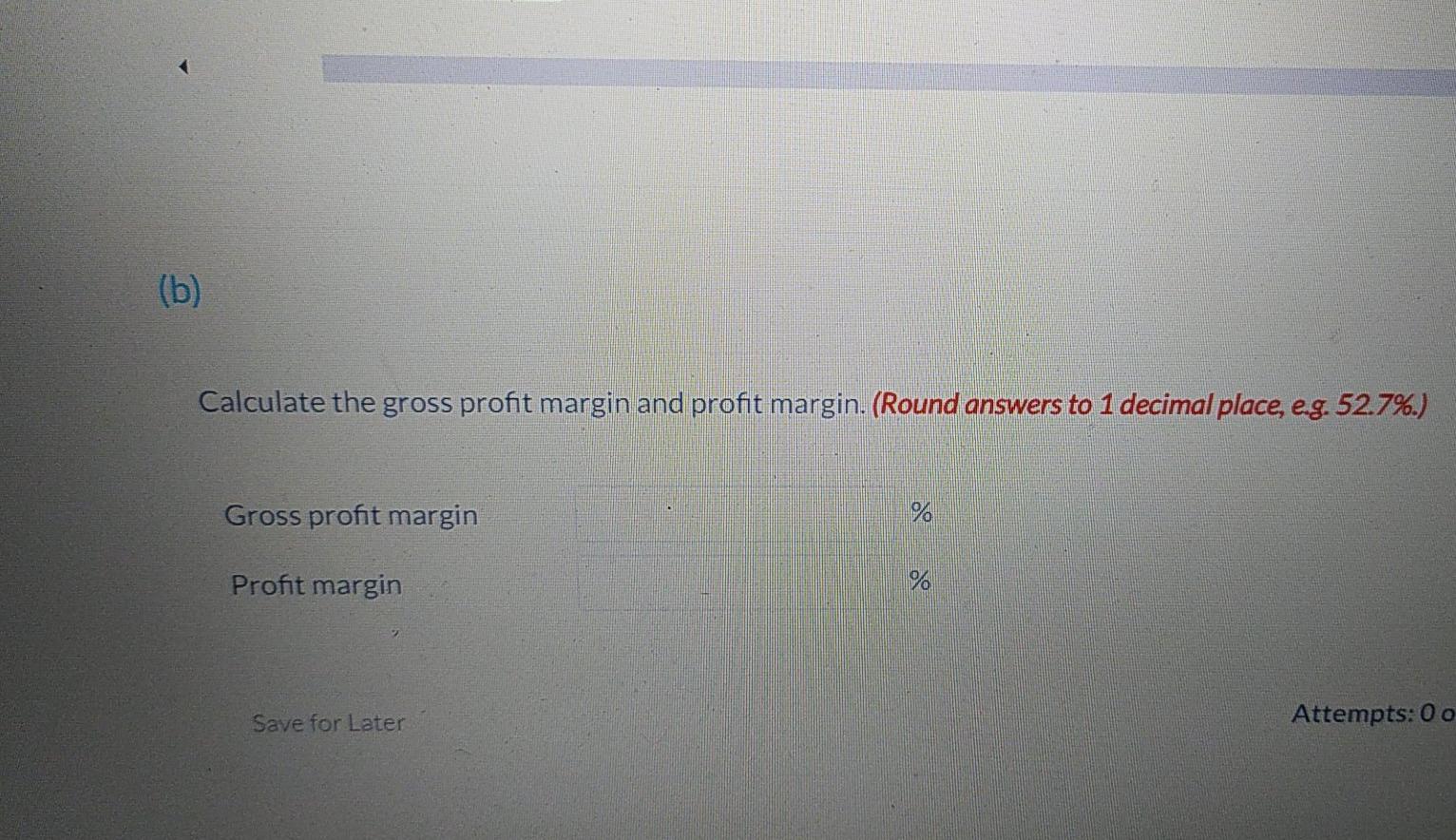

Please help me with the (b) part

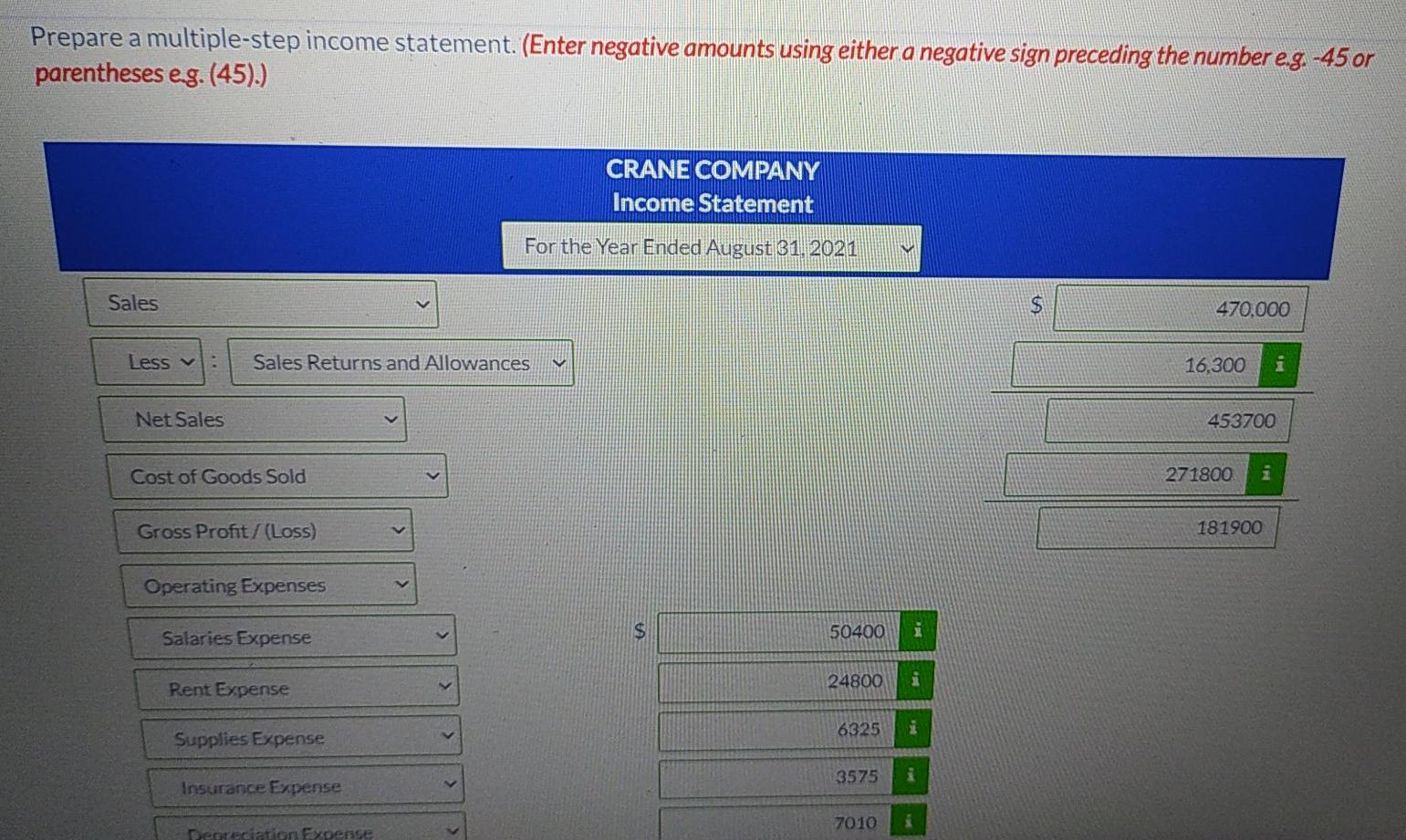

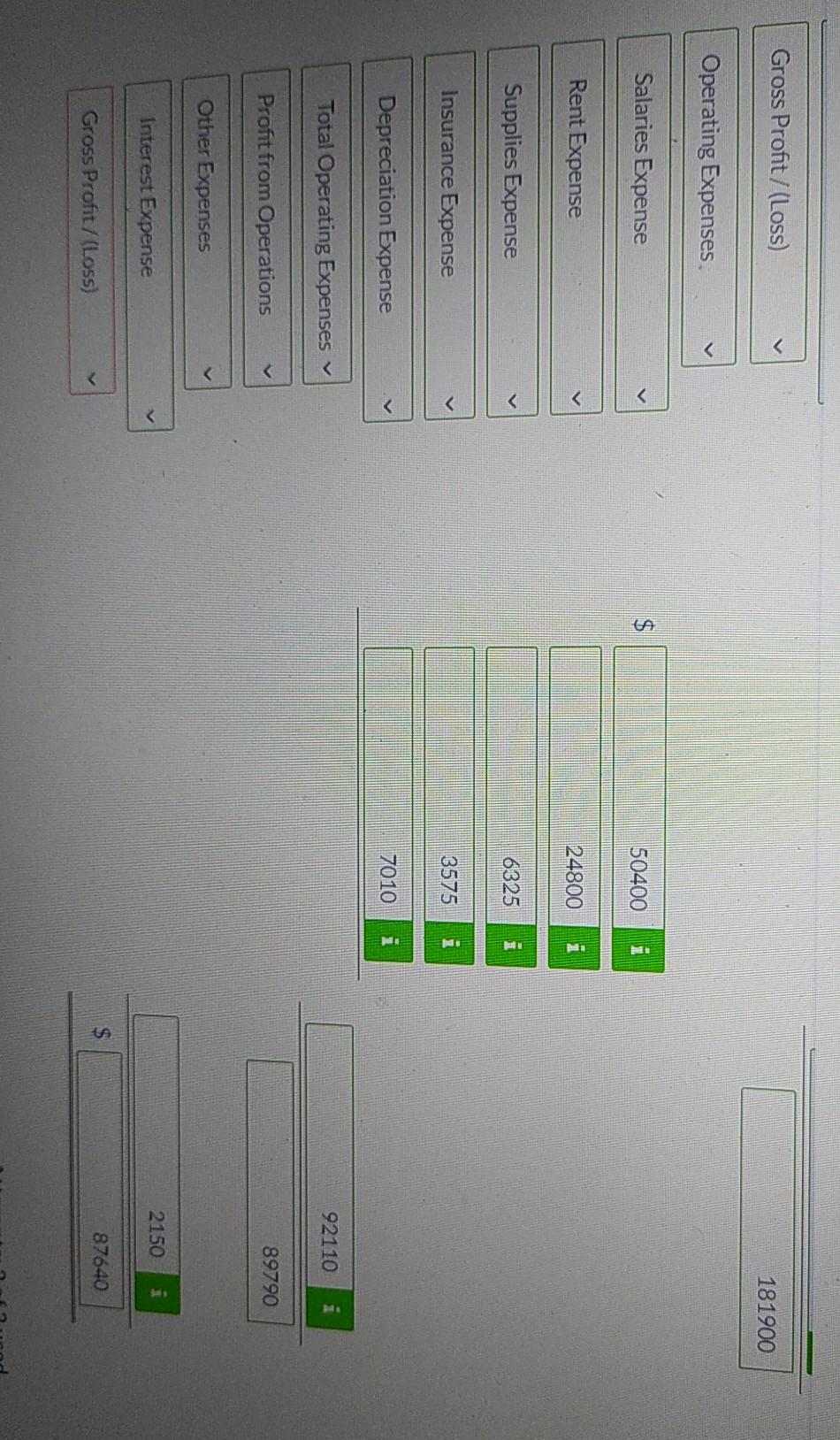

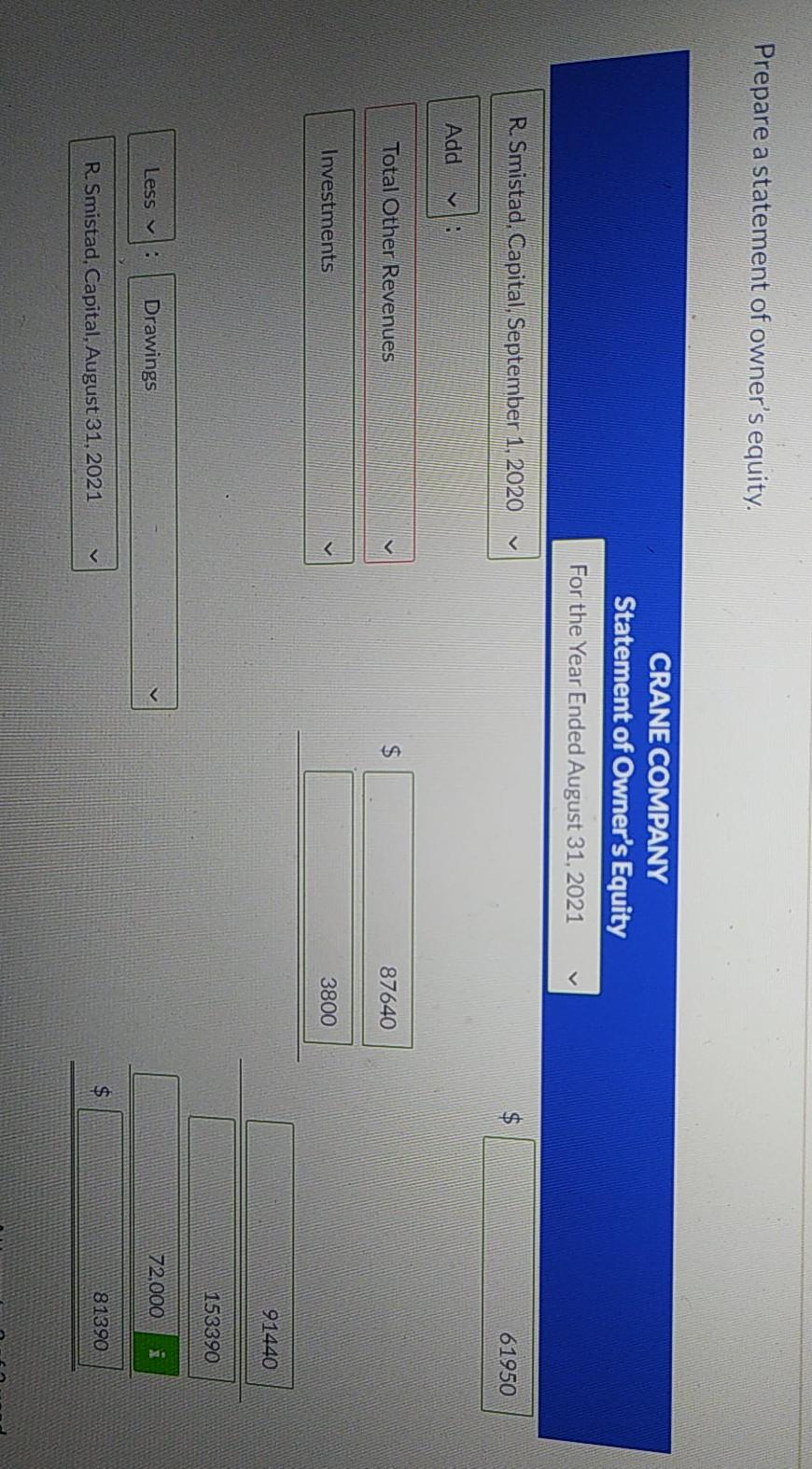

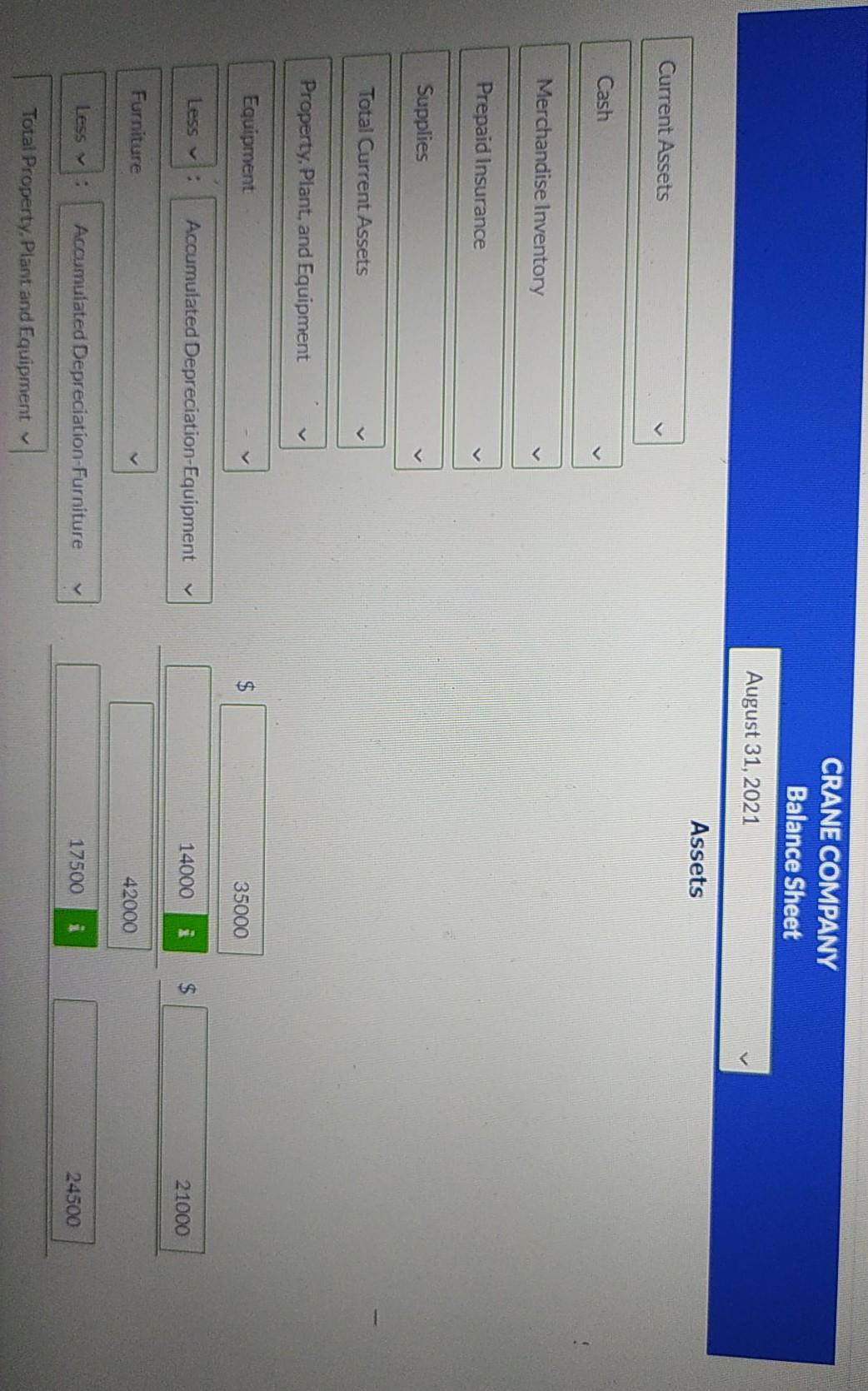

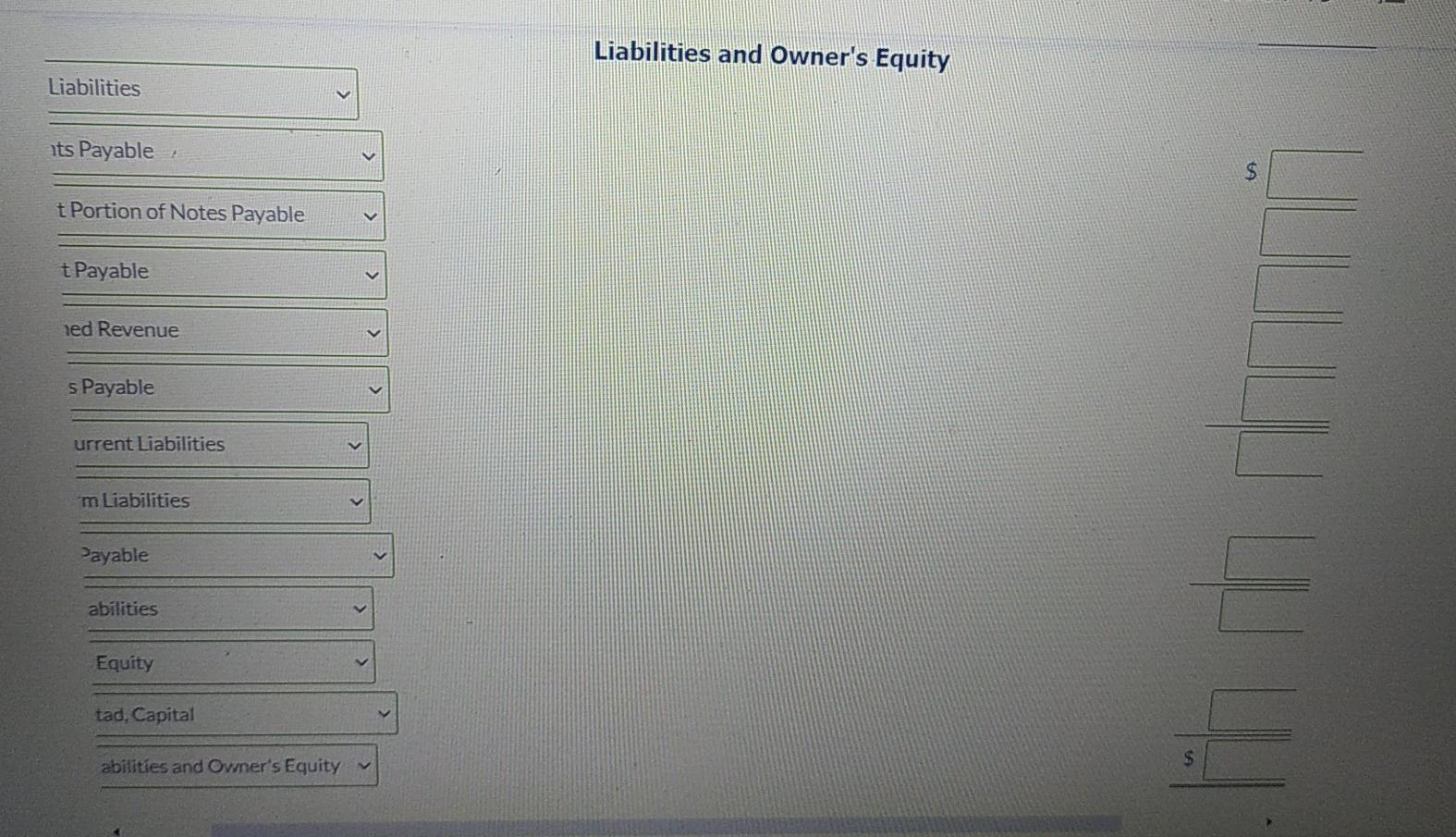

An alphabetical list of Cranes Company adjusted accounts at its fiscal year end. August 31, 2021, follows. All accounts have normal balances. $15,500 $42.000 14.000 575 17.500 65.750 72,000 26,080 Accounts payable Accumulated depreciation equipment Accumulated depreciation-furniture Cash Cost of goods sold Depreciation expense Equipment Furniture 271.800 24.800 7 010 Notes payable Prepaid insurance R. Smistad, capital R. Smistad, drawings Rent expense Salaries expense Salaries payable Sales Sales returns and allowances Supplies Supplies expensel Unearned revenue 35.000 42.000 50.400 2.250 470.000 16,300 950 6.325 3.575 Insurance expense Interest expense Interest payable Merchandise inventory 2.150 615 71,250 2.600 Additional information: 1. Of the notes payable. $6.400 becomes due on February 17 2022. The balance is due in 2023. 2. On July 18.2021. R. Smistad invested $3,800 cash in the business. Prepare a multiple-step income statement. (Enter negative amounts using either a negative sign preceding the numbereg.-45 or parentheses eg. (45).) CRANE COMPANY Income Statement For the Year Ended August 31, 2021 Sales $ 470.000 Less : Sales Returns and Allowances 16,300 Net Sales 453700 Cost of Goods Sold 271800 Gross Profit/(Loss) 181900 Operating Expenses $ 50400 i Salaries Expense Rent Expense 24800 6325 Supplies Expense 3575 Insurance Expense 7010 Pepreciation Expense Gross Profit/(Loss) 181900 Operating Expenses Salaries Expense 7010 Total Operating Expenses 92110 Profit from Operations 89790 Other Expenses Payable abilities ih in EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started