Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with the boxes I got wrong and explain why the new answers are right / explanations. Thank you! :-) Marin Corporation has

Please help me with the boxes I got wrong and explain why the new answers are right / explanations. Thank you! :-)

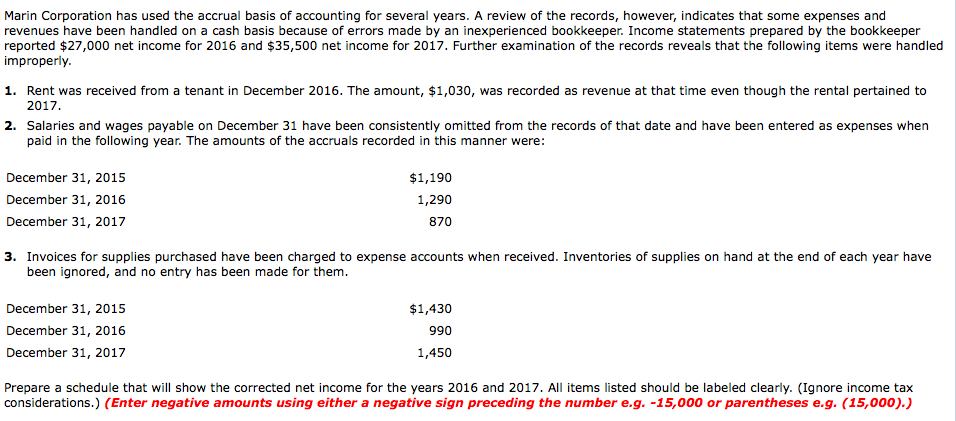

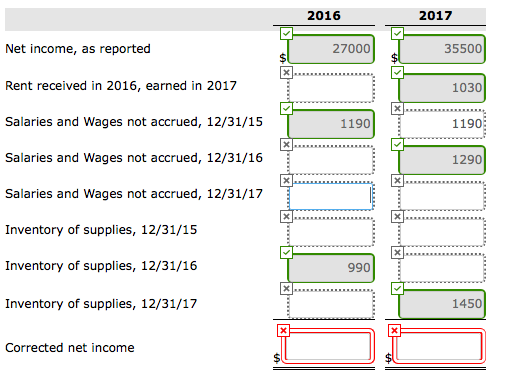

Marin Corporation has used the accrual basis of accounting for several years. A review of the records, however, indicates that some expenses and revenues have been handled on a cash basis because of errors made by an inexperienced bookkeeper. Income statements prepared by the bookkeeper reported $27,000 net income for 2016 and $35,500 net income for 2017. Further examination of the records reveals that the following items were handled improperly. 1. Rent was received from a tenant in December 2016. The amount, $1,030, was recorded as revenue at that time even though the rental pertained to 2017. 2. Salaries and wages payable on December 31 have been consistently omitted from the records of that date and have been entered as expenses when paid in the following year. The amounts of the accruals recorded in this manner were: December 31, 2015 December 31, 2016 December 31, 2017 $1,190 1,290 870 3. Invoices for supplies purchased have been charged to expense accounts when received. Inventories of supplies on hand at the end of each year have been ignored, and no entry has been made for them. December 31, 2015 December 31, 2016 December 31, 2017 $1,430 990 1,450 Prepare a schedule that will show the corrected net income for the years 2016 and 2017. All items listed should be labeled clearly. (Ignore income tax considerations.) (Enter negative amounts using either a negative sign preceding the number e.g. -15,000 or parentheses e.g. (15,000).) 2016 2017 Net income, as reported 27000 35500 ) Rent received in 2016, earned in 2017 1030 Salaries and Wages not accrued, 12/31/15 1190 ) Salaries and Wages not accrued, 12/31/16 T 1290 ) Salaries and Wages not accrued, 12/31/17 ) Inventory of supplies, 12/31/15 Inventory of supplies, 12/31/16 Inventory of supplies, 12/31/17 1450 Corrected net income Marin Corporation has used the accrual basis of accounting for several years. A review of the records, however, indicates that some expenses and revenues have been handled on a cash basis because of errors made by an inexperienced bookkeeper. Income statements prepared by the bookkeeper reported $27,000 net income for 2016 and $35,500 net income for 2017. Further examination of the records reveals that the following items were handled improperly. 1. Rent was received from a tenant in December 2016. The amount, $1,030, was recorded as revenue at that time even though the rental pertained to 2017. 2. Salaries and wages payable on December 31 have been consistently omitted from the records of that date and have been entered as expenses when paid in the following year. The amounts of the accruals recorded in this manner were: December 31, 2015 December 31, 2016 December 31, 2017 $1,190 1,290 870 3. Invoices for supplies purchased have been charged to expense accounts when received. Inventories of supplies on hand at the end of each year have been ignored, and no entry has been made for them. December 31, 2015 December 31, 2016 December 31, 2017 $1,430 990 1,450 Prepare a schedule that will show the corrected net income for the years 2016 and 2017. All items listed should be labeled clearly. (Ignore income tax considerations.) (Enter negative amounts using either a negative sign preceding the number e.g. -15,000 or parentheses e.g. (15,000).) 2016 2017 Net income, as reported 27000 35500 ) Rent received in 2016, earned in 2017 1030 Salaries and Wages not accrued, 12/31/15 1190 ) Salaries and Wages not accrued, 12/31/16 T 1290 ) Salaries and Wages not accrued, 12/31/17 ) Inventory of supplies, 12/31/15 Inventory of supplies, 12/31/16 Inventory of supplies, 12/31/17 1450 Corrected net incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started