Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with the following 2 questions down below . please and thank you.. including brief explanation if possible. 1. required : a.bad account

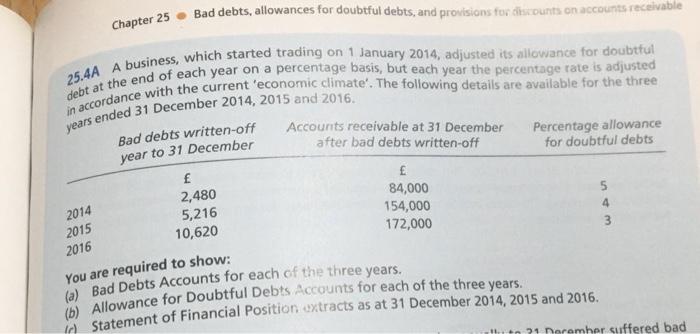

please help me with the following 2 questions down below . please and thank you.. including brief explanation if possible.

a.bad account for each year of the three years

b. allowance for doubful debt account for each of the three years

c. statement of financial position extract as of 31,December 2014,2015 and 2016

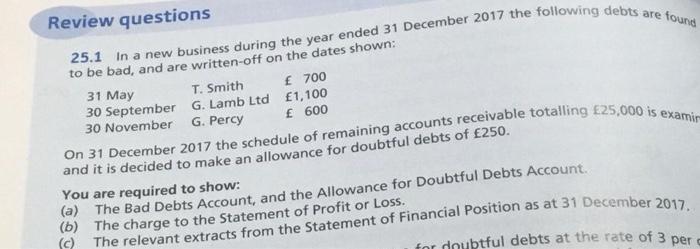

2. required

a. bad debts account and allowance for doubtful accounts

b. the charge to the statement of profit or loss

c. the relevant extract from the statement of financial position as of 31, December 2017

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started