Question: PLEASE HELP ME WITH THE FOLLOWING HIGHLIGHTED POINT Your help would be up vote Really need help with this. All information are included I had

PLEASE HELP ME WITH THE FOLLOWING HIGHLIGHTED POINT

Your help would be up vote

Really need help with this. All information are included

I had upload PDF and this is size the best i can get. Please save the image, that might help. My apologies

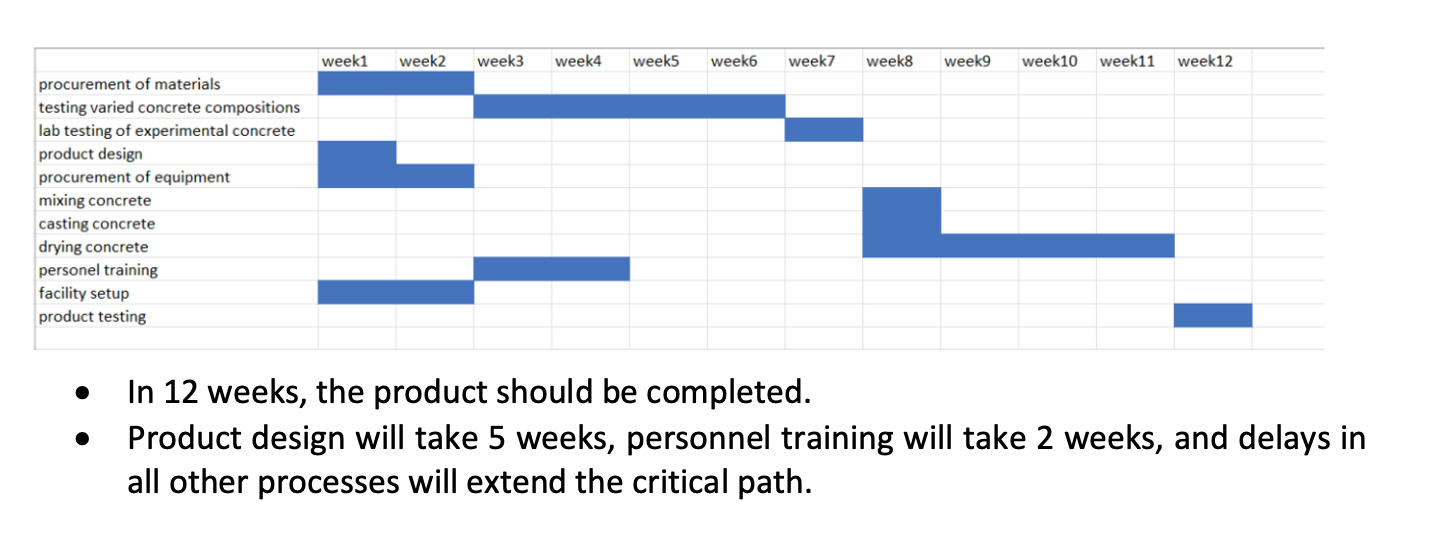

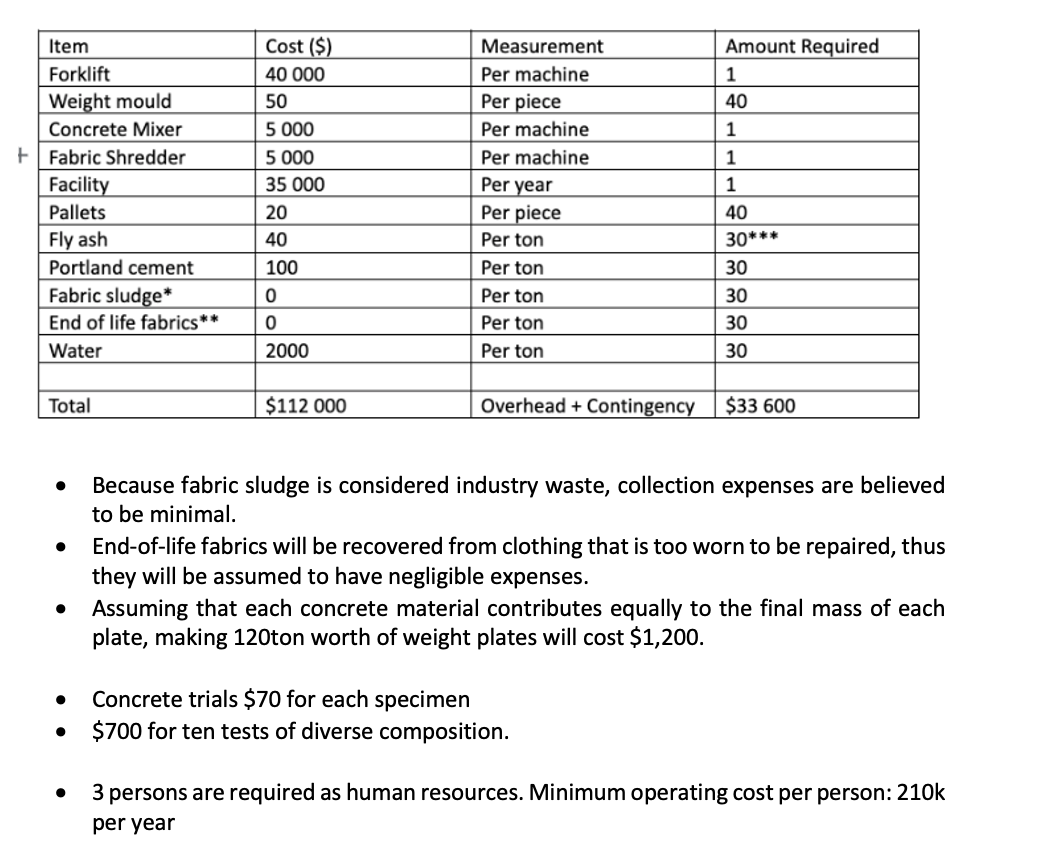

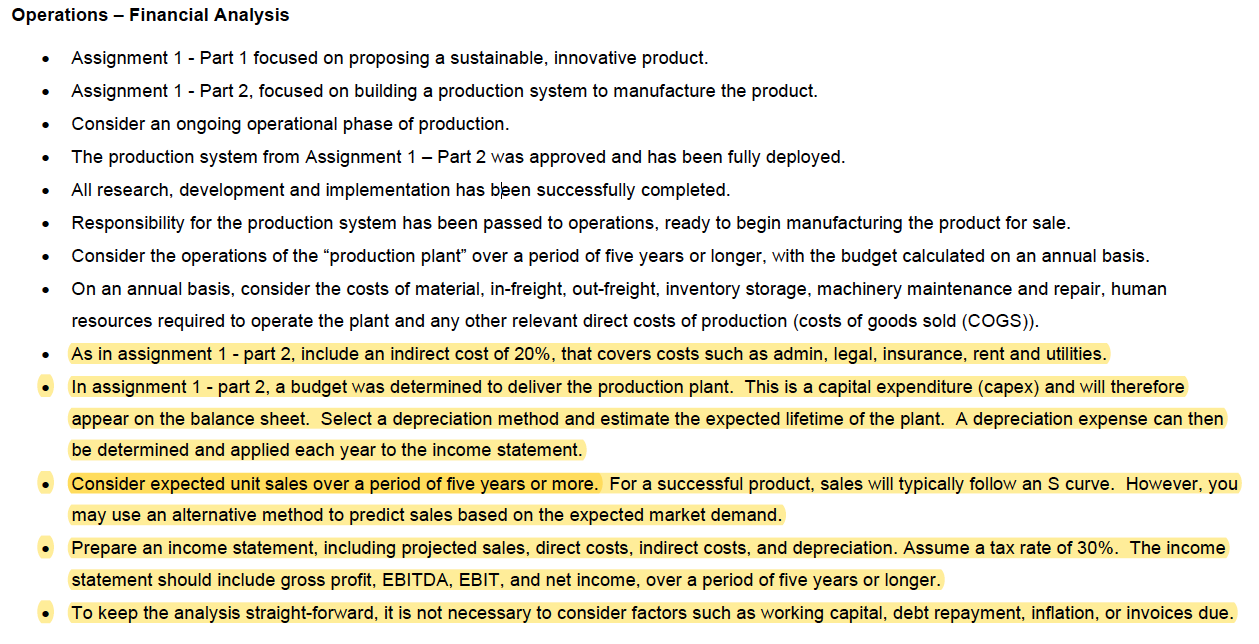

PROJECT Concrete weight plates manufactured from fly ash and textile waste, as well as textile waste sludge, are part of the proposed project. To increase the endurance of the concrete, it is coated with recycled plastic. The present fast fashion trend has resulted in vast quantities of apparel being created and then discarded, resulting in an increase in textile waste. According to the Australian Government [2,] Australia is the second greatest producer of textile waste, with each individual producing on average 23kg of textile waste that is disposed of each year. Synthetic materials, such as nylon and polyester, which account for a major fraction of these overall wastes, are plastic derivatives that take a long time to breakdown. As a result, textile waste accumulates in landfills, negatively impacting the ecosystem. Another by-product of modern demands is fly ash, which is produced by the combustion of coal to meet energy demands. The environment benefits from the removal of wastes as well as the decrease of raw resources necessary to make weight plates, such as sand, gravel, and iron, by using these items that would otherwise be waste. Weight plates are currently composed of concrete or cast iron and then covered in either plastic or rubber. Cast iron plates are more expensive than concrete plates because of material expenses, but they last longer. In this instance, the consumer has no other options and must choose between these two unsustainable possibilities. Weight plates with only the coating produced from recycled plastic or rubber are the closest choice to recycled plates,' as they are constructed from recycled plastic or rubber. The goal of the invention is to extend the life of present concrete-based weights by employing recycled materials. At specific ratios of fabric waste, using textile sludge waste and fly ash in the concrete mixture can generate material with a similar density to regular concrete but a higher compressive strength [1]. One of the most significant disadvantages of concrete is its brittleness, which is frequently reduced in industry by reinforcing it. A study indicated that reinforcing concrete with textile trimmings has a comparable impact in terms of lowering brittleness [4]. By encasing the resulting polymer concrete in recycled plastic, the weights' resilience and lifespan can be increased, potentially leading to superior concrete weights. To provide a longer product lifespan, the product will require determining the optimal ratio of elements in the concrete mixture. End-of-life textiles must be shredded before being mixed with fly ash, textile waste sludge, sand, and Portland cement. The concrete mixture will be cast and allowed to air dry before being encased with recyclable plastics if it proves advantageous. When making polymer concrete, the density must also be taken into account to ensure that the weights are not excessive. To provide a longer product lifespan, the product will require determining the optimal ratio of elements in the concrete mixture. End-of-life textiles must be shredded before being mixed with fly ash, textile waste sludge, sand, and Portland cement. The concrete mixture will be cast and allowed to air dry before being encased with recyclable plastics if it proves advantageous. When making polymer concrete, the density must also be taken into account to ensure that the weights are not excessive. week1 week2 week3 week4 week5 week6 week7 week8 week9 week10 week11 week12 In 12 weeks, the product should be completed. Product design will take 5 weeks, personnel training will take 2 weeks, and delays in all other processes will extend the critical path. procurement of materials testing varied concrete compositions lab testing of experimental concrete product design procurement of equipment mixing concrete casting concrete drying concrete personel training facility setup product testing Cost ($) Measurement Amount Required Item Forklift 40 000 Per machine 1 Weight mould 50 Per piece 40 Concrete Mixer 5 000 Per machine 1 +Fabric Shredder 5 000 Per machine 1 Facility 35 000 Per year 1 Pallets 20 Per piece 40 Fly ash 40 Per ton 30*** Portland cement 100 Per ton 30 Fabric sludge* 0 Per ton 30 End of life fabrics** 0 Per ton 30 Water 2000 Per ton 30 Total $112 000 Overhead + Contingency $33 600 Because fabric sludge is considered industry waste, collection expenses are believed to be minimal. End-of-life fabrics will be recovered from clothing that is too worn to be repaired, thus they will be assumed to have negligible expenses. Assuming that each concrete material contributes equally to the final mass of each plate, making 120ton worth of weight plates will cost $1,200. Concrete trials $70 for each specimen $700 for ten tests of diverse composition. 3 persons are required as human resources. Minimum operating cost per person: 210k per year Operations - Financial Analysis Assignment 1 - Part 1 focused on proposing a sustainable, innovative product. Assignment 1 - Part 2, focused on building a production system to manufacture the product. Consider an ongoing operational phase of production. The production system from Assignment 1 - Part 2 was approved and has been fully deployed. All research, development and implementation has been successfully completed. Responsibility for the production system has been passed to operations, ready to begin manufacturing the product for sale. Consider the operations of the "production plant" over a period of five years or longer, with the budget calculated on an annual basis. On an annual basis, consider the costs of material, in-freight, out-freight, inventory storage, machinery maintenance and repair, human resources required to operate the plant and any other relevant direct costs of production (costs of goods sold (COGS)). As in assignment 1 - part 2, include an indirect cost of 20%, that covers costs such as admin, legal, insurance, rent and utilities. In assignment 1 - part 2, a budget was determined to deliver the production plant. This is a capital expenditure (capex) and will therefore appear on the balance sheet. Select a depreciation method and estimate the expected lifetime of the plant. A depreciation expense can then be determined and applied each year to the income statement. . Consider expected unit sales over a period of five years or more. For a successful product, sales will typically follow an S curve. However, you may use an alternative method to predict sales based on the expected market demand. . Prepare an income statement, including projected sales, direct costs, indirect costs, and depreciation. Assume a tax rate of 30%. The income statement should include gross profit, EBITDA, EBIT, and net income, over a period of five years or longer. To keep the analysis straight-forward, it is not necessary to consider factors such as working capital, debt repayment, inflation, or invoices due. Consider scenarios (worst-case, most-likely, best-case) across key financial variables, including price, units sold per year, COGS, and depreciation rate. Conduct a break-even analysis using the parameters above based on the most likely case. How long until breakeven? PROJECT Concrete weight plates manufactured from fly ash and textile waste, as well as textile waste sludge, are part of the proposed project. To increase the endurance of the concrete, it is coated with recycled plastic. The present fast fashion trend has resulted in vast quantities of apparel being created and then discarded, resulting in an increase in textile waste. According to the Australian Government [2,] Australia is the second greatest producer of textile waste, with each individual producing on average 23kg of textile waste that is disposed of each year. Synthetic materials, such as nylon and polyester, which account for a major fraction of these overall wastes, are plastic derivatives that take a long time to breakdown. As a result, textile waste accumulates in landfills, negatively impacting the ecosystem. Another by-product of modern demands is fly ash, which is produced by the combustion of coal to meet energy demands. The environment benefits from the removal of wastes as well as the decrease of raw resources necessary to make weight plates, such as sand, gravel, and iron, by using these items that would otherwise be waste. Weight plates are currently composed of concrete or cast iron and then covered in either plastic or rubber. Cast iron plates are more expensive than concrete plates because of material expenses, but they last longer. In this instance, the consumer has no other options and must choose between these two unsustainable possibilities. Weight plates with only the coating produced from recycled plastic or rubber are the closest choice to recycled plates,' as they are constructed from recycled plastic or rubber. The goal of the invention is to extend the life of present concrete-based weights by employing recycled materials. At specific ratios of fabric waste, using textile sludge waste and fly ash in the concrete mixture can generate material with a similar density to regular concrete but a higher compressive strength [1]. One of the most significant disadvantages of concrete is its brittleness, which is frequently reduced in industry by reinforcing it. A study indicated that reinforcing concrete with textile trimmings has a comparable impact in terms of lowering brittleness [4]. By encasing the resulting polymer concrete in recycled plastic, the weights' resilience and lifespan can be increased, potentially leading to superior concrete weights. To provide a longer product lifespan, the product will require determining the optimal ratio of elements in the concrete mixture. End-of-life textiles must be shredded before being mixed with fly ash, textile waste sludge, sand, and Portland cement. The concrete mixture will be cast and allowed to air dry before being encased with recyclable plastics if it proves advantageous. When making polymer concrete, the density must also be taken into account to ensure that the weights are not excessive. To provide a longer product lifespan, the product will require determining the optimal ratio of elements in the concrete mixture. End-of-life textiles must be shredded before being mixed with fly ash, textile waste sludge, sand, and Portland cement. The concrete mixture will be cast and allowed to air dry before being encased with recyclable plastics if it proves advantageous. When making polymer concrete, the density must also be taken into account to ensure that the weights are not excessive. week1 week2 week3 week4 week5 week6 week7 week8 week9 week10 week11 week12 In 12 weeks, the product should be completed. Product design will take 5 weeks, personnel training will take 2 weeks, and delays in all other processes will extend the critical path. procurement of materials testing varied concrete compositions lab testing of experimental concrete product design procurement of equipment mixing concrete casting concrete drying concrete personel training facility setup product testing Cost ($) Measurement Amount Required Item Forklift 40 000 Per machine 1 Weight mould 50 Per piece 40 Concrete Mixer 5 000 Per machine 1 +Fabric Shredder 5 000 Per machine 1 Facility 35 000 Per year 1 Pallets 20 Per piece 40 Fly ash 40 Per ton 30*** Portland cement 100 Per ton 30 Fabric sludge* 0 Per ton 30 End of life fabrics** 0 Per ton 30 Water 2000 Per ton 30 Total $112 000 Overhead + Contingency $33 600 Because fabric sludge is considered industry waste, collection expenses are believed to be minimal. End-of-life fabrics will be recovered from clothing that is too worn to be repaired, thus they will be assumed to have negligible expenses. Assuming that each concrete material contributes equally to the final mass of each plate, making 120ton worth of weight plates will cost $1,200. Concrete trials $70 for each specimen $700 for ten tests of diverse composition. 3 persons are required as human resources. Minimum operating cost per person: 210k per year Operations - Financial Analysis Assignment 1 - Part 1 focused on proposing a sustainable, innovative product. Assignment 1 - Part 2, focused on building a production system to manufacture the product. Consider an ongoing operational phase of production. The production system from Assignment 1 - Part 2 was approved and has been fully deployed. All research, development and implementation has been successfully completed. Responsibility for the production system has been passed to operations, ready to begin manufacturing the product for sale. Consider the operations of the "production plant" over a period of five years or longer, with the budget calculated on an annual basis. On an annual basis, consider the costs of material, in-freight, out-freight, inventory storage, machinery maintenance and repair, human resources required to operate the plant and any other relevant direct costs of production (costs of goods sold (COGS)). As in assignment 1 - part 2, include an indirect cost of 20%, that covers costs such as admin, legal, insurance, rent and utilities. In assignment 1 - part 2, a budget was determined to deliver the production plant. This is a capital expenditure (capex) and will therefore appear on the balance sheet. Select a depreciation method and estimate the expected lifetime of the plant. A depreciation expense can then be determined and applied each year to the income statement. . Consider expected unit sales over a period of five years or more. For a successful product, sales will typically follow an S curve. However, you may use an alternative method to predict sales based on the expected market demand. . Prepare an income statement, including projected sales, direct costs, indirect costs, and depreciation. Assume a tax rate of 30%. The income statement should include gross profit, EBITDA, EBIT, and net income, over a period of five years or longer. To keep the analysis straight-forward, it is not necessary to consider factors such as working capital, debt repayment, inflation, or invoices due. Consider scenarios (worst-case, most-likely, best-case) across key financial variables, including price, units sold per year, COGS, and depreciation rate. Conduct a break-even analysis using the parameters above based on the most likely case. How long until breakeven

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts