Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with the Q4! Refer to FNM's last publically reported Balance Sheet before it was placed into Conservatorship: FNM Balance Sheet (000 UON)

Please help me with the Q4!

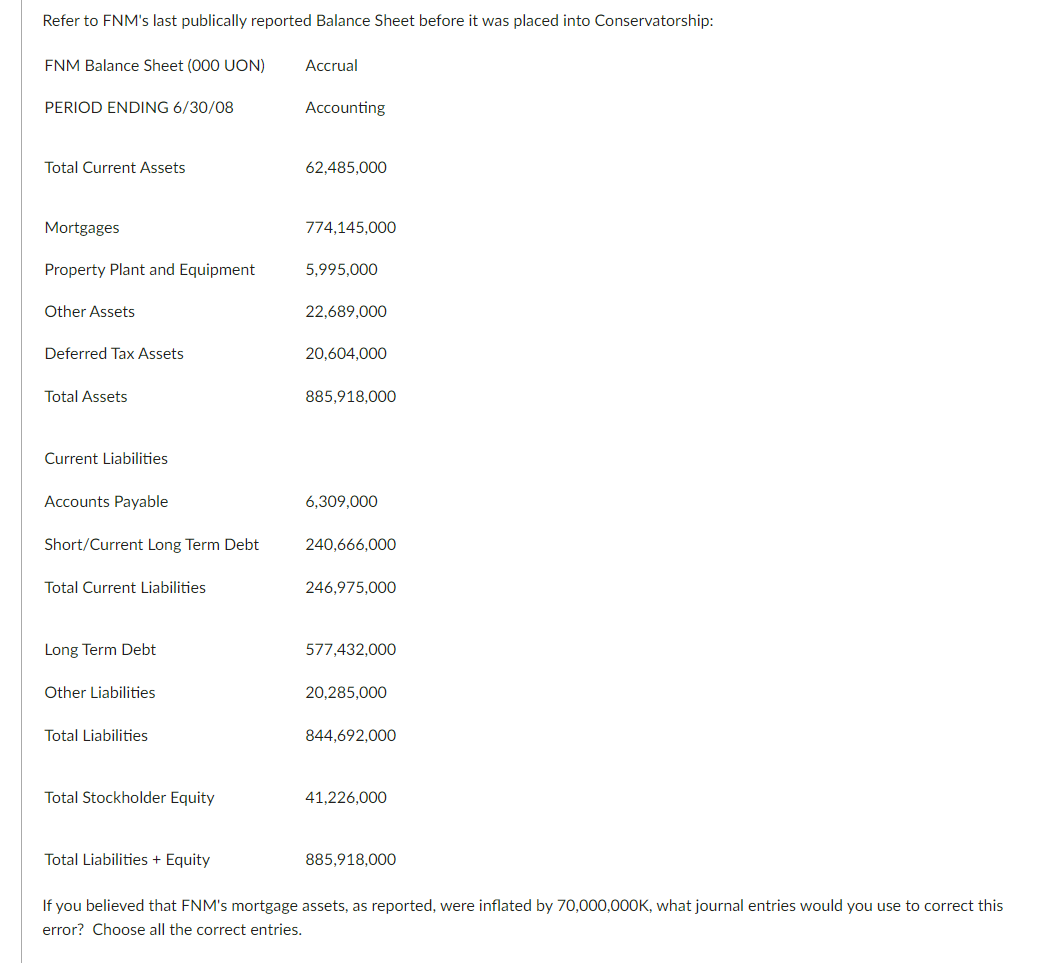

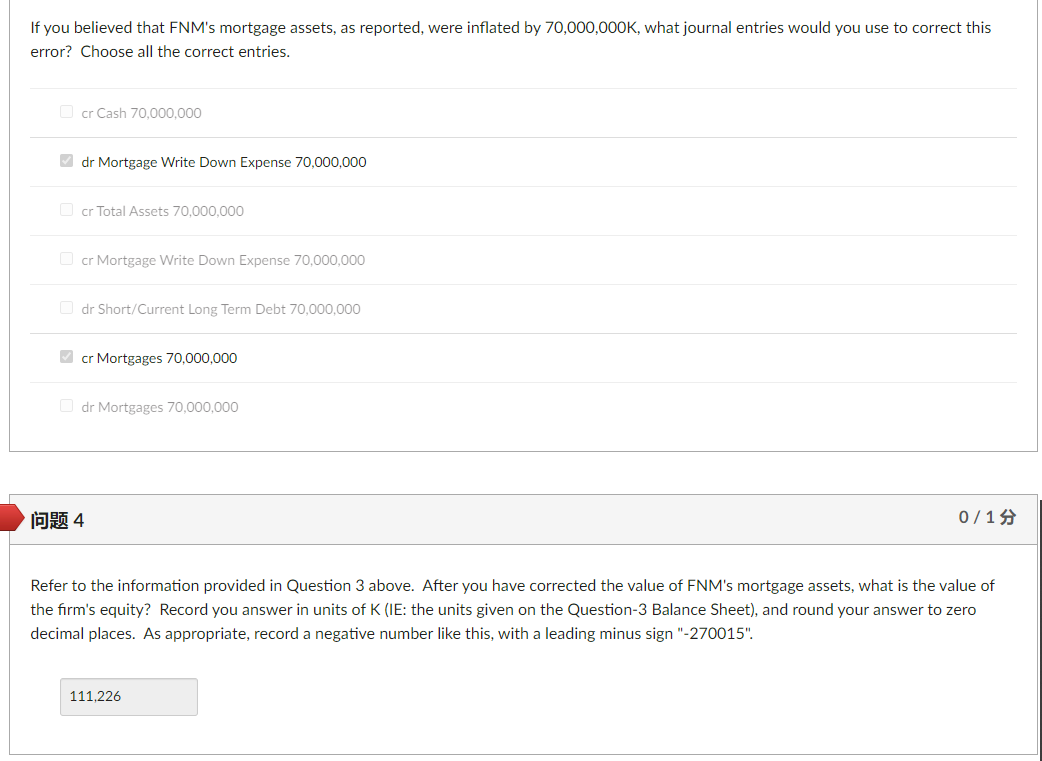

Refer to FNM's last publically reported Balance Sheet before it was placed into Conservatorship: FNM Balance Sheet (000 UON) Accrual PERIOD ENDING 6/30/08 Accounting Total Current Assets 62,485,000 Mortgages 774,145,000 Property Plant and Equipment 5,995,000 Other Assets 22,689,000 Deferred Tax Assets 20,604,000 Total Assets 885,918,000 Current Liabilities Accounts Payable 6,309,000 Short/Current Long Term Debt 240,666,000 Total Current Liabilities 246,975,000 Long Term Debt 577.432.000 Other Liabilities 20,285,000 Total Liabilities 844,692,000 Total Stockholder Equity 41,226,000 Total Liabilities + Equity 885,918,000 If you believed that FNM's mortgage assets, as reported, were inflated by 70,000,000K, what journal entries would you use to correct this error? Choose all the correct entries. If you believed that FNM's mortgage assets, as reported, were inflated by 70,000,000K, what journal entries would you use to correct this error? Choose all the correct entries. cr Cash 70,000,000 dr Mortgage Write Down Expense 70,000,000 cr Total Assets 70,000,000 cr Mortgage Write Down Expense 70,000,000 dr Short/Current Long Term Debt 70,000,000 cr Mortgages 70,000,000 dr Mortgages 70,000,000 4 0/14 Refer to the information provided in Question 3 above. After you have corrected the value of FNM's mortgage assets, what is the value of the firm's equity? Record you answer in units of K (IE: the units given on the Question-3 Balance Sheet), and round your answer to zero decimal places. As appropriate, record a negative number like this, with a leading minus sign"-270015". 111,226Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started