Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with these multiple choices question I am writing a test which ends in 20 minutes please 3. Which of the following statements

please help me with these multiple choices question I am writing a test which ends in 20 minutes please

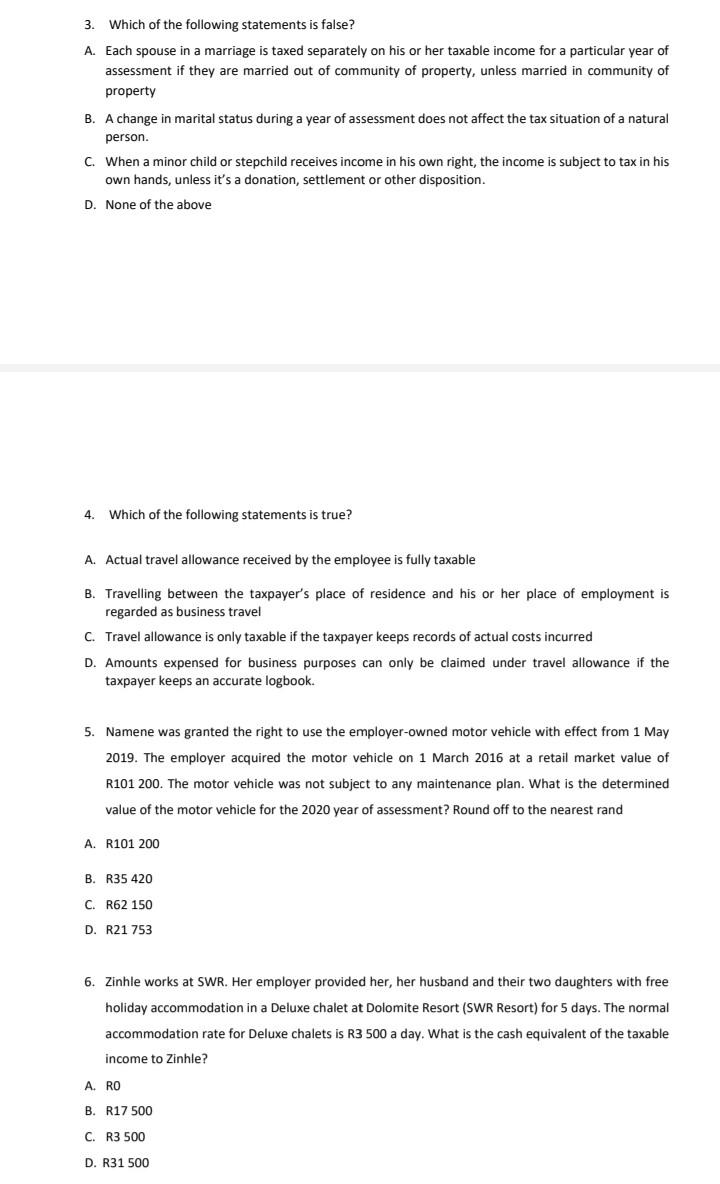

3. Which of the following statements is false? A. Each spouse in a marriage is taxed separately on his or her taxable income for a particular year of assessment if they are married out of community of property, unless married in community of property B. A change in marital status during a year of assessment does not affect the tax situation of a natural person. C. When a minor child or stepchild receives income in his own right, the income is subject to tax in his own hands, unless it's a donation, settlement or other disposition. D. None of the above 4. Which of the following statements is true? A. Actual travel allowance received by the employee is fully taxable B. Travelling between the taxpayer's place of residence and his or her place of employment is regarded as business travel C. Travel allowance is only taxable if the taxpayer keeps records of actual costs incurred D. Amounts expensed for business purposes can only be claimed under travel allowance if the taxpayer keeps an accurate logbook. 5. Namene was granted the right to use the employer-owned motor vehicle with effect from 1 May 2019. The employer acquired the motor vehicle on 1 March 2016 at a retail market value of R101 200. The motor vehicle was not subject to any maintenance plan. What is the determined value of the motor vehicle for the 2020 year of assessment? Round off to the nearest rand A. R101 200 B. R35 420 C. R62 150 D. R21 753 6. Zinhle works at SWR. Her employer provided her, her husband and their two daughters with free holiday accommodation in a Deluxe chalet at Dolomite Resort (SWR Resort) for 5 days. The normal accommodation rate for Deluxe chalets is R3 500 a day. What is the cash equivalent of the taxable income to Zinhle? A.RO B. R17 500 C. R3 500 D. R31 500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started