please help me with these questions . It is managerial accounting

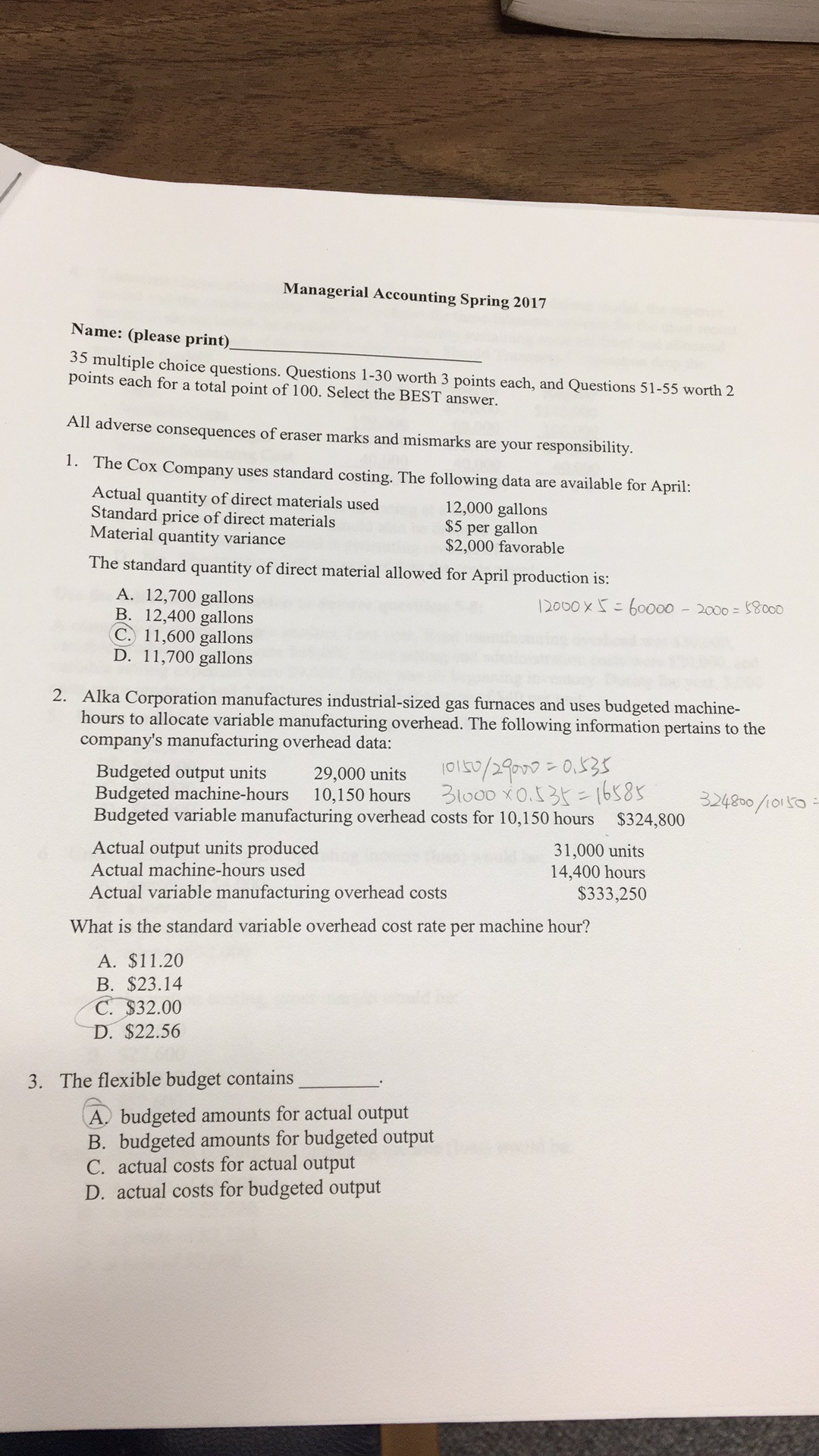

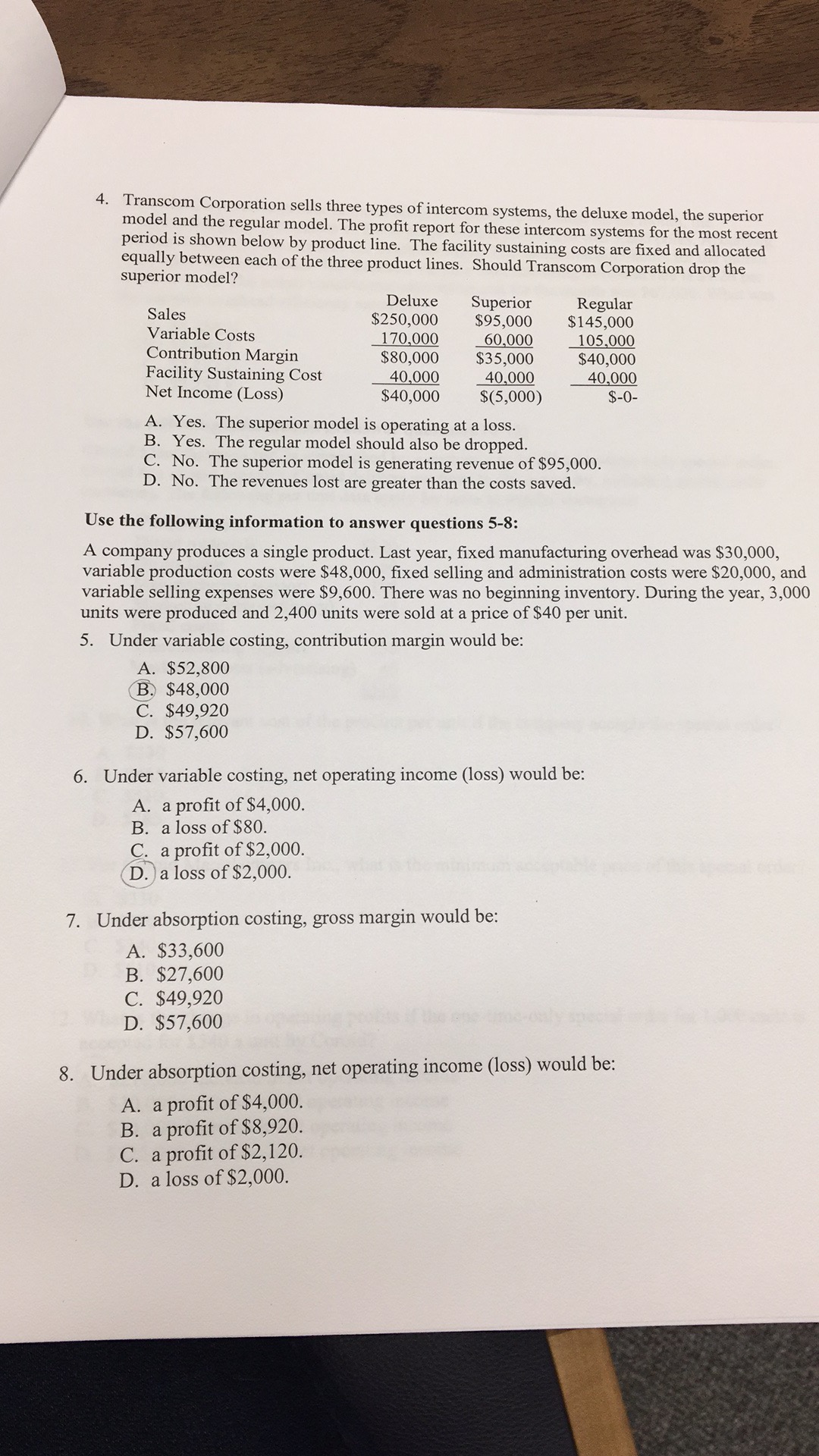

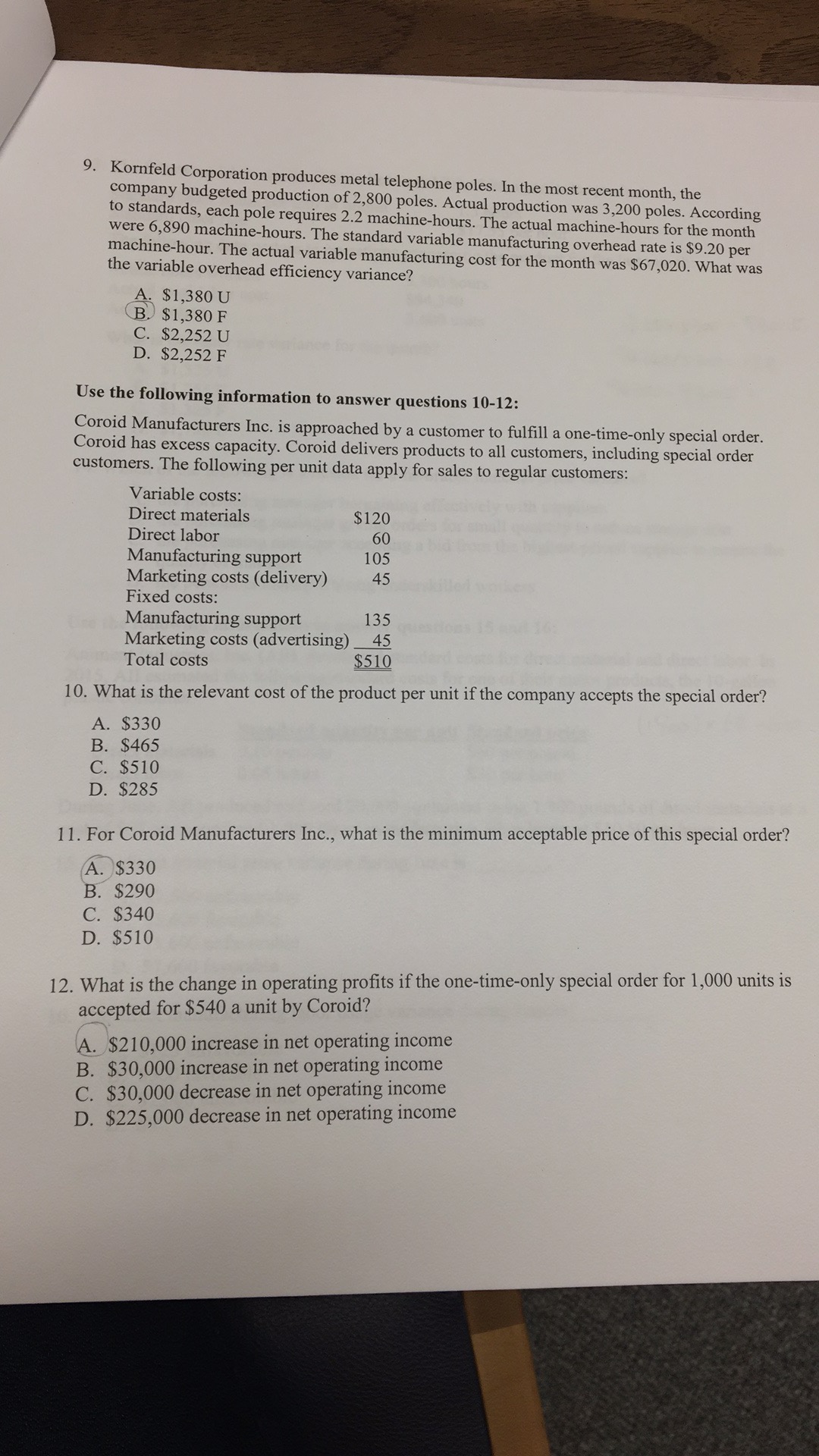

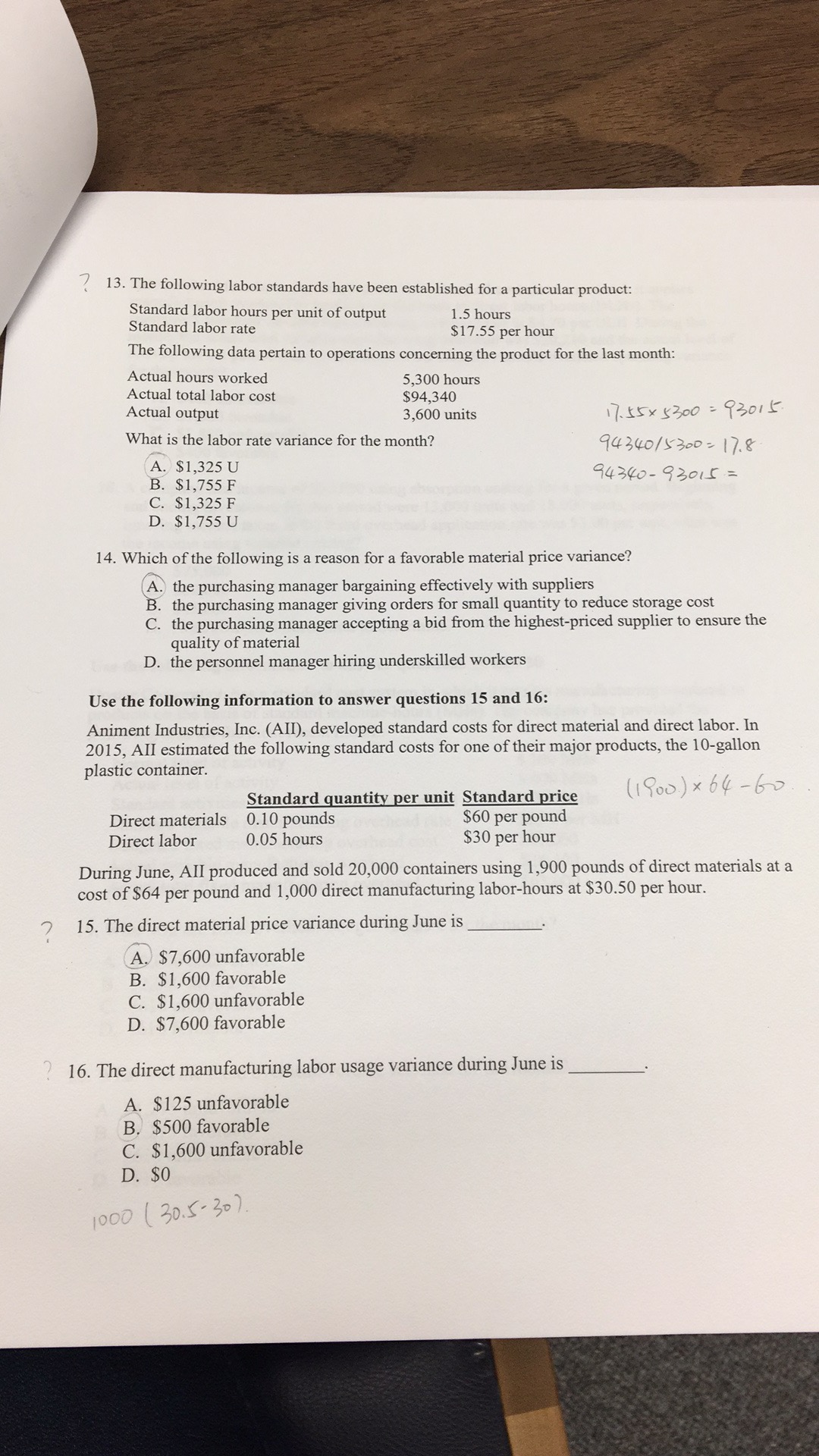

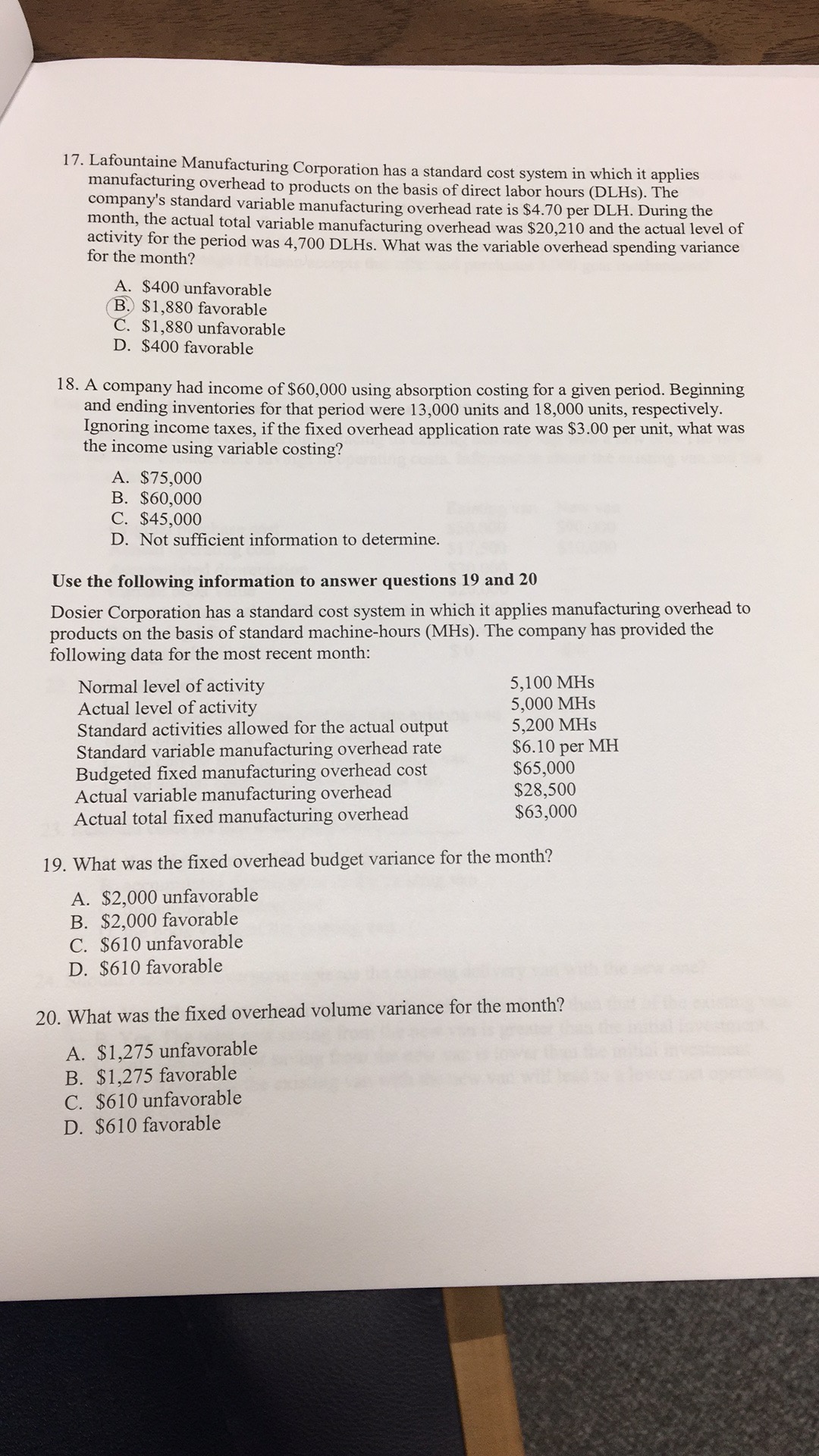

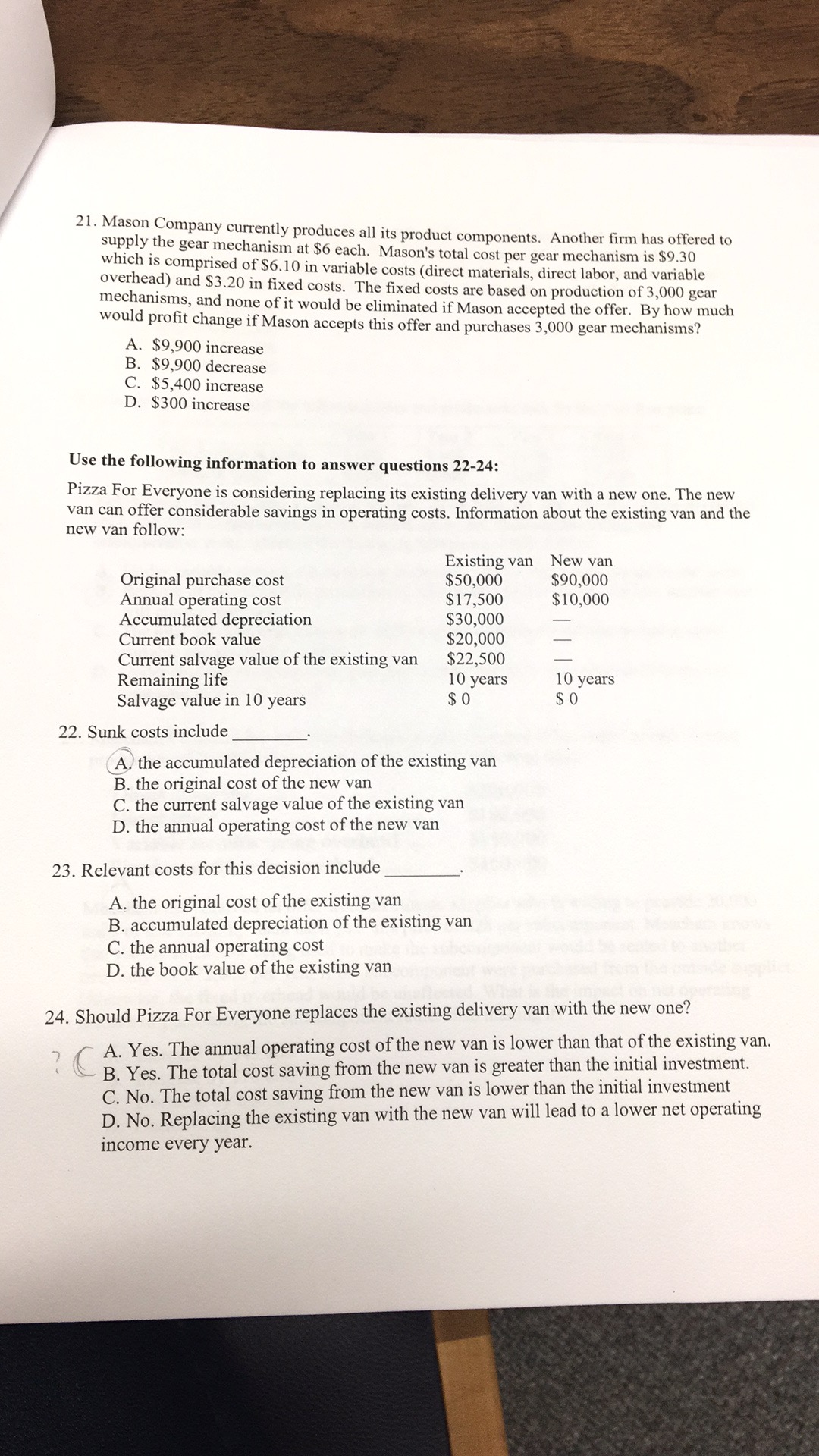

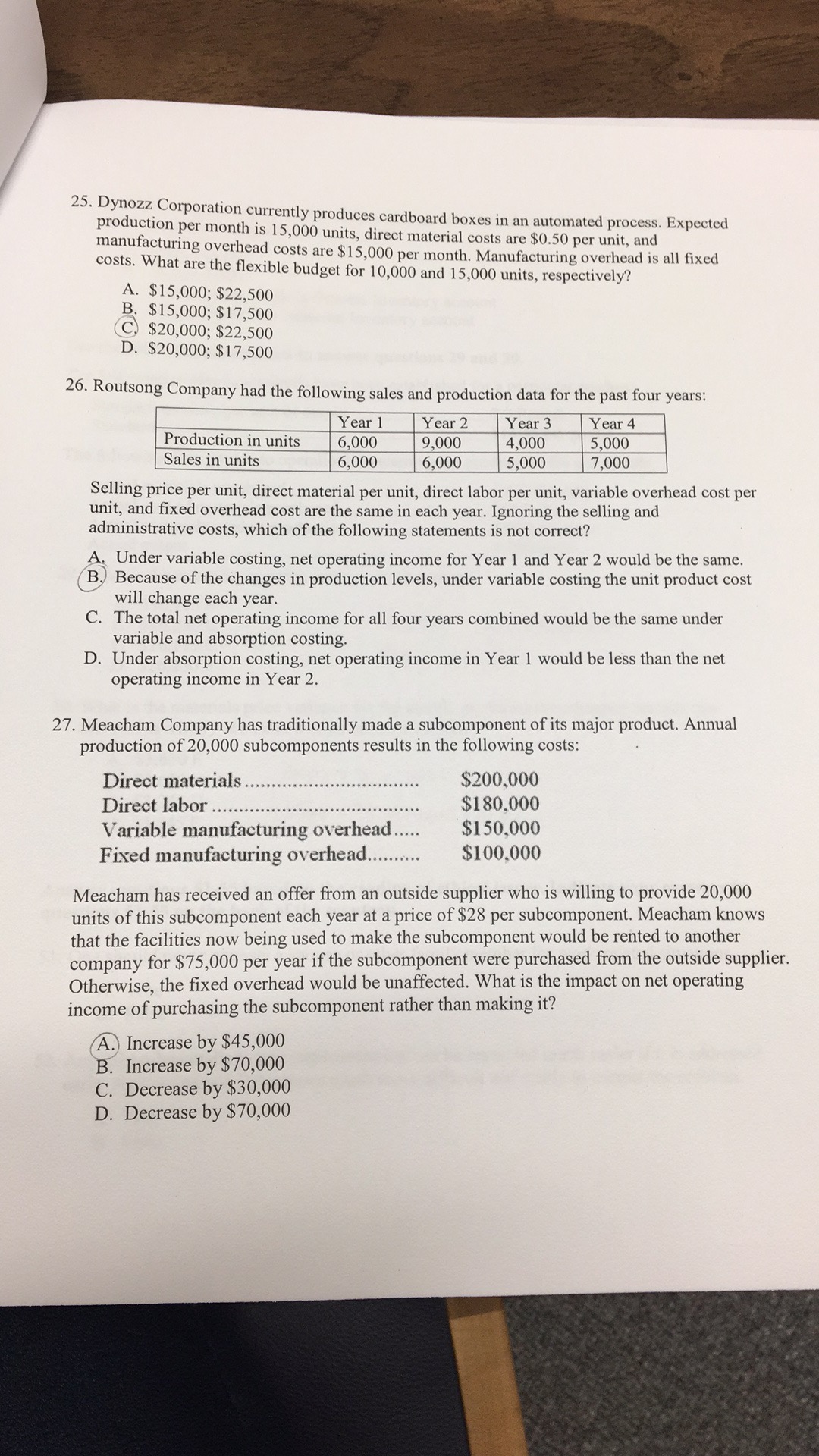

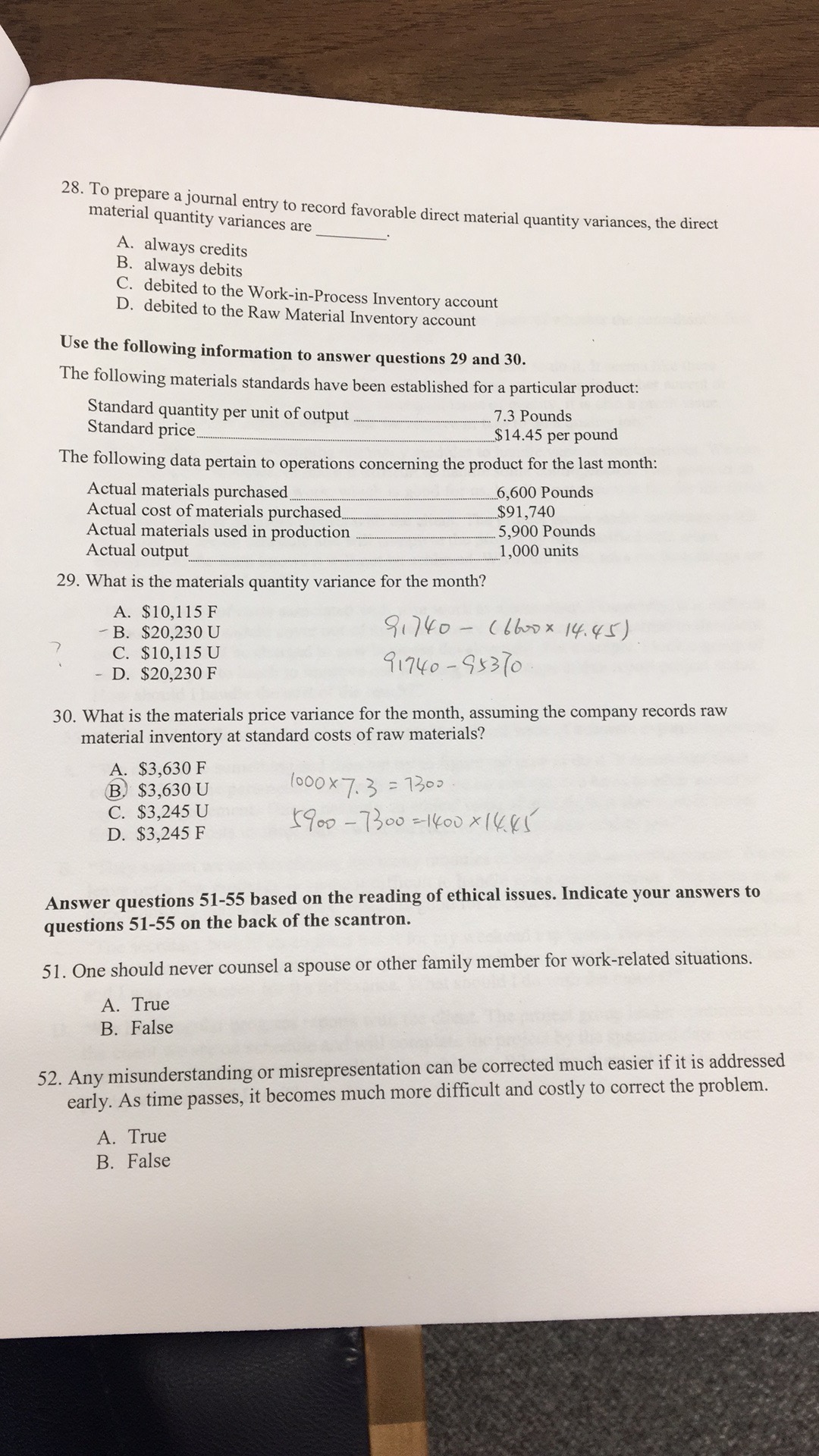

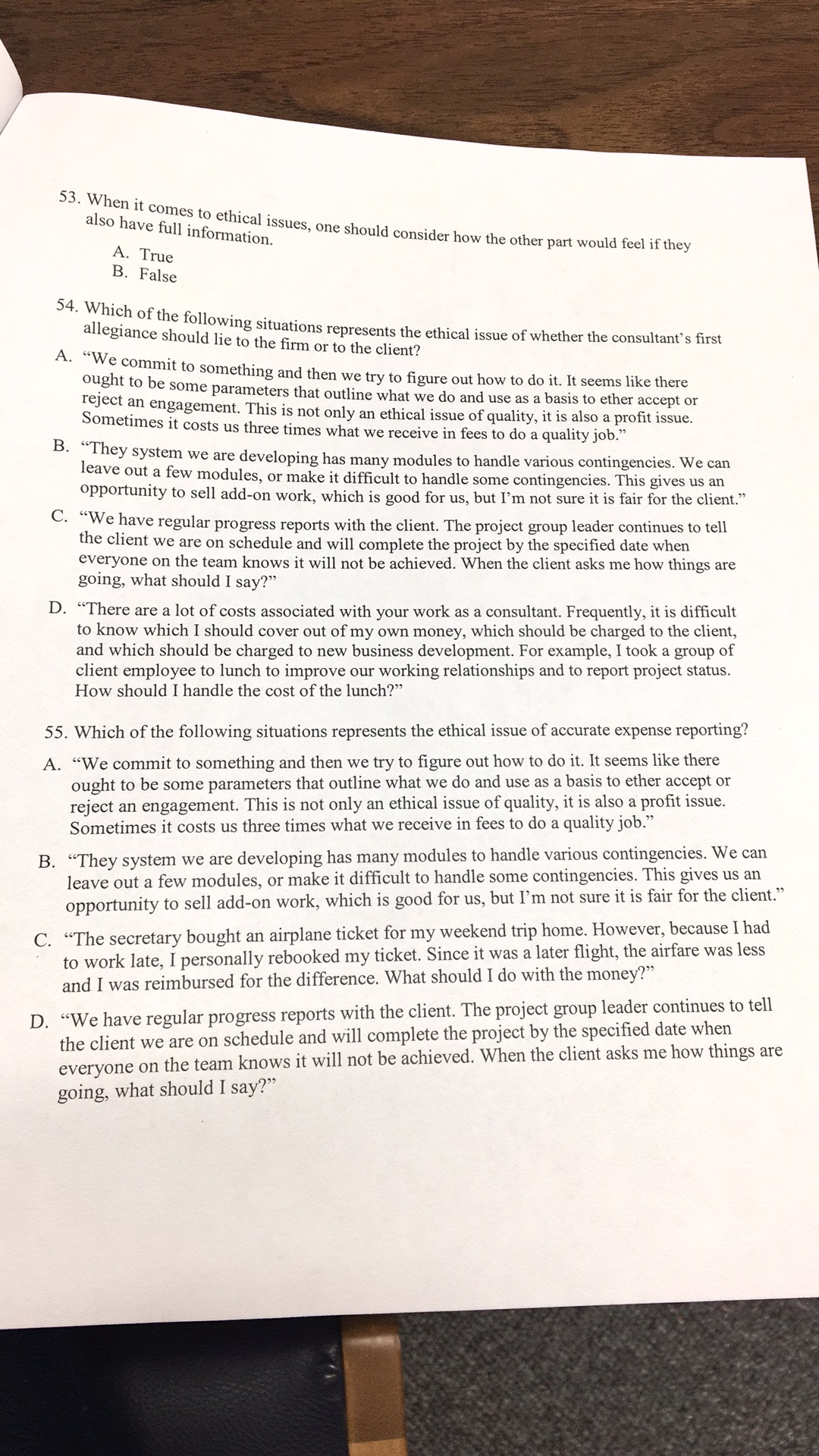

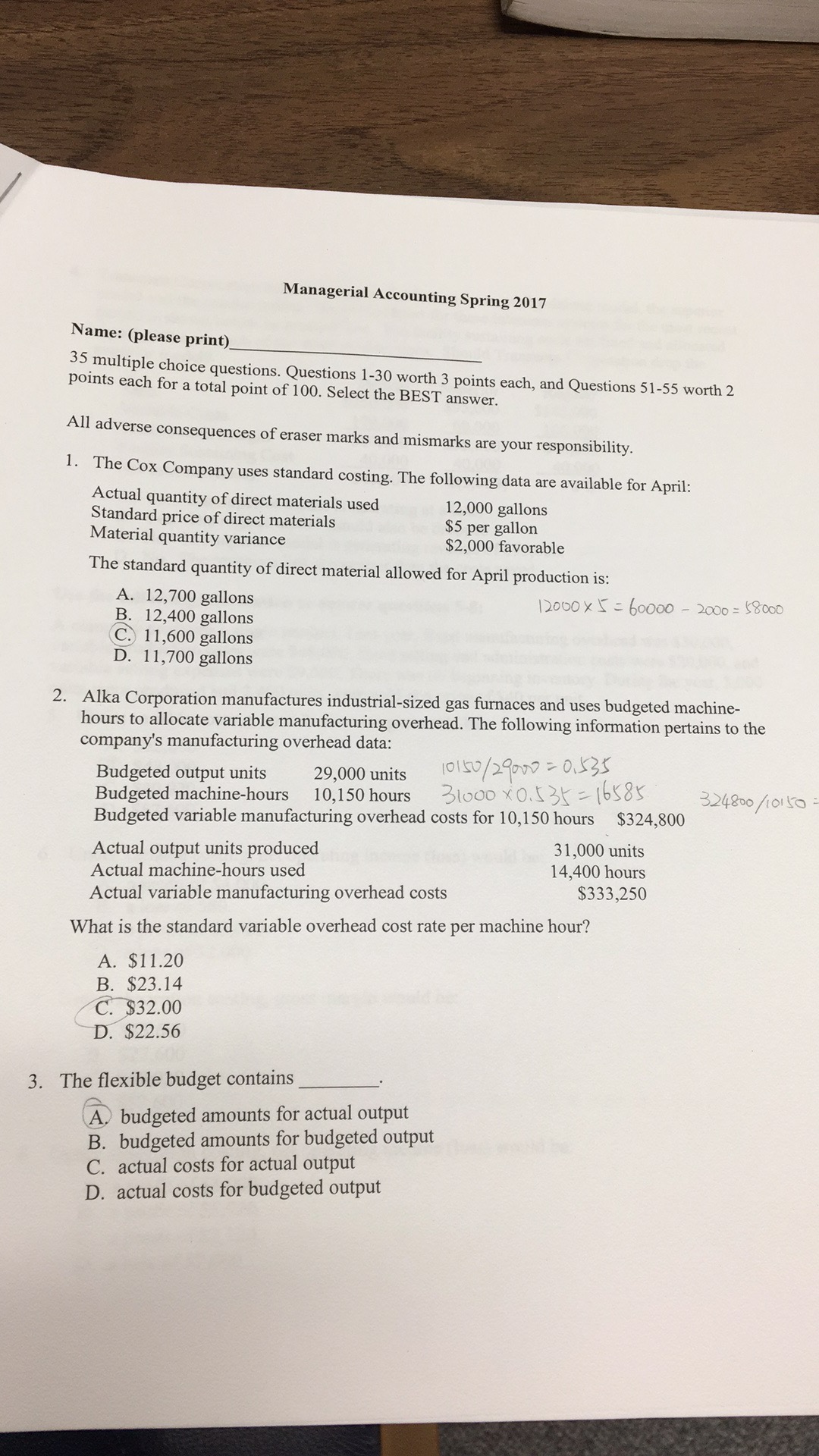

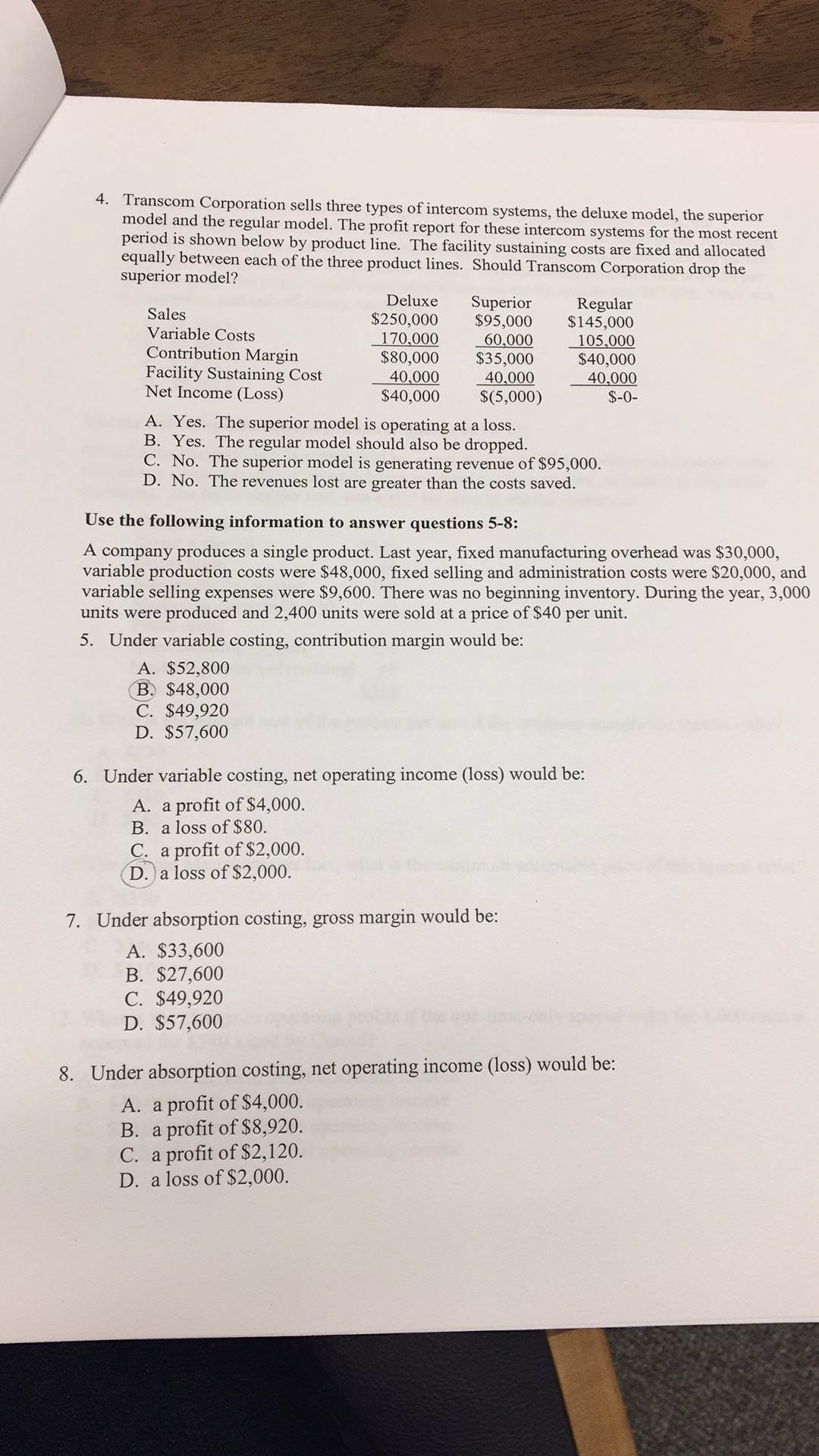

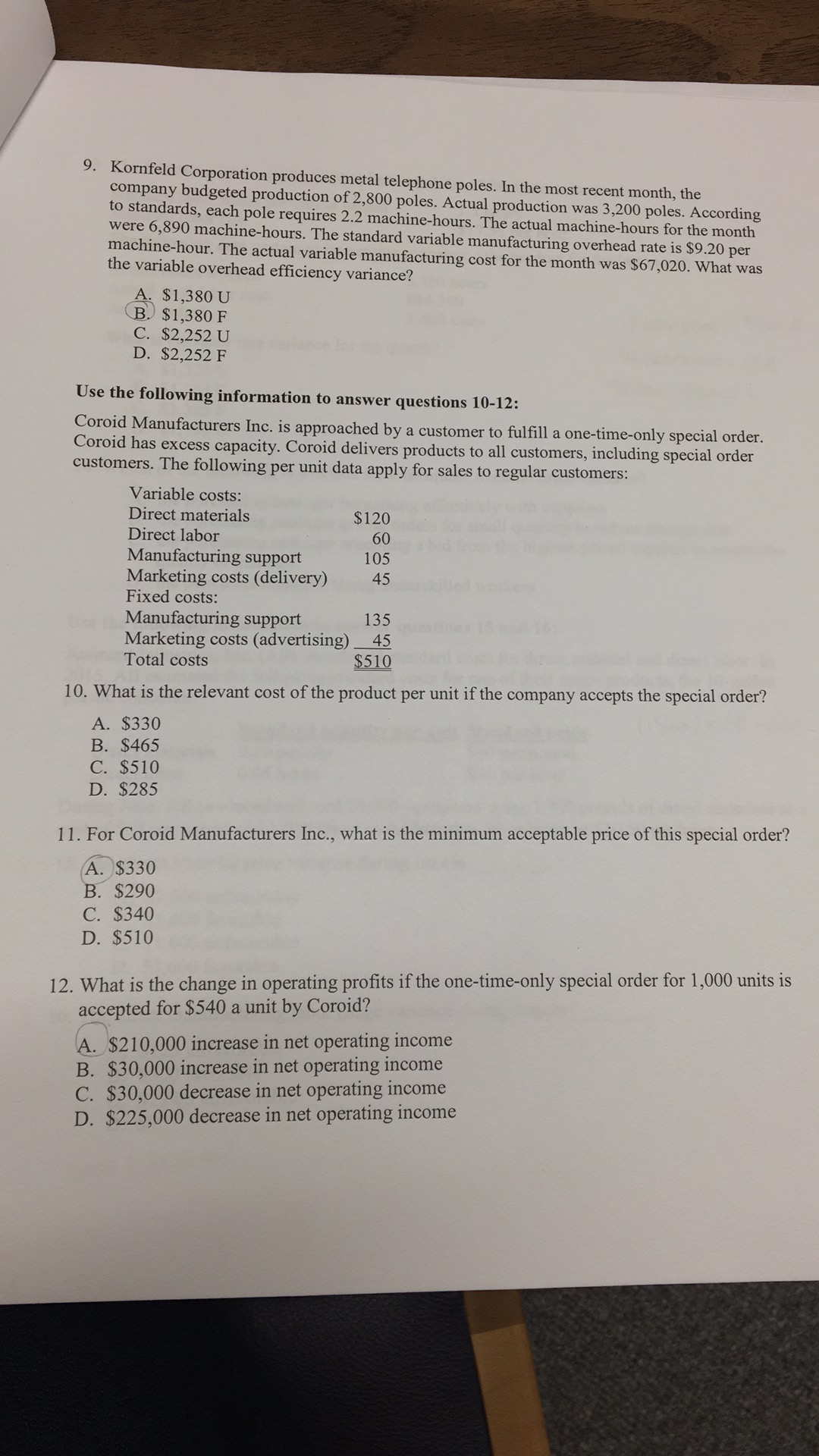

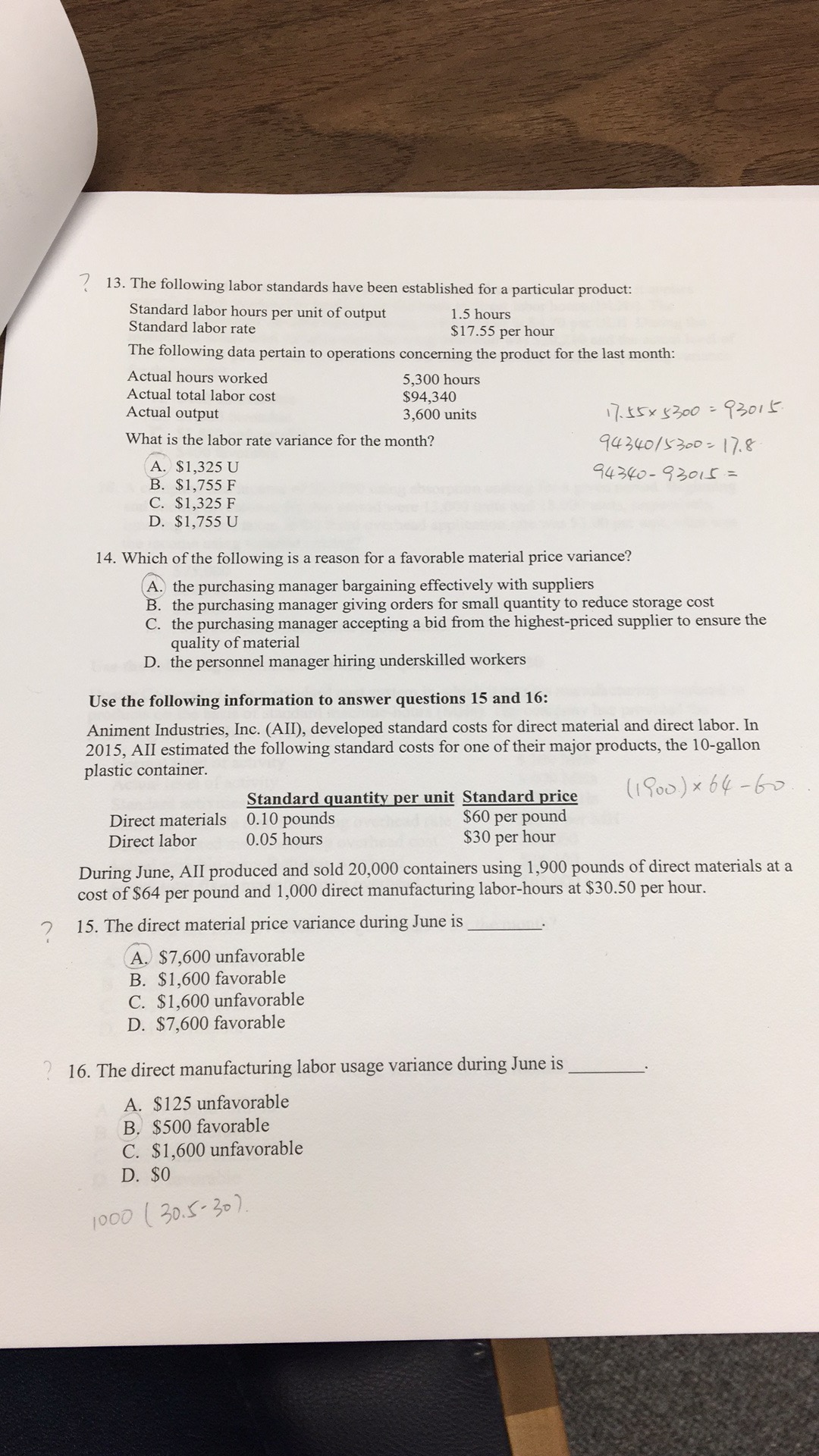

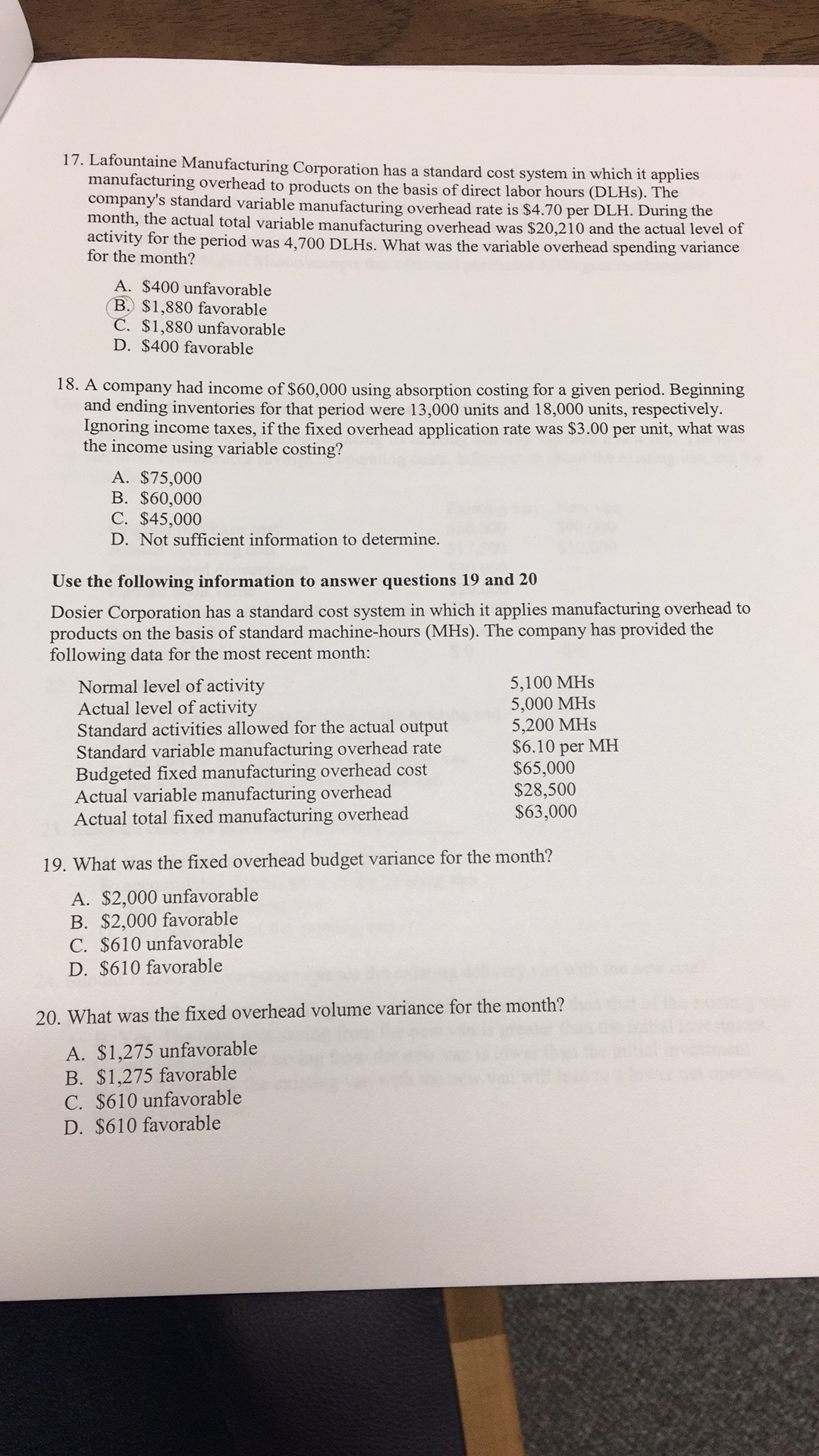

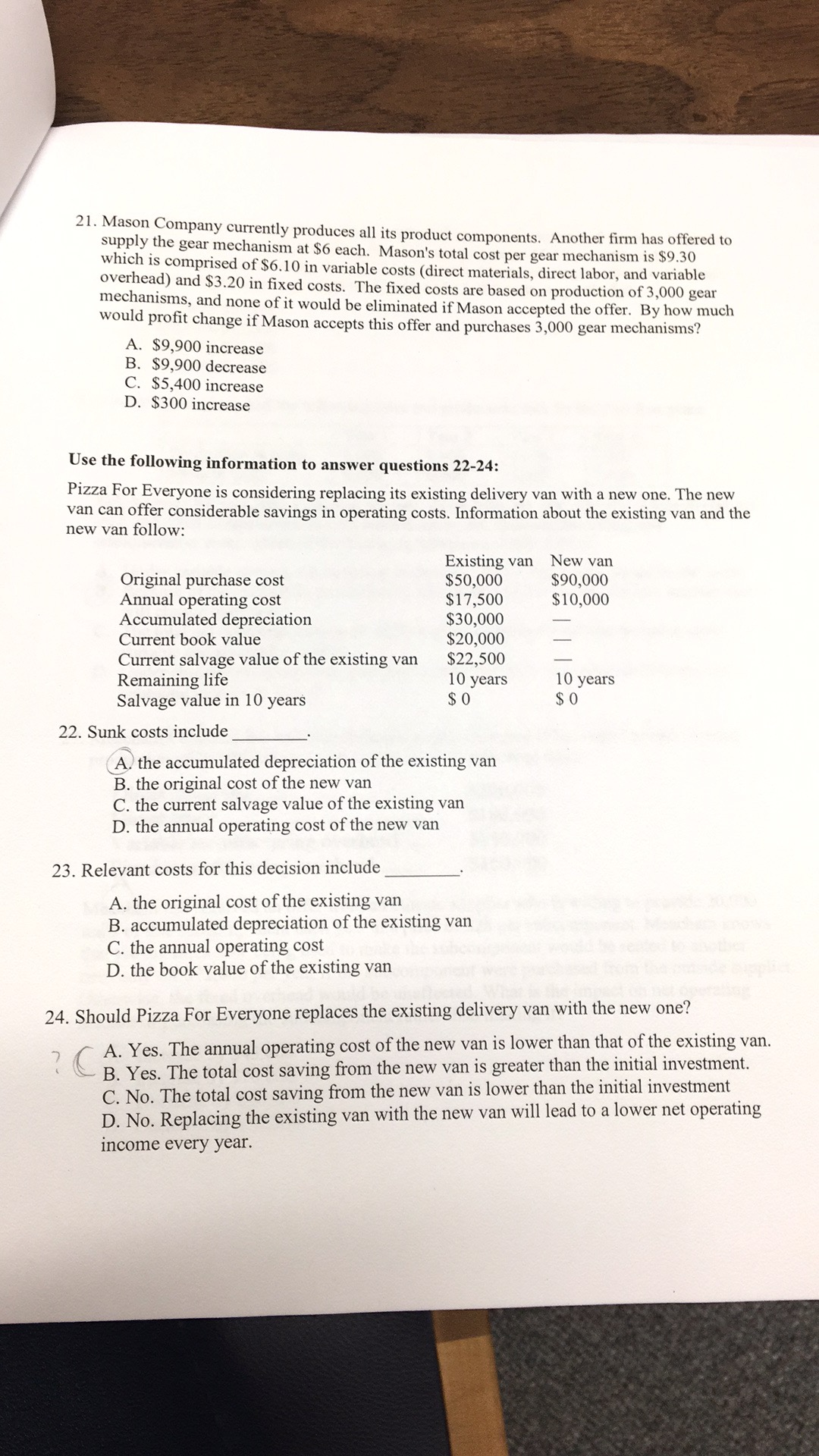

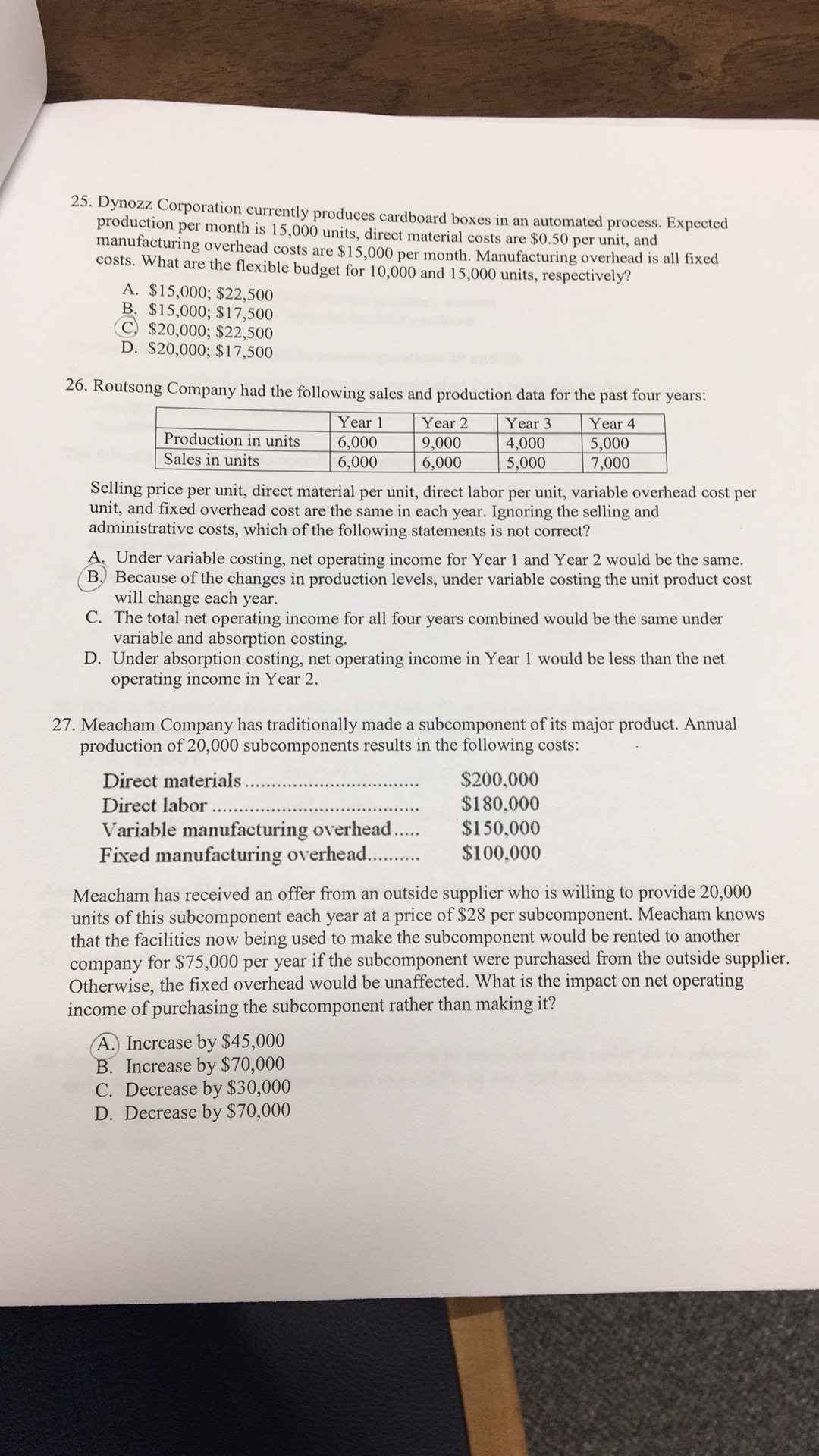

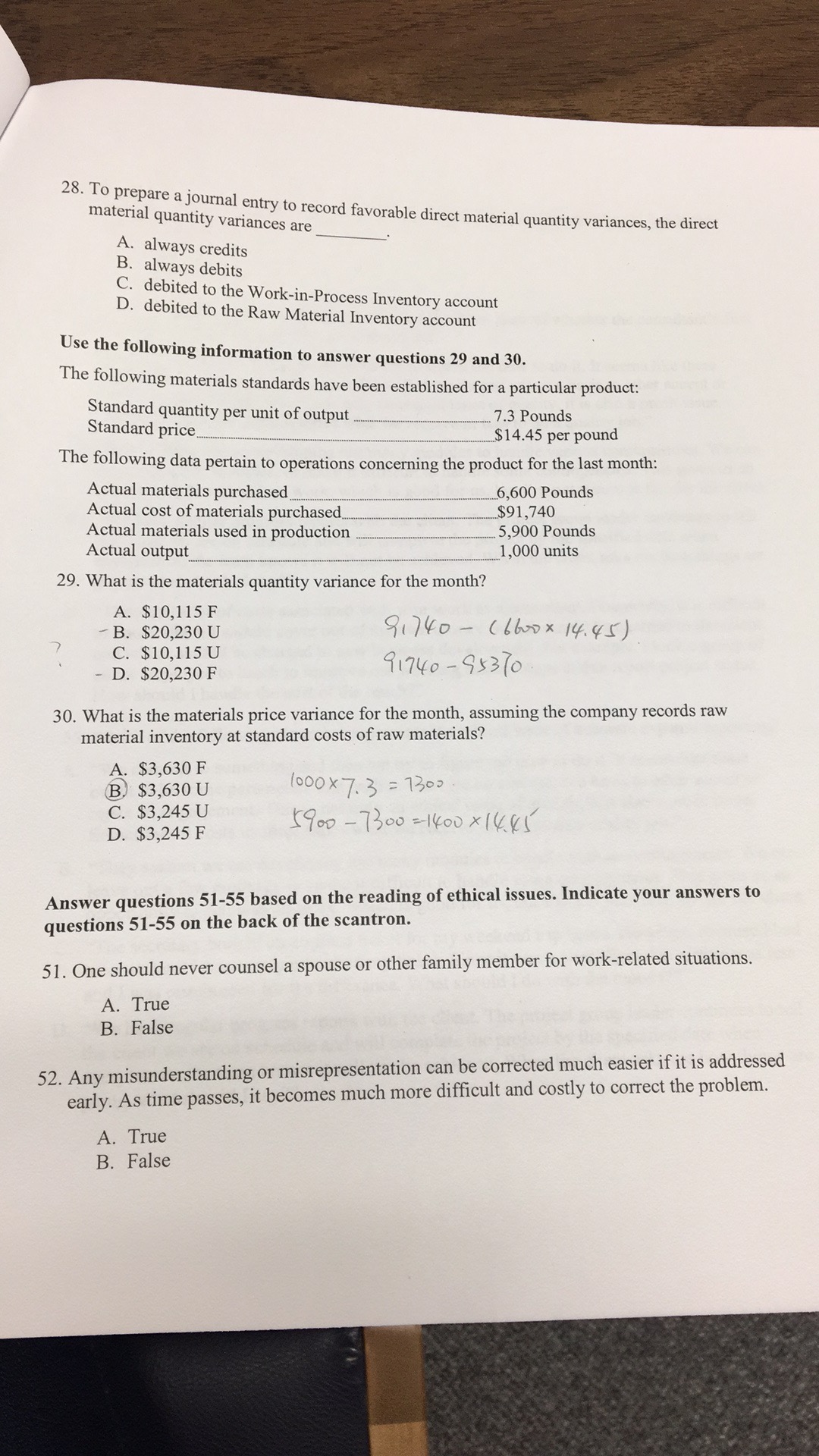

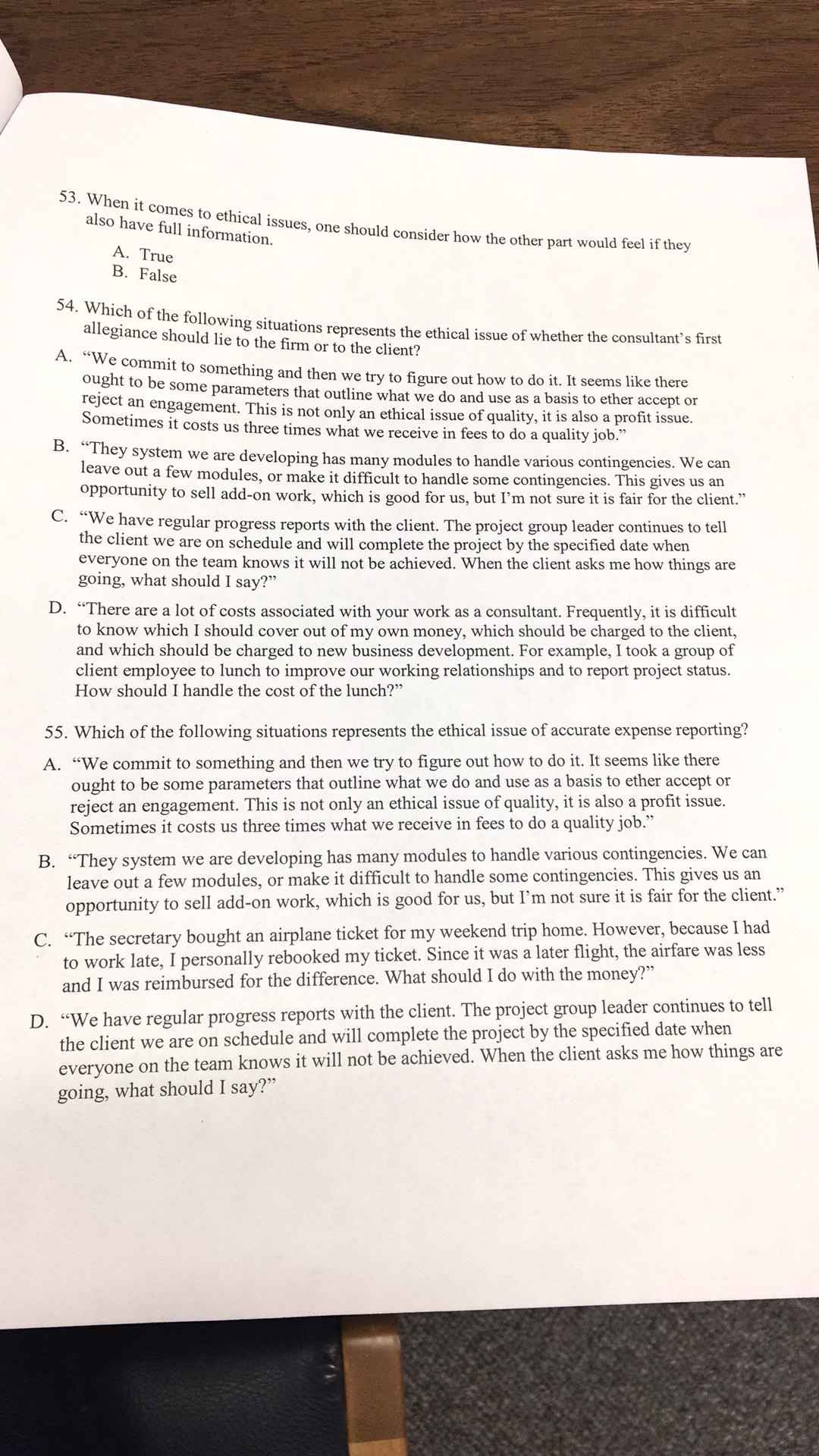

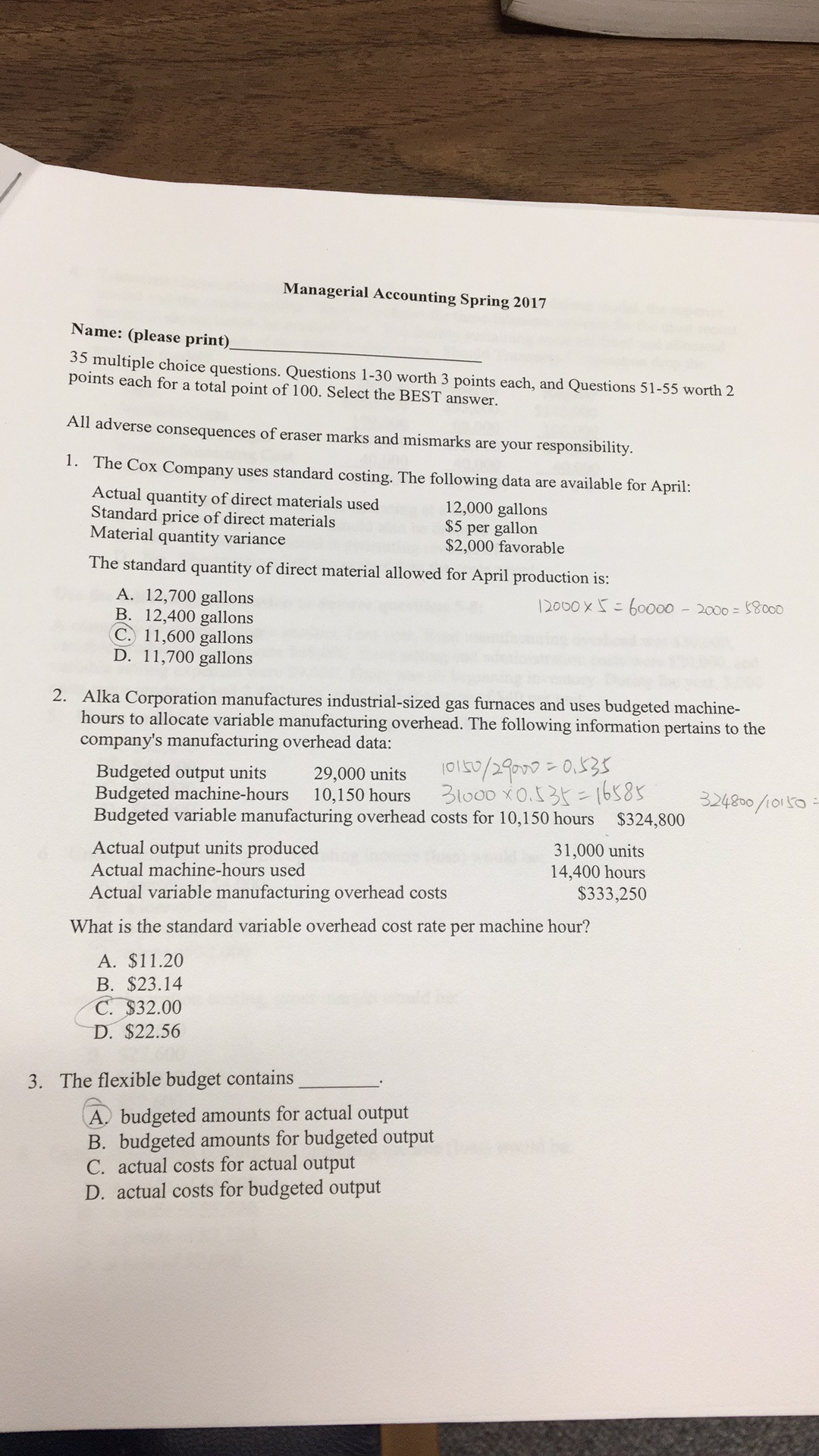

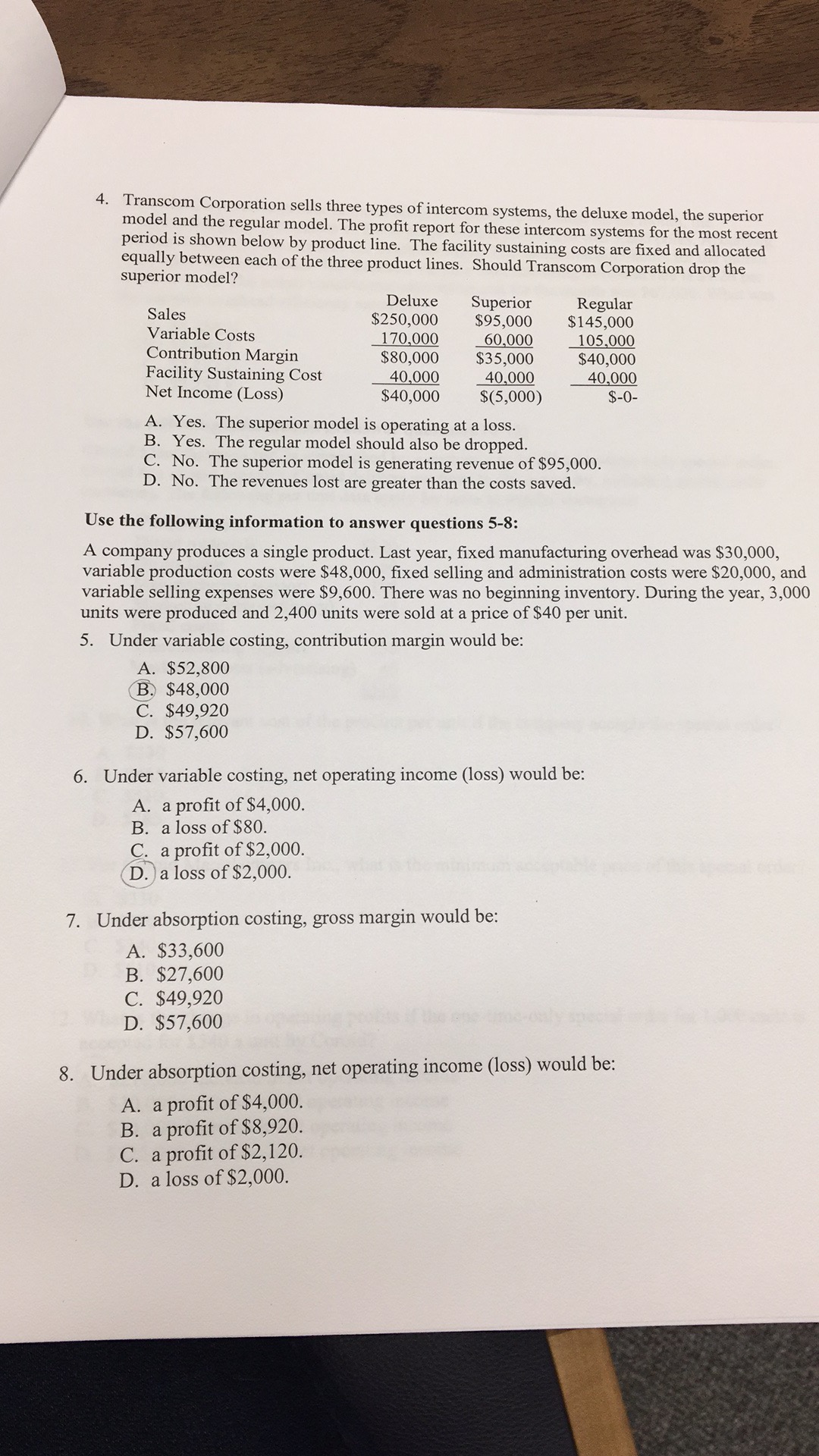

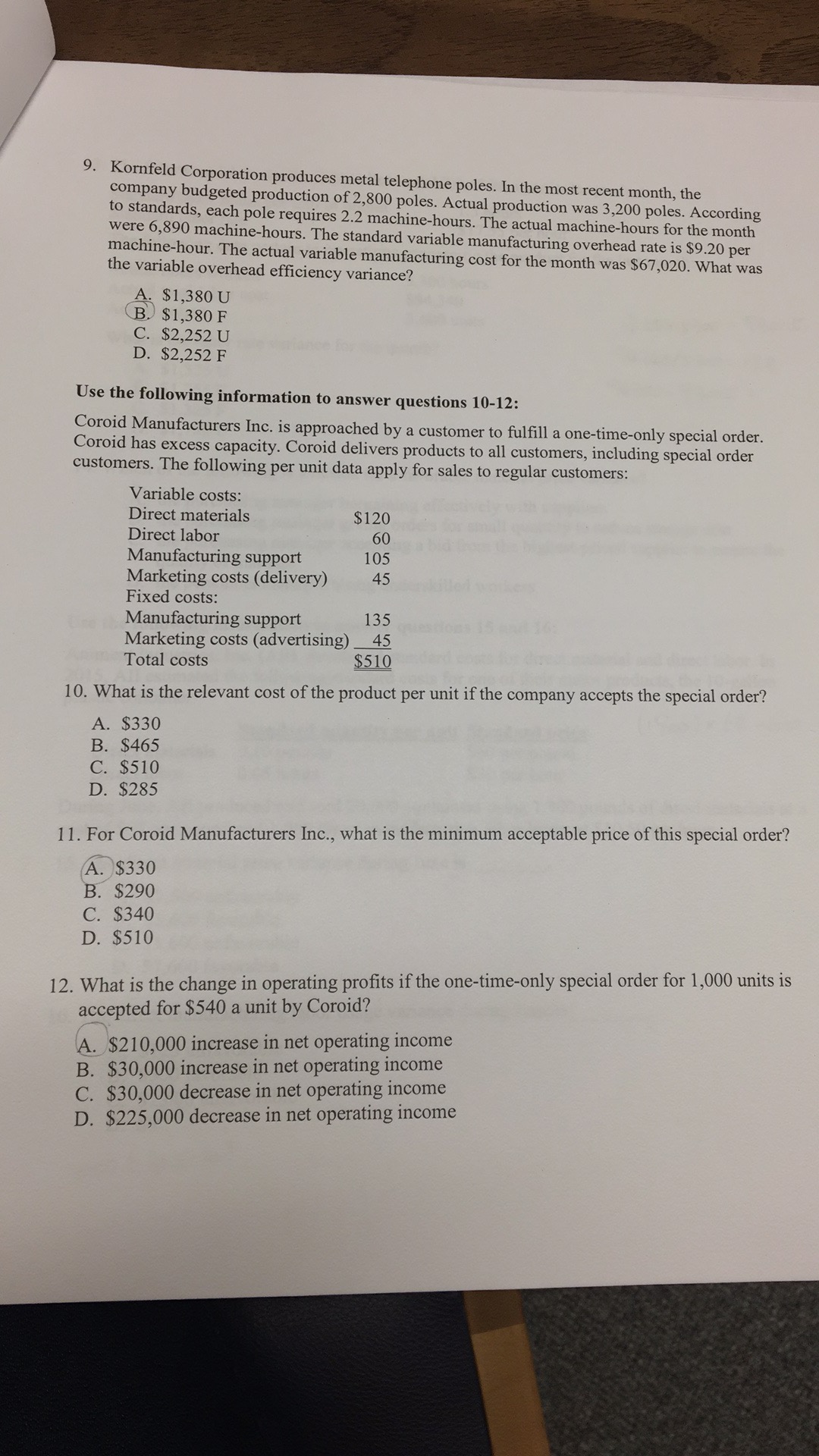

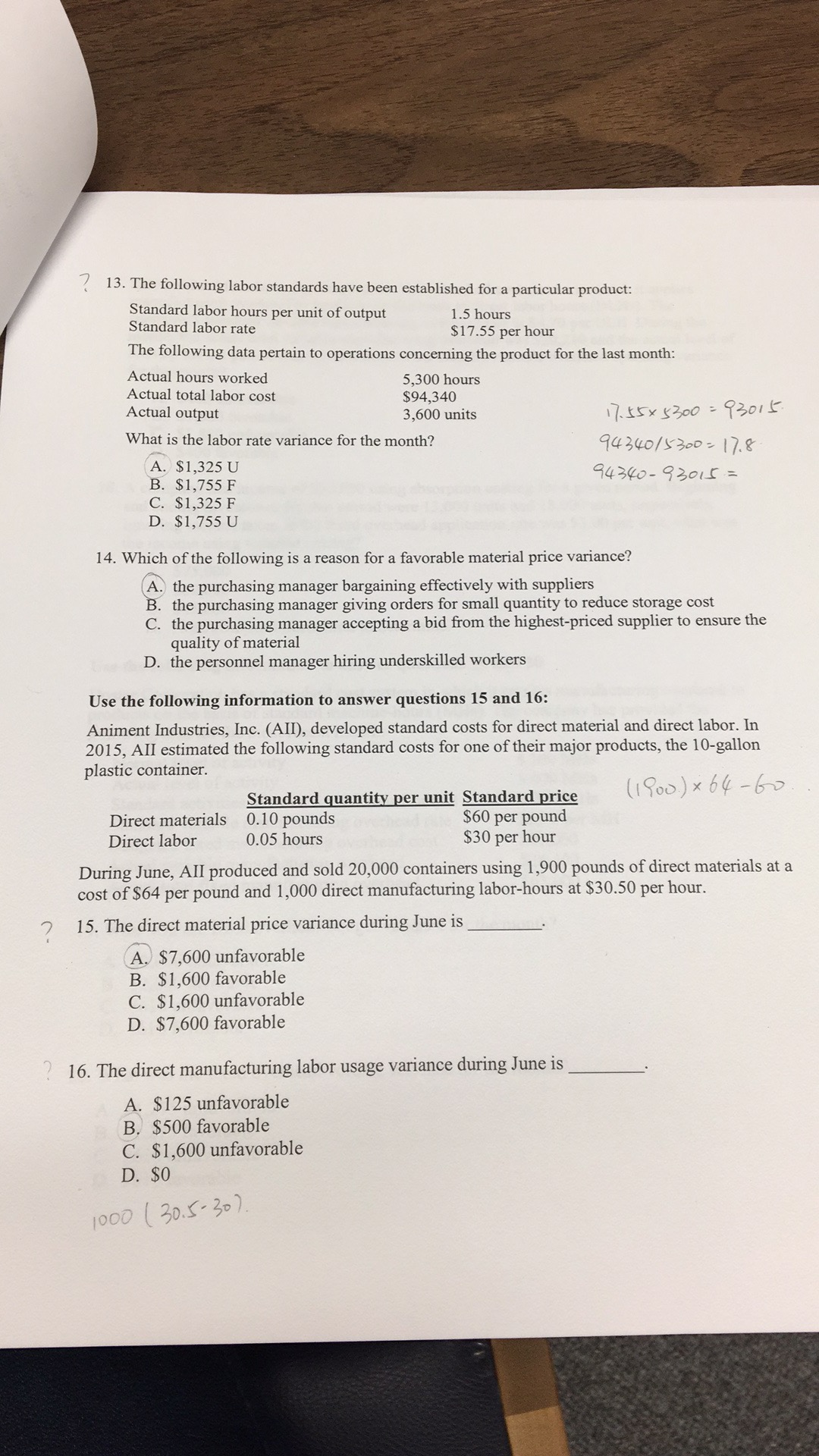

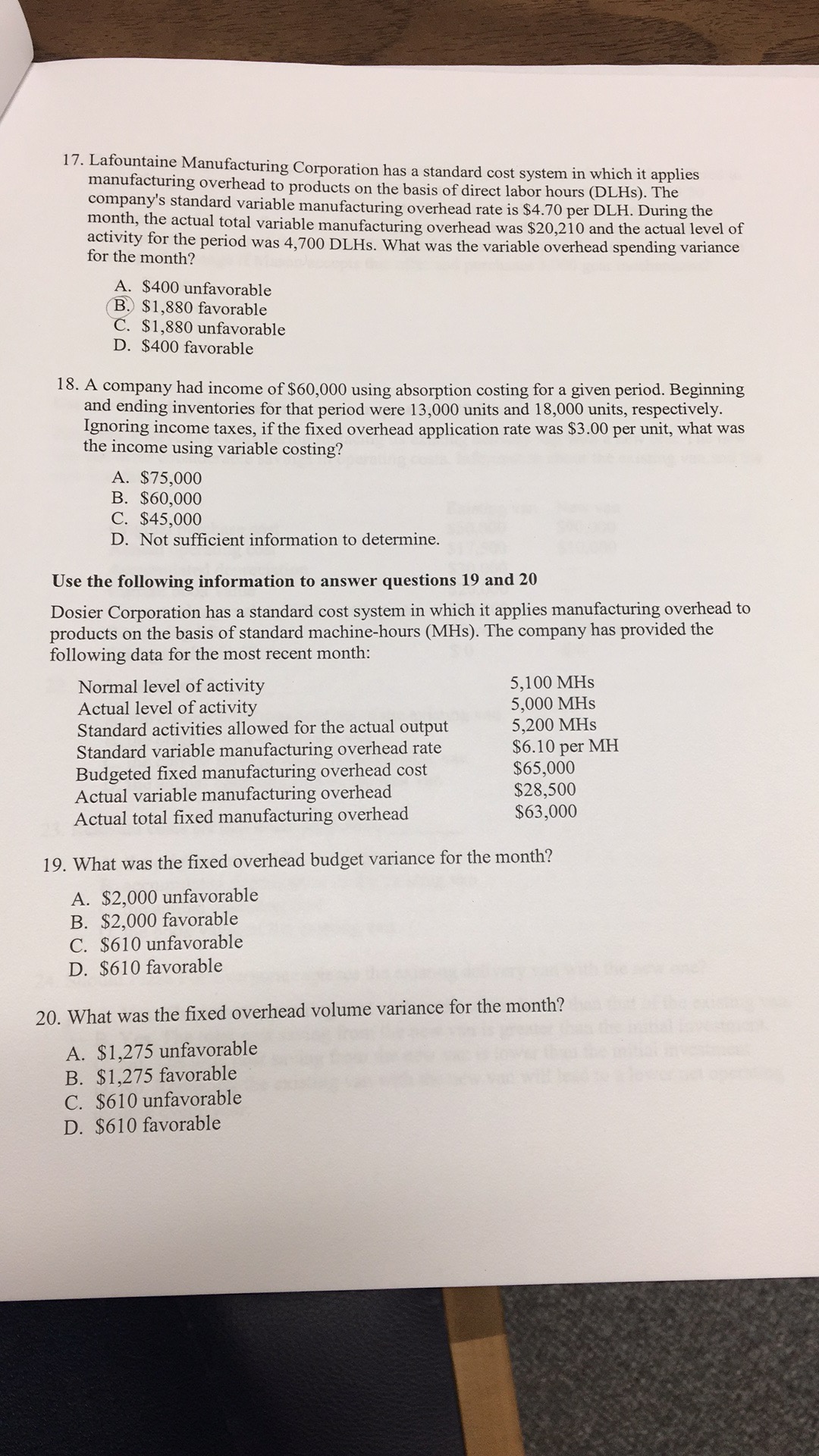

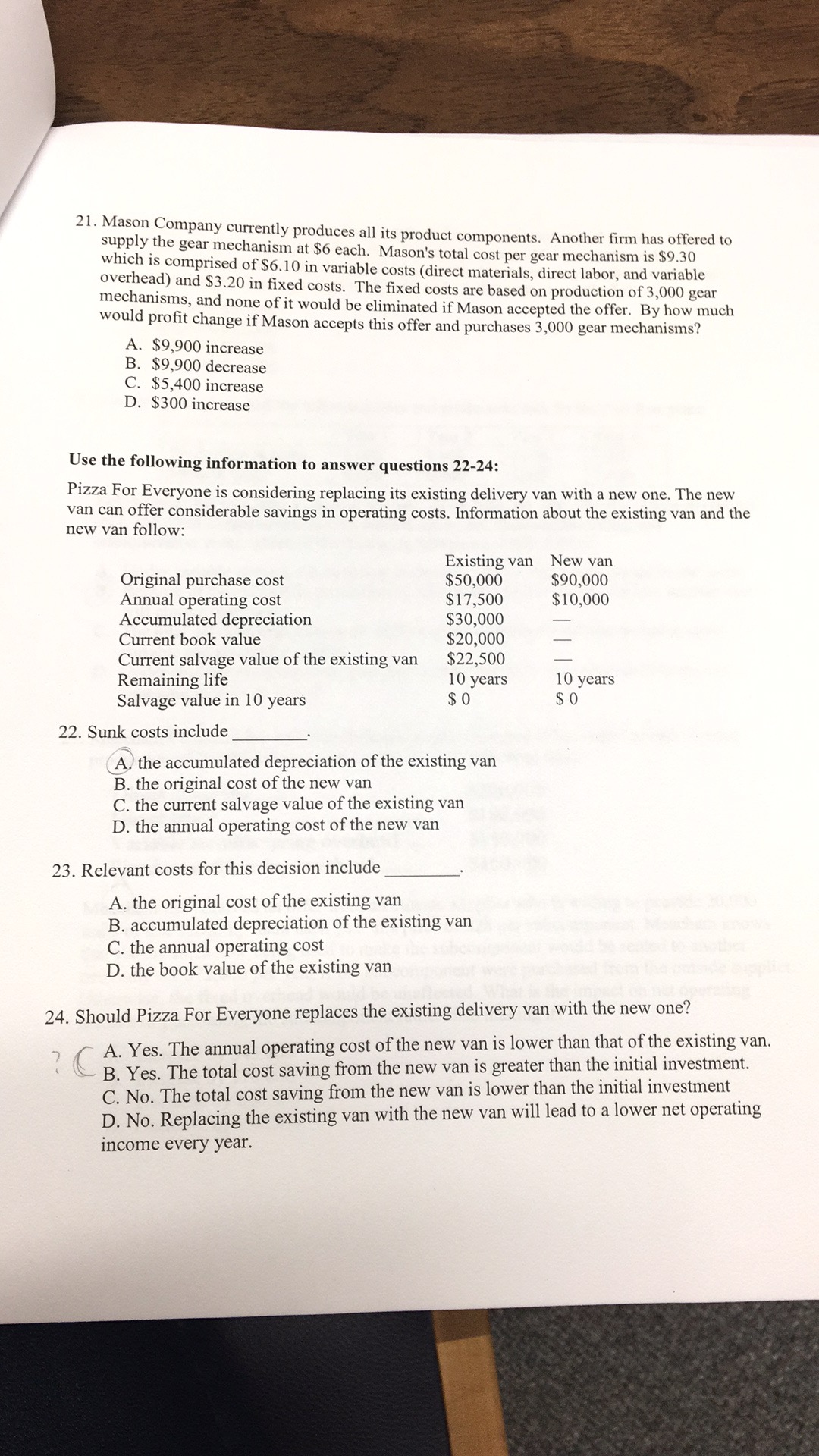

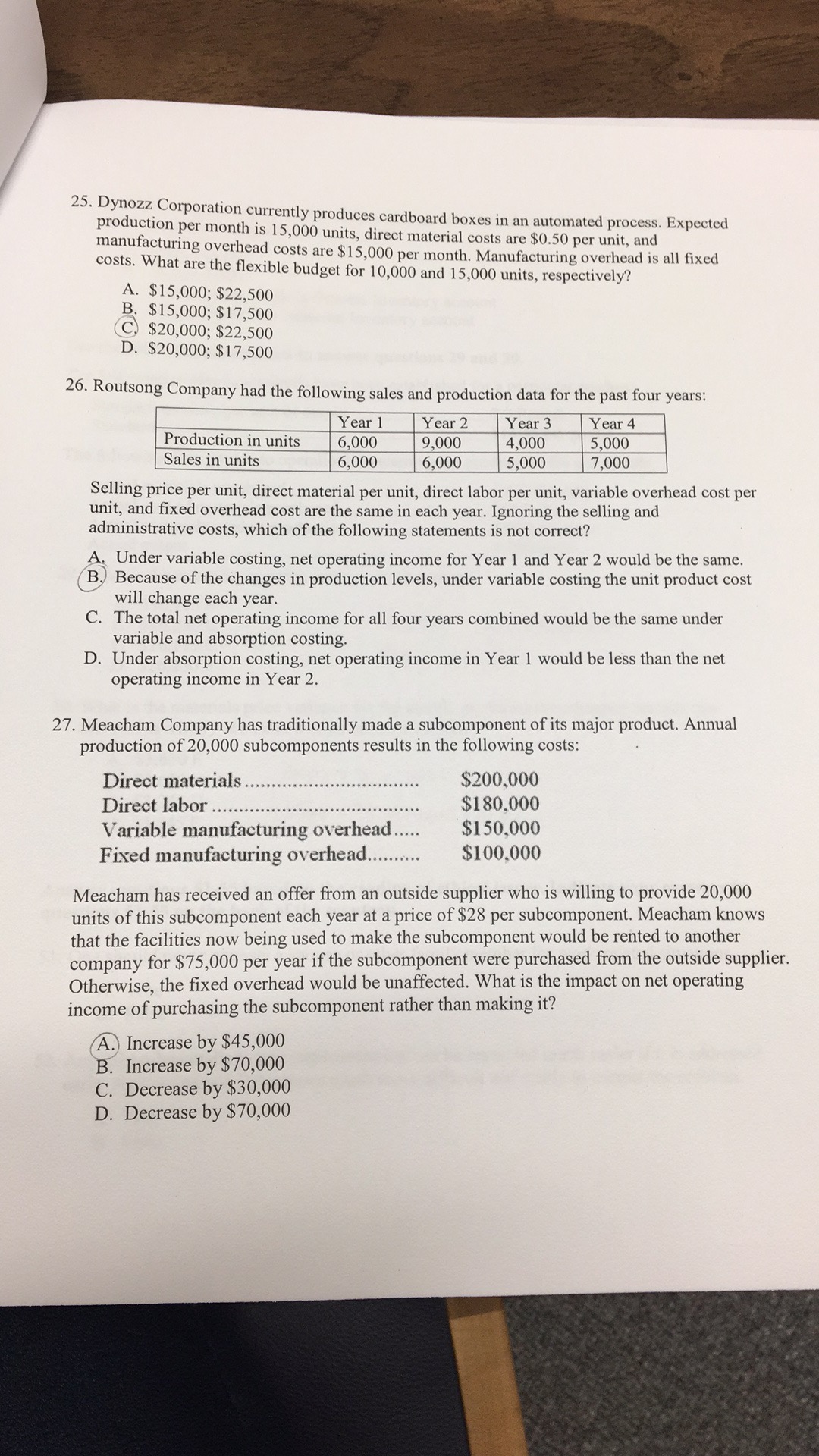

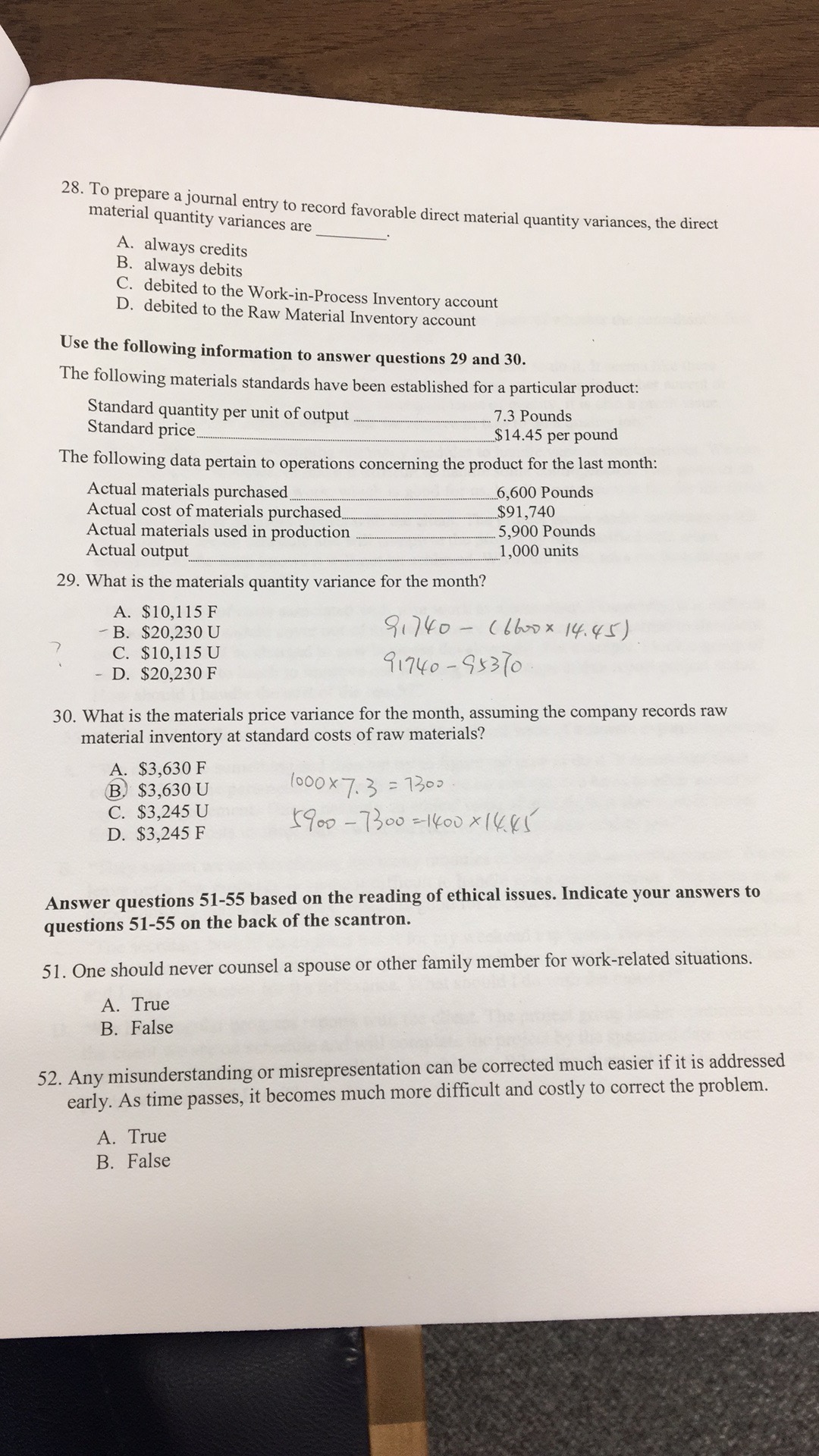

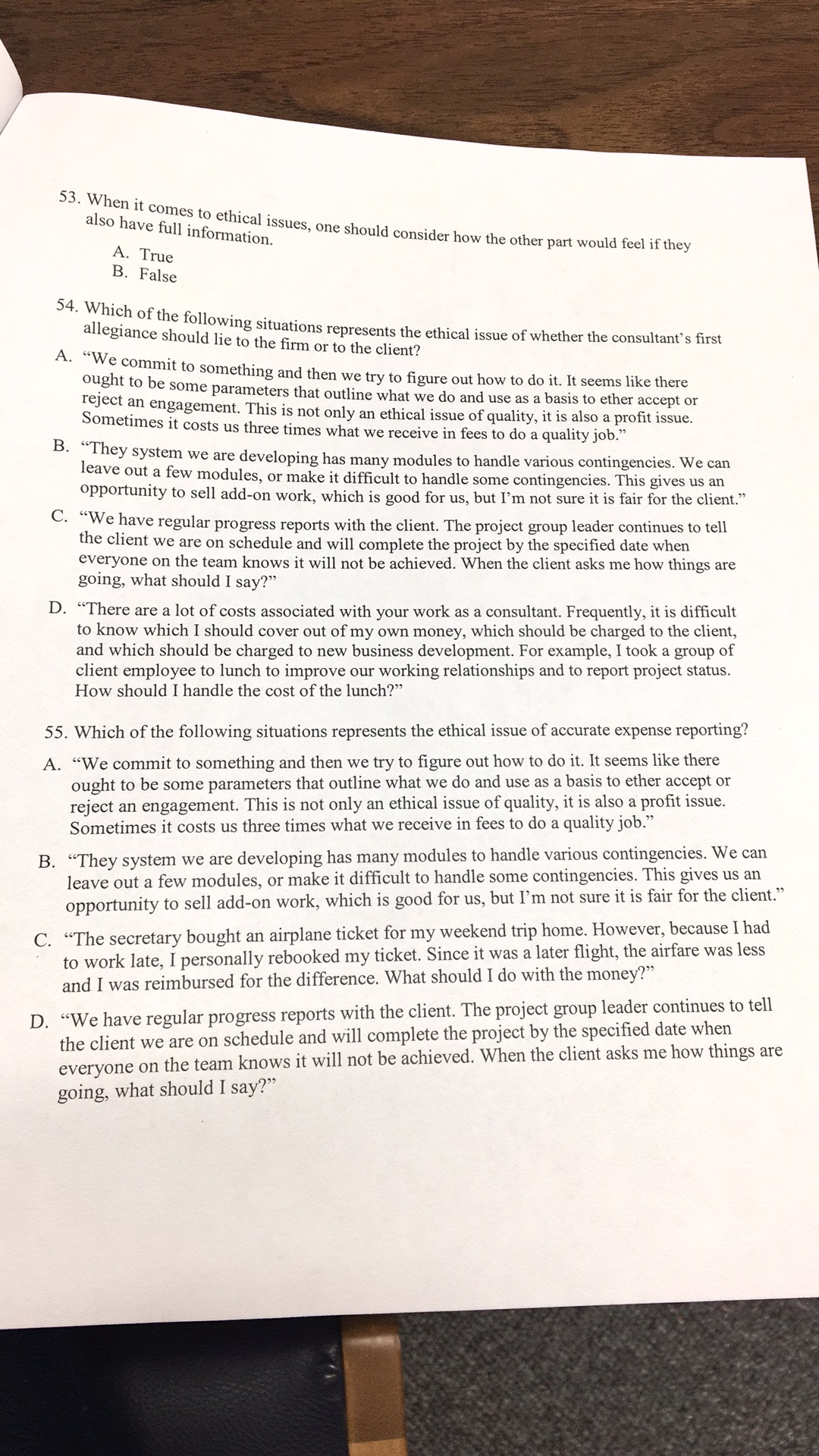

Name: (Please print) 35,multiple choice pomts each for a total point of 100. Select the BEST questions. Questions 1-30 worth 3 Actual quantity of direct materials used 12,000 gallons Standard price of direct materials $5 per gallon Material quantity variance $2,000 favorable The standard quantity of direct material allowed for April production is: A. 12,700 gallons lEGOOX E _: 60000 # 1000 : QDGC 3- 12,400 gallons 11,600 gallons D. 11,700 gallons 2. Alka Corporation manufactures industrial-sized gas furnaces and uses budgeted machine- hours to allocate variable manufacturing overhead. The following information pertains to the company's manufacturing overhead data: Budgeted output units 29,000 units \"3133/ 2.11am? _ ; O'K gi , 8 ' Budgeted machine-hours 10,150 hours %looo w o. t 3: : 1 .'> K 52%0/10'"? . Budgeted variable manufacturing overhead costs for 10,150 hours $324,800 Actual output units produced 31,000 units Actual machinehours used 14,400 hours Actual variable manufacturing overhead costs $333,250 What is the standard variable overhead cost rate per machine hour? A. $11.20 B. $23.14 332.00 'D.' $22.56 3. The exible budget contains A budgeted amounts for actual output budgeted amounts for budgeted output C. actual costs for actual output D. actual costs for budgeted output 4. Transcom Corporation sells three typ model and the regular model. The period is shown below by product equally betWeen each of the three superior model? Sales Variable Costs Contribution Margin Facility Sustaining Cost Net Income (Loss) Deluxe $25 0,000 1'70 000 $80,000 40,000 $40,000 es of intercom systems, the deluxe model, the superior prot report for these intercom systems for the most recent line. The facility sustaining costs are xed and allocated product lines. Should Transcorn Corporation drop the Superior Regular $95,000 $145,000 60,000 105 000 $35,000 $40,000 40,000 40 000 $(5,000) $~0~ A. Yes. The superior model is operating at a loss. B. Yes. The regular model should also be dropped. C. No. The superior model is generating revenue of $95,000. D. No. The revenues lost are greater than the costs saved. Use the following information to answer questions 5-8: A company produces a single product. Last year, xed manufacturing overhead was $30,000, variable production costs were $48,000, xed selling and administration costs were $20,000, and variable selling expenses were $9,600. There was no beginning inventory. During the year, 3,000 units were produced and 2,400 units were sold at a price of $40 per unit. 5. Under variable costing, contribution margin would be: A. $52,300 (133 $48,000 0. $49,920 D. $57,600 6. Under variable costing, net operating income (loss) would be: A. a prot of $4,000. B. a loss of$80. C. a prot of $2,000. @321 loss of $2,000. 7. Under absorption costing, gross margin would be: A. $33,600 B. $27,600 C. $49,920 D. $57,600 8. Under absorption costing, net operating income (loss) would be: A. a prot of $4,000. B. a prot of $8,920. C. a prot of $2,120. D. a loss of $2,000. \f7 13. The foIlowing labor standards have been established for a particular product: Standard labor hours per unit of output 1.5 hours Standard labor rate $17.55 per hour The following data pertain to operations concerning the product for the last month: Actual hours worked 5,300 hours Actual total labor cost $94,340 Actual output 3,600 units *1 in 37200 " l)?\" ' r What is the labor rate variance for the month? CM. goo/$300 -, f 7 9* 'A. $1,325 U | '3. $1,755 F Cm WW 2,911 : C. $1,325 F D. $1,755 U 14. Which of the following is a reason for a favorable material price variance? (g; the purchasing manager bargaining effectively with suppliers . the purchasing manager giving orders for small quantity to reduce storage cost C. the purchasing manager accepting a bid from the highest-priced supplier to ensure the quality of material D. the personnel manager hiring underslcilled workers Use the following information to answer questions 15 and 16: Animent Industries, Inc. (All), developed standard costs for direct material and direct labor. In 2015, All estimated the following standard costs for one of their major products, the lOgallon plastic container. A I Standard Quantity per unit Standard price \"9:00) X L (2 - if"? Direct materials 0.10 pounds $60 per pound Direct labor 0.05 hours $30 per hour During June, All produced and sold 20,000 containers using 1,900 pounds of direct materials at a cost of $64 per pound and 1,000 direct manufacturing labor-hours at $30.50 per hour. '? 15. The direct material price variance during June is E $7,600 unfavorable B. $1,600 favorable C. $1,600 unfavorable D. $7,600 favorable 16. The direct manufacturing labor usage variance during June is A. $125 unfavorable a," $500 favorable C. $1,600 unfavorable D. $0 toot"? [7205' g\") 17. Lafountaine Manufacturin manufa ' corn p \"3311;: 3:511\"? to Produ-Bts on the basis of direct labor hours (DLHs). The month, the actual variable manufacturing overhead rate is $4.70 per DLl-l. During the total variable manufacturing overhead was $20,21 0 and the actual level of activi fo th ' , for \"131110; th: period was 4,700 DLHs. What was the variable overhead spending variance g Corporation has a standard cost system in which it applies A. $400 unfavorable . $1,880 favorable . $1,880 unfavorable D. $400 favorable 18. A company-had income of $60,000 using absorption costing for a given period. Beginning and ending inventories for that period were 13,000 units and 18,000 units, respectively. Ignoring meome taxes, if the xed overhead application rate was $3.00 per unit, what was the income using variable costing? A. $75,000 B. $60,000 C. $45,000 D. Not sufcient information to determine. Use the following information to answer questions 19 and 20 Dosier Corporation has a standard cost system in which it applies manufacturing overhead to products on the basis of standard machine-hours (MI-ls). The company has provided the following data for the most recent month: Normal level of activity 5,100 MI-Is Actual level of activity 5,000 MHs Standard activities allowed for the actual output 5,200 MHs Standard variable manufacturing overhead rate $6.10 per Ml-I Budgeted xed manufacturing overhead cost $65,000 Actual variable manufacturing overhead $28,500 Actual total xed manufacturing overhead $63,000 19. What was the xed overhead budget variance for the month? A. $2,000 unfavorable B. $2,000 favorable C. $610 unfavorable D. $610 favorable 20. What was the xed overhead volume variance for the month? A. $1,275 unfavorable B. $1,275 favorable ' C. $610 unfavcrabl-e D. $61'0'faVorabIe fired costs. The xed costs are based on production of 3,000 gear 1 would be elnmnated 1f Mason accepted the offer. By how much Mason accepts this offer and purchases 3,000 gear mechanisms? A. $9,900 increase B. $9,900 decrease C. $5,400 increase D. $300 increase Use the following information to answer questions 2224: Plzza For Everyone is considering replacing its existing delivery van with a new one. The new van can offer considerable savings in operating costs. Information about the existing van and the new van follow: Existing van New van Original purchase cost $50,000 $90,000 Annual operating cost $17,500 $10,000 Accumulated depreciation $30,000 Current book value $20,000 Current salvage value of the existing van $22,500 - Remaining life 10 years 10 years Salvage value in 10 years $ 0 $ 0 22. Sunk costs include "'-'\\ the accumulated depreciation of the existing van B. the original cost of the new van C. the current salvage value of the existing van D. the annual operating cost of the new van 23. Relevant costs for this decision include A. the original cost of the existing van B. accumulated depreciation of the existing van C. the annual operating cost I). the book value of the existing van 24. Should Pizza For Everyone replaces the existing delivery van with the new one? 7 g; A. Yes. The annual operating cost of the new van is lower than that of the existing van. ' ' ' B. Yes. The total cost saving from the new van is greater than the initial investment. C. No. The total cost saving from the new van is lower than the initial investment D. No. Replacing the existing van with the new van will lead to a lower net operating income every year. A- $15,000; $22,500 (B. $15,000;$17,500 L5) $20,000; $22,500 D. $20,000;$17,500 26' Routsong COmpany had the following sales and production data for the past four years: | _ 6,000 9,000 4,000 5 000 6,000 6,000 5,000 7,000 Selling price per unit, direct material per unit, direct labor per unit, variable overhead cost per Hula-and ned overhead cost are the same in each year. Ignoring the selling and administrative costs, Which of the following statements is not correct? 6 Under variable costing, net operating income for Year 1 and Year 2 would be the same. B Because of the changes in production levels, under variable costing the unit product cost will change each year. C. The total net operating income for all four years combined would be the same under variable and absorption costing. D. Under absorption costing, net operating income in Year 1 would be less than the net operating income in Year 2. 27. Meacham Company has traditionally made a subcomponent of its major product. Annual production of 20,000 subcomponents results in the following costs: Direct materials ................................. $200,000 Direct labor ................... . ................... $180,000 Variable manufacturing overhead ..... $150,000 Fixed manufacturing overhead ....... -. .. $00,000 Meacham has received an offer from an outside supplier who is willing to provide 20,000 units of this subcomponent each year at a price of $28 per subcomponent. Meacham knows that the facilities now being used to make the subcomponent would be rented to another company for $75,000 per year if the subcomponcnt were purchased from the outside supplier. Otherwise, the xed overhead would be unaffected. What is the impact on net operating income of purchasing the subcomponent rather than making it'? Increase by $45,000 Increase by $70,000 C. \"Decrease by $30,000 D. Decrease by $70,000 28' To Prepare ajoum material qUantity al entry m r . CCOrd favora ' - variances are me (meet \"men\" quantity variances, the direct A' always Credits ;_____. 3' aIWays debits C. debited to the Work-in- D. de . Process Inventor account bited to the Raw Material Inventory azcount Use t - . Th fhe followmg information to answer questions 29 and 30_ e 01 ' . 10Wlng matenals standards have been established for a particular product: .................................... 7.3 Pounds ...................... $14.45 per pound Standard quantit - y erunt f Standard Price____......3 ................ l if.) Output """" The fOHOWing data Pertain to operations concerning the product for the last month: Actual materials purchasedm __________________________ _6,600 Pounds Actual cost of materials purch \"$91,740 I Actual materials used in production ...... 5,900 Pounds Actual output\" 29. What is the materials quantity variance for the month? A. $10,] 15 F j 13. $20,230U r7o~ (Maw 14:4er ' 0. $10,115 U 'i' ' - D. $20,230F 17W "933% ' 30. What is the materials price variance for the month, assuming the company records raw material inventory at standard costs of raw materials? A. $3,630 F L13 $3,630U WOW. 5 : Ho: (3. 3,245 U D. $3,245 F W\"? "72\"" "WW \"(421/ Answer questions 51-55 based on the reading of ethical issues. Indicate your answers to questions 51-55 on the back of the scantron. 51. One should never counsel a spouse or other family member for workrelated situations. A. True B. False resentation can be corrected much easier if it is addressed 52. Any misunderstanding or misrep more difcult and costly to correct the problem. early. As time passes, it becomes much A. True B. False 53' when it \"mas t - _ 3130 have fu - o etthal :53 11 Info - lies, One Sho l . I'Tnat U d consid A. True 1011. or how the other part Would feel if they 3- False 54~ Which oft Sometim es . It costs us three times what we receive in fees to do a quality job-39 13. \"The 5 st ' leaveyouji aefglwwe attic developing has many modules to handle various contingencies. We can Opportunit t mo ules, or make it difficult to handle some contingencies. This gives us an y o sell add-on work, which is good for us, but I'm not sure it is fair for the client.\" C. \"W - the elhave regular Progress reports With the client. The project group leader continues to tell C rent We are on schedule and will complete the project by the specied date when everyone on the team knows it will not be achieved. When the client asks me how things are 30mg, What should I say?" D. \"There are a lot of costs associated with your work as a consultant. Frequently, it is difficult to know which I should cover out of my own money, which should be charged to the client, and which should be charged to new business development. For example, i took a group of client employee to lunch to improve our working relationships and to report project status. How should I handle the cost of the lunch?\" 55. Which of the following situations represents the ethical issue of accurate expense reporting? A. \"We commit to something and then we try to gure out how to do it. It seems like there ought to be some parameters that outline what we do and use as a basis to other accept or reject an engagement. This is not only an ethical issue of quality, it is also a prot issue. Sometimes it costs us three times what we receive in fees to do a quality job.\" B. \"They system we are developing has many modules to handle various contingencies. We can leave out a few modules, or make it difCult to handle some contingencies. This gives us an rtunity to sell addon work, which is good for us, but l'rn not sure it is fair for the client.\" C. \"The secretary bought an airplane ticket for my weekend trip home. However, because i had to work late, I personally rebooked my ticket. Since it was a later ight, the airfare was less and I was reimbursed for the difference. What should I do with the money?\" The project group leader continues to tell 6 and will complete the project by the specied date when t will not be achieved. When the client asks me how things are oppo D. \"We have regular progress reports with the client. the client we are on schedul everyone on the team knows 1 going, what should I say?\