Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with these table. I did this problem many time and i got the wrong result. :( i got wrong right at the

please help me with these table. I did this problem many time and i got the wrong result. :(

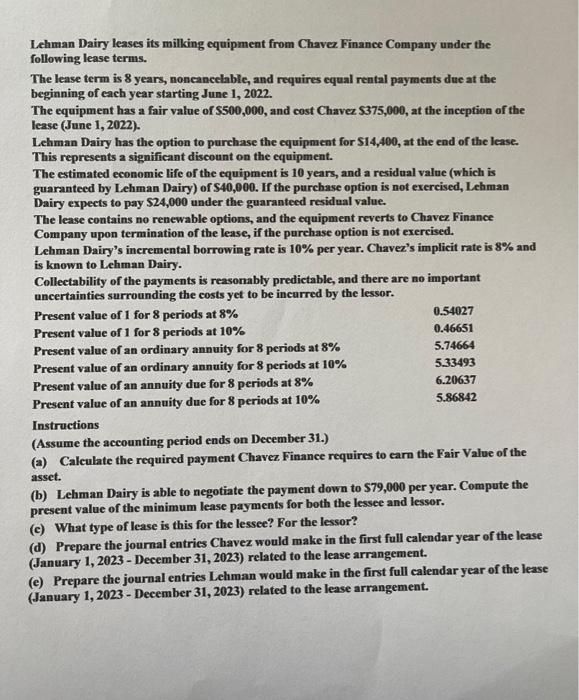

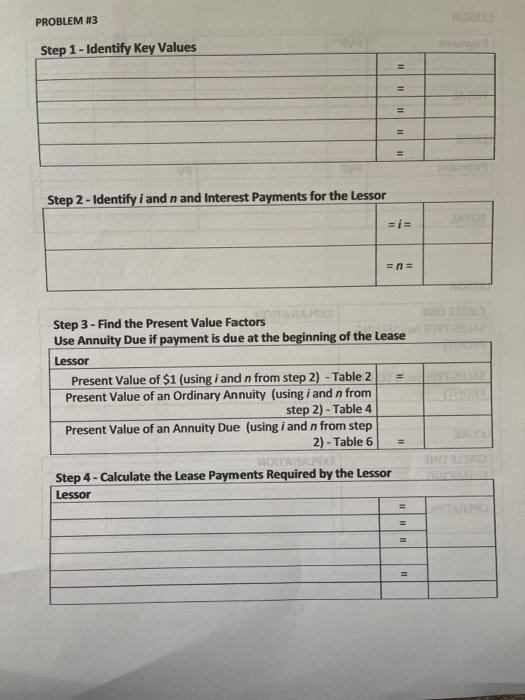

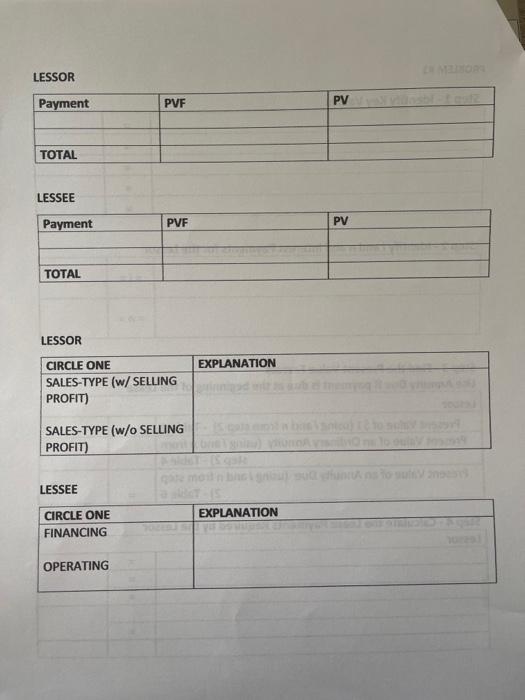

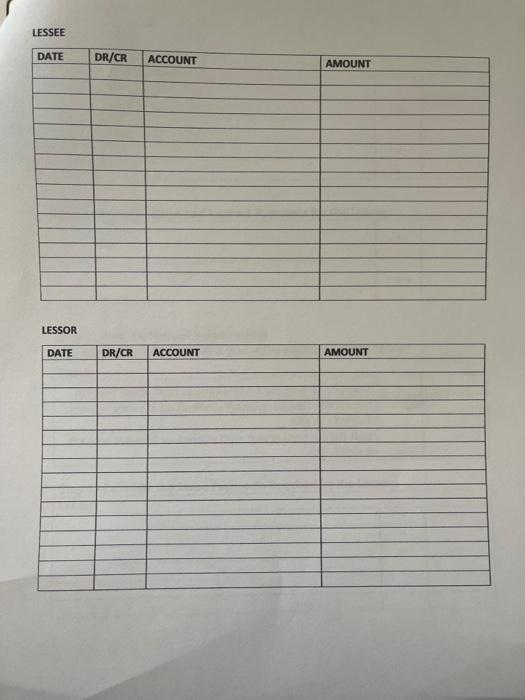

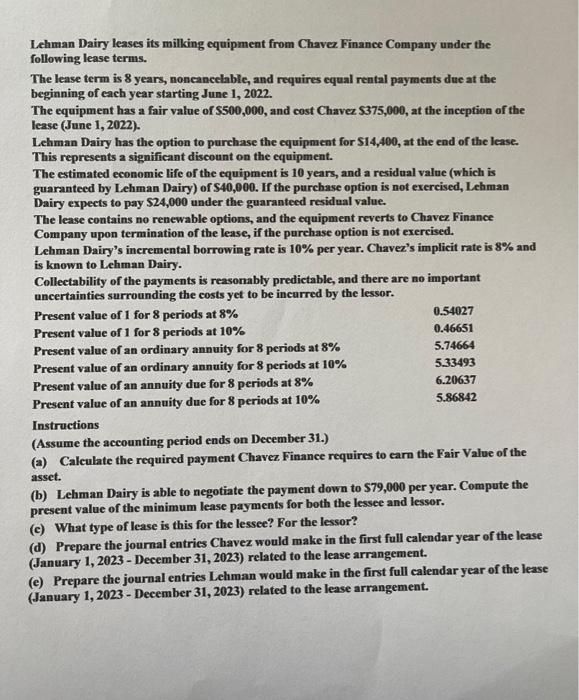

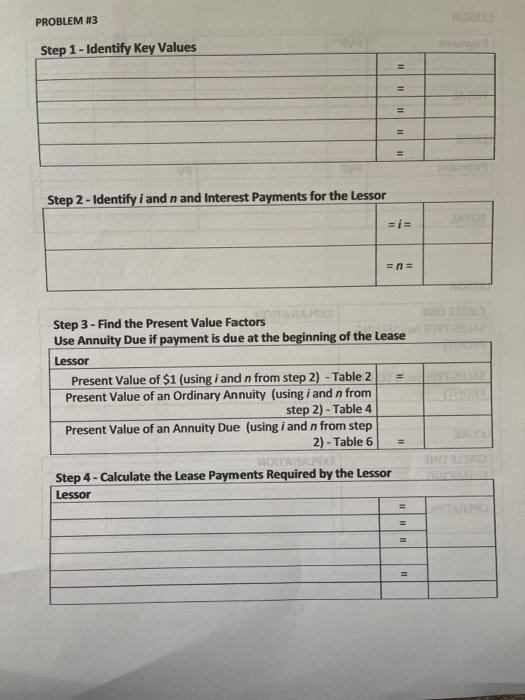

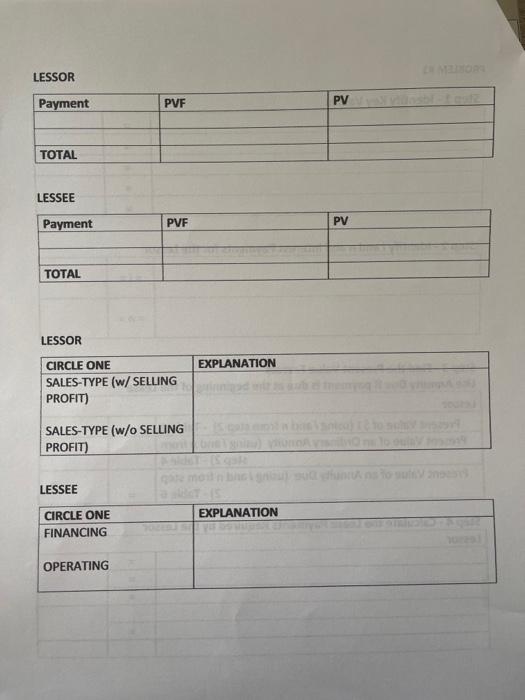

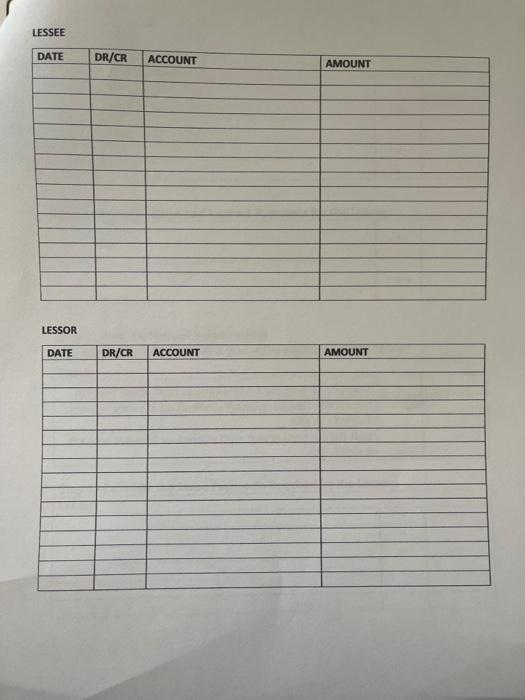

Lehman Dairy leases its milking equipment from Chavez Finance Company under the following lease terms. The lease term is 8 years, noneancelable, and requires equal rental payments due at the beginning of each year starting June 1,2022. The equipment has a fair value of $500,000, and cost Chavez $375,000, at the inception of the lease (June 1, 2022). Lehman Dairy has the option to purchase the equipment for $14,400, at the end of the lease. This represents a significant discount on the equipment. The estimated economic life of the equipment is 10 years, and a residual value (which is guaranteed by Lehman Dairy) of $40,000. If the purchase option is not exercised, Lehman Dairy expeets to pay $24,000 under the guaranteed residual value. The lease contains no renewable options, and the equipment reverts to Chavez Finance Company upon termination of the lease, if the purchase option is not exercised. Lehman Dairy's ineremental borrowing rate is 10% per year. Chavez's implicit rate is 8% and is known to Lehman Dairy. Collectability of the payments is reasonably predictable, and there are no important uncertainties surrounding the costs yet to be incurred by the lessor. Instructions (Assume the accounting period ends on December 31.) (a) Calculate the required payment Chavez. Finance requires to earn the Fair Value of the asset. (b) Lehman Dairy is able to negotiate the payment down to $79,000 per year. Compute the present value of the minimum lease payments for both the lessee and lessor. (c) What type of lease is this for the lessee? For the lessor? (d) Prepare the journal entries Chavez would make in the first full calendar year of the lease (January 1, 2023 - December 31, 2023) related to the lease arrangement. (e) Prepare the journal entries Lehman would make in the first full calendar year of the lease (January 1, 2023 - December 31, 2023) related to the lease arrangement. Step 3 - Find the Present Value Factors Ise Annuitv Due if pavment is due at the beginning of the Lease ctan A. Calealsta tha leace Pavments Reauired bv the Lessor LESSOR LESSEE LESSOR LESSEE LESSEE LESSOR Lehman Dairy leases its milking equipment from Chavez Finance Company under the following lease terms. The lease term is 8 years, noneancelable, and requires equal rental payments due at the beginning of each year starting June 1,2022. The equipment has a fair value of $500,000, and cost Chavez $375,000, at the inception of the lease (June 1, 2022). Lehman Dairy has the option to purchase the equipment for $14,400, at the end of the lease. This represents a significant discount on the equipment. The estimated economic life of the equipment is 10 years, and a residual value (which is guaranteed by Lehman Dairy) of $40,000. If the purchase option is not exercised, Lehman Dairy expeets to pay $24,000 under the guaranteed residual value. The lease contains no renewable options, and the equipment reverts to Chavez Finance Company upon termination of the lease, if the purchase option is not exercised. Lehman Dairy's ineremental borrowing rate is 10% per year. Chavez's implicit rate is 8% and is known to Lehman Dairy. Collectability of the payments is reasonably predictable, and there are no important uncertainties surrounding the costs yet to be incurred by the lessor. Instructions (Assume the accounting period ends on December 31.) (a) Calculate the required payment Chavez. Finance requires to earn the Fair Value of the asset. (b) Lehman Dairy is able to negotiate the payment down to $79,000 per year. Compute the present value of the minimum lease payments for both the lessee and lessor. (c) What type of lease is this for the lessee? For the lessor? (d) Prepare the journal entries Chavez would make in the first full calendar year of the lease (January 1, 2023 - December 31, 2023) related to the lease arrangement. (e) Prepare the journal entries Lehman would make in the first full calendar year of the lease (January 1, 2023 - December 31, 2023) related to the lease arrangement. Step 3 - Find the Present Value Factors Ise Annuitv Due if pavment is due at the beginning of the Lease ctan A. Calealsta tha leace Pavments Reauired bv the Lessor LESSOR LESSEE LESSOR LESSEE LESSEE LESSOR i got wrong right at the BPO and Residual value (which one i should take to calculate to get the periodic payment? and what should i do with the payment down 79,000?) please help me with this problem. thank you very much!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started