Answered step by step

Verified Expert Solution

Question

1 Approved Answer

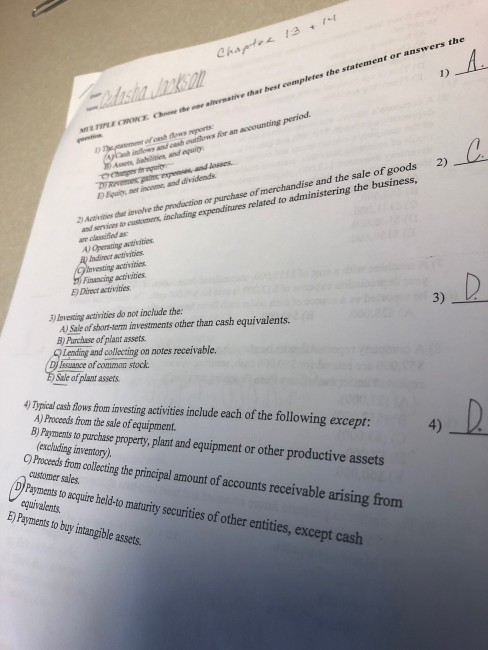

please help me with this accounting homework Chapts 1a 1) X Choome the nne athernatre thas best completes the statement or answers the D Equit,

please help me with this accounting homework

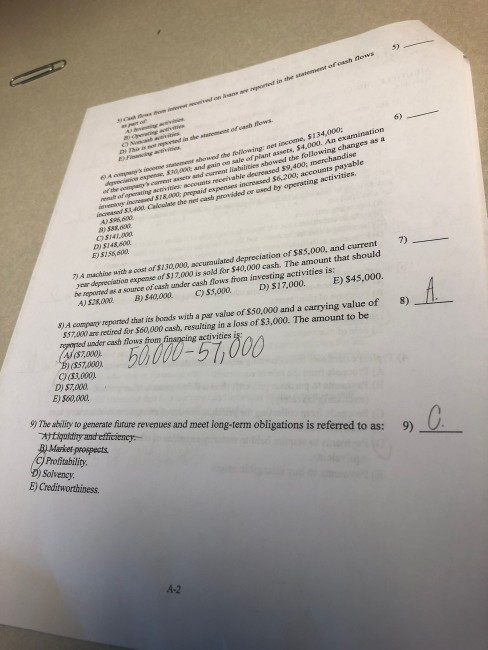

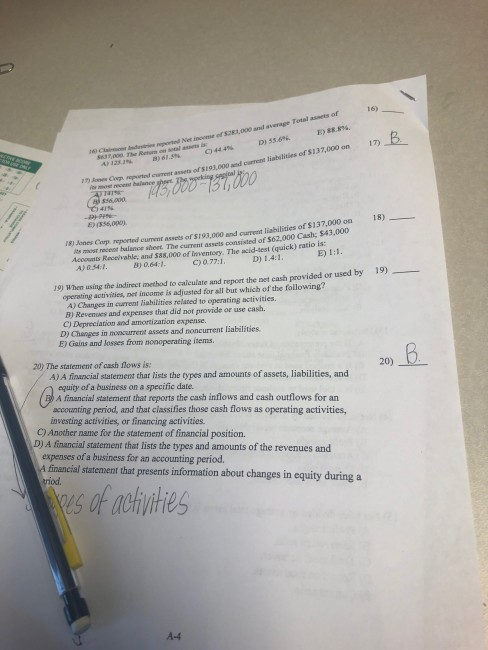

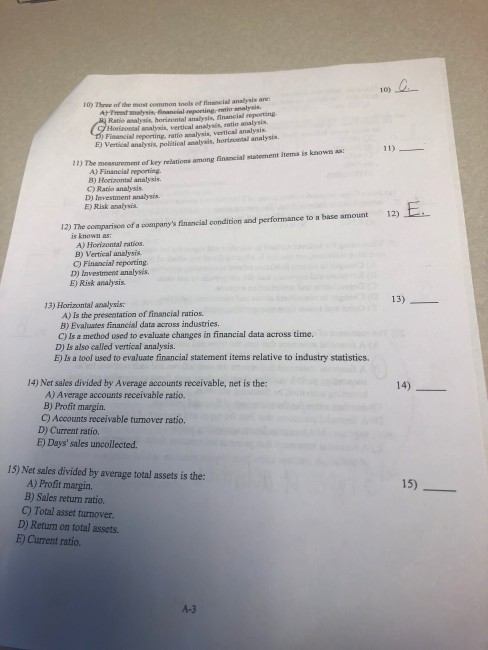

Chapts 1a 1) X Choome the nne athernatre thas best completes the statement or answers the D Equit, ner incomes, and dividends Acies the vohe the prodaction or purchase of merchandise and the sale of goods 2) customers, inchading expenditures related to administering the business, and services A) Indiet actvibies Finaneing activities Direct activities 3) Anvesting activities do not include the: Al Sale of short-term investments other than cash equivalents. B) Punchase of plant assets suance of common stock and collecting on notes receivable. Sale of plant assets. Typical cash ows from investing activities include each of the following except: A) Proceds from the sale of equipment. B) Payments to purchase property, plant and equipment or other productive assets (excluding inventory) Proceeds from collcting the principal amount of accounts receivable 4) customer sales. /Paymensto acoquire held-to maturity securities of other entities, except cash equivalents. arising from E) Payments to buy intangible assets ofcash flows $134,000: assets, 54,000. An examination ie epesasn, s3oat and venney insrd $18,000 prepaid expenses increesed $6,200; accounts payable inasd St400 Cacalase the net cash prenided or used by operating activities A)5%, ) $88000 CS141,000 ofthe erparycent assets and current liabilidies showed the folowing receivable decreased $9,400; merchandise oregeranng ac ties accounts D) $148,600 E) $156,600 7 A machine wrih cost of $130,00, ancumulated depreciation of $85,000, and current year depreciation expense of $17,000 is sold for $40,000 cash. The amount that should be reported as a source of eash under cash fiows from investing activities is: A)2802 B)$A0,000 )5,000 D) $17,000. E) S45,000. )A campary repoarted that its bonds with a par value of $50,000 and a carrying value of 5$7,400ae retired for $60,000 cash, resulting in a loss of $3,000. The amount to be nonted under cash fows fron finanging activities 8) $,000% )(857,000) C(53,00 D) $7,000 E)560,00x 9) The ability to generate future revenues and meet long-term obligations is referred to as: prospects 9)C D) Solvency E) Creditworthiness. A-2 Ner ineme ot 2,0 and average Toal ats of16) 55.6 %. E)88.8%. t D, 55.6%. D) R 17) C)444% B)6,3% cument assets of $193000 and current lisbilities of $137,000 on E(555,000) $43,000 recesnt balance sheet. The current assets consisted of S62,000 Cash C) 0.77:1 18) Jones Carp reperted cument assets of s193,000 and ourent liabilities of $137,000 on 18) Accoumts Receivahle, and $588,000 of Inventory. The acid-sest (quick A) 054:1 ) ratio is: B) 0.64:1 19) Whem using the indirect method to caleuiate and report the net cash provided or used by 19)_ operating activities, net income is adjusted for all but which of the following? A) Changes in current lishilities related to operating activities B) Revenues and expenses thar did not provide or use cash C) Depreciation and amortization expense. D) Changes in moncurrent assets and noncurrent liabilities E) Gains and Josses from nonoperating items. 20) The statement of cash flows is: A) A financial staterment that lists the types and amounts of assets, liabilities, and 20) equity of a business on a specific date. A financial staternent that reports the cash inflows and cash outflows for an accounting period, and that classifies those cash flows as operating activities, investing activities, or financing activities. C) Another name for the statement of financial position. D) A financiai statement that lists the types and amounts of the revenues and espenses of a business for an accounting period. 4 financial statement that presents information about changes in equity during a eus f achiythes A-4 10) 10) Three of the most common tools of finencial analysis are analysis Ratie asalysis, horinontal analysis, financial reporting Horizontal analysis, vertical analysis, ratio analysis. Financial reporting, ratio analysis, vertical analysis. E Vertical analysis, political analyais, horincetal analysis. 1) The mrasurement of key relations among finncial statement items is known as A) Financial reporting B) Horizontal analysis C) Ratio analysis D) Investment analysis E) Risk anaysis 12) 12) The comparison of a company's financial condition and performance to a base amount is known as: A) Horizontal ratios B) Vertical analysis C) Finacial reporting D) Investment analysis E) Risk analysis 13 13) Horizontal analysis: A) Is the presentation of financial ratios B) Evaluates finaneial data across industries C) Is a method used to evaluste changes in financial data across time. D) Is also calied vertical analysis. E) Is a tool used to evaluate financial statement items relative to industry statistics. 14) Net sales divided by Average sccounts receivable, net is the 14) A) Average accounts receivable ratio. B) Profit margin. C) Accounts receivable tumover ratio D) Current ratio E) Days' sales uncollected. 15) Net sales divided by average total assets is the: 15) A) Profft margin. B) Sales retum ratio. C) Total asset tumover. D) Return on total assets. E) Current ratio. A-3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started