please help me with this accounting question

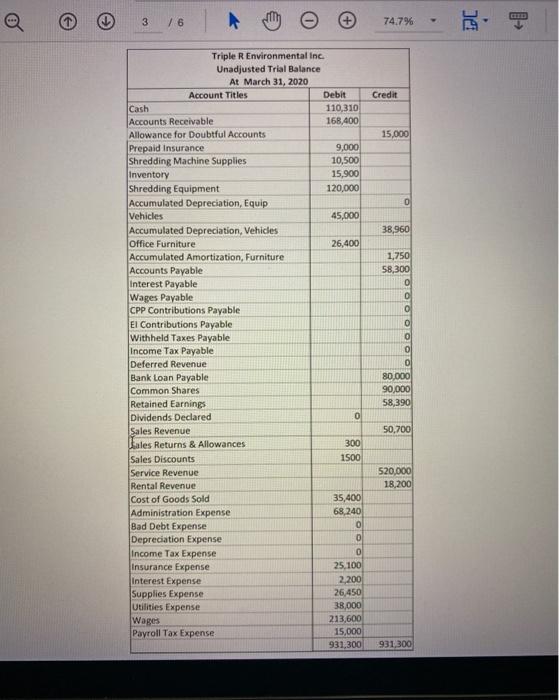

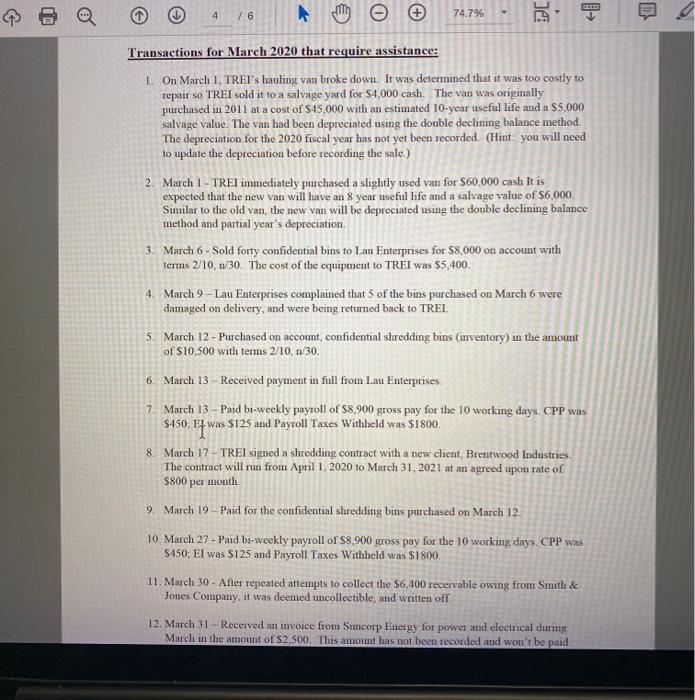

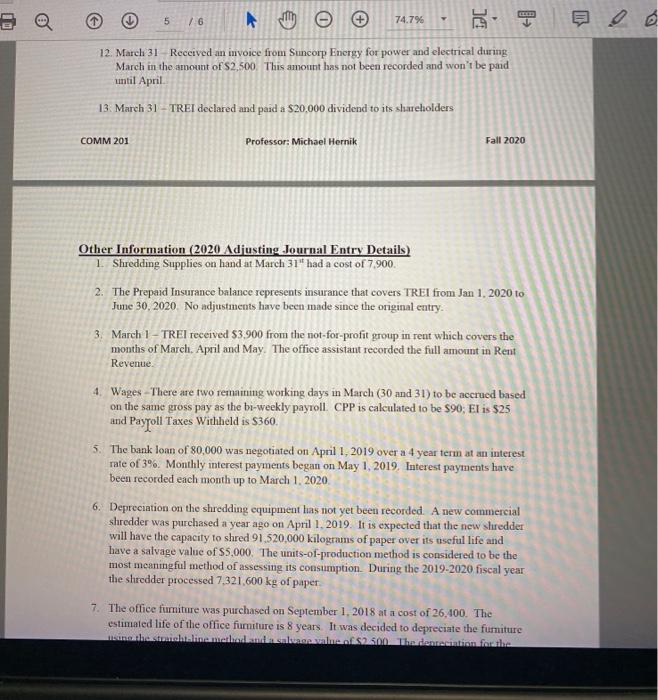

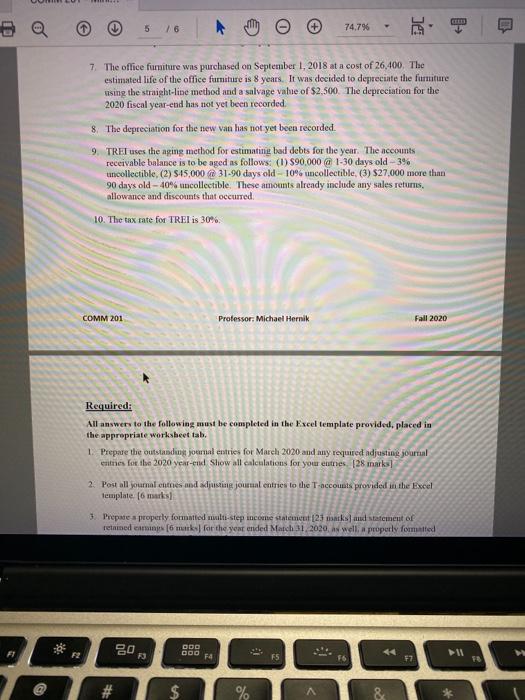

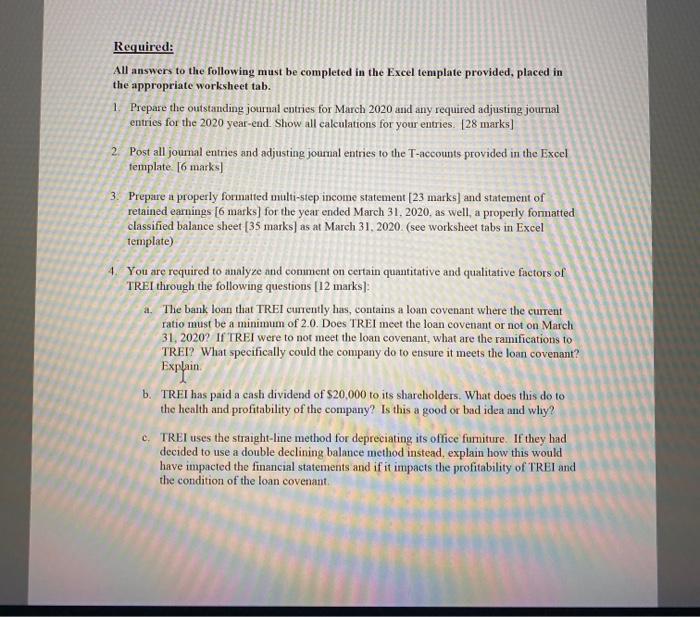

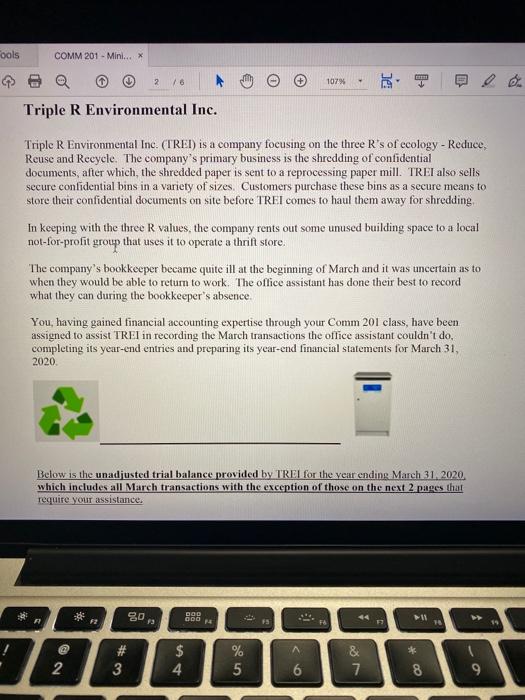

oals COMM 201 - Mini... X 2 / 107% DL Triple R Environmental Inc. Triple R Environmental Inc. (TREI) is a company focusing on the three R's of ecology - Reduce. Reuse and Recycle. The company's primary business is the shredding of confidential documents, after which the shredded paper is sent to a reprocessing paper mill. TREI also sells secure confidential bins in a variety of sizes. Customers purchase these bins as a secure means to store their confidential documents on site before TREI comes to haul them away for shredding In keeping with the three R values, the company rents out some unused building space to a local not-for-profit group that uses it to operate a thrift store The company's bookkeeper became quite ill at the beginning of March and it was uncertain as to when they would be able to return to work. The office assistant has done their best to record what they can during the bookkeeper's absence You, having gained financial accounting expertise through your Comm 201 class, have been assigned to assist TREI in recording the March transactions the office assistant couldn't do, completing its year-end entries and preparing its year-end financial statements for March 31, 2020 Below is the unadjusted trial balance provided by TREI for the year ending March 31, 2020 which includes all March transactions with the exception of those on the next 2 pages that require your assistance. 30 POD OD 14 11 F3 F3 A @ 2 # 3 $ 4 % 5 & 7 * 8 6 9 3 16 74.7% Credit 15,000 0 38,960 1,750 58,300 O 0 0 OD Triple R Environmental Inc. Unadjusted Trial Balance At March 31, 2020 Account Titles Debit Cash 110,310 Accounts Receivable 168,400 Allowance for Doubtful Accounts Prepaid Insurance 9,000 Shredding Machine Supplies 10,500 Inventory 15,900 Shredding Equipment 120,000 Accumulated Depreciation, Equip Vehicles 45,000 Accumulated Depreciation, Vehicles Office Furniture 26,400 Accumulated Amortization, Furniture Accounts Payable Interest Payable Wages Payable CPP Contributions Payable El Contributions Payable Withheld Taxes Payable Income Tax Payable Deferred Revenue Bank Loan Payable Common Shares Retained Earnings Dividends Declared 0 Sales Revenue Lales Returns & Allowances 300 Sales Discounts 1500 Service Revenue Rental Revenue Cost of Goods Sold 35,400 Administration Expense 68,240 Bad Debt Expense 0 Depreciation Expense 0 Income Tax Expense 0 Insurance Expense 25,100 Interest Expense 2.200 Supplies Expense 26,450 Utilities Expense 38,000 Wages 213,600 Payroll Tax Expense 15,000 931,300 0 0 80.000 90,000 58,390 50,700 520,000 18,200 931,300 G 4 / 6 O 74.7% je Transactions for March 2020 that require assistance: 1. On March 1. TREI's hauling van broke down. It was determined that it was too costly to Tepar so TREI sold it to a salvage yard for $4,000 cash. The van was originally purchased in 2011 at a cost of $45,000 with an estimated 10-year useful life and a $5,000 salvage value. The van had been depreciated using the double declining balance method. The depreciation for the 2020 fiscal year has not yet been recorded. (Hint you will need to update the depreciation before recording the sale.) 2. March 1 - TREI immediately purchased a slightly used van for $60.000 cash It is expected that the new van will have an 8 year useful life and a salvage value of $6.000 Similar to the old van, the new van will be depreciated using the double declining balance method and partial year's depreciation. 3. March 6 - Sold forty confidential bins to Lau Enterprises for 58,000 on account with terms 2/10, 1/30. The cost of the equipment to TREI was $5,400. 4. March 9 - Lau Enterprises complained that 5 of the bins purchased on March 6 were damaged on delivery, and were being returned back to TREL 5. March 12 - Purchased on account, confidential shredding bins (inventory) in the amount of $10,500 with terms 2/10, 1/30. 6. March 13 - Received payment in full from Lau Enterprises 7. March 13 - Paid bi-weekly payroll of $8,900 gross pay for the 10 working days. CPP was $450. Ef was $125 and Payroll Taxes Withheld was $1800 8 March 17 - TREI signed a shredding contract with a new client, Brentwood Industries. The contract will run from April 1, 2020 10 March 31, 2021 at an agreed upon rate of $800 per month 9. March 19 - Paid for the confidential shredding bins purchased on March 12 10. March 27 - Paid bi-weekly payroll of $8,900 gross pay for the 10 working days CPP was 5450: El was $125 and Payroll Taxes Withheld was $1800. 11. March 30 - After repeated attempts to collect the $6.400 receivable owing from Smith & Jones Company, it was deemed uncollectible, and written of 12. March 31 - Received an invoice from Suncorp Energy for power and electrical during March in the amount of $2.500. This amount has not been recorded and won't be paid 5 /6 AU 74.7% DC 12. March 31 Received an invoice from Suncorp Energy for power and electrical during March in the amount of S2,500. This amount has not been recorded and won't be paid until April 13. March 31 - TREI declared and paid a $20,000 dividend to its shareholders COMM 201 Professor: Michael Hernik Fall 2020 Fall 2020 Other Information (2020 Adjusting Journal Entry Details) 1 Shredding Supplies on hand at March 31" had a cost of 7.900. 2. The Prepaid Insurance balance represents insurance that covers TREI from Jan 1, 2020 to June 30, 2020 No adjustments have been made since the original entry. 3. March 1 - TREI received $3.900 from the not-for-profit group in rent which covers the months of March April and May. The office assistant recorded the full amount in Rent Revenue. 4. Wages There are two remaining working days in March (30 and 31) to be accrued based on the same gross pay as the bi-weekly payroll CPP is calculated to be $90; El is $25 and Payroll Taxes Withheld is $360, 5. The bank loan of 80,000 was negotiated on April 1, 2019 over a 4 year term at an interest rate of 3%. Monthly interest payments began on May 1, 2019. Interest payments have been recorded each month up to March 1, 2020 6. Deprecintion on the shredding equipment has not yet been recorded. A new commercial shredder was purchased a year ago on April 1, 2019. It is expected that the new shredder will have the capacity to shred 91,520,000 kilograms of paper over its useful life and have a salvage value of $5,000. The units-of-production method is considered to be the most meaningful method of assessing its consumption. During the 2019-2020 fiscal year the shredder processed 7,321,600 kg of paper 7. The office furniture was purchased on September 1, 2018 at a cost of 26,400. The estimated life of the office furniture is 8 years. It was decided to depreciate the furniture inthamahalinamathanamtiranthamanalmersas the tenraaintiansforutha 5 74.796 7. The office furniture wis purchased on September 1, 2018 at a cost of 26,400, The estimated life of the office furniture is 8 years. It was decided to depreciate the furniture using the straight-line method and a salvage vahe of $2,500. The depreciation for the 2020 fiscal year-end has not yet been recorded. 8. The depreciation for the new van has not yet been recorded. 9. TREI uses the aging method for estimating bad debts for the year. The accounts receivable balance is to be aged as follows: (1) $90,000 @ 1-30 days old - 3% uncollectible, (2) S45,000 31.90 days old 10% uncollectible, (3) $27.000 more than 90 days old - 40% uncollectible. These amounts already include any sales retums, allowance and discounts that occurred 10. The tax rate for TREI is 30% COMM 201 Professor, Michael Hernik Fall 2020 Required: All answers to the following must be completed in the Excel template provided, placed in the appropriate worksheet tab. 1. Prepare the outstanding journal entries for March 2020 and any required adjusting journal entries for the 2020 year-end Show all calculations for your unes 128 marks] 2. Post all youmal ones and wat journal entries to the T-accounts provided in the Excel template [6 marks 3. Prepare properly formatted multi-step income statement 123 ks) and statement of etnised erias (6 murks for the year ended Match 01 2020, as wella properly formatted . Bo DDD ODO