Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with this assignment is due tomorrow In the month of July, Lisa's Oil Co. performed 4,000 oil changes at a price of

please help me with this assignment is due tomorrow

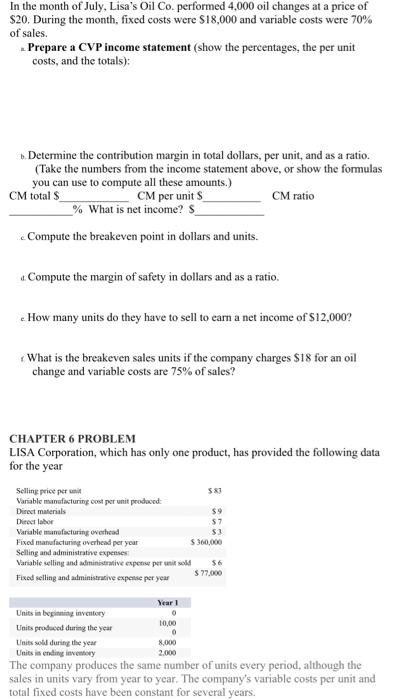

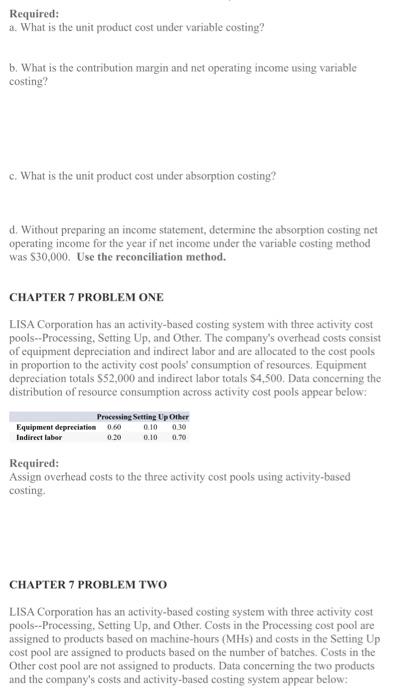

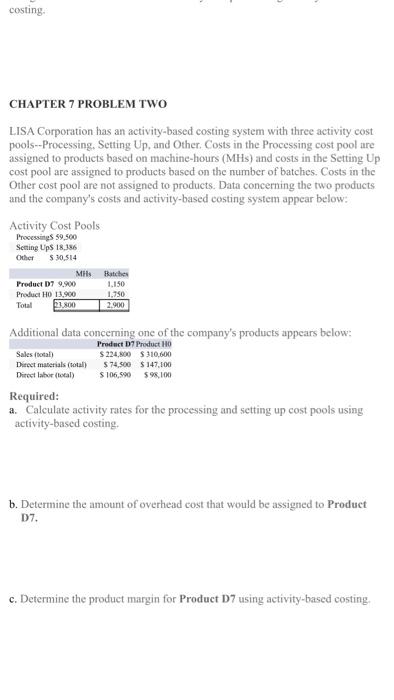

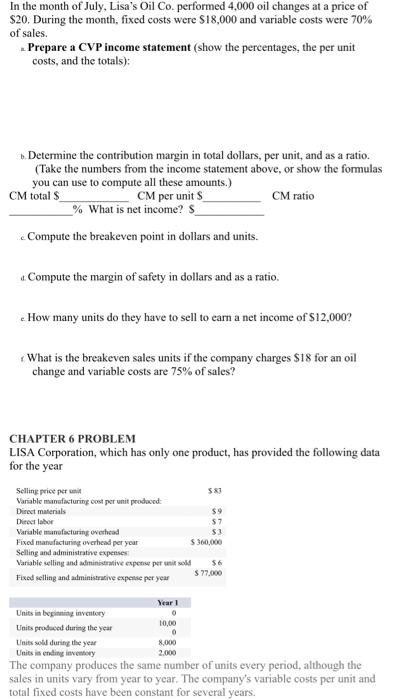

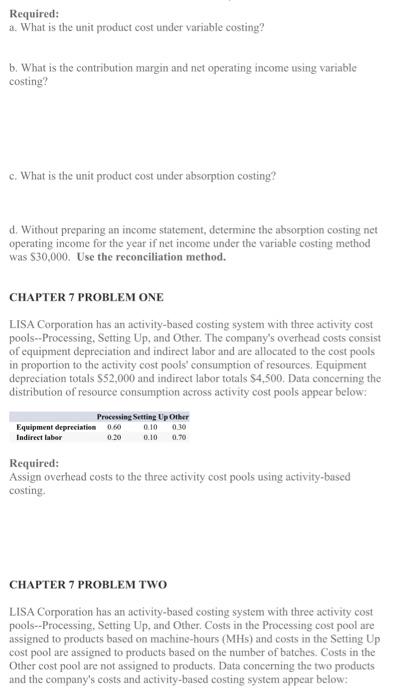

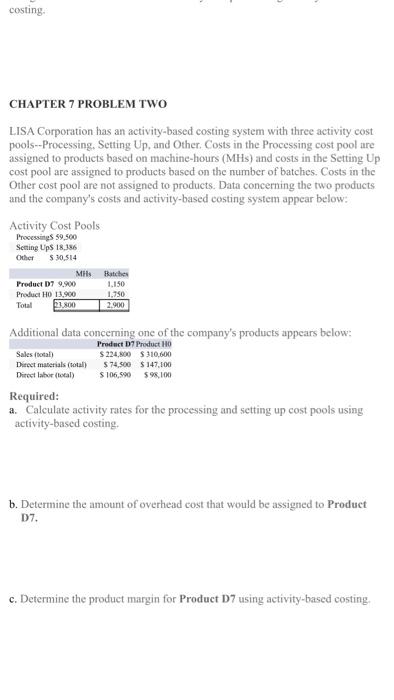

In the month of July, Lisa's Oil Co. performed 4,000 oil changes at a price of $20. During the month, fixed costs were $18,000 and variable costs were 70% of sales. Prepare a CVP income statement (show the percentages, the per unit costs, and the totals): b. Determine the contribution margin in total dollars, per unit, and as a ratio. (Take the numbers from the income statement above, or show the formulas you can use to compute all these amounts.) CM per unit S CM total S CM ratio % What is net income? S_ e Compute the breakeven point in dollars and units. 4. Compute the margin of safety in dollars and as a ratio. How many units do they have to sell to earn a net income of $12,000? What is the breakeven sales units if the company charges $18 for an oil change and variable costs are 75% of sales? CHAPTER 6 PROBLEM LISA Corporation, which has only one product, has provided the following data for the year Selling price per unit Variable manufacturing cost per unit produced: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead per year Selling and administrative expenses Variable selling and administrative expense per unit sold Fixed selling and administrative expense per year Units in beginning inventory Units produced during the year Units sold during the year Units in ending inventory Year 1 0 10,00 0 8,000 2,000 5.83 $9 $7 $3 $360,000 $6 $77,000 The company produces the same number of units every period, although the sales in units vary from year to year. The company's variable costs per unit and total fixed costs have been constant for several years. Required: a. What is the unit product cost under variable costing? b. What is the contribution margin and net operating income using variable costing? c. What is the unit product cost under absorption costing? d. Without preparing an income statement, determine the absorption costing net operating income for the year if net income under the variable costing method was $30,000. Use the reconciliation method. CHAPTER 7 PROBLEM ONE LISA Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $52,000 and indirect labor totals $4,500. Data concerning the distribution of resource consumption across activity cost pools appear below: Processing Setting Up Other Equipment depreciation 0.60 0.10 0.30 Indir 0.10 0.7 0.20 Required: Assign overhead costs to the three activity cost pools using activity-based costing. CHAPTER 7 PROBLEM TWO LISA Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. Costs in the Processing cost pool are assigned to products based on machine-hours (MHS) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below: costing. CHAPTER 7 PROBLEM TWO LISA Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below: Activity Cost Pools Processings 59,500 Senting Up$ 18,386 Other $ 30,514 MHS Product D7 9.900 Product H0 13,900 Total 23,800 Batches 1,150 1.750 2.900 Additional data concerning one of the company's products appears below: Product D7 Product Ho Sales (total) Direct materials (total) Direct labor (total) $310,600 $ 224,800 $74,500 $147,100 $106,590 $98,100 Required: a. Calculate activity rates for the processing and setting up cost pools using activity-based costing. b. Determine the amount of overhead cost that would be assigned to Product D7. c. Determine the product margin for Product D7 using activity-based costing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started