Please help me with this by providing the answer in Excel. Thank you!

Please help me with this by providing the answer in Excel. Thank you!

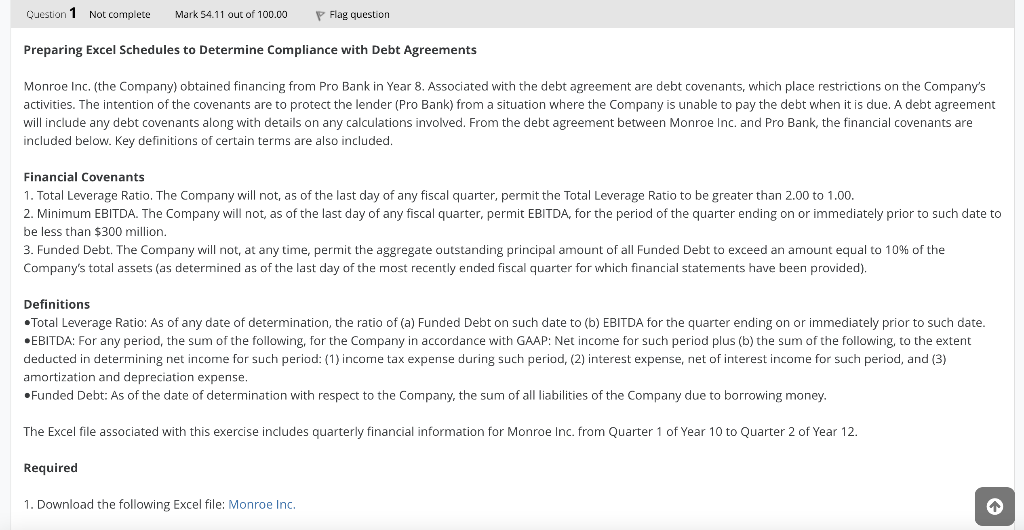

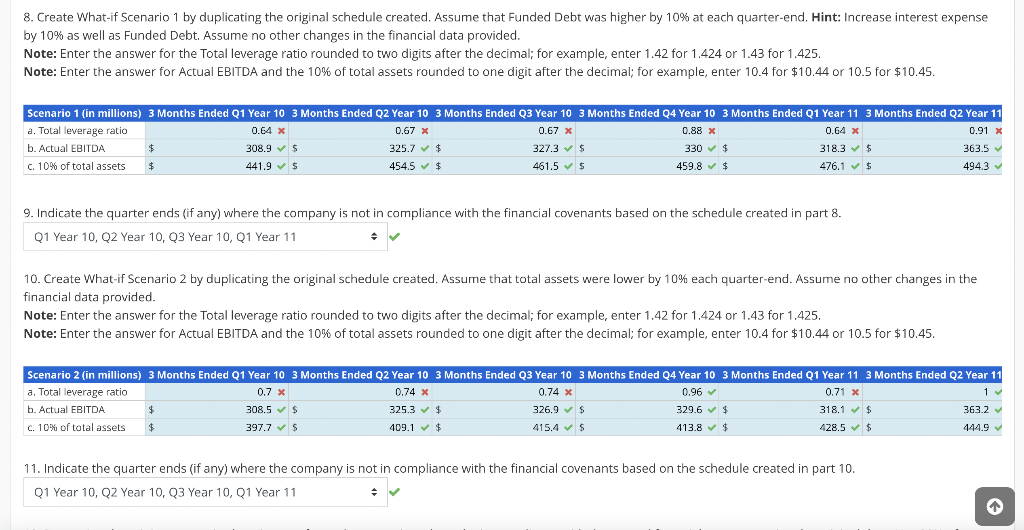

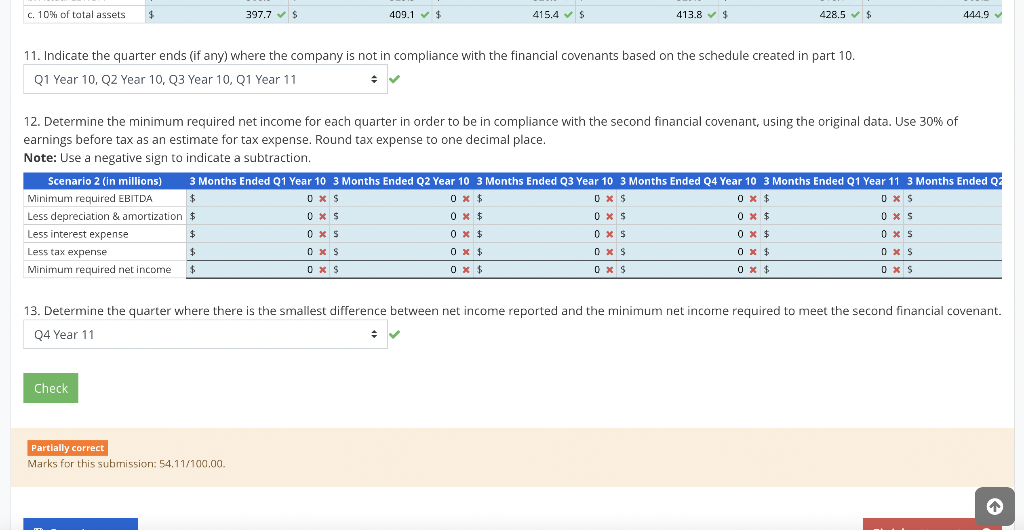

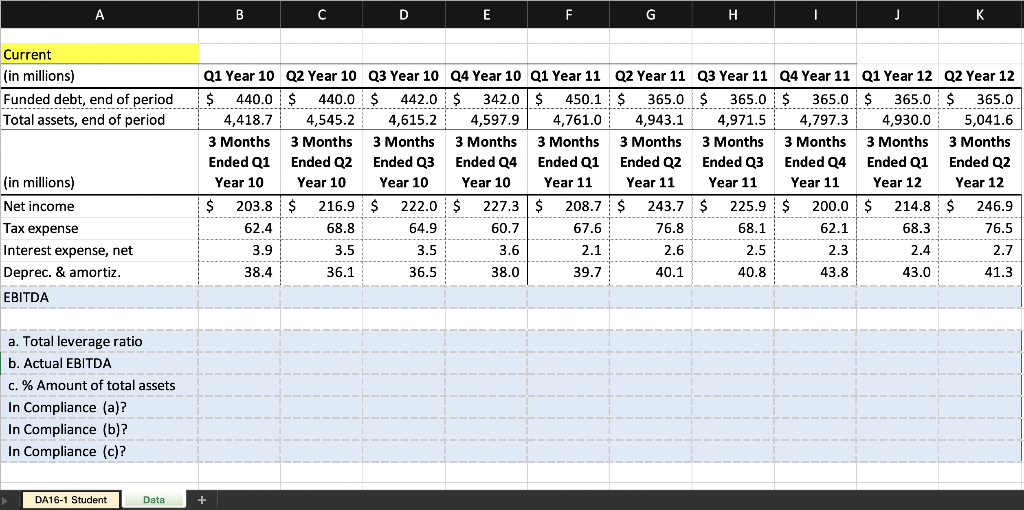

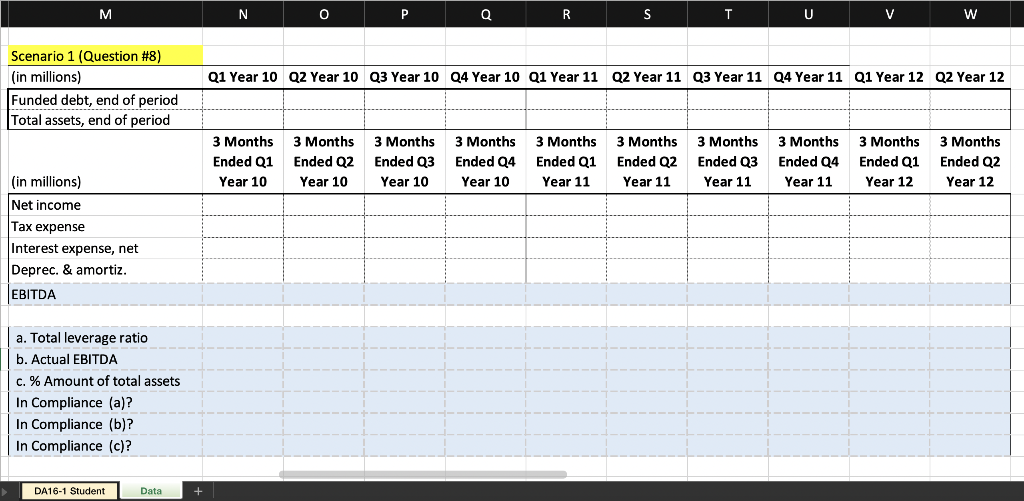

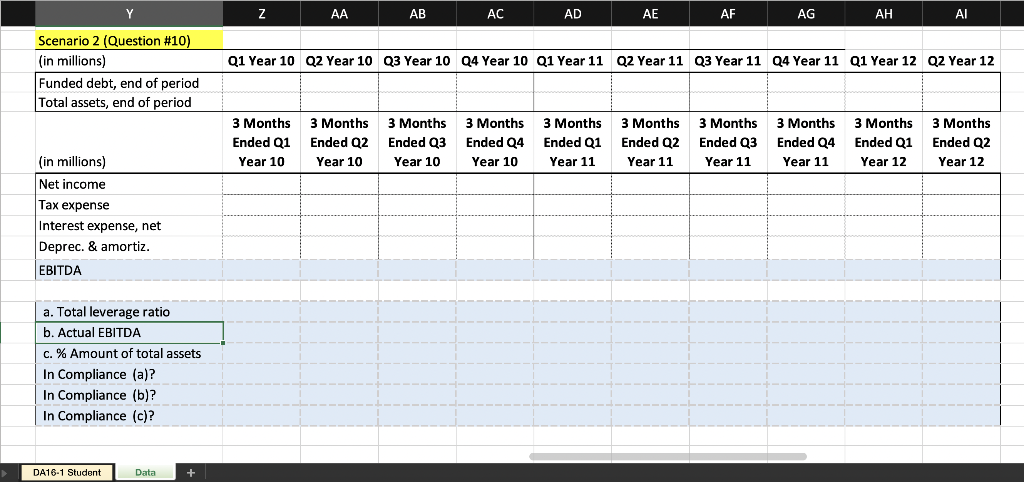

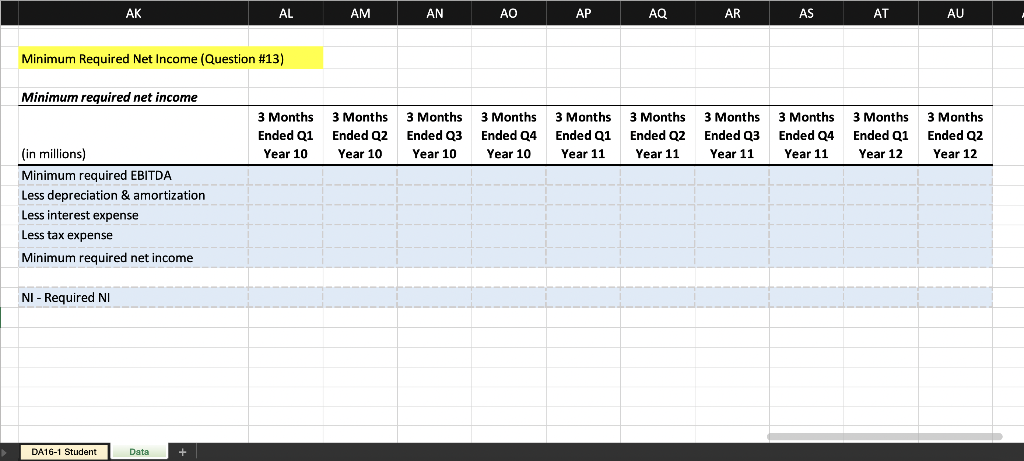

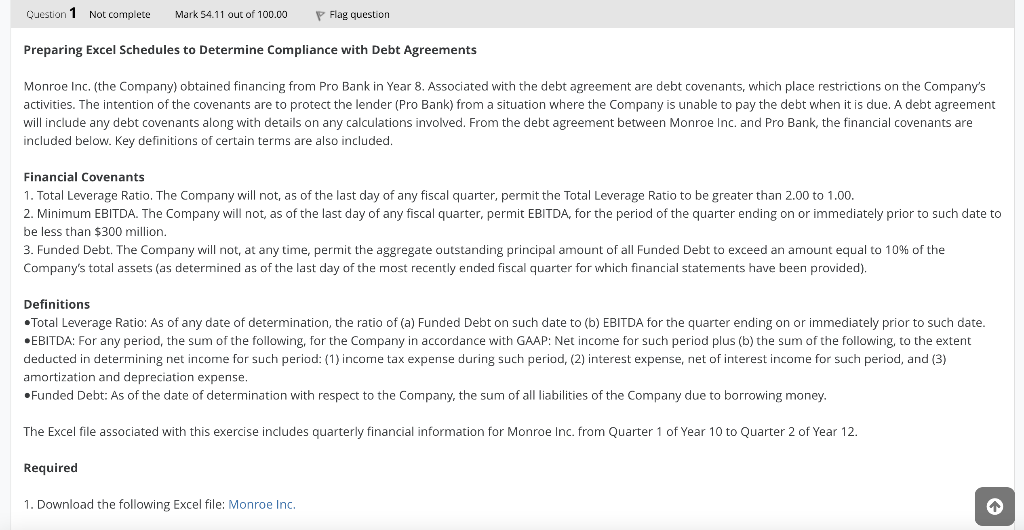

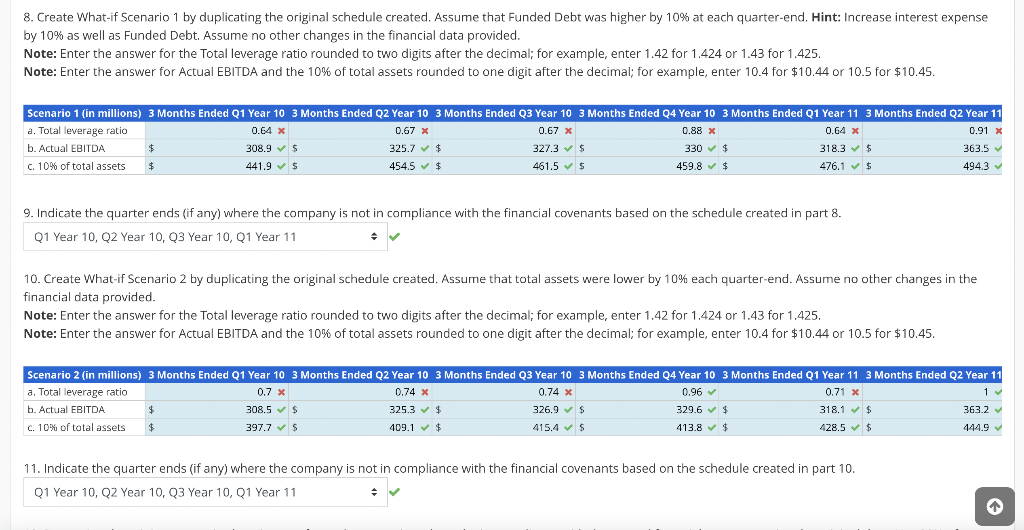

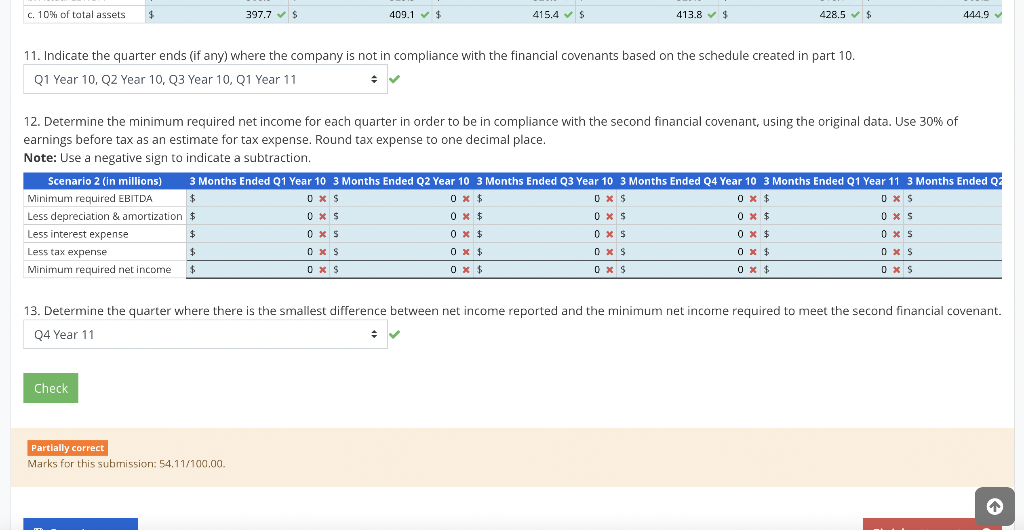

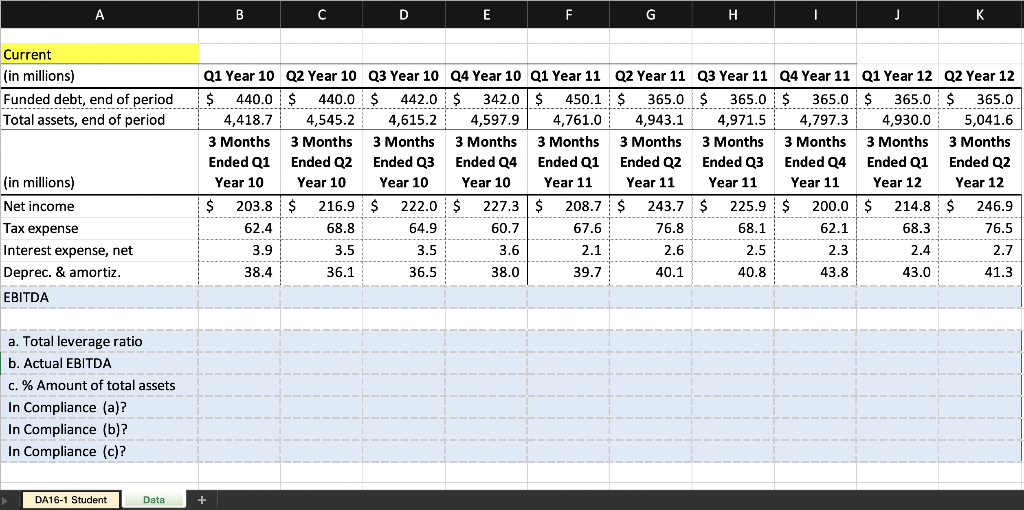

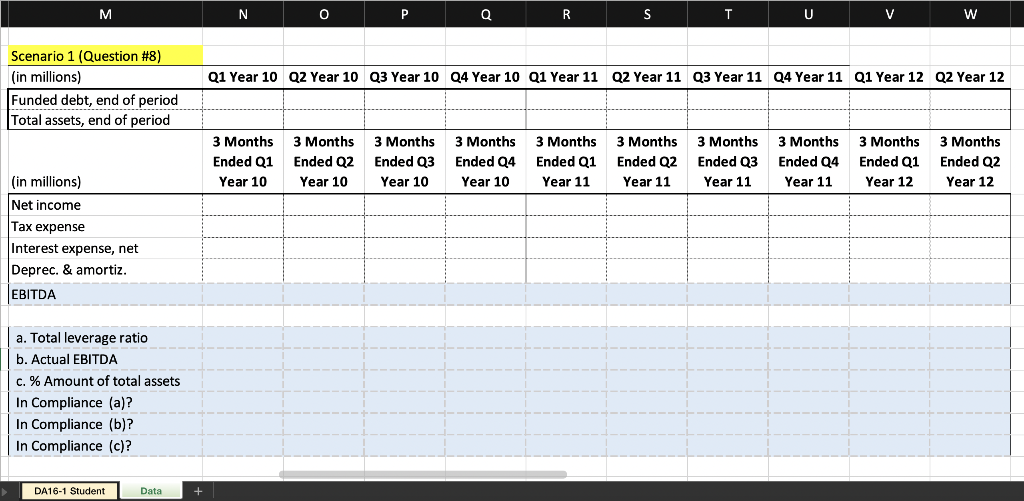

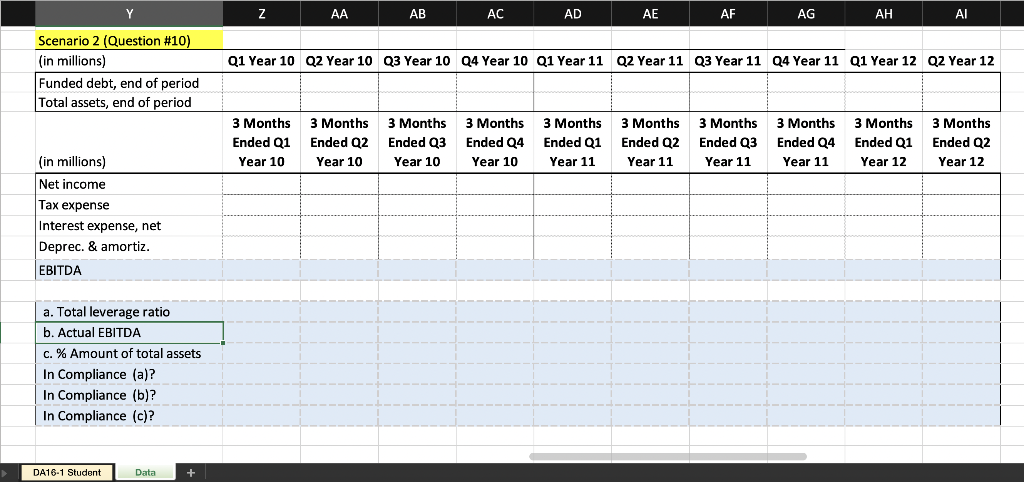

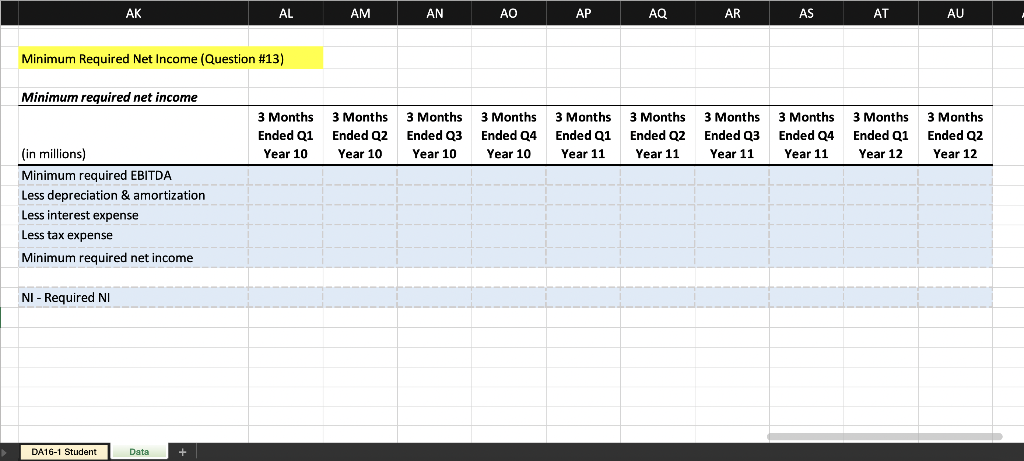

Preparing Excel Schedules to Determine Compliance with Debt Agreements Monroe Inc. (the Company) obtained financing from Pro Bank in Year 8 . Associated with the debt agreement are debt covenants, which place restrictions on the Company's activities. The intention of the covenants are to protect the lender (Pro Bank) from a situation where the Company is unable to pay the debt when it is due. A debt agreement will include any debt covenants along with details on any calculations involved. From the debt agreement between Monroe Inc. and Pro Bank, the financial covenants are included below. Key definitions of certain terms are also included. Financial Covenants 1. Total Leverage Ratio. The Company will not, as of the last day of any fiscal quarter, permit the Total Leverage Ratio to be greater than 2.00 to 1.00. 2. Minimum EBITDA. The Company will not, as of the last day of any fiscal quarter, permit EBITDA, for the period of the quarter ending on or immediately prior to such date to be less than $300 million. 3. Funded Debt. The Company will not, at any time, permit the aggregate outstanding principal amount of all Funded Debt to exceed an amount equal to 10% of the Company's total assets (as determined as of the last day of the most recently ended fiscal quarter for which financial statements have been provided). Definitions - Total Leverage Ratio: As of any date of determination, the ratio of (a) Funded Debt on such date to (b) EBITDA for the quarter ending on or immediately prior to such date. -EBITDA: For any period, the sum of the following, for the Company in accordance with GAAP: Net income for such period plus (b) the sum of the following, to the extent deducted in determining net income for such period: (1) income tax expense during such period, (2) interest expense, net of interest income for such period, and (3) amortization and depreciation expense. -Funded Debt: As of the date of determination with respect to the Company, the sum of all liabilities of the Company due to borrowing money. The Excel file associated with this exercise includes quarterly financial information for Monroe Inc. from Quarter 1 of Year 10 to Quarter 2 of Year 12. Required 1. Download the following Excel file: Monroe Inc. 8. Create What-if Scenario 1 by duplicating the original schedule created. Assume that Funded Debt was higher by 10% at each quarter-end. Hint: Increase interest expense by 10% as well as Funded Debt. Assume no other changes in the financial data provided. Note: Enter the answer for the Total leverage ratio rounded to two digits after the decimal; for example, enter 1.42 for 1.424 or 1.43 for 1.425. Note: Enter the answer for Actual EBITDA and the 10% of total assets rounded to one digit after the decimal; for example, enter 10.4 for $10.44 or 10.5 for $10.45. 5 a. b. c. 9. Indicate the quarter ends (if any) where the company is not in compliance with the financial covenants based on the schedule created in part 8. 10. Create What-if Scenario 2 by duplicating the original schedule created. Assume that total assets were lower by 10% each quarter-end. Assume no other changes in the financial data provided. Note: Enter the answer for the Total leverage ratio rounded to two digits after the decimal; for example, enter 1.42 for 1.424 or 1.43 for 1.425. Note: Enter the answer for Actual EBITDA and the 10% of total assets rounded to one digit after the decimal; for example, enter 10.4 for $10.44 or 10.5 for $10.45. 11. Indicate the quarter ends (if any) where the company is not in compliance with the financial covenants based on the schedule created in part 10. 11. Indicate the quarter ends (if any) where the company is not in compliance with the financial covenants based on the schedule created in part 10. 12. Determine the minimum required net income for each quarter in order to be in compliance with the second financial covenant, using the original data. Use 30% of earnings before tax as an estimate for tax expense. Round tax expense to one decimal place. Note: Use a negative sign to indicate a subtraction. 13. Determine the quarter where there is the smallest difference between net income reported and the minimum net income required to meet the second financial covenant. A B C D E F G H 1 J K Current EBITDA a. Total leverage ratio b. Actual EBITDA c. \% Amount of total assets In Compliance (a)? In Compliance (b)? In Compliance (c)? M N P Q R S T U V W Scenario 1 (Question \#8) a. Total leverage ratio b. Actual EBITDA c. \% Amount of total assets In Compliance (a)? In Compliance (b)? In Compliance (c)? AK AL AM AN AO AP AQ AR AS AT AU Minimum Required Net Income (Question \#13) Minimum required net income NI - Required NI Preparing Excel Schedules to Determine Compliance with Debt Agreements Monroe Inc. (the Company) obtained financing from Pro Bank in Year 8 . Associated with the debt agreement are debt covenants, which place restrictions on the Company's activities. The intention of the covenants are to protect the lender (Pro Bank) from a situation where the Company is unable to pay the debt when it is due. A debt agreement will include any debt covenants along with details on any calculations involved. From the debt agreement between Monroe Inc. and Pro Bank, the financial covenants are included below. Key definitions of certain terms are also included. Financial Covenants 1. Total Leverage Ratio. The Company will not, as of the last day of any fiscal quarter, permit the Total Leverage Ratio to be greater than 2.00 to 1.00. 2. Minimum EBITDA. The Company will not, as of the last day of any fiscal quarter, permit EBITDA, for the period of the quarter ending on or immediately prior to such date to be less than $300 million. 3. Funded Debt. The Company will not, at any time, permit the aggregate outstanding principal amount of all Funded Debt to exceed an amount equal to 10% of the Company's total assets (as determined as of the last day of the most recently ended fiscal quarter for which financial statements have been provided). Definitions - Total Leverage Ratio: As of any date of determination, the ratio of (a) Funded Debt on such date to (b) EBITDA for the quarter ending on or immediately prior to such date. -EBITDA: For any period, the sum of the following, for the Company in accordance with GAAP: Net income for such period plus (b) the sum of the following, to the extent deducted in determining net income for such period: (1) income tax expense during such period, (2) interest expense, net of interest income for such period, and (3) amortization and depreciation expense. -Funded Debt: As of the date of determination with respect to the Company, the sum of all liabilities of the Company due to borrowing money. The Excel file associated with this exercise includes quarterly financial information for Monroe Inc. from Quarter 1 of Year 10 to Quarter 2 of Year 12. Required 1. Download the following Excel file: Monroe Inc. 8. Create What-if Scenario 1 by duplicating the original schedule created. Assume that Funded Debt was higher by 10% at each quarter-end. Hint: Increase interest expense by 10% as well as Funded Debt. Assume no other changes in the financial data provided. Note: Enter the answer for the Total leverage ratio rounded to two digits after the decimal; for example, enter 1.42 for 1.424 or 1.43 for 1.425. Note: Enter the answer for Actual EBITDA and the 10% of total assets rounded to one digit after the decimal; for example, enter 10.4 for $10.44 or 10.5 for $10.45. 5 a. b. c. 9. Indicate the quarter ends (if any) where the company is not in compliance with the financial covenants based on the schedule created in part 8. 10. Create What-if Scenario 2 by duplicating the original schedule created. Assume that total assets were lower by 10% each quarter-end. Assume no other changes in the financial data provided. Note: Enter the answer for the Total leverage ratio rounded to two digits after the decimal; for example, enter 1.42 for 1.424 or 1.43 for 1.425. Note: Enter the answer for Actual EBITDA and the 10% of total assets rounded to one digit after the decimal; for example, enter 10.4 for $10.44 or 10.5 for $10.45. 11. Indicate the quarter ends (if any) where the company is not in compliance with the financial covenants based on the schedule created in part 10. 11. Indicate the quarter ends (if any) where the company is not in compliance with the financial covenants based on the schedule created in part 10. 12. Determine the minimum required net income for each quarter in order to be in compliance with the second financial covenant, using the original data. Use 30% of earnings before tax as an estimate for tax expense. Round tax expense to one decimal place. Note: Use a negative sign to indicate a subtraction. 13. Determine the quarter where there is the smallest difference between net income reported and the minimum net income required to meet the second financial covenant. A B C D E F G H 1 J K Current EBITDA a. Total leverage ratio b. Actual EBITDA c. \% Amount of total assets In Compliance (a)? In Compliance (b)? In Compliance (c)? M N P Q R S T U V W Scenario 1 (Question \#8) a. Total leverage ratio b. Actual EBITDA c. \% Amount of total assets In Compliance (a)? In Compliance (b)? In Compliance (c)? AK AL AM AN AO AP AQ AR AS AT AU Minimum Required Net Income (Question \#13) Minimum required net income NI - Required NI

Please help me with this by providing the answer in Excel. Thank you!

Please help me with this by providing the answer in Excel. Thank you!