Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with this question [100 marks] Each part of this question carries equal marks. I. List five different costs a company may encounter

Please help me with this question

[100 marks]

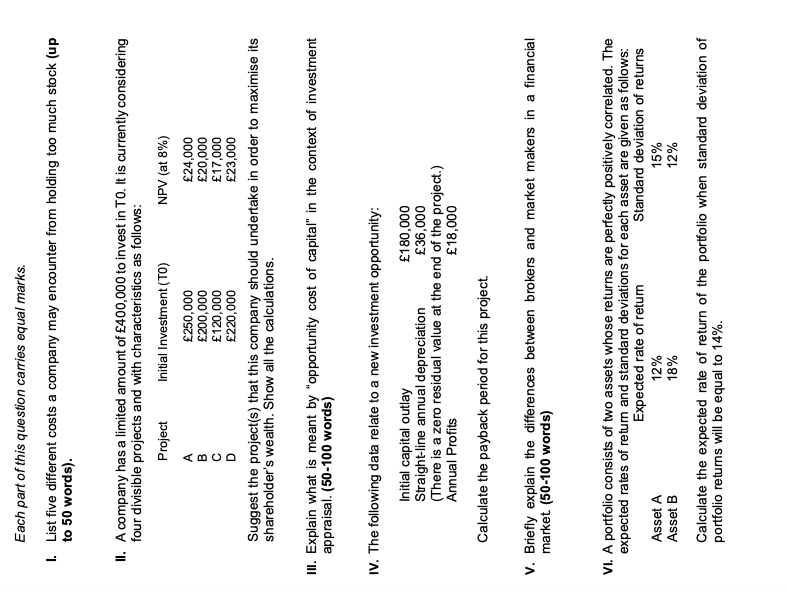

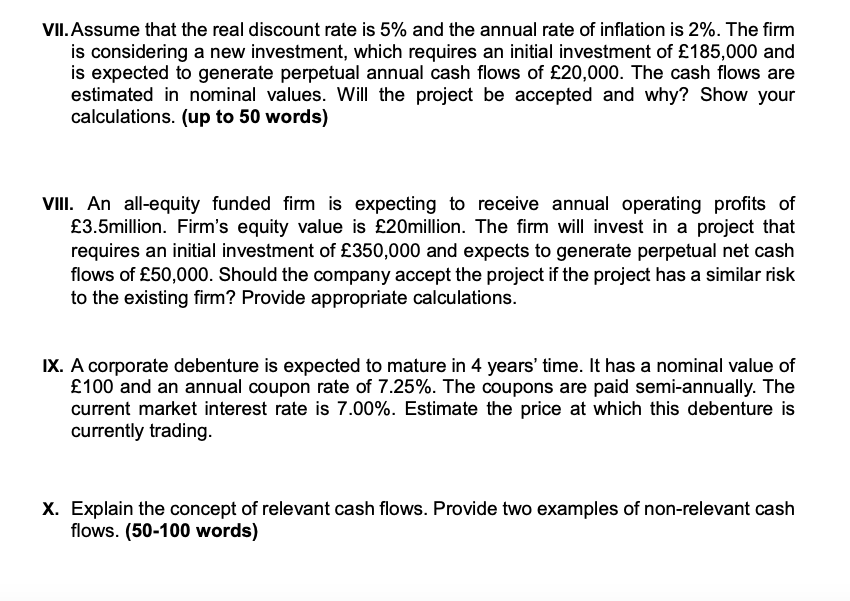

Each part of this question carries equal marks. I. List five different costs a company may encounter from holding too much stock (up to 50 words). II. A company has a limited amount of 400,000 to invest in TO. It is currently considering four divisible projects and with characteristics as follows: Project Initial Investment (TO) NPV (at 8%) 250,000 24,000 200,000 20,000 120,000 17,000 D 220,000 23,000 Suggest the project(s) that this company should undertake in order to maximise its shareholder's wealth. Show all the calculations. B C III. Explain what is meant by "opportunity cost of capital" in the context of investment appraisal. (50-100 words) IV. The following data relate to a new investment opportunity: Initial capital outlay 180,000 Straight-line annual depreciation 36,000 (There is a zero residual value at the end of the project.) Annual Profits 18,000 Calculate the payback period for this project. V. Briefly explain the differences between brokers and market makers in a financial market. (50-100 words) VI. A portfolio consists of two assets whose returns are perfectly positively correlated. The expected rates of return and standard deviations for each asset are given as follows: Expected rate of return Standard deviation of returns Asset A 12% 15% Asset B 18% 12% Calculate the expected rate of return of the portfolio when standard deviation of portfolio returns will be equal to 14%. VII. Assume that the real discount rate is 5% and the annual rate of inflation is 2%. The firm is considering a new investment, which requires an initial investment of 185,000 and is expected to generate perpetual annual cash flows of 20,000. The cash flows are estimated in nominal values. Will the project be accepted and why? Show your calculations. (up to 50 words) VIII. An all-equity funded firm is expecting to receive annual operating profits of 3.5million. Firm's equity value is 20million. The firm will invest in a project that requires an initial investment of 350,000 and expects to generate perpetual net cash flows of 50,000. Should the company accept the project if the project has a similar risk to the existing firm? Provide appropriate calculations. IX. A corporate debenture is expected to mature in 4 years' time. It has a nominal value of 100 and an annual coupon rate of 7.25%. The coupons are paid semi-annually. The current market interest rate is 7.00%. Estimate the price at which this debenture is currently trading. X. Explain the concept of relevant cash flows. Provide two examples of non-relevant cash flows. (50-100 words) Each part of this question carries equal marks. I. List five different costs a company may encounter from holding too much stock (up to 50 words). II. A company has a limited amount of 400,000 to invest in TO. It is currently considering four divisible projects and with characteristics as follows: Project Initial Investment (TO) NPV (at 8%) 250,000 24,000 200,000 20,000 120,000 17,000 D 220,000 23,000 Suggest the project(s) that this company should undertake in order to maximise its shareholder's wealth. Show all the calculations. B C III. Explain what is meant by "opportunity cost of capital" in the context of investment appraisal. (50-100 words) IV. The following data relate to a new investment opportunity: Initial capital outlay 180,000 Straight-line annual depreciation 36,000 (There is a zero residual value at the end of the project.) Annual Profits 18,000 Calculate the payback period for this project. V. Briefly explain the differences between brokers and market makers in a financial market. (50-100 words) VI. A portfolio consists of two assets whose returns are perfectly positively correlated. The expected rates of return and standard deviations for each asset are given as follows: Expected rate of return Standard deviation of returns Asset A 12% 15% Asset B 18% 12% Calculate the expected rate of return of the portfolio when standard deviation of portfolio returns will be equal to 14%. VII. Assume that the real discount rate is 5% and the annual rate of inflation is 2%. The firm is considering a new investment, which requires an initial investment of 185,000 and is expected to generate perpetual annual cash flows of 20,000. The cash flows are estimated in nominal values. Will the project be accepted and why? Show your calculations. (up to 50 words) VIII. An all-equity funded firm is expecting to receive annual operating profits of 3.5million. Firm's equity value is 20million. The firm will invest in a project that requires an initial investment of 350,000 and expects to generate perpetual net cash flows of 50,000. Should the company accept the project if the project has a similar risk to the existing firm? Provide appropriate calculations. IX. A corporate debenture is expected to mature in 4 years' time. It has a nominal value of 100 and an annual coupon rate of 7.25%. The coupons are paid semi-annually. The current market interest rate is 7.00%. Estimate the price at which this debenture is currently trading. X. Explain the concept of relevant cash flows. Provide two examples of non-relevant cash flows. (50-100 words)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started