please help me with this question.

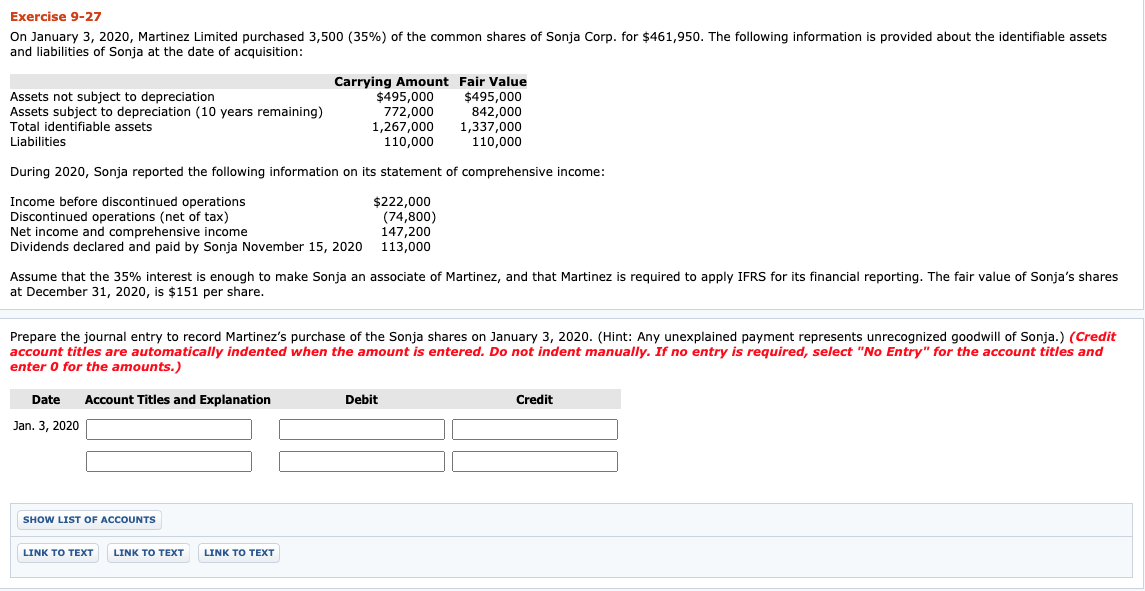

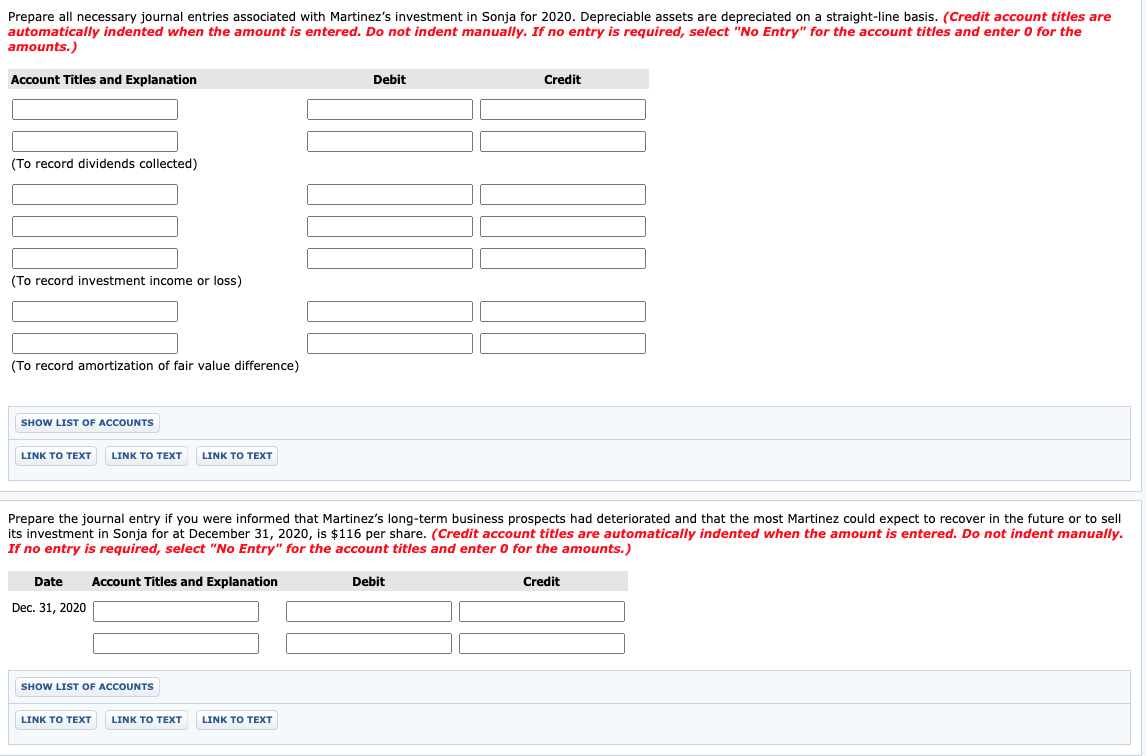

Exercise 9-27 On January 3, 2020, Martinez Limited purchased 3,500 (35%) of the common shares of Sonja Corp. for $461,950. The following information is provided about the identifiable assets and liabilities of Sonja at the date of acquisition: Carrying Amount Fair Value Assets not subject to depreciation $495,000 $495,000 Assets subject to depreciation (10 years remaining) 772,000 842,000 Total identifiable assets 1,267,000 1,337,000 Liabilities 110,000 110,000 During 2020, Sonja reported the following information on its statement of comprehensive income: Income before discontinued operations $222,000 Discontinued operations (net of tax) (74,800) Net income and comprehensive income 147,200 Dividends declared and paid by Sonja November 15, 2020 113,000 Assume that the 35% interest is enough to make Sonja an associate of Martinez, and that Martinez is required to apply IFRS for its financial reporting. The fair value of Sonja's shares at December 31, 2020, is $151 per share. Prepare the journal entry to record Martinez's purchase of the Sonja shares on January 3, 2020. (Hint: Any unexplained payment represents unrecognized goodwill of Sonja.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 3, 2020 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXTPrepare all necessary journal entries associated with Martinez's investment in Sonja for 2020. Depreciable assets are depreciated on a straight-line basis. (Credit account titles are amounts.) automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the Account Titles and Explanation Debit Credit (To record dividends collected) (To record investment income or loss) (To record amortization of fair value difference) SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT Prepare the journal entry if you were informed that Martinez's long-term business prospects had deteriorated and that the most Martinez could expect to recover in the future or to sell its investment in Sonja for at December 31, 2020, is $116 per share. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT