Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with this question! Happy Releaf Ltd 2018 was a lucky year for Penelope Wildflower! She was one of the first Canadians awarded

please help me with this question!

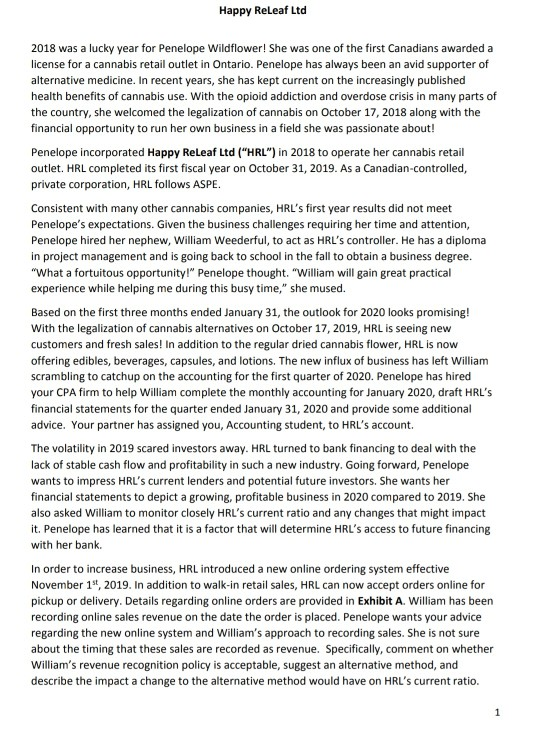

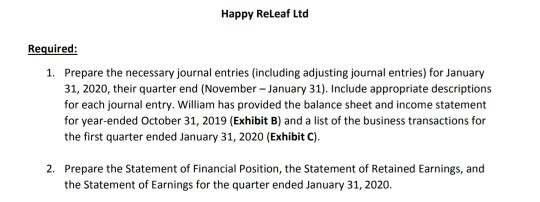

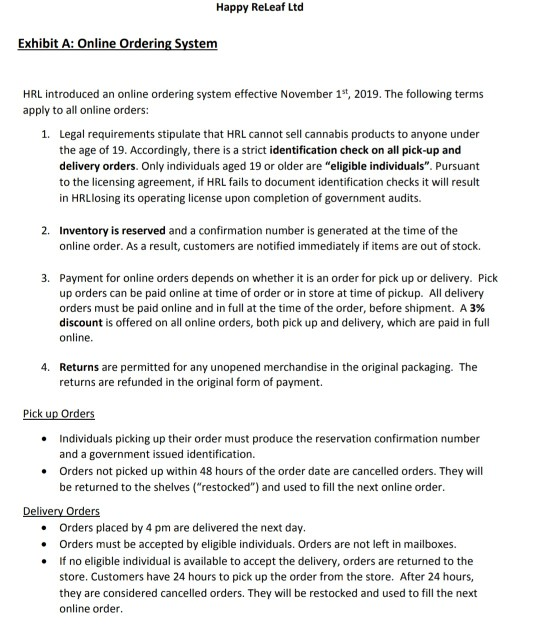

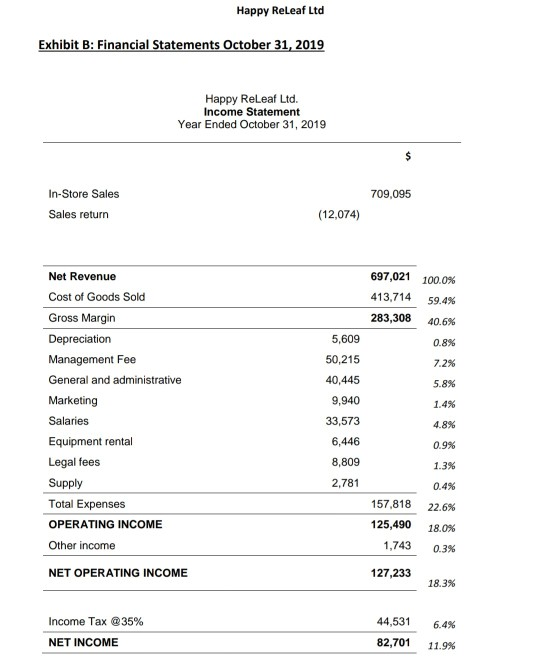

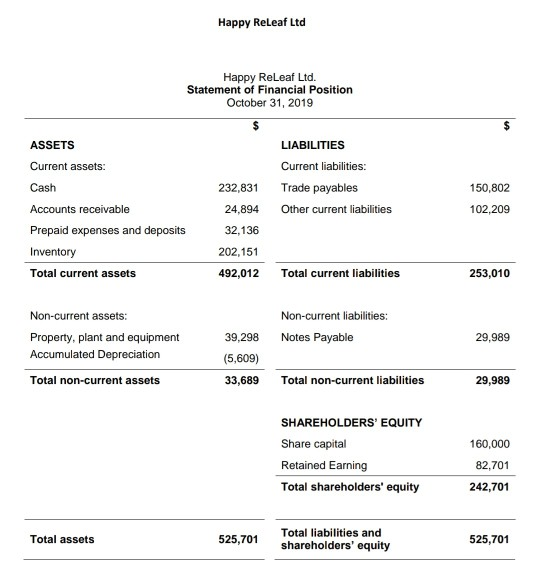

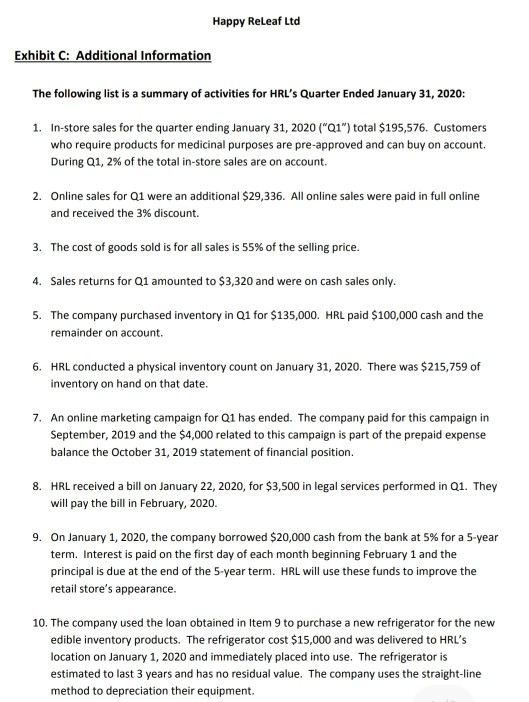

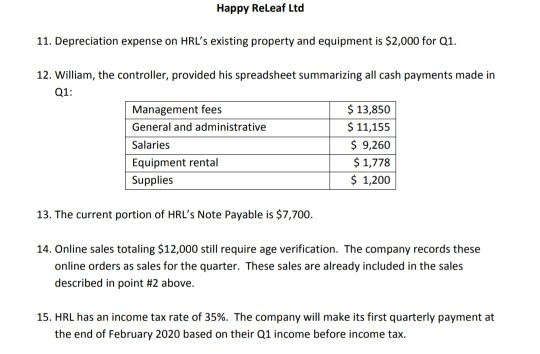

Happy Releaf Ltd 2018 was a lucky year for Penelope Wildflower! She was one of the first Canadians awarded a license for a cannabis retail outlet in Ontario. Penelope has always been an avid supporter of alternative medicine. In recent years, she has kept current on the increasingly published health benefits of cannabis use. With the opioid addiction and overdose crisis in many parts of the country, she welcomed the legalization of cannabis on October 17, 2018 along with the financial opportunity to run her own business in a field she was passionate about! Penelope incorporated Happy Releaf Ltd ("HRL") in 2018 to operate her cannabis retail outlet.HRL completed its first fiscal year on October 31, 2019. As a Canadian-controlled, private corporation, HRL follows ASPE. Consistent with many other cannabis companies, HRL's first year results did not meet Penelope's expectations. Given the business challenges requiring her time and attention, Penelope hired her nephew, William Weederful, to act as HRL's controller. He has a diploma in project management and is going back to school in the fall to obtain a business degree. "What a fortuitous opportunity!" Penelope thought. "William will gain great practical experience while helping me during this busy time," she mused. Based on the first three months ended January 31, the outlook for 2020 looks promising! With the legalization of cannabis alternatives on October 17, 2019, HRL is seeing new customers and fresh sales! In addition to the regular dried cannabis flower, HRL is now offering edibles, beverages, capsules, and lotions. The new influx of business has left William scrambling to catchup on the accounting for the first quarter of 2020. Penelope has hired your CPA firm to help William complete the monthly accounting for January 2020, draft HRL'S financial statements for the quarter ended January 31, 2020 and provide some additional advice. Your partner has assigned you, Accounting student, to HRL's account. The volatility in 2019 scared investors away. HRL turned to bank financing to deal with the lack of stable cash flow and profitability in such a new industry. Going forward, Penelope wants to impress HRL's current lenders and potential future investors. She wants her financial statements to depict a growing, profitable business in 2020 compared to 2019. She also asked William to monitor closely HRL's current ratio and any changes that might impact it. Penelope has learned that it is a factor that will determine HRL's access to future financing with her bank. In order to increase business, HRL introduced a new online ordering system effective November 1, 2019. In addition to walk-in retail sales, HRL can now accept orders online for pickup or delivery. Details regarding online orders are provided in Exhibit A. William has been recording online sales revenue on the date the order is placed. Penelope wants your advice regarding the new online system and William's approach to recording sales. She is not sure about the timing that these sales are recorded as revenue. Specifically, comment on whether William's revenue recognition policy is acceptable, suggest an alternative method, and describe the impact a change to the alternative method would have on HRL's current ratio. Happy Releaf Ltd Required: 1. Prepare the necessary journal entries (including adjusting journal entries) for January 31, 2020, their quarter end (November - January 31). Include appropriate descriptions for each journal entry. William has provided the balance sheet and income statement for year-ended October 31, 2019 (Exhibit B) and a list of the business transactions for the first quarter ended January 31, 2020 (Exhibit C). 2. Prepare the Statement of Financial Position, the Statement of Retained Earnings, and the Statement of Earnings for the quarter ended January 31, 2020. Happy Releaf Ltd Exhibit A: Online Ordering System HRL introduced an online ordering system effective November 19, 2019. The following terms apply to all online orders: 1. Legal requirements stipulate that HRL cannot sell cannabis products to anyone under the age of 19. Accordingly, there is a strict identification check on all pick-up and delivery orders. Only individuals aged 19 or older are "eligible individuals". Pursuant to the licensing agreement, if HRL fails to document identification checks it will result in HRLlosing its operating license upon completion of government audits. 2. Inventory is reserved and a confirmation number is generated at the time of the online order. As a result, customers are notified immediately if items are out of stock. 3. Payment for online orders depends on whether it is an order for pick up or delivery. Pick up orders can be paid online at time of order or in store at time of pickup. All delivery orders must be paid online and in full at the time of the order, before shipment. A 3% discount is offered on all online orders, both pick up and delivery, which are paid in full online. 4. Returns are permitted for any unopened merchandise in the original packaging. The returns are refunded in the original form of payment. Pick up Orders Individuals picking up their order must produce the reservation confirmation number and a government issued identification. Orders not picked up within 48 hours of the order date are cancelled orders. They will be returned to the shelves ("restocked") and used to fill the next online order. Delivery Orders Orders placed by 4 pm are delivered the next day. Orders must be accepted by eligible individuals. Orders are not left in mailboxes. If no eligible individual is available to accept the delivery, orders are returned to the store. Customers have 24 hours to pick up the order from the store. After 24 hours, they are considered cancelled orders. They will be restocked and used to fill the next online order. Happy Releaf Ltd Exhibit B: Financial Statements October 31, 2019 Happy ReLeaf Ltd. Income Statement Year Ended October 31, 2019 709,095 In-Store Sales Sales return (12,074) Net Revenue Cost of Goods Sold Gross Margin Depreciation Management Fee General and administrative Marketing Salaries Equipment rental Legal fees 5,609 50,215 40,445 9,940 33,573 6,446 8,809 697,021 100.0% 413,714 59.4% 283,308 40.6% 0.8% 7.2% 5.8% 1.4% 4.8% 0.9% 1.3% Supply 2.781 0.4% Total Expenses OPERATING INCOME 157,818 125,490 1,743 22.6% 18.0% 0.3% Other income NET OPERATING INCOME 127,233 18.3% Income Tax @35% NET INCOME 44,531 82,701 6.4% 11.9% Happy ReLeaf Ltd Happy ReLeaf Ltd. Statement of Financial Position October 31, 2019 LIABILITIES ASSETS Current assets: Cash Accounts receivable Prepaid expenses and deposits Inventory Total current assets Current liabilities: Trade payables Other current liabilities 150,802 102,209 232,831 24,894 32,136 202,151 492,012 Total current liabilities 253,010 Non-current assets: Property, plant and equipment Accumulated Depreciation Non-current liabilities: Notes Payable 29,989 39,298 (5,609) Total non-current assets Total non-current liabilities 29,989 SHAREHOLDERS' EQUITY Share capital Retained Earning Total shareholders' equity 160,000 82,701 242,701 Total assets 525,701 Total liabilities and shareholders' equity 525,701 Happy Releaf Ltd Exhibit C: Additional Information The following list is a summary of activities for HRL's Quarter Ended January 31, 2020: 1. In-store sales for the quarter ending January 31, 2020 ("Q1") total $195,576. Customers who require products for medicinal purposes are pre-approved and can buy on account. During Q1, 2% of the total in-store sales are on account. 2. Online sales for Q1 were an additional $29,336. All online sales were paid in full online and received the 3% discount. 3. The cost of goods sold is for all sales is 55% of the selling price. 4. Sales returns for Q1 amounted to $3,320 and were on cash sales only. 5. The company purchased inventory in Q1 for $135,000. HRL paid $100,000 cash and the remainder on account. 6. HRL conducted a physical inventory count on January 31, 2020. There was $215,759 of inventory on hand on that date. 7. An online marketing campaign for Q1 has ended. The company paid for this campaign in September, 2019 and the $4,000 related to this campaign is part of the prepaid expense balance the October 31, 2019 statement of financial position. 8. HRL received a bill on January 22, 2020, for $3,500 in legal services performed in Q1. They will pay the bill in February, 2020. 9. On January 1, 2020, the company borrowed $20,000 cash from the bank at 5% for a 5-year term. Interest is paid on the first day of each month beginning February 1 and the principal is due at the end of the 5-year term. HRL will use these funds to improve the retail store's appearance. 10. The company used the loan obtained in Item 9 to purchase a new refrigerator for the new edible inventory products. The refrigerator cost $15,000 and was delivered to HRL'S location on January 1, 2020 and immediately placed into use. The refrigerator is estimated to last 3 years and has no residual value. The company uses the straight-line method to depreciation their equipment. Happy Releaf Ltd 11. Depreciation expense on HRL's existing property and equipment is $2,000 for 01. 12. William, the controller, provided his spreadsheet summarizing all cash payments made in Q1: Management fees $ 13,850 General and administrative $ 11,155 Salaries $ 9,260 Equipment rental $ 1,778 Supplies $ 1,200 13. The current portion of HRL's Note Payable is $7,700. 14. Online sales totaling $12,000 still require age verification. The company records these online orders as sales for the quarter. These sales are already included in the sales described in point #2 above. 15. HRL has an income tax rate of 35%. The company will make its first quarterly payment at the end of February 2020 based on their Q1 income before income tax. Happy Releaf Ltd 2018 was a lucky year for Penelope Wildflower! She was one of the first Canadians awarded a license for a cannabis retail outlet in Ontario. Penelope has always been an avid supporter of alternative medicine. In recent years, she has kept current on the increasingly published health benefits of cannabis use. With the opioid addiction and overdose crisis in many parts of the country, she welcomed the legalization of cannabis on October 17, 2018 along with the financial opportunity to run her own business in a field she was passionate about! Penelope incorporated Happy Releaf Ltd ("HRL") in 2018 to operate her cannabis retail outlet.HRL completed its first fiscal year on October 31, 2019. As a Canadian-controlled, private corporation, HRL follows ASPE. Consistent with many other cannabis companies, HRL's first year results did not meet Penelope's expectations. Given the business challenges requiring her time and attention, Penelope hired her nephew, William Weederful, to act as HRL's controller. He has a diploma in project management and is going back to school in the fall to obtain a business degree. "What a fortuitous opportunity!" Penelope thought. "William will gain great practical experience while helping me during this busy time," she mused. Based on the first three months ended January 31, the outlook for 2020 looks promising! With the legalization of cannabis alternatives on October 17, 2019, HRL is seeing new customers and fresh sales! In addition to the regular dried cannabis flower, HRL is now offering edibles, beverages, capsules, and lotions. The new influx of business has left William scrambling to catchup on the accounting for the first quarter of 2020. Penelope has hired your CPA firm to help William complete the monthly accounting for January 2020, draft HRL'S financial statements for the quarter ended January 31, 2020 and provide some additional advice. Your partner has assigned you, Accounting student, to HRL's account. The volatility in 2019 scared investors away. HRL turned to bank financing to deal with the lack of stable cash flow and profitability in such a new industry. Going forward, Penelope wants to impress HRL's current lenders and potential future investors. She wants her financial statements to depict a growing, profitable business in 2020 compared to 2019. She also asked William to monitor closely HRL's current ratio and any changes that might impact it. Penelope has learned that it is a factor that will determine HRL's access to future financing with her bank. In order to increase business, HRL introduced a new online ordering system effective November 1, 2019. In addition to walk-in retail sales, HRL can now accept orders online for pickup or delivery. Details regarding online orders are provided in Exhibit A. William has been recording online sales revenue on the date the order is placed. Penelope wants your advice regarding the new online system and William's approach to recording sales. She is not sure about the timing that these sales are recorded as revenue. Specifically, comment on whether William's revenue recognition policy is acceptable, suggest an alternative method, and describe the impact a change to the alternative method would have on HRL's current ratio. Happy Releaf Ltd Required: 1. Prepare the necessary journal entries (including adjusting journal entries) for January 31, 2020, their quarter end (November - January 31). Include appropriate descriptions for each journal entry. William has provided the balance sheet and income statement for year-ended October 31, 2019 (Exhibit B) and a list of the business transactions for the first quarter ended January 31, 2020 (Exhibit C). 2. Prepare the Statement of Financial Position, the Statement of Retained Earnings, and the Statement of Earnings for the quarter ended January 31, 2020. Happy Releaf Ltd Exhibit A: Online Ordering System HRL introduced an online ordering system effective November 19, 2019. The following terms apply to all online orders: 1. Legal requirements stipulate that HRL cannot sell cannabis products to anyone under the age of 19. Accordingly, there is a strict identification check on all pick-up and delivery orders. Only individuals aged 19 or older are "eligible individuals". Pursuant to the licensing agreement, if HRL fails to document identification checks it will result in HRLlosing its operating license upon completion of government audits. 2. Inventory is reserved and a confirmation number is generated at the time of the online order. As a result, customers are notified immediately if items are out of stock. 3. Payment for online orders depends on whether it is an order for pick up or delivery. Pick up orders can be paid online at time of order or in store at time of pickup. All delivery orders must be paid online and in full at the time of the order, before shipment. A 3% discount is offered on all online orders, both pick up and delivery, which are paid in full online. 4. Returns are permitted for any unopened merchandise in the original packaging. The returns are refunded in the original form of payment. Pick up Orders Individuals picking up their order must produce the reservation confirmation number and a government issued identification. Orders not picked up within 48 hours of the order date are cancelled orders. They will be returned to the shelves ("restocked") and used to fill the next online order. Delivery Orders Orders placed by 4 pm are delivered the next day. Orders must be accepted by eligible individuals. Orders are not left in mailboxes. If no eligible individual is available to accept the delivery, orders are returned to the store. Customers have 24 hours to pick up the order from the store. After 24 hours, they are considered cancelled orders. They will be restocked and used to fill the next online order. Happy Releaf Ltd Exhibit B: Financial Statements October 31, 2019 Happy ReLeaf Ltd. Income Statement Year Ended October 31, 2019 709,095 In-Store Sales Sales return (12,074) Net Revenue Cost of Goods Sold Gross Margin Depreciation Management Fee General and administrative Marketing Salaries Equipment rental Legal fees 5,609 50,215 40,445 9,940 33,573 6,446 8,809 697,021 100.0% 413,714 59.4% 283,308 40.6% 0.8% 7.2% 5.8% 1.4% 4.8% 0.9% 1.3% Supply 2.781 0.4% Total Expenses OPERATING INCOME 157,818 125,490 1,743 22.6% 18.0% 0.3% Other income NET OPERATING INCOME 127,233 18.3% Income Tax @35% NET INCOME 44,531 82,701 6.4% 11.9% Happy ReLeaf Ltd Happy ReLeaf Ltd. Statement of Financial Position October 31, 2019 LIABILITIES ASSETS Current assets: Cash Accounts receivable Prepaid expenses and deposits Inventory Total current assets Current liabilities: Trade payables Other current liabilities 150,802 102,209 232,831 24,894 32,136 202,151 492,012 Total current liabilities 253,010 Non-current assets: Property, plant and equipment Accumulated Depreciation Non-current liabilities: Notes Payable 29,989 39,298 (5,609) Total non-current assets Total non-current liabilities 29,989 SHAREHOLDERS' EQUITY Share capital Retained Earning Total shareholders' equity 160,000 82,701 242,701 Total assets 525,701 Total liabilities and shareholders' equity 525,701 Happy Releaf Ltd Exhibit C: Additional Information The following list is a summary of activities for HRL's Quarter Ended January 31, 2020: 1. In-store sales for the quarter ending January 31, 2020 ("Q1") total $195,576. Customers who require products for medicinal purposes are pre-approved and can buy on account. During Q1, 2% of the total in-store sales are on account. 2. Online sales for Q1 were an additional $29,336. All online sales were paid in full online and received the 3% discount. 3. The cost of goods sold is for all sales is 55% of the selling price. 4. Sales returns for Q1 amounted to $3,320 and were on cash sales only. 5. The company purchased inventory in Q1 for $135,000. HRL paid $100,000 cash and the remainder on account. 6. HRL conducted a physical inventory count on January 31, 2020. There was $215,759 of inventory on hand on that date. 7. An online marketing campaign for Q1 has ended. The company paid for this campaign in September, 2019 and the $4,000 related to this campaign is part of the prepaid expense balance the October 31, 2019 statement of financial position. 8. HRL received a bill on January 22, 2020, for $3,500 in legal services performed in Q1. They will pay the bill in February, 2020. 9. On January 1, 2020, the company borrowed $20,000 cash from the bank at 5% for a 5-year term. Interest is paid on the first day of each month beginning February 1 and the principal is due at the end of the 5-year term. HRL will use these funds to improve the retail store's appearance. 10. The company used the loan obtained in Item 9 to purchase a new refrigerator for the new edible inventory products. The refrigerator cost $15,000 and was delivered to HRL'S location on January 1, 2020 and immediately placed into use. The refrigerator is estimated to last 3 years and has no residual value. The company uses the straight-line method to depreciation their equipment. Happy Releaf Ltd 11. Depreciation expense on HRL's existing property and equipment is $2,000 for 01. 12. William, the controller, provided his spreadsheet summarizing all cash payments made in Q1: Management fees $ 13,850 General and administrative $ 11,155 Salaries $ 9,260 Equipment rental $ 1,778 Supplies $ 1,200 13. The current portion of HRL's Note Payable is $7,700. 14. Online sales totaling $12,000 still require age verification. The company records these online orders as sales for the quarter. These sales are already included in the sales described in point #2 above. 15. HRL has an income tax rate of 35%. The company will make its first quarterly payment at the end of February 2020 based on their Q1 income before income taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started