please help me with this question.

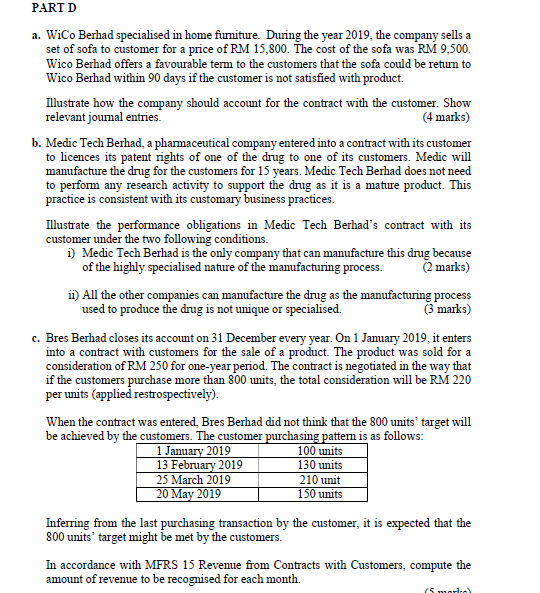

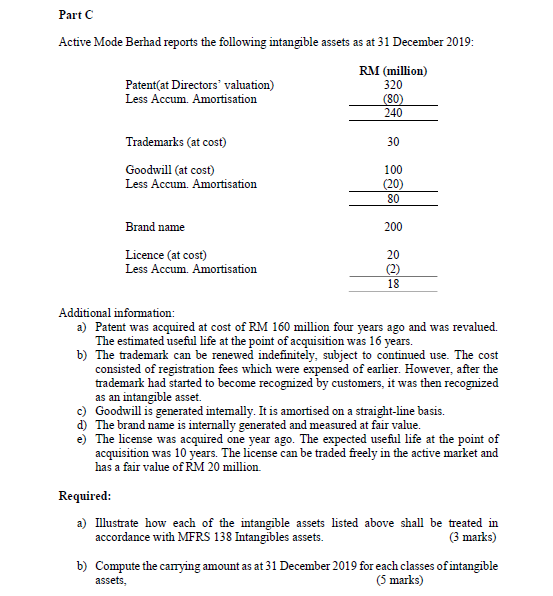

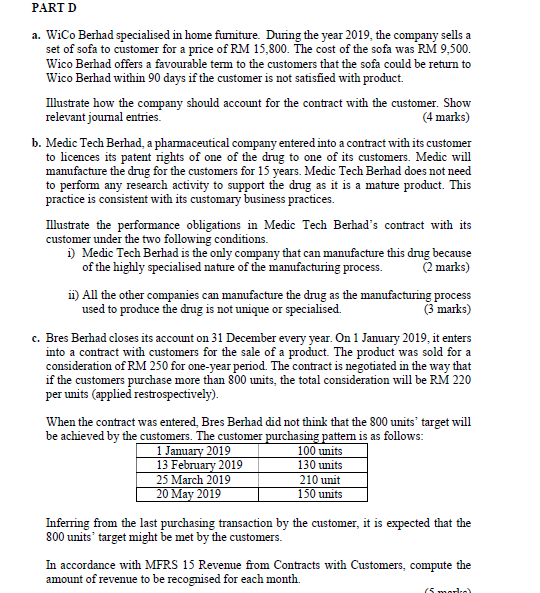

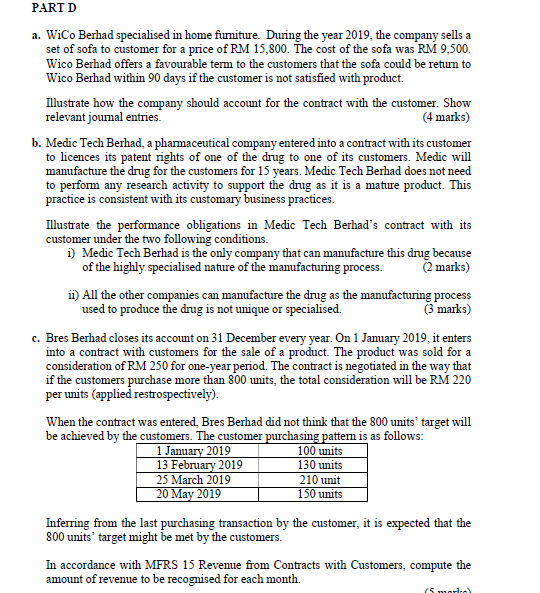

Part C Active Mode Berhad reports the following intangible assets as at 31 December 2019: RM (million) Patent(at Directors' valuation) 320 Less Accum. Amortisation 80 240 Trademarks (at cost) 30 Goodwill (at cost) 100 Less Accum. Amortisation (20 80 Brand name 200 Licence (at cost) 20 Less Accum. Amortisation (2) 18 Additional information: a) Patent was acquired at cost of RM 160 million four years ago and was revalued. The estimated useful life at the point of acquisition was 16 years. b) The trademark can be renewed indefinitely, subject to continued use. The cost consisted of registration fees which were expensed of earlier. However, after the trademark had started to become recognized by customers, it was then recognized as an intangible asset. c) Goodwill is generated internally. It is amortised on a straight-line basis. e) The brand name is internally generated and measured at fair value The license was acquired one year ago. The expected useful life at the point of acquisition was 10 years. The license can be traded freely in the active market and has a fair value of RM 20 million. Required: a) Illustrate how each of the intangible assets listed above shall be treated in accordance with MFRS 138 Intangibles assets. (3 marks) b) Compute the carrying amount as at 31 December 2019 for each classes of intangible assets, (3 marks)PART D a. WiCo Berhad specialised in home furniture. During the year 2019, the company sells a set of sofa to customer for a price of RM 15,800. The cost of the sofa was RM 9,500. Wico Berhad offers a favourable term to the customers that the sofa could be return to Wico Berhad within 90 days if the customer is not satisfied with product Illustrate how the company should account for the contract with the customer. Show relevant journal entries. (4 marks) b. Medic Tech Berhad, a pharmaceutical company entered into a contract with its customer to licences its patent rights of one of the drug to one of its customers. Medic will manufacture the drug for the customers for 15 years. Medic Tech Berhad does not need to perform any research activity to support the drug as it is a mature product. This practice is consistent with its customary business practices. Illustrate the performance obligations in Medic Tech Berhad's contract with its customer under the two following conditions. i) Medic Tech Berhad is the only company that can manufacture this drug because of the highly specialised nature of the manufacturing process. (2 marks) ii) All the other companies can manufacture the drug as the manufacturing process used to produce the drug is not unique or specialised. (3 marks) c. Bres Berhad closes its account on 31 December every year. On 1 January 2019, it enters into a contract with customers for the sale of a product. The product was sold for a consideration of RM 250 for one-year period. The contract is negotiated in the way that if the customers purchase more than 800 units, the total consideration will be RM 220 per units (applied restrospectively). When the contract was entered, Bres Berhad did not think that the 800 units' target will be achieved by the customers. The customer purchasing pattern is as follows: 1 January 2019 100 units 13 February 2019 130 units 25 March 2019 210 unit 20 May 2019 150 units Inferring from the last purchasing transaction by the customer, it is expected that the 800 units' target might be met by the customers. In accordance with MFRS 15 Revenue from Contracts with Customers, compute the amount of revenue to be recognised for each month