Answered step by step

Verified Expert Solution

Question

1 Approved Answer

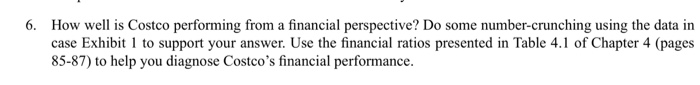

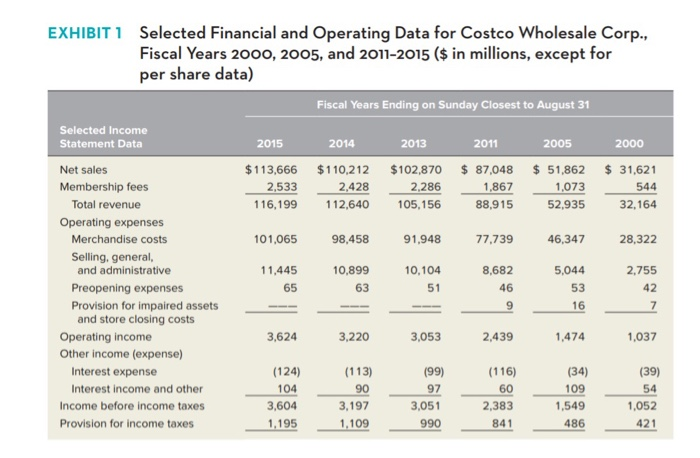

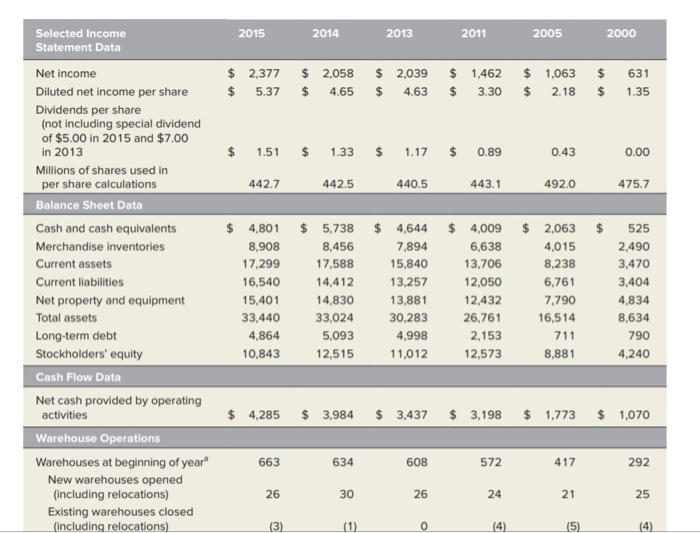

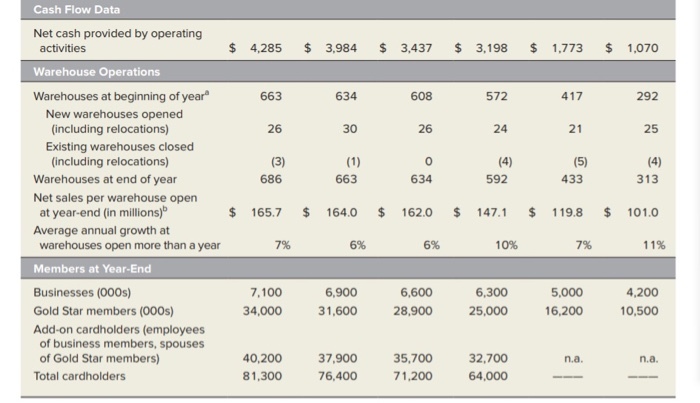

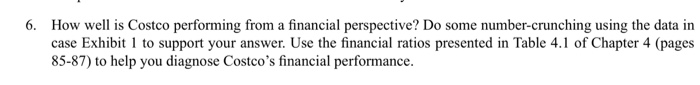

Please help me with this question,Thx. 6. How well is Costco performing from a financial perspective? Do some number-crunching using the data in case Exhibit

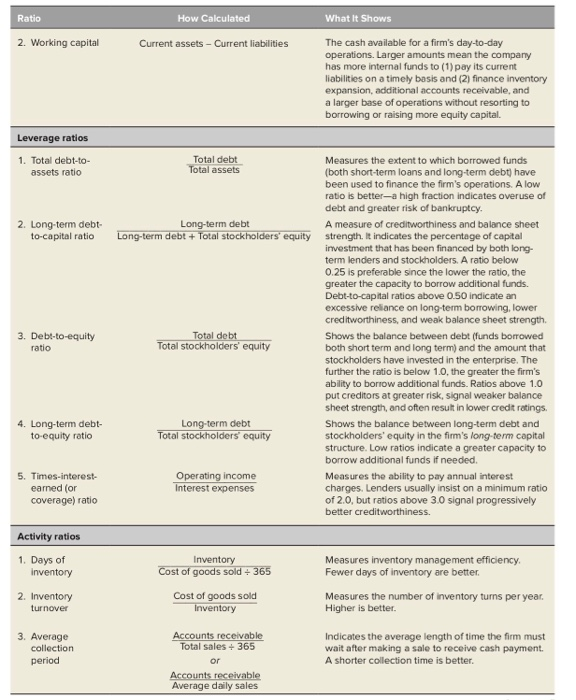

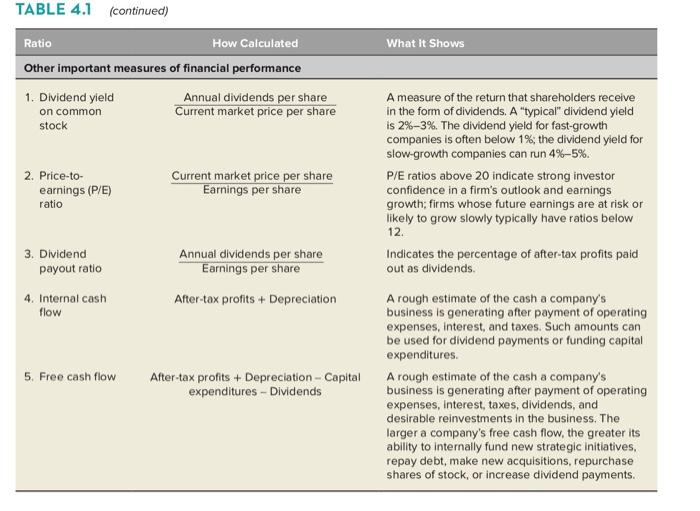

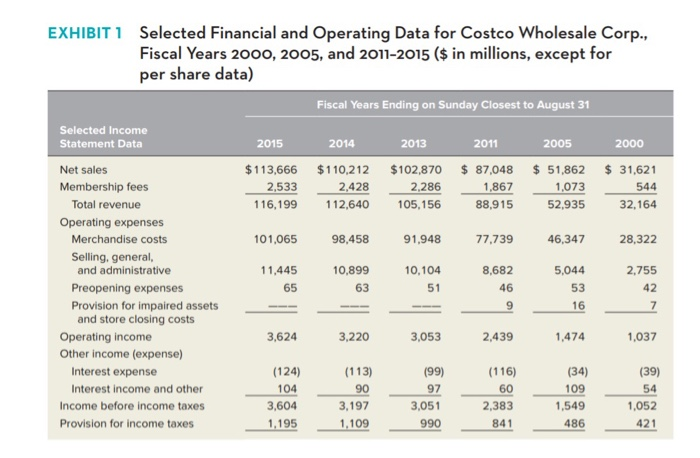

Please help me with this question,Thx.

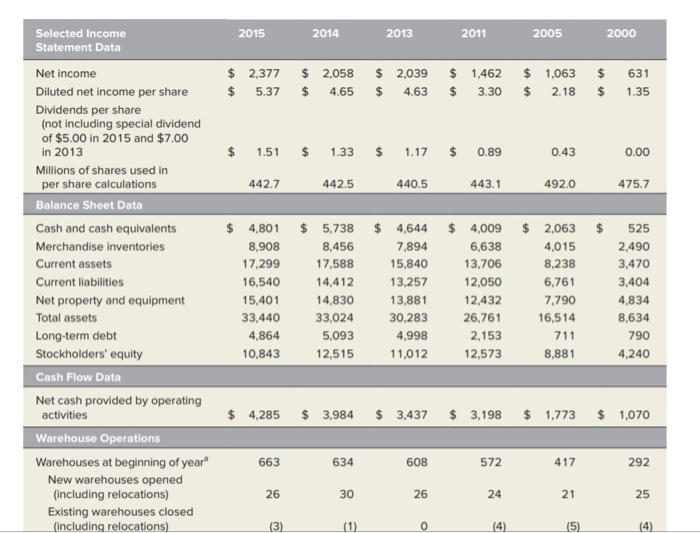

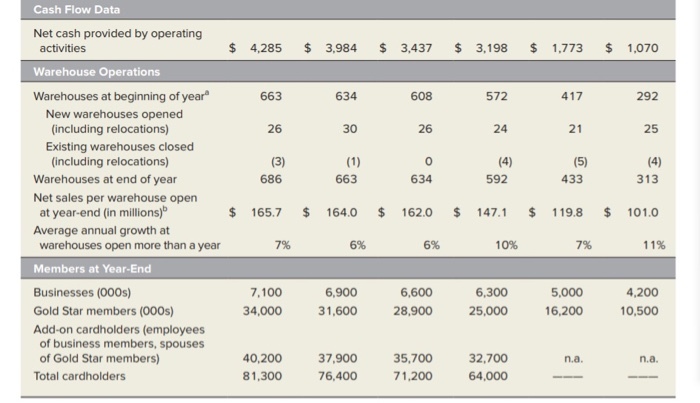

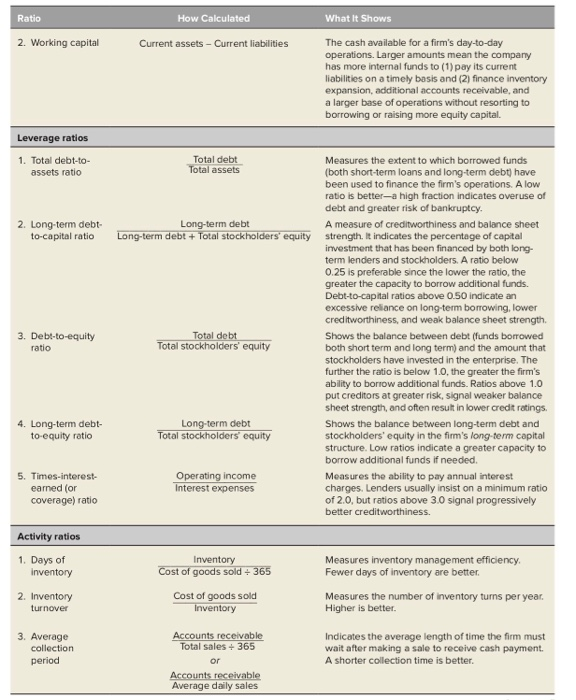

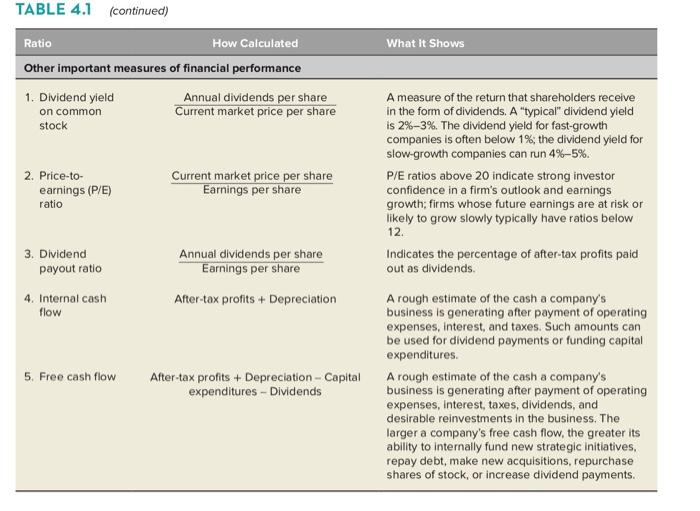

6. How well is Costco performing from a financial perspective? Do some number-crunching using the data in case Exhibit 1 to support your answer. Use the financial ratios presented in Table 4.1 of Chapter 4 (pages 85-87) to help you diagnose Costco's financial performance. EXHIBITI Selected Financial and Operating Data for Costco Wholesale Corp., Fiscal Years 2000, 2005, and 2011-2015 ($ in millions, except for per share data) Fiscal Years Ending on Sunday Closest to August 31 Selected Income Statement Data 2015 $113,666 2,533 116,199 2014 $110,212 2,428 112,640 2013 $102,870 2 ,286 105,156 2011 $ 87,048 1,867 88,915 2005 $ 51,862 1,073 52,935 2000 $ 31,621 32,164 101,065 98,458 91,948 77,739 46,347 28,322 10,899 5,044 11,445 65 10,104 51 8,682 46 2.755 42 63 Net sales Membership fees Total revenue Operating expenses Merchandise costs Selling, general, and administrative Preopening expenses Provision for impaired assets and store closing costs Operating income Other income (expense) Interest expense Interest income and other Income before income taxes Provision for income taxes 53 16 3,624 3,220 3,053 2,439 1,474 1,037 (116) (39) 60 54 (124) 104 3,604 1,195 (113) 90 3,197 1,109 (99) 97 3,051 990 (34) 109 1,549 486 2,383 841 1,052 421 Selected Income Statement Data 2015 2014 2013 2011 2005 2000 $ 2,377 $ 5.37 $ 2,058 $ 4.65 $ $ 2,039 4.63 $ 1,462 $ 3.30 $ 1,063 $ 2.18 $ $ 631 1.35 $ 1.51 $ 1.33 $ 1.17 $ 0.89 0.43 0.00 442.7 442.5 440.5 443.1 492.0 475.7 Net income Diluted net income per share Dividends per share (not including special dividend of $5.00 in 2015 and $7.00 in 2013 Millions of shares used in per share calculations Balance Sheet Data Cash and cash equivalents Merchandise inventories Current assets Current liabilities Net property and equipment Total assets Long-term debt Stockholders' equity Cash Flow Data $ $ $ $ $ $ 4,801 8,908 17,299 16,540 15,401 33,440 4,864 10,843 5,738 8,456 17,588 14,412 14,830 33,024 5,093 12,515 4,644 7,894 15,840 13,257 13,881 30,283 4,998 11,012 4,009 6,638 13,706 12,050 12,432 26,761 2,153 12,573 2,063 4,015 8,238 6,761 7.790 16,514 711 8,881 525 2,490 3,470 3,404 4,834 8,634 790 4,240 Net cash provided by operating activities $ 4,285 $ 3,984 $ 3.437 $ 3,198 $ 1,773 $ 1,070 Warehouse Operations Warehouses at beginning of year New warehouses opened (including relocations) Existing warehouses closed (including relocations) 663 - 26 (3) 634 30 (1) 608 26 o 572 24 (4) 417 21 (5) 292 25 (4) $ 3,984 $ 3,437 $3,198 $ 1,773 $ 1.070 572 417 26 30 (1) 663 24 (4) 592 21 (5) 433 25 (4) 313 634 Cash Flow Data Net cash provided by operating activities $ 4,285 Warehouse Operations Warehouses at beginning of year 663 New warehouses opened (including relocations) - 26 Existing warehouses closed (including relocations) (3) Warehouses at end of year 686 Net sales per warehouse open at year-end (in millions) $ 165.7 Average annual growth at warehouses open more than a year 7% Members at Year-End Businesses (000s) 7,100 Gold Star members (000s) 34,000 Add-on cardholders (employees of business members, spouses of Gold Star members) 40,200 Total cardholders 81,300 $ $ $ $ $ 164.0 6% 162.0 6% 147.1 10% 119.8 7% 101.0 11% 6,900 31,600 6,600 28,900 6,300 25,000 5,000 16,200 4,200 10,500 na. n.a. 37,900 76,400 35,700 71,200 32,700 64,000 Ratio How Calculated What It Shows 2. Working capital Current assets - Current liabilities The cash available for a firm's day-to-day operations. Larger amounts mean the company has more internal funds to (1) pay its current liabilities on a timely basis and (2) finance inventory expansion, additional accounts receivable, and a larger base of operations without resorting to borrowing or raising more equity capital. Leverage ratios 1. Total debt-to- assets ratio Total debt Total assets 2. Long-term debt- to-capital ratio Long-term debt Long-term debt + Total stockholders' equity 3. Debt-to-equity Total debt Total stockholders' equity Measures the extent to which borrowed funds (both short-term loans and long-term debt) have been used to finance the firm's operations. A low ratio is better-a high fraction indicates overuse of debt and greater risk of bankruptcy. A measure of creditworthiness and balance sheet strength. It indicates the percentage of capital investment that has been financed by both long- term lenders and stockholders. A ratio below 0.25 is preferable since the lower the ratio, the greater the capacity to borrow additional funds. Debt-to-capital ratios above 0.50 indicate an excessive reliance on long-term borrowing, lower creditworthiness, and weak balance sheet strength. Shows the balance between debt (funds borrowed both short term and long term) and the amount that stockholders have invested in the enterprise. The further the ratio is below 1.0. the greater the firm's ability to borrow additional funds. Ratios above 1.0 put creditors at greater risk, signal weaker balance sheet strength, and often result in lower credit ratings Shows the balance between long-term debt and stockholders' equity in the firm's long-term capital structure. Low ratios indicate a greater capacity to borrow additional funds if needed. Measures the ability to pay annual interest charges. Lenders usually insist on a minimum ratio of 2.0, but ratios above 3.0 signal progressively better creditworthiness. ratio 4. Long-term debt- to-equity ratio Long-term debt Total stockholders' equity 5. Times-interest- earned (or coverage) ratio Operating income Interest expenses Activity ratios 1. Days of inventory Inventory Cost of goods sold - 365 Measures inventory management efficiency Fewer days of inventory are better 2. Inventory turnover Cost of goods sold Inventory Measures the number of inventory turns per year. Higher is better. 3. Average collection period Accounts receivable Total sales - 365 Indicates the average length of time the firm must wait after making a sale to receive cash payment. A shorter collection time is better. or Accounts receivable Average daily sales TABLE 4.1 (continued) Ratio How Calculated What It Shows Other important measures of financial performance 1. Dividend yield on common stock Annual dividends per share Current market price per share A measure of the return that shareholders receive in the form of dividends. A "typical" dividend yield is 2%-3%. The dividend yield for fast-growth companies is often below 1%; the dividend yield for slow-growth companies can run 4%-5%. P/E ratios above 20 indicate strong investor confidence in a firm's outlook and earnings growth; firms whose future earnings are at risk or likely to grow slowly typically have ratios below 2. Price-to- earnings (P/E) ratio Current market price per share Earnings per share 12. 3. Dividend payout ratio Annual dividends per share Earnings per share Indicates the percentage of after-tax profits paid out as dividends. After-tax profits + Depreciation 4. Internal cash flow A rough estimate of the cash a company's business is generating after payment of operating expenses, interest, and taxes. Such amounts can be used for dividend payments or funding capital expenditures. 5. Free cash flow After-tax profits + Depreciation - Capital expenditures - Dividends A rough estimate of the cash a company's business is generating after payment of operating expenses, interest, taxes, dividends, and desirable reinvestments in the business. The larger a company's free cash flow, the greater its ability to internally fund new strategic initiatives, repay debt, make new acquisitions, repurchase shares of stock, or increase dividend payments. 6. How well is Costco performing from a financial perspective? Do some number-crunching using the data in case Exhibit 1 to support your answer. Use the financial ratios presented in Table 4.1 of Chapter 4 (pages 85-87) to help you diagnose Costco's financial performance. EXHIBITI Selected Financial and Operating Data for Costco Wholesale Corp., Fiscal Years 2000, 2005, and 2011-2015 ($ in millions, except for per share data) Fiscal Years Ending on Sunday Closest to August 31 Selected Income Statement Data 2015 $113,666 2,533 116,199 2014 $110,212 2,428 112,640 2013 $102,870 2 ,286 105,156 2011 $ 87,048 1,867 88,915 2005 $ 51,862 1,073 52,935 2000 $ 31,621 32,164 101,065 98,458 91,948 77,739 46,347 28,322 10,899 5,044 11,445 65 10,104 51 8,682 46 2.755 42 63 Net sales Membership fees Total revenue Operating expenses Merchandise costs Selling, general, and administrative Preopening expenses Provision for impaired assets and store closing costs Operating income Other income (expense) Interest expense Interest income and other Income before income taxes Provision for income taxes 53 16 3,624 3,220 3,053 2,439 1,474 1,037 (116) (39) 60 54 (124) 104 3,604 1,195 (113) 90 3,197 1,109 (99) 97 3,051 990 (34) 109 1,549 486 2,383 841 1,052 421 Selected Income Statement Data 2015 2014 2013 2011 2005 2000 $ 2,377 $ 5.37 $ 2,058 $ 4.65 $ $ 2,039 4.63 $ 1,462 $ 3.30 $ 1,063 $ 2.18 $ $ 631 1.35 $ 1.51 $ 1.33 $ 1.17 $ 0.89 0.43 0.00 442.7 442.5 440.5 443.1 492.0 475.7 Net income Diluted net income per share Dividends per share (not including special dividend of $5.00 in 2015 and $7.00 in 2013 Millions of shares used in per share calculations Balance Sheet Data Cash and cash equivalents Merchandise inventories Current assets Current liabilities Net property and equipment Total assets Long-term debt Stockholders' equity Cash Flow Data $ $ $ $ $ $ 4,801 8,908 17,299 16,540 15,401 33,440 4,864 10,843 5,738 8,456 17,588 14,412 14,830 33,024 5,093 12,515 4,644 7,894 15,840 13,257 13,881 30,283 4,998 11,012 4,009 6,638 13,706 12,050 12,432 26,761 2,153 12,573 2,063 4,015 8,238 6,761 7.790 16,514 711 8,881 525 2,490 3,470 3,404 4,834 8,634 790 4,240 Net cash provided by operating activities $ 4,285 $ 3,984 $ 3.437 $ 3,198 $ 1,773 $ 1,070 Warehouse Operations Warehouses at beginning of year New warehouses opened (including relocations) Existing warehouses closed (including relocations) 663 - 26 (3) 634 30 (1) 608 26 o 572 24 (4) 417 21 (5) 292 25 (4) $ 3,984 $ 3,437 $3,198 $ 1,773 $ 1.070 572 417 26 30 (1) 663 24 (4) 592 21 (5) 433 25 (4) 313 634 Cash Flow Data Net cash provided by operating activities $ 4,285 Warehouse Operations Warehouses at beginning of year 663 New warehouses opened (including relocations) - 26 Existing warehouses closed (including relocations) (3) Warehouses at end of year 686 Net sales per warehouse open at year-end (in millions) $ 165.7 Average annual growth at warehouses open more than a year 7% Members at Year-End Businesses (000s) 7,100 Gold Star members (000s) 34,000 Add-on cardholders (employees of business members, spouses of Gold Star members) 40,200 Total cardholders 81,300 $ $ $ $ $ 164.0 6% 162.0 6% 147.1 10% 119.8 7% 101.0 11% 6,900 31,600 6,600 28,900 6,300 25,000 5,000 16,200 4,200 10,500 na. n.a. 37,900 76,400 35,700 71,200 32,700 64,000 Ratio How Calculated What It Shows 2. Working capital Current assets - Current liabilities The cash available for a firm's day-to-day operations. Larger amounts mean the company has more internal funds to (1) pay its current liabilities on a timely basis and (2) finance inventory expansion, additional accounts receivable, and a larger base of operations without resorting to borrowing or raising more equity capital. Leverage ratios 1. Total debt-to- assets ratio Total debt Total assets 2. Long-term debt- to-capital ratio Long-term debt Long-term debt + Total stockholders' equity 3. Debt-to-equity Total debt Total stockholders' equity Measures the extent to which borrowed funds (both short-term loans and long-term debt) have been used to finance the firm's operations. A low ratio is better-a high fraction indicates overuse of debt and greater risk of bankruptcy. A measure of creditworthiness and balance sheet strength. It indicates the percentage of capital investment that has been financed by both long- term lenders and stockholders. A ratio below 0.25 is preferable since the lower the ratio, the greater the capacity to borrow additional funds. Debt-to-capital ratios above 0.50 indicate an excessive reliance on long-term borrowing, lower creditworthiness, and weak balance sheet strength. Shows the balance between debt (funds borrowed both short term and long term) and the amount that stockholders have invested in the enterprise. The further the ratio is below 1.0. the greater the firm's ability to borrow additional funds. Ratios above 1.0 put creditors at greater risk, signal weaker balance sheet strength, and often result in lower credit ratings Shows the balance between long-term debt and stockholders' equity in the firm's long-term capital structure. Low ratios indicate a greater capacity to borrow additional funds if needed. Measures the ability to pay annual interest charges. Lenders usually insist on a minimum ratio of 2.0, but ratios above 3.0 signal progressively better creditworthiness. ratio 4. Long-term debt- to-equity ratio Long-term debt Total stockholders' equity 5. Times-interest- earned (or coverage) ratio Operating income Interest expenses Activity ratios 1. Days of inventory Inventory Cost of goods sold - 365 Measures inventory management efficiency Fewer days of inventory are better 2. Inventory turnover Cost of goods sold Inventory Measures the number of inventory turns per year. Higher is better. 3. Average collection period Accounts receivable Total sales - 365 Indicates the average length of time the firm must wait after making a sale to receive cash payment. A shorter collection time is better. or Accounts receivable Average daily sales TABLE 4.1 (continued) Ratio How Calculated What It Shows Other important measures of financial performance 1. Dividend yield on common stock Annual dividends per share Current market price per share A measure of the return that shareholders receive in the form of dividends. A "typical" dividend yield is 2%-3%. The dividend yield for fast-growth companies is often below 1%; the dividend yield for slow-growth companies can run 4%-5%. P/E ratios above 20 indicate strong investor confidence in a firm's outlook and earnings growth; firms whose future earnings are at risk or likely to grow slowly typically have ratios below 2. Price-to- earnings (P/E) ratio Current market price per share Earnings per share 12. 3. Dividend payout ratio Annual dividends per share Earnings per share Indicates the percentage of after-tax profits paid out as dividends. After-tax profits + Depreciation 4. Internal cash flow A rough estimate of the cash a company's business is generating after payment of operating expenses, interest, and taxes. Such amounts can be used for dividend payments or funding capital expenditures. 5. Free cash flow After-tax profits + Depreciation - Capital expenditures - Dividends A rough estimate of the cash a company's business is generating after payment of operating expenses, interest, taxes, dividends, and desirable reinvestments in the business. The larger a company's free cash flow, the greater its ability to internally fund new strategic initiatives, repay debt, make new acquisitions, repurchase shares of stock, or increase dividend payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started