PLEASE help me with this! This is the 6th time I am re-uploading this question. I even have the chart below.

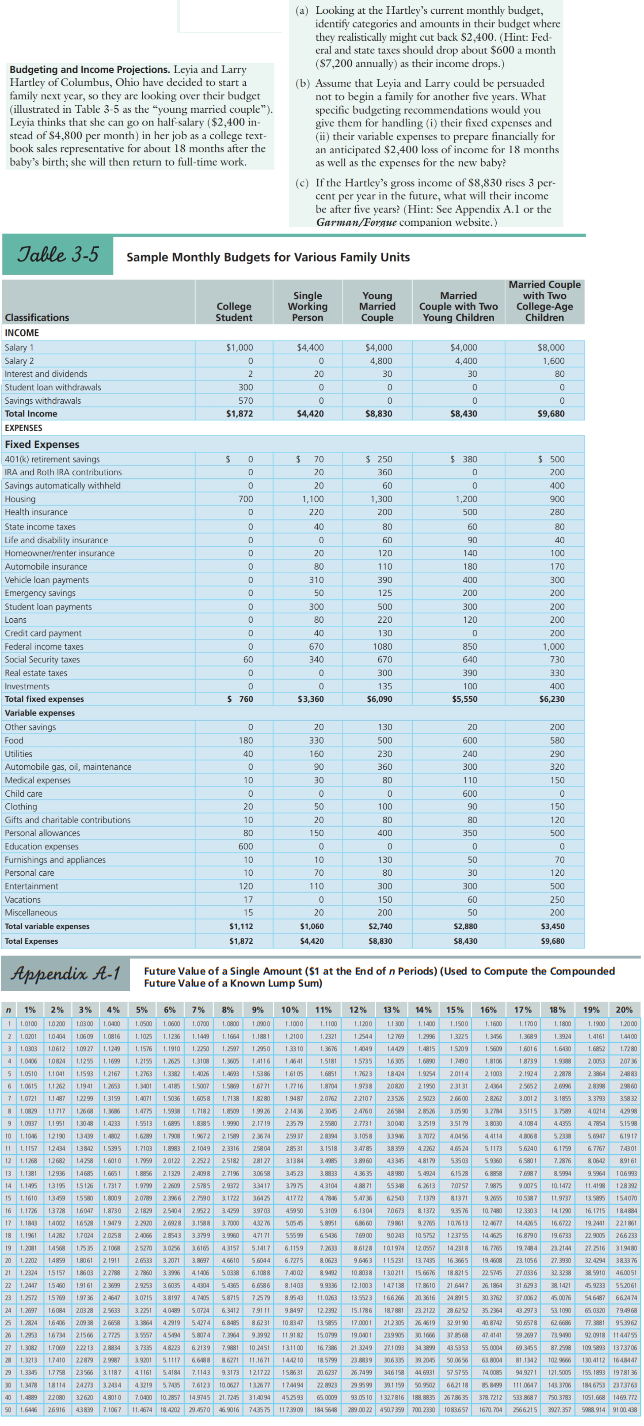

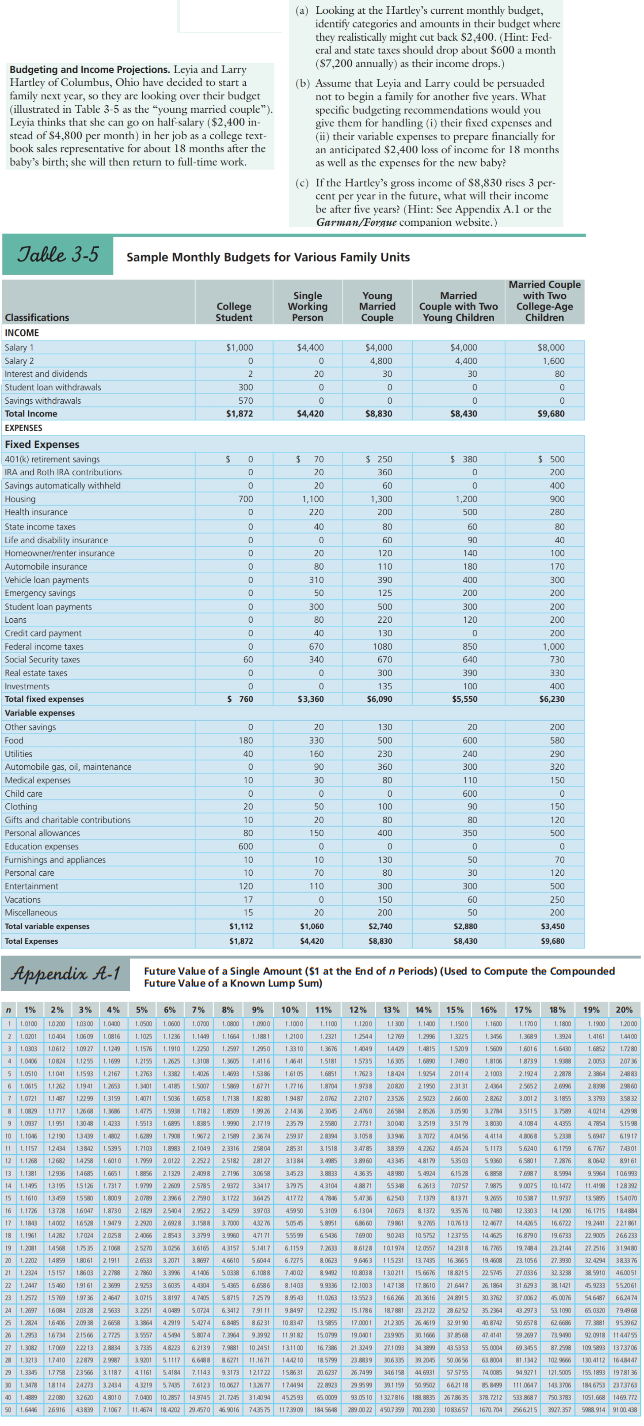

Budgeting and Income Projections. Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget (illustrated in Table 3-5 as the "young married couple"). Levia thinks that she can go on half salary ($2,400 in- stead of $4,800 per month) in her job as a college text- book sales representative for about 18 months after the baby's birth; she will then return to full-time work, (a) Looking at the Hartley's current monthly budget, identify categories and amounts in their budget where they realistically might cut back $2,400. (Hint: Fed- eral and state taxes should drop about $600 a month (97,200 annually) as their income drops.) (b) Assume that Leyia and Larry could be persuaded not to begin a family for another five years. What specific budgeting recommendations would you give them for handling (i) their fixed expenses and (ii) their variable expenses to prepare financially for an anticipated $2,400 loss of income for 18 months as well as the expenses for the new baby! (c) If the Hartley's gross income of $8,830 rises 3 per- cent per year in the future, what will their income be after five years? (Hint: See Appendix A.1 or the Garman/Forque companion website.) Jable 3-5 Sample Monthly Budgets for Various Family Units College Student Single Working Person Young Married Couple Married Couple with Two Young Children Married couple with Two College-Age Children $1,000 0 0 2 2 300 570 $1,872 $4,400 0 20 0 0 $4,420 $4,000 4,800 30 0 0 0 $8,830 $4,000 4,400 30 0 0 0 58,430 $8,000 1,600 80 0 0 0 59,680 $ 0 0 $ 380 0 0 700 D $ 70 20 20 1,100 220 40 0 0 0 0 0 D 0 20 80 310 Classifications INCOME Salary Salary 2 Interest and dividends Student loan withdrawals Savings withdrawals Total Income EXPENSES Fixed Expenses 401(k) retirement savings IRA and Roth IRA Contributions Savings automatically withheld Housing Health insurance State income taxes Life and disability insurance Homeowner/renter insurance Automobile insurance Vehicle loan payments Emergency savings Student loan payments Loans Credit card payment Federal income taxes Social Security taxes Real estate taxes Investments Total fixed expenses Variable expenses Other savings Food Utilities Automobile gas, oil, maintenance Medical expenses Child care Clothing Gifts and charitable contributions Personal allowances Education expenses Furnishings and appliances Personal care Entertainment Vacations Miscellaneous Total variable expenses $ 250 360 60 1,300 200 80 60 120 110 390 125 500 220 130 1080 670 300 135 $6,090 $ 500 200 400 900 280 80 40 100 170 300 200 200 200 200 1.000 730 330 400 $6,230 0 0 D 0 60 50 300 80 40 670 340 0 0 $ 760 0 0 $3,360 38889889383883389883882**98*1! D D 180 40 0 0 10 0 0 20 10 80 600 10 10 120 17 15 $1,112 $1,872 20 330 160 SO 30 0 0 50 20 150 130 500 230 360 80 0 100 80 400 0 0 130 80 300 150 200 $2,740 200 580 290 320 150 0 150 120 500 0 70 120 500 250 200 $3,450 $9,680 0 10 70 110 0 20 $1,060 $4,420 Total Expenses $8,830 Appendix A-1 Future Value of a Single Amount ($1 at the End of n Periods) (Used to compute the Compounded Future Value of a Known Lump Sum) 22 1.1941 n 1% 2% 3% 4% 1 1.0100 10200 1 10200 1.0300 10400 2 1.020110404 1.06.09 1.0816 3 1.0303 10612 1.0927 1.12 4 4 1.0006 108M11255 1.10m 5 1.050 1.1041 1.1593 1.2167 6 1.0615 1 262 7 7 1.0721 1.1487 1.2299 1.3199 8 109 11212 1.2008 1 . 9 1.0937 1.1951 1304 1.4233 10 1.100 1.2190 1349 1.22 11 1.1157 1.2434 1380 1.5295 12 1.126812682 14258 1.6010 13 1.1331 12936 14685 1.6651 14 1.113195 151 1.7317 15 1.1610139991558 1.8009 16 1.1726 13728 1601 1.8730 17 1.100 14002 16528 19179 18 1.1961 14282 1.70M 2.0258 19 1.2001 14568 1255 2.100 20 1.220214859 18061 21911 21 1.231.5157 18603 22 1.2447 1.5480 19161 2.3699 23 1.2572 157 1.973 2.4617 24 1.2897 16.08420328 25633 25 1.2 16.66 20938 2.6658 2 1.2953 16721566 2778 27 1.3082 1.700 2.2213 2.834 2 1.321317410 22879 2.997 29 1.33451.7758 23566 31187 30 MM 1. 18114 2427 M 40 1.4899 220803260 4.8010 50 1.6476 26916 4382 7.1067 5% 6% 7% 8% 9% 10% 11% 1.000 1.000 1.070 1.6800 10800 1.1000 1.1100 1.1075 1.1236 147 1166 1188 1.2100 1.2321 1.1576 1.1910 1.250 1.3310 1.66 1.2155 1. 1.3100 1.2005 14116 14 1.5181 1.2763 1.3382 1.40.26 1.43 1.5384 1610S 1.6851 1.01 1. 1.5007 1.5809 16721 17216 1.8704 10071 1.5036 1.6058 1.7138 18281 19487 2.0762 1.4775 1.592 1.7182 1.8509 199 2.14 2015 1.5513 1.6895 1.8885 1.9990 2.1719 23519 2.5580 1.9672 2199 2 25937 28094 1.7103 1.8983 2.1049 2.3316 25804 28531 3.1518 1.750 2.0122 2.2522 2.5182 28127 31384 3.85 2. 1329 24098 27196 30653 34523 3.8833 1.979 2.2609 2.5785 2.9372 33417 3.1975 43104 2070 23966 2.790 41772 4 2. 1829 2.5604 2.9522 39703 4999 53109 22920 20928 15 3.158 3.7000 432 500 5.8951 24066 2.8543 3.399 3.9960 47171 5.5599 6.5436 2.5270 3.0256 3.6165 43157 5.141 6.1159 7.633 2.6533 3.2071 3.8697 46610 5.6044 6.7275 8.0623 2.7860 33 4.1408 5.08 6.1088 7200 899 2.9253 3.6035 44304 5.4365 6.6586 8.1403 9.9336 3.0715 3.8197 47405 5.8715 7.359 8.9543 11.0263 3.2751 4.04999 5.0724 6.3412 79111 9.8497 12.2392 3.3864 42919 5.4274 6.885 108347 13.5855 4594 5.8074 9.1992 11 912 15.0199 3.7335 48223 6.2139 7.9881 102451 13110 16.73 3.9.201 5 1117 8.6271 11.1671 144210 18599 41161 54181 7.1143 9.3173 121722 15.8631 20.6237 43219 5. MIS 76123 100227 13.677 17419 22.0923 7.0400 10.2857 14.9745 21.7245 314094 45.7593 65.0009 11.4674 18.4202 29.4570 46.9016 7435 75 1173909 184.5648 12% 13% % 14% 15% 16% 1.1200 1.1 300 1.1400 1.1500 1.1600 1 1.2544 1279 1.2996 1.3225 1.3456 14049 14429 1.4813 1.5209 1.5609 15735 16 1.6090 1.1990 1.8106 1.7623 18424 1.9254 2.0114 2.1003 19738 208 2194 2. 1950 23131 2461 2.2107 23526 2.5022 2.6600 2.8262 2 AMO 265 20 3.0590 3274 2.7731 30040 3.2519 3.5179 3.8030 3.105 3.7072 40456 44114 3.4785 38359 4226 4.6524 5. 1173 38960 4335 481 53503 59380 4.3635 48980 5.4924 6.1528 48871 5538 6.2013 7.0757 7.9875 547) 6250 ZIN RII 9.2015 6.1304 70673 81372 93576 10.7490 6.00 79861 9.25 10.13 12.677 7.69.00 90243 10.5752 123755 144675 86128 10:19 120057 14.2018 16.75 9.6863 115231 13.7435 16.3665 19.4608 108038 130211 15.6676 188215 22.575 12.1003 147138 17.610 21647 26. 1864 13.5523 166266 20.3616 24.9915 303762 15.1786 18.7881 23.2122 28.6252 35.2364 17.0001 21.2305 26.4619 329190 40872 19.0001 21990 30.1666 47.4141 21.3249 27.100 3439 43.5353 55.0004 23.2009 306335 9201 500656 63.2004 26.7499 346158 44.6931 57.5755 74.0083 299599 2119 0902 662118 93.05101327816 188,8835 2678635 3787212 289.00 22 4907399 700.2330 1083657 167,704 17% 18% 19% 20% 1.1700 1. 1804 1.1900 1.2000 1.3689 1.392 1.4161 1.4400 16016 1.68 1.7280 18739 1.9 20053 207 2.1924 2.2878 2.3854 2.4883 2505 2099 29800 3.0012 3.1855 3.33 35832 35115 3.759 40214 4299 4.1084 44355 4.7854 5.1598 400 52 5692 61917 5.6240 6.1759 6.7767 74301 6.5801 7.2876 8.06.12 89161 7.6987 8.5994 9.5964 10.6993 9.0075 10.1472 11.4198 128392 105 11.9731 13. 154070 12.3303 14.1290 16.1715 184894 1442 16.6722 19.2011 221861 16.8790 19.6733 22.9005 266233 19.704 1994 232141 27.316 319180 23.1056 27.3930 32.4294 3833 27.0336 32.323 385910 460051 31.6293 3142 45.9233 55.2061 37.0062 45.000 546487 66.2474 43.2973 53.1090 65.03.20 79. 50.6578 62.66 77.381 953962 59.8097 73.920 92 0918 1144755 693455 87.25 109.59931373706 BL1M2 81.12 10296.66 130,4112 1648147 949271 121.500S 155. 1893 1978136 111067 1437 1846753 2373763 5338687 750.3783 1051.668 1469.772 2566215 3227.357 914 9100438 Budgeting and Income Projections. Leyia and Larry Hartley of Columbus, Ohio have decided to start a family next year, so they are looking over their budget (illustrated in Table 3-5 as the "young married couple"). Levia thinks that she can go on half salary ($2,400 in- stead of $4,800 per month) in her job as a college text- book sales representative for about 18 months after the baby's birth; she will then return to full-time work, (a) Looking at the Hartley's current monthly budget, identify categories and amounts in their budget where they realistically might cut back $2,400. (Hint: Fed- eral and state taxes should drop about $600 a month (97,200 annually) as their income drops.) (b) Assume that Leyia and Larry could be persuaded not to begin a family for another five years. What specific budgeting recommendations would you give them for handling (i) their fixed expenses and (ii) their variable expenses to prepare financially for an anticipated $2,400 loss of income for 18 months as well as the expenses for the new baby! (c) If the Hartley's gross income of $8,830 rises 3 per- cent per year in the future, what will their income be after five years? (Hint: See Appendix A.1 or the Garman/Forque companion website.) Jable 3-5 Sample Monthly Budgets for Various Family Units College Student Single Working Person Young Married Couple Married Couple with Two Young Children Married couple with Two College-Age Children $1,000 0 0 2 2 300 570 $1,872 $4,400 0 20 0 0 $4,420 $4,000 4,800 30 0 0 0 $8,830 $4,000 4,400 30 0 0 0 58,430 $8,000 1,600 80 0 0 0 59,680 $ 0 0 $ 380 0 0 700 D $ 70 20 20 1,100 220 40 0 0 0 0 0 D 0 20 80 310 Classifications INCOME Salary Salary 2 Interest and dividends Student loan withdrawals Savings withdrawals Total Income EXPENSES Fixed Expenses 401(k) retirement savings IRA and Roth IRA Contributions Savings automatically withheld Housing Health insurance State income taxes Life and disability insurance Homeowner/renter insurance Automobile insurance Vehicle loan payments Emergency savings Student loan payments Loans Credit card payment Federal income taxes Social Security taxes Real estate taxes Investments Total fixed expenses Variable expenses Other savings Food Utilities Automobile gas, oil, maintenance Medical expenses Child care Clothing Gifts and charitable contributions Personal allowances Education expenses Furnishings and appliances Personal care Entertainment Vacations Miscellaneous Total variable expenses $ 250 360 60 1,300 200 80 60 120 110 390 125 500 220 130 1080 670 300 135 $6,090 $ 500 200 400 900 280 80 40 100 170 300 200 200 200 200 1.000 730 330 400 $6,230 0 0 D 0 60 50 300 80 40 670 340 0 0 $ 760 0 0 $3,360 38889889383883389883882**98*1! D D 180 40 0 0 10 0 0 20 10 80 600 10 10 120 17 15 $1,112 $1,872 20 330 160 SO 30 0 0 50 20 150 130 500 230 360 80 0 100 80 400 0 0 130 80 300 150 200 $2,740 200 580 290 320 150 0 150 120 500 0 70 120 500 250 200 $3,450 $9,680 0 10 70 110 0 20 $1,060 $4,420 Total Expenses $8,830 Appendix A-1 Future Value of a Single Amount ($1 at the End of n Periods) (Used to compute the Compounded Future Value of a Known Lump Sum) 22 1.1941 n 1% 2% 3% 4% 1 1.0100 10200 1 10200 1.0300 10400 2 1.020110404 1.06.09 1.0816 3 1.0303 10612 1.0927 1.12 4 4 1.0006 108M11255 1.10m 5 1.050 1.1041 1.1593 1.2167 6 1.0615 1 262 7 7 1.0721 1.1487 1.2299 1.3199 8 109 11212 1.2008 1 . 9 1.0937 1.1951 1304 1.4233 10 1.100 1.2190 1349 1.22 11 1.1157 1.2434 1380 1.5295 12 1.126812682 14258 1.6010 13 1.1331 12936 14685 1.6651 14 1.113195 151 1.7317 15 1.1610139991558 1.8009 16 1.1726 13728 1601 1.8730 17 1.100 14002 16528 19179 18 1.1961 14282 1.70M 2.0258 19 1.2001 14568 1255 2.100 20 1.220214859 18061 21911 21 1.231.5157 18603 22 1.2447 1.5480 19161 2.3699 23 1.2572 157 1.973 2.4617 24 1.2897 16.08420328 25633 25 1.2 16.66 20938 2.6658 2 1.2953 16721566 2778 27 1.3082 1.700 2.2213 2.834 2 1.321317410 22879 2.997 29 1.33451.7758 23566 31187 30 MM 1. 18114 2427 M 40 1.4899 220803260 4.8010 50 1.6476 26916 4382 7.1067 5% 6% 7% 8% 9% 10% 11% 1.000 1.000 1.070 1.6800 10800 1.1000 1.1100 1.1075 1.1236 147 1166 1188 1.2100 1.2321 1.1576 1.1910 1.250 1.3310 1.66 1.2155 1. 1.3100 1.2005 14116 14 1.5181 1.2763 1.3382 1.40.26 1.43 1.5384 1610S 1.6851 1.01 1. 1.5007 1.5809 16721 17216 1.8704 10071 1.5036 1.6058 1.7138 18281 19487 2.0762 1.4775 1.592 1.7182 1.8509 199 2.14 2015 1.5513 1.6895 1.8885 1.9990 2.1719 23519 2.5580 1.9672 2199 2 25937 28094 1.7103 1.8983 2.1049 2.3316 25804 28531 3.1518 1.750 2.0122 2.2522 2.5182 28127 31384 3.85 2. 1329 24098 27196 30653 34523 3.8833 1.979 2.2609 2.5785 2.9372 33417 3.1975 43104 2070 23966 2.790 41772 4 2. 1829 2.5604 2.9522 39703 4999 53109 22920 20928 15 3.158 3.7000 432 500 5.8951 24066 2.8543 3.399 3.9960 47171 5.5599 6.5436 2.5270 3.0256 3.6165 43157 5.141 6.1159 7.633 2.6533 3.2071 3.8697 46610 5.6044 6.7275 8.0623 2.7860 33 4.1408 5.08 6.1088 7200 899 2.9253 3.6035 44304 5.4365 6.6586 8.1403 9.9336 3.0715 3.8197 47405 5.8715 7.359 8.9543 11.0263 3.2751 4.04999 5.0724 6.3412 79111 9.8497 12.2392 3.3864 42919 5.4274 6.885 108347 13.5855 4594 5.8074 9.1992 11 912 15.0199 3.7335 48223 6.2139 7.9881 102451 13110 16.73 3.9.201 5 1117 8.6271 11.1671 144210 18599 41161 54181 7.1143 9.3173 121722 15.8631 20.6237 43219 5. MIS 76123 100227 13.677 17419 22.0923 7.0400 10.2857 14.9745 21.7245 314094 45.7593 65.0009 11.4674 18.4202 29.4570 46.9016 7435 75 1173909 184.5648 12% 13% % 14% 15% 16% 1.1200 1.1 300 1.1400 1.1500 1.1600 1 1.2544 1279 1.2996 1.3225 1.3456 14049 14429 1.4813 1.5209 1.5609 15735 16 1.6090 1.1990 1.8106 1.7623 18424 1.9254 2.0114 2.1003 19738 208 2194 2. 1950 23131 2461 2.2107 23526 2.5022 2.6600 2.8262 2 AMO 265 20 3.0590 3274 2.7731 30040 3.2519 3.5179 3.8030 3.105 3.7072 40456 44114 3.4785 38359 4226 4.6524 5. 1173 38960 4335 481 53503 59380 4.3635 48980 5.4924 6.1528 48871 5538 6.2013 7.0757 7.9875 547) 6250 ZIN RII 9.2015 6.1304 70673 81372 93576 10.7490 6.00 79861 9.25 10.13 12.677 7.69.00 90243 10.5752 123755 144675 86128 10:19 120057 14.2018 16.75 9.6863 115231 13.7435 16.3665 19.4608 108038 130211 15.6676 188215 22.575 12.1003 147138 17.610 21647 26. 1864 13.5523 166266 20.3616 24.9915 303762 15.1786 18.7881 23.2122 28.6252 35.2364 17.0001 21.2305 26.4619 329190 40872 19.0001 21990 30.1666 47.4141 21.3249 27.100 3439 43.5353 55.0004 23.2009 306335 9201 500656 63.2004 26.7499 346158 44.6931 57.5755 74.0083 299599 2119 0902 662118 93.05101327816 188,8835 2678635 3787212 289.00 22 4907399 700.2330 1083657 167,704 17% 18% 19% 20% 1.1700 1. 1804 1.1900 1.2000 1.3689 1.392 1.4161 1.4400 16016 1.68 1.7280 18739 1.9 20053 207 2.1924 2.2878 2.3854 2.4883 2505 2099 29800 3.0012 3.1855 3.33 35832 35115 3.759 40214 4299 4.1084 44355 4.7854 5.1598 400 52 5692 61917 5.6240 6.1759 6.7767 74301 6.5801 7.2876 8.06.12 89161 7.6987 8.5994 9.5964 10.6993 9.0075 10.1472 11.4198 128392 105 11.9731 13. 154070 12.3303 14.1290 16.1715 184894 1442 16.6722 19.2011 221861 16.8790 19.6733 22.9005 266233 19.704 1994 232141 27.316 319180 23.1056 27.3930 32.4294 3833 27.0336 32.323 385910 460051 31.6293 3142 45.9233 55.2061 37.0062 45.000 546487 66.2474 43.2973 53.1090 65.03.20 79. 50.6578 62.66 77.381 953962 59.8097 73.920 92 0918 1144755 693455 87.25 109.59931373706 BL1M2 81.12 10296.66 130,4112 1648147 949271 121.500S 155. 1893 1978136 111067 1437 1846753 2373763 5338687 750.3783 1051.668 1469.772 2566215 3227.357 914 9100438