Answered step by step

Verified Expert Solution

Question

1 Approved Answer

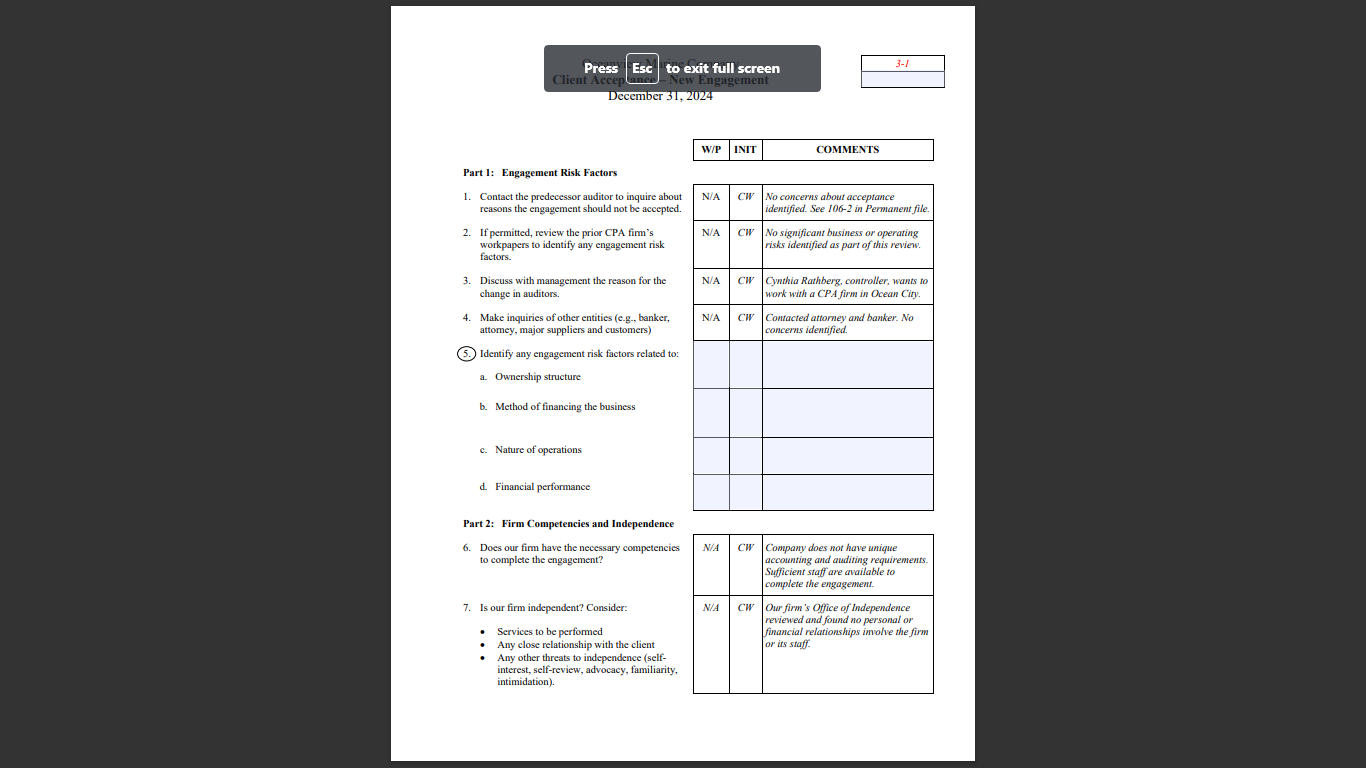

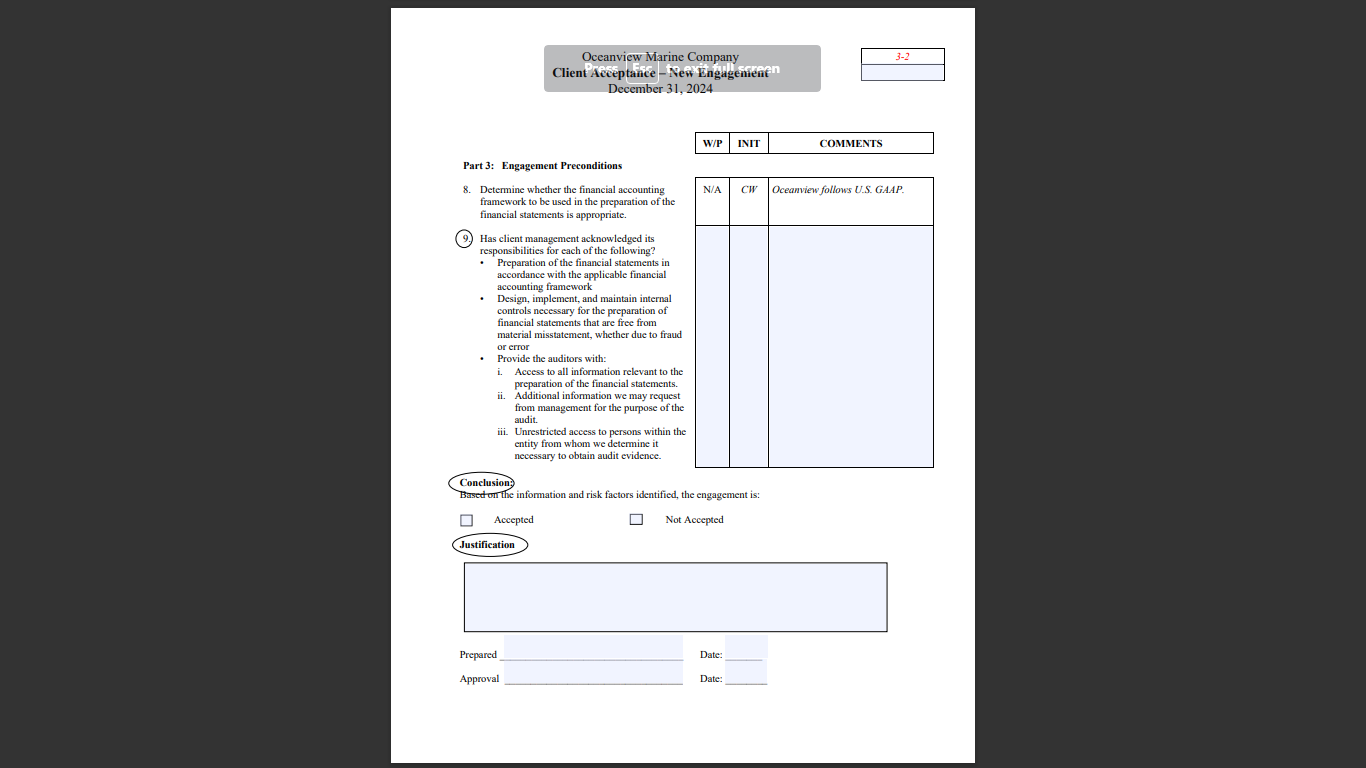

Please help me with this..Due this Saturday (10/7) Press Esc to exit full screen nt Accep ance New Engagement December 31, 2024 Part 1: Engagement

Please help me with this..Due this Saturday (10/7)

Press Esc to exit full screen nt Accep ance New Engagement December 31, 2024 Part 1: Engagement Risk Factors 1. Contact the predecessor auditor to inquire about reasons the engagement should not be accepted. 2. If permitted, review the prior CPA firm's workpapers to identify any engagement risk factors. 3. Discuss with management the reason for the change in auditors. 4. Make inquiries of other entities (e.g., banker, attorney, major suppliers and customers) (5.) Identify any engagement risk factors related to: a. Ownership structure b. Method of financing the business c. Nature of operations d. Financial performance Part 2: Firm Competencies and Independence 6. Does our firm have the necessary competencies to complete the engagement? 7. Is our firm independent? Consider: - Services to be performed - Any close relationship with the client - Any other threats to independence (selfinterest, self-review, advocacy, familiarity, intimidation). financial statements is appropriate. 9. Has client management acknowledged its responsibilities for each of the following? - Preparation of the financial statements in accordance with the applicable financial accounting framework - Design, implement, and maintain internal controls necessary for the preparation of financial statements that are free from material misstatement, whether due to fraud or error - Provide the auditors with: i. Access to all information relevant to the preparation of the financial statements. ii. Additional information we may request from management for the purpose of the audit. iii. Unrestricted access to persons within the entity from whom we determine it necessary to obtain audit evidence. Press Esc to exit full screen nt Accep ance New Engagement December 31, 2024 Part 1: Engagement Risk Factors 1. Contact the predecessor auditor to inquire about reasons the engagement should not be accepted. 2. If permitted, review the prior CPA firm's workpapers to identify any engagement risk factors. 3. Discuss with management the reason for the change in auditors. 4. Make inquiries of other entities (e.g., banker, attorney, major suppliers and customers) (5.) Identify any engagement risk factors related to: a. Ownership structure b. Method of financing the business c. Nature of operations d. Financial performance Part 2: Firm Competencies and Independence 6. Does our firm have the necessary competencies to complete the engagement? 7. Is our firm independent? Consider: - Services to be performed - Any close relationship with the client - Any other threats to independence (selfinterest, self-review, advocacy, familiarity, intimidation). financial statements is appropriate. 9. Has client management acknowledged its responsibilities for each of the following? - Preparation of the financial statements in accordance with the applicable financial accounting framework - Design, implement, and maintain internal controls necessary for the preparation of financial statements that are free from material misstatement, whether due to fraud or error - Provide the auditors with: i. Access to all information relevant to the preparation of the financial statements. ii. Additional information we may request from management for the purpose of the audit. iii. Unrestricted access to persons within the entity from whom we determine it necessary to obtain audit evidenceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started