Please help me with what i did wrong thanks

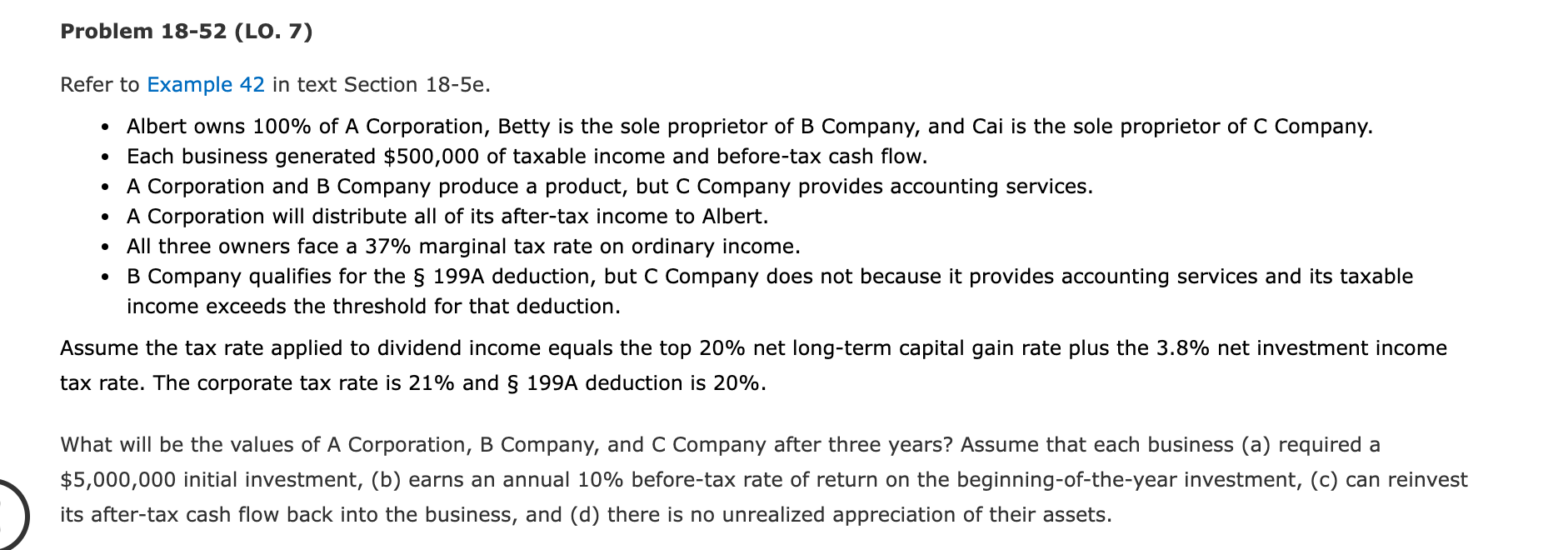

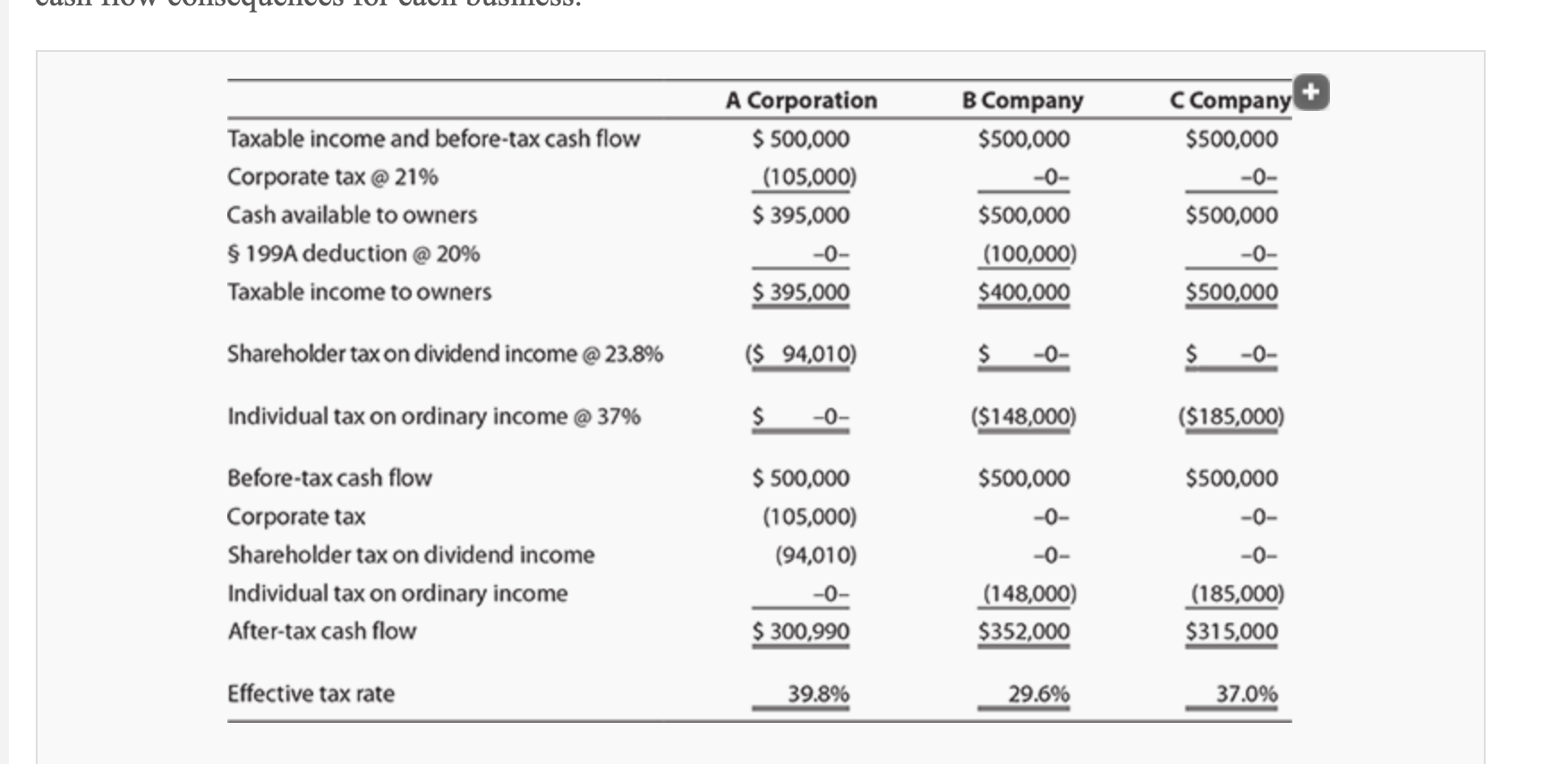

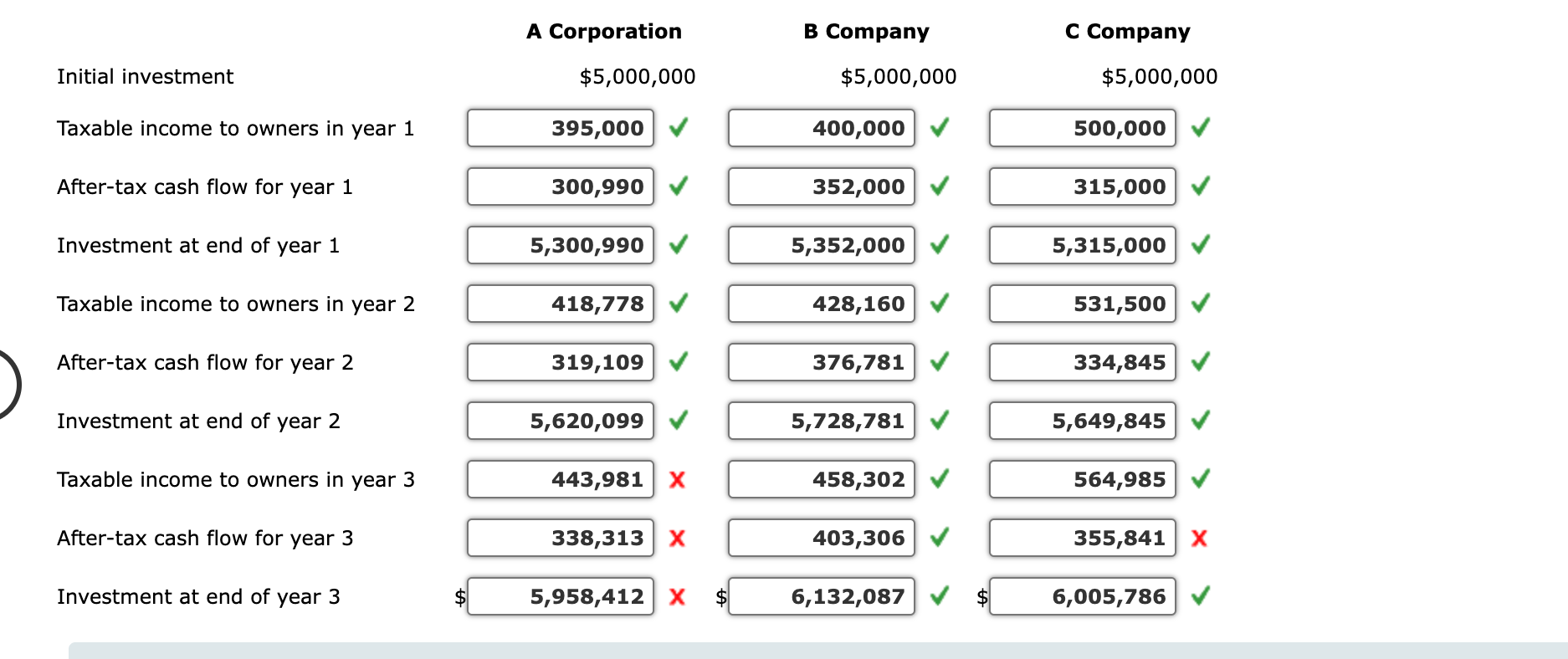

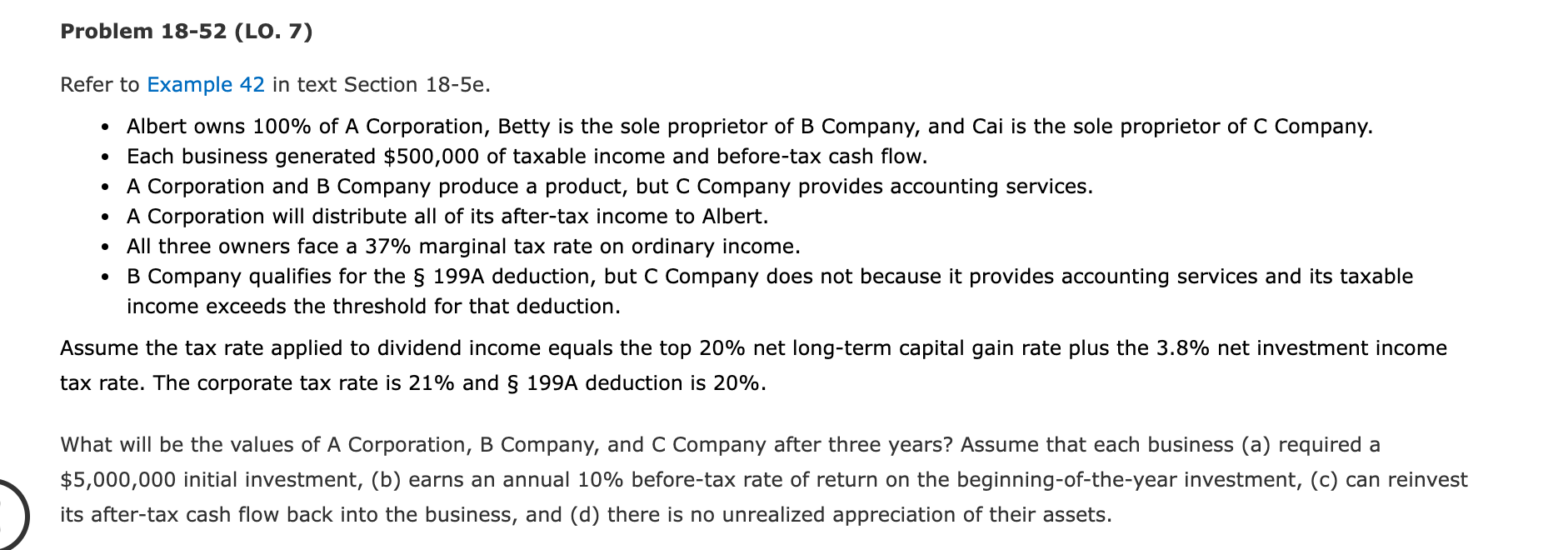

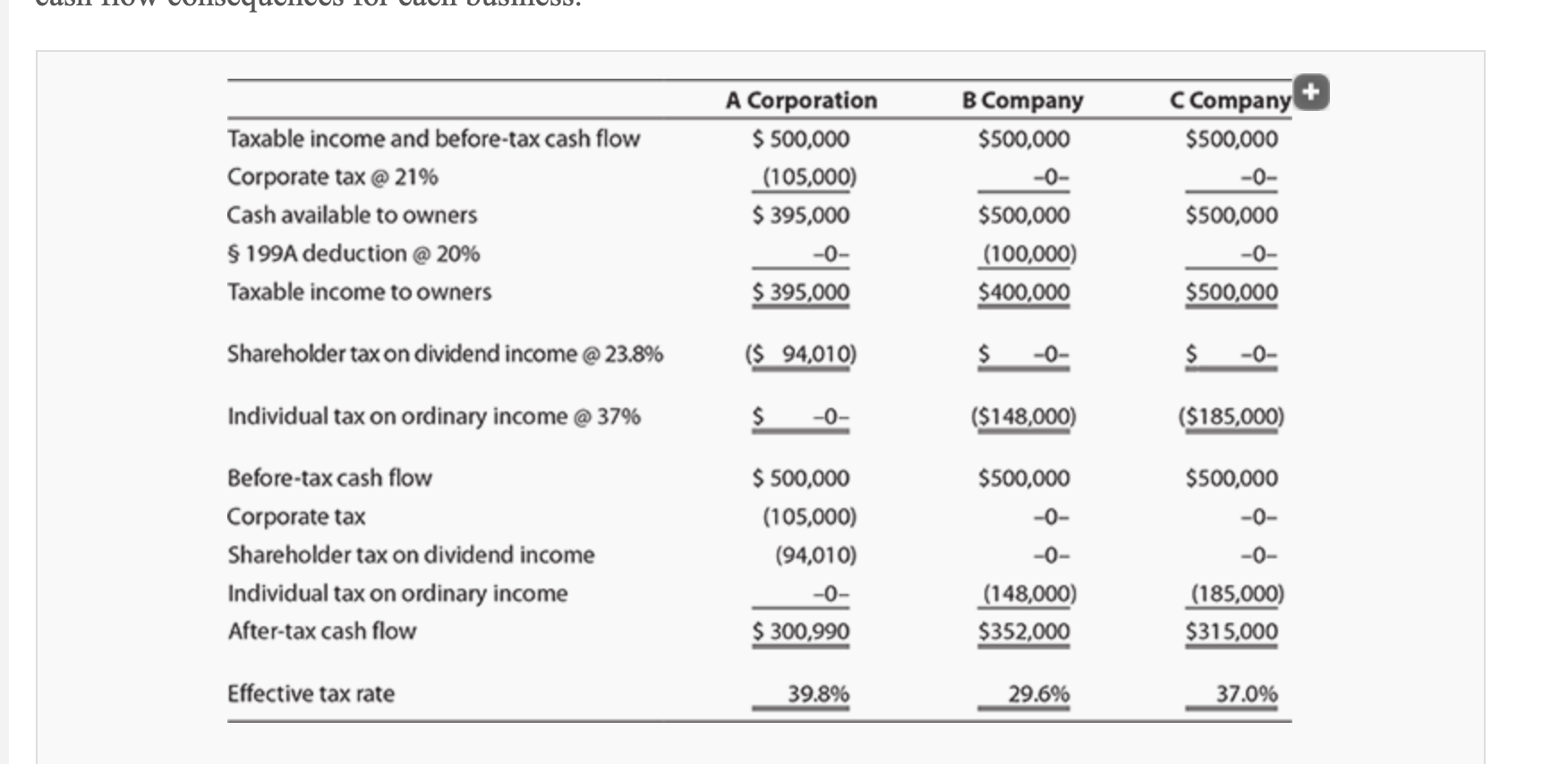

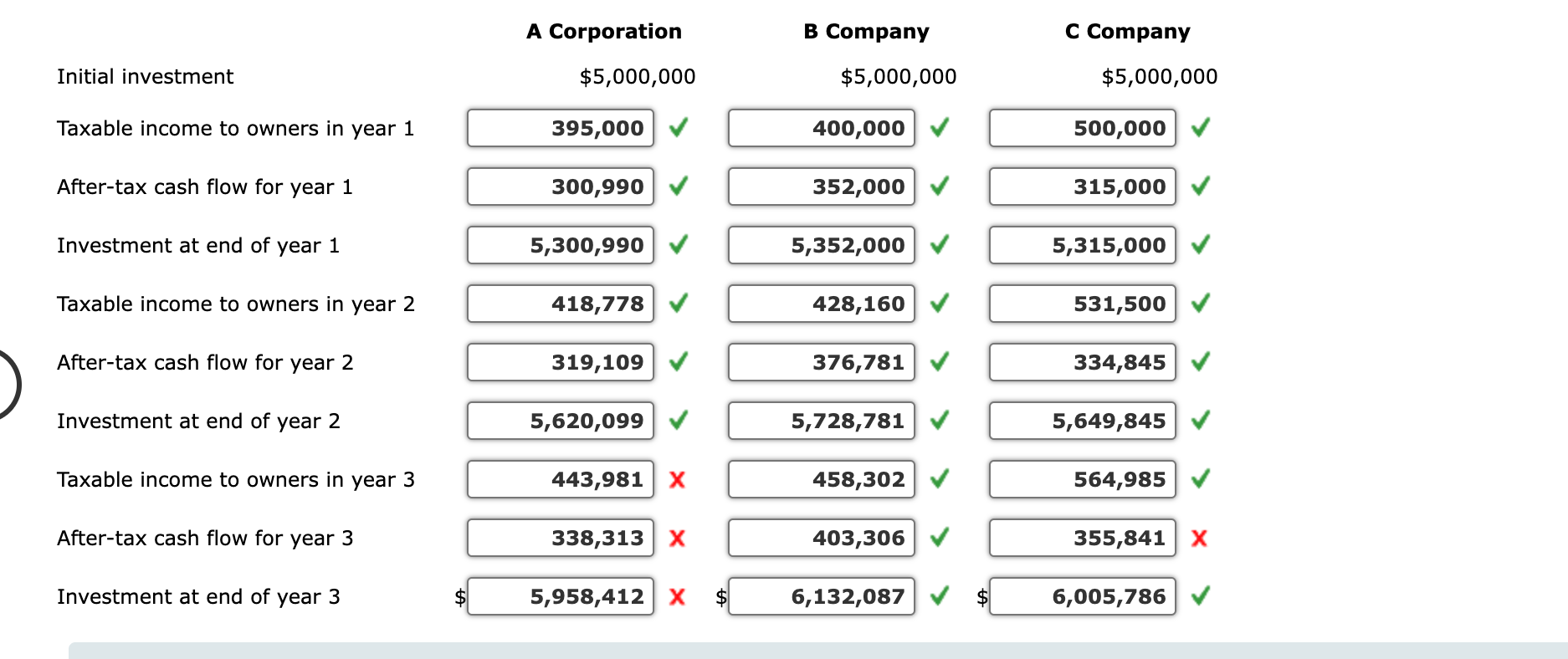

Problem 18-52 (LO. 7) Refer to Example 42 in text Section 18-5e. . . . Albert owns 100% of A Corporation, Betty is the sole proprietor of B Company, and Cai is the sole proprietor of C Company. Each business generated $500,000 of taxable income and before-tax cash flow. A Corporation and B Company produce a product, but c Company provides accounting services. A Corporation will distribute all of its after-tax income to Albert. All three owners face a 37% marginal tax rate on ordinary income. B Company qualifies for the 199A deduction, but c Company does not because it provides accounting services and its taxable income exceeds the threshold for that deduction. . Assume the tax rate applied to dividend income equals the top 20% net long-term capital gain rate plus the 3.8% net investment income tax rate. The corp ate tax rate is 21% and 199A deduction is 20%. What will be the values of A Corporation, B Company, and c Company after three years? Assume that each business (a) required a $5,000,000 initial investment, (b) earns an annual 10% before-tax rate of return on the beginning-of-the-year investment, (c) can reinvest its after-tax cash flow back into the business, and (d) there is no unrealized appreciation of their assets. B Company $500,000 Taxable income and before-tax cash flow Corporate tax @ 21% Cash available to owners $ 199A deduction @ 20% Taxable income to owners A Corporation $ 500,000 (105,000) $ 395,000 -0- $ 395,000 C Company + $500,000 -0- $500,000 -0- $500,000 $500,000 (100,000) $400,000 Shareholder tax on dividend income @23.8% ($ 94,010) $ -0- $ -O- Individual tax on ordinary income @ 37% $ -O- ($148,000) ($185,000) Before-tax cash flow Corporate tax Shareholder tax on dividend income Individual tax on ordinary income After-tax cash flow $ 500,000 (105,000) (94,010) -0- $ 300,990 $500,000 -0- -0- (148,000) $352,000 $500,000 -0- -O- (185,000) $315,000 Effective tax rate 39.8% 29.6% 37.0% A Corporation B Company C Company Initial investment $5,000,000 $5,000,000 $5,000,000 Taxable income to owners in year 1 395,000 400,000 500,000 After-tax cash flow for year 1 300,990 352,000 315,000 Investment at end of year 1 5,300,990 5,352,000 5,315,000 Taxable income to owners in year 2 418,778 428,160 531,500 After-tax cash flow for year 2 319,109 376,781 334,845 Investment at end of year 2 5,620,099 5,728,781 5,649,845 Taxable income to owners in year 3 443,981 X 458,302 564,985 After-tax cash flow for year 3 338,313 x 403,306 355,841 x Investment at end of year 3 $ 5,958,412 X $ 6,132,087 $ 6,005,786 Problem 18-52 (LO. 7) Refer to Example 42 in text Section 18-5e. . . . Albert owns 100% of A Corporation, Betty is the sole proprietor of B Company, and Cai is the sole proprietor of C Company. Each business generated $500,000 of taxable income and before-tax cash flow. A Corporation and B Company produce a product, but c Company provides accounting services. A Corporation will distribute all of its after-tax income to Albert. All three owners face a 37% marginal tax rate on ordinary income. B Company qualifies for the 199A deduction, but c Company does not because it provides accounting services and its taxable income exceeds the threshold for that deduction. . Assume the tax rate applied to dividend income equals the top 20% net long-term capital gain rate plus the 3.8% net investment income tax rate. The corp ate tax rate is 21% and 199A deduction is 20%. What will be the values of A Corporation, B Company, and c Company after three years? Assume that each business (a) required a $5,000,000 initial investment, (b) earns an annual 10% before-tax rate of return on the beginning-of-the-year investment, (c) can reinvest its after-tax cash flow back into the business, and (d) there is no unrealized appreciation of their assets. B Company $500,000 Taxable income and before-tax cash flow Corporate tax @ 21% Cash available to owners $ 199A deduction @ 20% Taxable income to owners A Corporation $ 500,000 (105,000) $ 395,000 -0- $ 395,000 C Company + $500,000 -0- $500,000 -0- $500,000 $500,000 (100,000) $400,000 Shareholder tax on dividend income @23.8% ($ 94,010) $ -0- $ -O- Individual tax on ordinary income @ 37% $ -O- ($148,000) ($185,000) Before-tax cash flow Corporate tax Shareholder tax on dividend income Individual tax on ordinary income After-tax cash flow $ 500,000 (105,000) (94,010) -0- $ 300,990 $500,000 -0- -0- (148,000) $352,000 $500,000 -0- -O- (185,000) $315,000 Effective tax rate 39.8% 29.6% 37.0% A Corporation B Company C Company Initial investment $5,000,000 $5,000,000 $5,000,000 Taxable income to owners in year 1 395,000 400,000 500,000 After-tax cash flow for year 1 300,990 352,000 315,000 Investment at end of year 1 5,300,990 5,352,000 5,315,000 Taxable income to owners in year 2 418,778 428,160 531,500 After-tax cash flow for year 2 319,109 376,781 334,845 Investment at end of year 2 5,620,099 5,728,781 5,649,845 Taxable income to owners in year 3 443,981 X 458,302 564,985 After-tax cash flow for year 3 338,313 x 403,306 355,841 x Investment at end of year 3 $ 5,958,412 X $ 6,132,087 $ 6,005,786