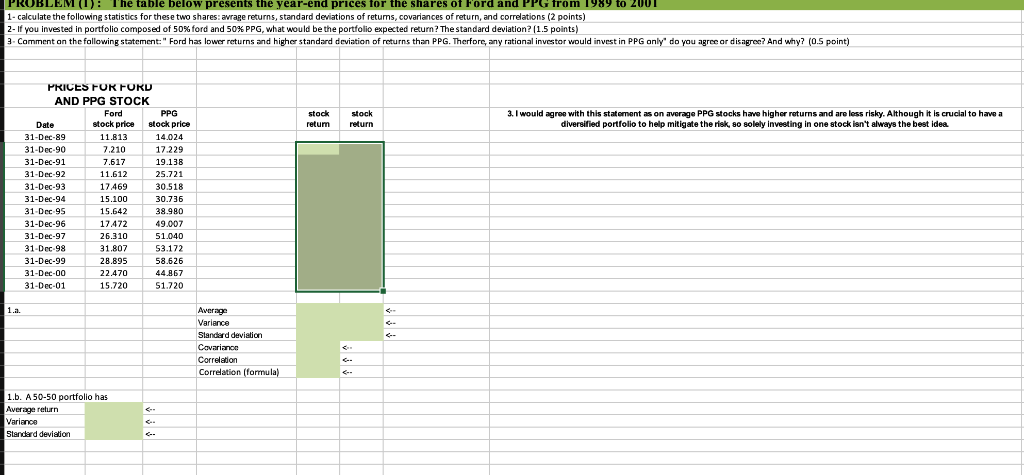

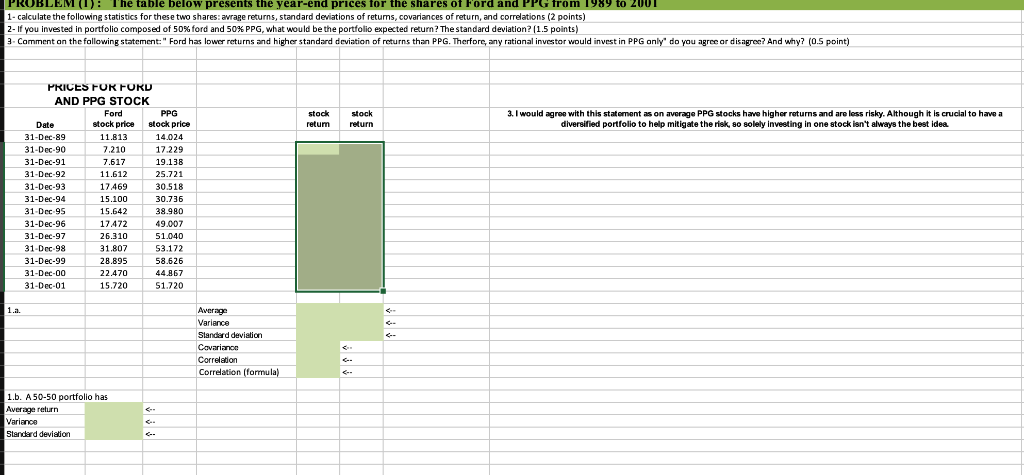

Please help me work this out with the formulas used! Thanks.

PROBLEMO 1- calculate the following statistics for these two shares:avrage returns, standard deviations of retums, covariances of return, and correlations (2 points 2-If you invested in portfolio composed of 50% ford and 50% PPG, what would be the portfolio expected return? The standard deviation 1.5 points) T'he table below presents the year-end prices for the shares of Ford and PPG fro Comment an the fallowing statement:" Ford has lower returns and higher standard deviation of returns than PPG. Therfore, any ratianal inves tor would invest in PPG anly do you agree ordisagrc? And why? (0.S point) AND PPG STOCK Ford stock price 11.813 7.210 7.617 11.612 17 469 15.100 15.642 17472 26.310 31.807 28.895 22.470 15.720 PPG stock price 14.024 17.229 19.138 25.721 30.518 30.736 38.980 49.007 51.040 S3.172 58.626 44867 51.720 stock return 3. I would agree with this statoment as on average PPG stocks have higher roturns and are less risky. Although it is crucial to have a diversified portfolio to help mitigate the risk, so solely inveeting in one stock isn't always the best idea stock retum Date 31-Dec-89 31-Dec-90 31-Dec-91 31-Dec-92 31-Dec-93 31-Dec-94 31 Dec 9S 31-Dec-96 31-Dec-97 31-Dec-98 31-Dec-99 31-Dec-00 31-Dec-01 Average Variance Slanderd deviation Correlation Correlation (formula .b. A50-50 portfolio has verage return Variance Standard deviaion PROBLEMO 1- calculate the following statistics for these two shares:avrage returns, standard deviations of retums, covariances of return, and correlations (2 points 2-If you invested in portfolio composed of 50% ford and 50% PPG, what would be the portfolio expected return? The standard deviation 1.5 points) T'he table below presents the year-end prices for the shares of Ford and PPG fro Comment an the fallowing statement:" Ford has lower returns and higher standard deviation of returns than PPG. Therfore, any ratianal inves tor would invest in PPG anly do you agree ordisagrc? And why? (0.S point) AND PPG STOCK Ford stock price 11.813 7.210 7.617 11.612 17 469 15.100 15.642 17472 26.310 31.807 28.895 22.470 15.720 PPG stock price 14.024 17.229 19.138 25.721 30.518 30.736 38.980 49.007 51.040 S3.172 58.626 44867 51.720 stock return 3. I would agree with this statoment as on average PPG stocks have higher roturns and are less risky. Although it is crucial to have a diversified portfolio to help mitigate the risk, so solely inveeting in one stock isn't always the best idea stock retum Date 31-Dec-89 31-Dec-90 31-Dec-91 31-Dec-92 31-Dec-93 31-Dec-94 31 Dec 9S 31-Dec-96 31-Dec-97 31-Dec-98 31-Dec-99 31-Dec-00 31-Dec-01 Average Variance Slanderd deviation Correlation Correlation (formula .b. A50-50 portfolio has verage return Variance Standard deviaion