Answered step by step

Verified Expert Solution

Question

1 Approved Answer

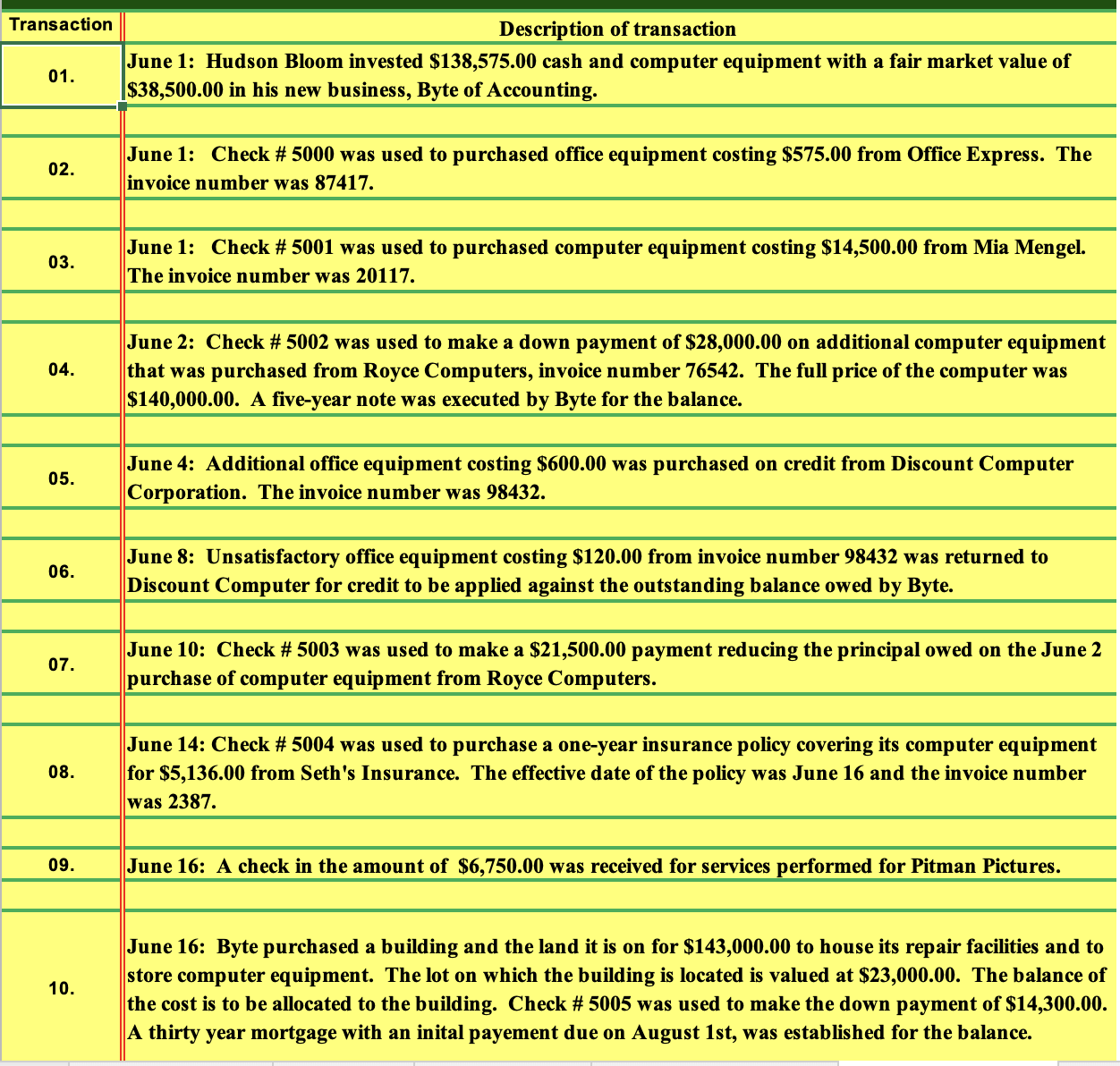

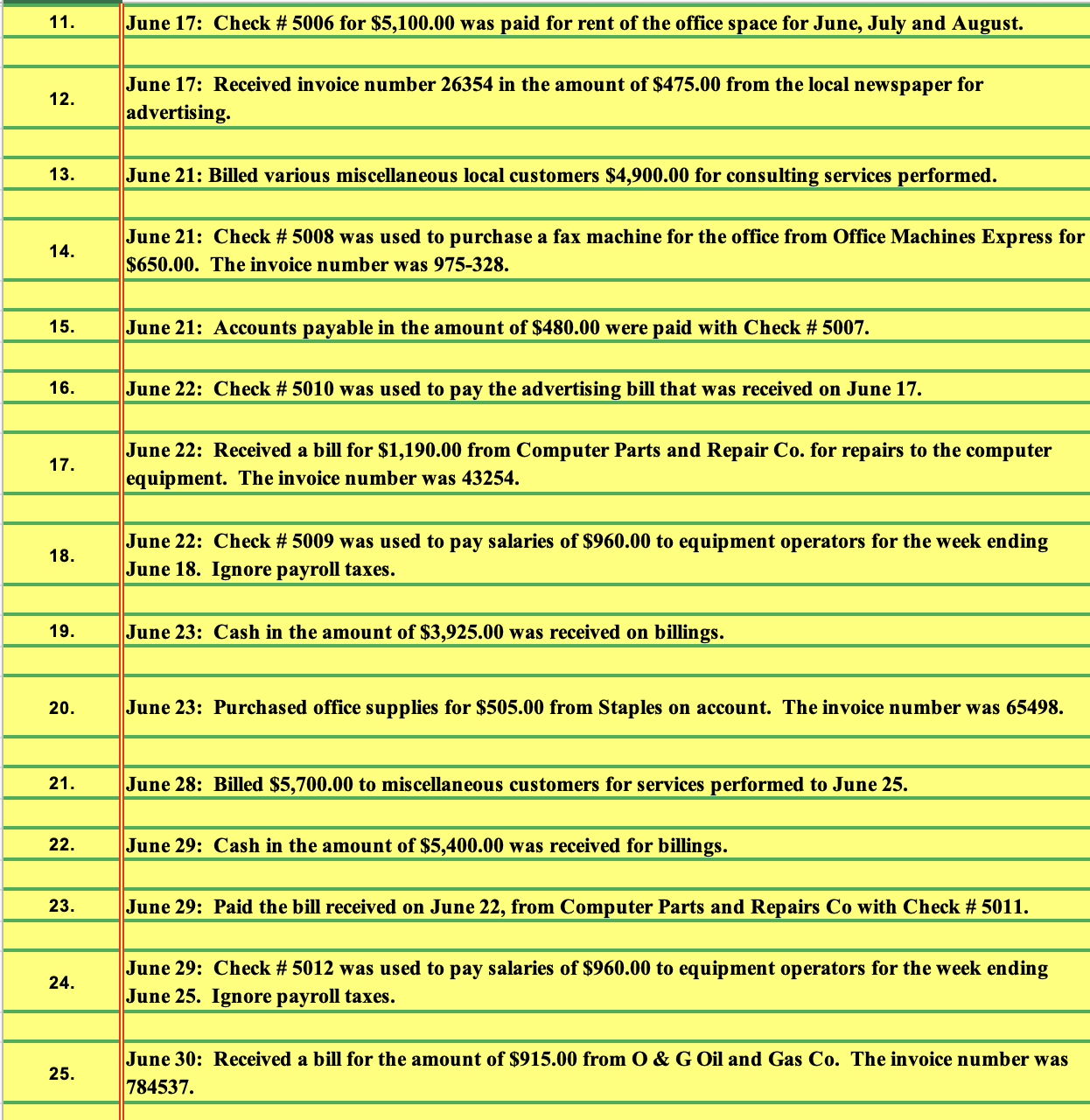

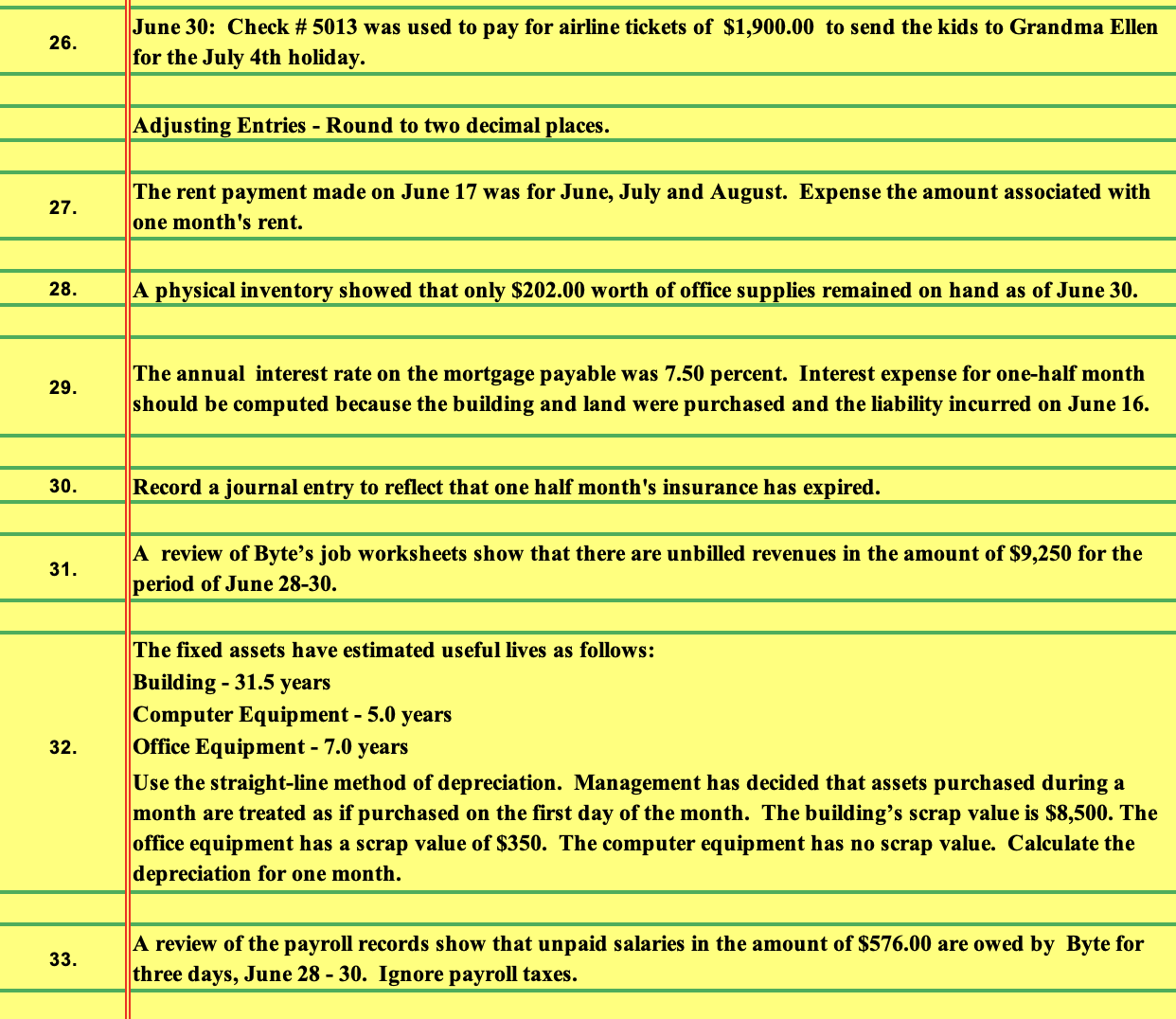

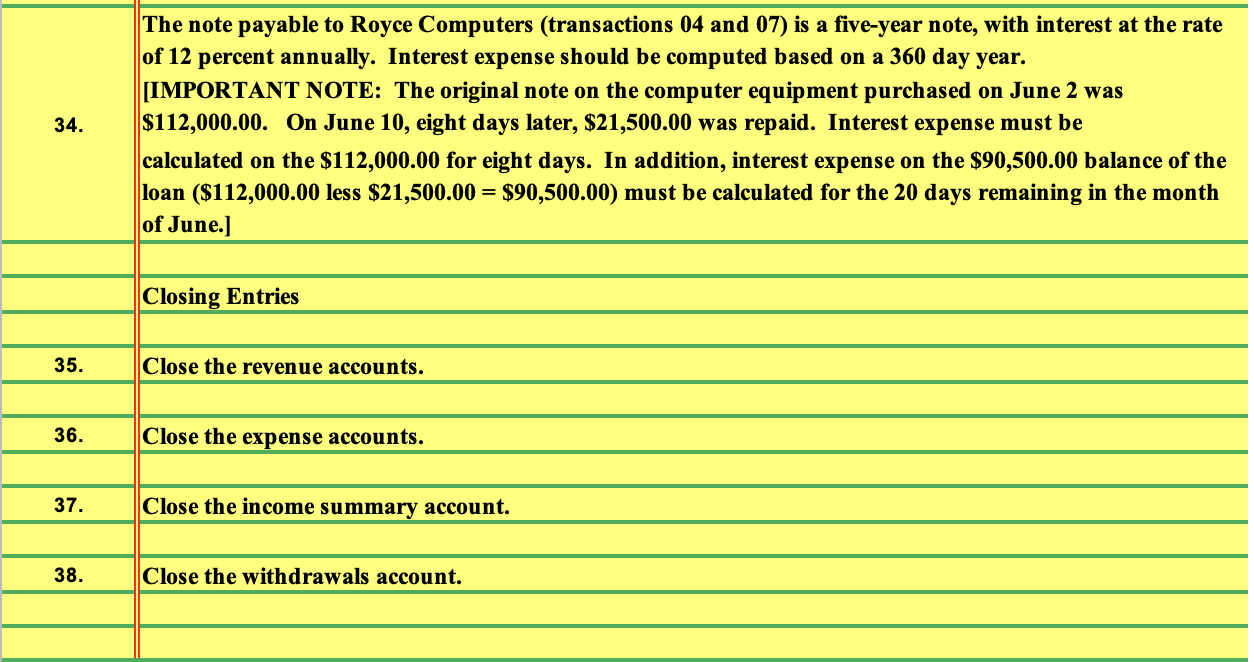

please help me write a general journal! begin{tabular}{|c|c|} hline Transaction & Description of transaction hline 01. & begin{tabular}{l} June 1: Hudson Bloom invested $138,575.00

please help me write a general journal!

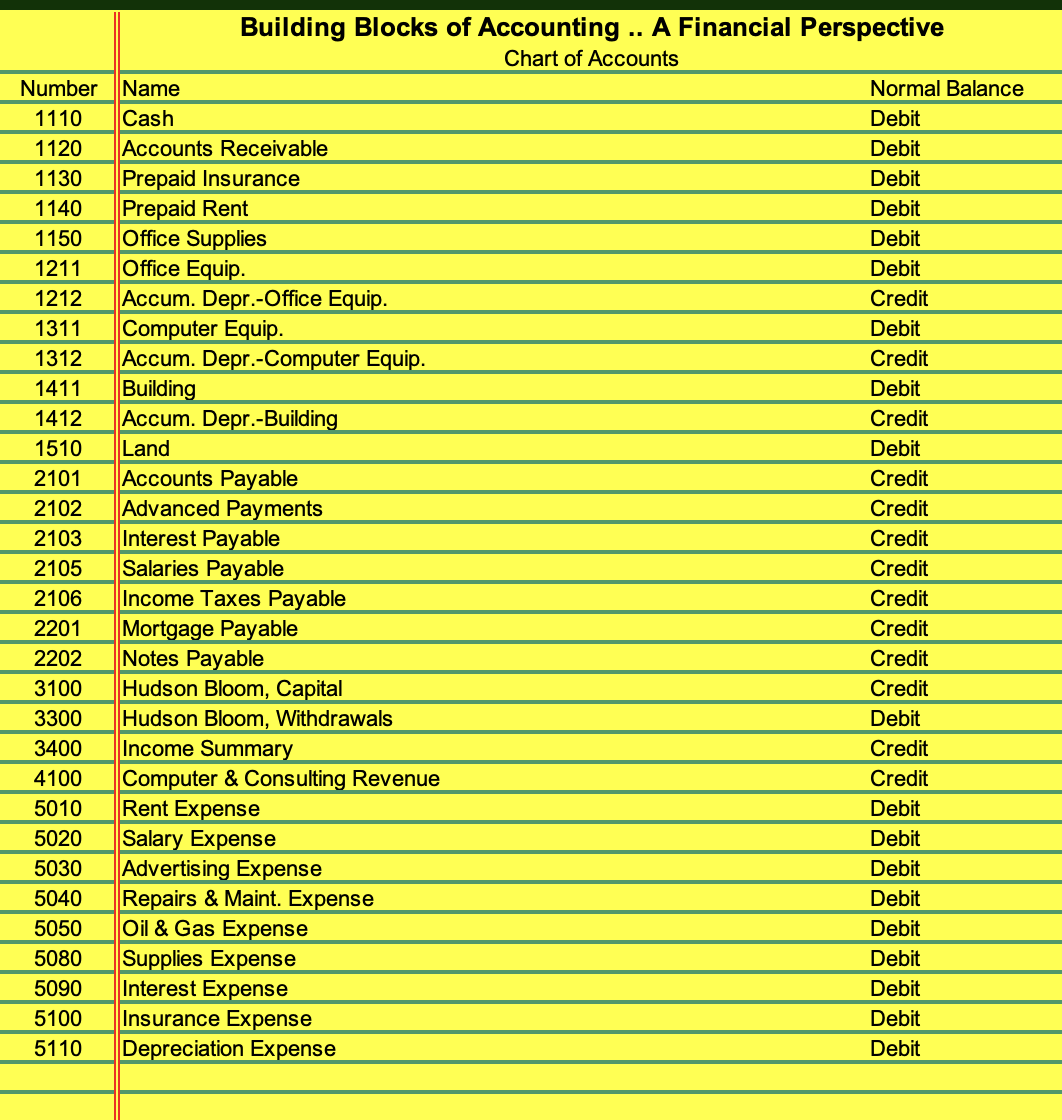

\begin{tabular}{|c|c|} \hline Transaction & Description of transaction \\ \hline 01. & \begin{tabular}{l} June 1: Hudson Bloom invested $138,575.00 cash and computer equipment with a fair market value of \\ $38,500.00 in his new business, Byte of Accounting. \end{tabular} \\ \hline 02. & \begin{tabular}{l} June 1: Check \# 5000 was used to purchased office equipment costing $575.00 from Office Express. The \\ invoice number was 87417 . \end{tabular} \\ \hline 03. & \begin{tabular}{l} June 1: Check \# 5001 was used to purchased computer equipment costing $14,500.00 from Mia Mengel. \\ The invoice number was 20117 . \end{tabular} \\ \hline 04. & \begin{tabular}{l} June 2: Check \# 5002 was used to make a down payment of $28,000.00 on additional computer equipment \\ that was purchased from Royce Computers, invoice number 76542 . The full price of the computer was \\ $140,000.00. A five-year note was executed by Byte for the balance. \end{tabular} \\ \hline 05. & \begin{tabular}{l} June 4: Additional office equipment costing $600.00 was purchased on credit from Discount Computer \\ Corporation. The invoice number was 98432 . \end{tabular} \\ \hline 06. & \begin{tabular}{l} June 8: Unsatisfactory office equipment costing $120.00 from invoice number 98432 was returned to \\ Discount Computer for credit to be applied against the outstanding balance owed by Byte. \end{tabular} \\ \hline 07. & \begin{tabular}{l} June 10: Check \# 5003 was used to make a $21,500.00 payment reducing the principal owed on the June 2 \\ purchase of computer equipment from Royce Computers. \end{tabular} \\ \hline 08. & \begin{tabular}{l} June 14: Check \# 5004 was used to purchase a one-year insurance policy covering its computer equipment \\ for $5,136.00 from Seth's Insurance. The effective date of the policy was June 16 and the invoice number \\ was 2387 . \end{tabular} \\ \hline 09. & June 16: A check in the amount of $6,750.00 was received for services performed for Pitman Pictures. \\ \hline 10. & \begin{tabular}{l} June 16: Byte purchased a building and the land it is on for $143,000.00 to house its repair facilities and to \\ store computer equipment. The lot on which the building is located is valued at $23,000.00. The balance of \\ the cost is to be allocated to the building. Check #5005 was used to make the down payment of $14,300.00. \\ A thirty year mortgage with an inital payement due on August 1 st, was established for the balance. \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 11. & June 17: Check \# 5006 for $$5,100.00 was paid for rent of the office space for June, July and August. \\ \hline 12. & \begin{tabular}{l} June 17: Received invoice number 26354 in the amount of $475.00 from the local newspaper for \\ advertising. \end{tabular} \\ \hline 13. & June 21: Billed various miscellaneous local customers $4,900.00 for consulting services performed. \\ \hline 14. & \begin{tabular}{l} June 21: Check \# 5008 was used to purchase a fax machine for the office from Office Machines Express for \\ $650.00. The invoice number was 975328. \end{tabular} \\ \hline 15. & June 21: Accounts payable in the amount of $480.00 were paid with Check \# 5007 . \\ \hline 16. & June 22: Check \# 5010 was used to pay the advertising bill that was received on June 17. \\ \hline 17. & \begin{tabular}{l} June 22: Received a bill for $1,190.00 from Computer Parts and Repair Co. for repairs to the computer \\ equipment. The invoice number was 43254 . \end{tabular} \\ \hline 18. & \begin{tabular}{l} June 22: Check \# 5009 was used to pay salaries of $960.00 to equipment operators for the week ending \\ June 18. Ignore payroll taxes. \end{tabular} \\ \hline 19. & June 23: Cash in the amount of $3,925.00 was received on billings. \\ \hline 20. & June 23: Purchased office supplies for $505.00 from Staples on account. The invoice number was 65498 . \\ \hline 21. & June 28: Billed \$5,700.00 to miscellaneous customers for services performed to June 25 . \\ \hline 22. & June 29: Cash in the amount of $5,400.00 was received for billings. \\ \hline 23. & June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co with Check \# 5011. \\ \hline 24. & \begin{tabular}{l} June 29: Check \# 5012 was used to pay salaries of $960.00 to equipment operators for the week ending \\ June 25. Ignore payroll taxes. \end{tabular} \\ \hline 25. & \begin{tabular}{l} June 30: Received a bill for the amount of $915.00 from O&G Oil and Gas Co. The invoice number was \\ 784537 . \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 26. & \begin{tabular}{l} June 30: Check \# 5013 was used to pay for airline tickets of $1,900.00 to send the kids to Grandma Ellen \\ for the July 4th holiday. \end{tabular} \\ \hline & Adjusting Entries - Round to two decimal places. \\ \hline 27. & \begin{tabular}{l} The rent payment made on June 17 was for June, July and August. Expense the amount associated with \\ one month's rent. \end{tabular} \\ \hline 28. & A physical inventory showed that only $202.00 worth of office supplies remained on hand as of June 30 . \\ \hline 29. & \begin{tabular}{l} The annual interest rate on the mortgage payable was 7.50 percent. Interest expense for one-half month \\ should be computed because the building and land were purchased and the liability incurred on June 16 . \end{tabular} \\ \hline 30. & Record a journal entry to reflect that one half month's insurance has expired. \\ \hline 31. & \begin{tabular}{l} A review of Byte's job worksheets show that there are unbilled revenues in the amount of $9,250 for the \\ period of June 2830. \end{tabular} \\ \hline 32. & \begin{tabular}{l} The fixed assets have estimated useful lives as follows: \\ Building - 31.5 years \\ Computer Equipment - 5.0 years \\ Office Equipment - 7.0 years \\ Use the straight-line method of depreciation. Management has decided that assets purchased during a \\ month are treated as if purchased on the first day of the month. The building's scrap value is $8,500. The \\ office equipment has a scrap value of $350. The computer equipment has no scrap value. Calculate the \\ depreciation for one month. \end{tabular} \\ \hline 33. & \begin{tabular}{l} A review of the payroll records show that unpaid salaries in the amount of $576.00 are owed by Byte for \\ three days, June 2830. Ignore payroll taxes. \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 34. & \begin{tabular}{l} The note payable to Royce Computers (transactions 04 and 07 ) is a five-year note, with interest at the rate \\ of 12 percent annually. Interest expense should be computed based on a 360 day year. \\ [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was \\ $112,000.00. On June 10 , eight days later, $21,500.00 was repaid. Interest expense must be \\ calculated on the $112,000.00 for eight days. In addition, interest expense on the $90,500.00 balance of the \\ loan ($112,000.00 less $21,500.00=$90,500.00) must be calculated for the 20 days remaining in the month \\ of June.] \end{tabular} \\ \hline & Closing Entries \\ \hline 35. & Close the revenue accounts. \\ \hline 36. & Close the expense accounts. \\ \hline 37. & Close the income summary account. \\ \hline 38. & Close the withdrawals account. \\ \hline \end{tabular} Building Blocks of Accounting .. A Financial Perspective Chart of Accounts \begin{tabular}{|c|c|c|} \hline Number & Name & Normal Balance \\ \hline 1110 & Cash & Debit \\ \hline 1120 & Accounts Receivable & Debit \\ \hline 1130 & Prepaid Insurance & Debit \\ \hline 1140 & Prepaid Rent & Debit \\ \hline 1150 & Office Supplies & Debit \\ \hline 1211 & Office Equip. & Debit \\ \hline 1212 & Accum. Depr.-Office Equip. & Credit \\ \hline 1311 & Computer Equip. & Debit \\ \hline 1312 & Accum. Depr.-Computer Equip. & Credit \\ \hline 1411 & Building & Debit \\ \hline 1412 & Accum. Depr.-Building & Credit \\ \hline 1510 & Land & Debit \\ \hline 2101 & Accounts Payable & Credit \\ \hline 2102 & Advanced Payments & Credit \\ \hline 2103 & Interest Payable & Credit \\ \hline 2105 & Salaries Payable & Credit \\ \hline 2106 & Income Taxes Payable & Credit \\ \hline 2201 & Mortgage Payable & Credit \\ \hline 2202 & Notes Payable & Credit \\ \hline 3100 & Hudson Bloom, Capital & Credit \\ \hline 3300 & Hudson Bloom, Withdrawals & Debit \\ \hline 3400 & Income Summary & Credit \\ \hline 4100 & Computer \& Consulting Revenue & Credit \\ \hline 5010 & Rent Expense & Debit \\ \hline 5020 & Salary Expense & Debit \\ \hline 5030 & Advertising Expense & Debit \\ \hline 5040 & Repairs \& Maint. Expense & Debit \\ \hline 5050 & Oil \& Gas Expense & Debit \\ \hline 5080 & Supplies Expense & Debit \\ \hline 5090 & Interest Expense & Debit \\ \hline 5100 & Insurance Expense & Debit \\ \hline 5110 & Depreciation Expense & Debit \\ \hline \end{tabular} A Byte of Accounting A Byte of Accounting A Byte of Accounting

\begin{tabular}{|c|c|} \hline Transaction & Description of transaction \\ \hline 01. & \begin{tabular}{l} June 1: Hudson Bloom invested $138,575.00 cash and computer equipment with a fair market value of \\ $38,500.00 in his new business, Byte of Accounting. \end{tabular} \\ \hline 02. & \begin{tabular}{l} June 1: Check \# 5000 was used to purchased office equipment costing $575.00 from Office Express. The \\ invoice number was 87417 . \end{tabular} \\ \hline 03. & \begin{tabular}{l} June 1: Check \# 5001 was used to purchased computer equipment costing $14,500.00 from Mia Mengel. \\ The invoice number was 20117 . \end{tabular} \\ \hline 04. & \begin{tabular}{l} June 2: Check \# 5002 was used to make a down payment of $28,000.00 on additional computer equipment \\ that was purchased from Royce Computers, invoice number 76542 . The full price of the computer was \\ $140,000.00. A five-year note was executed by Byte for the balance. \end{tabular} \\ \hline 05. & \begin{tabular}{l} June 4: Additional office equipment costing $600.00 was purchased on credit from Discount Computer \\ Corporation. The invoice number was 98432 . \end{tabular} \\ \hline 06. & \begin{tabular}{l} June 8: Unsatisfactory office equipment costing $120.00 from invoice number 98432 was returned to \\ Discount Computer for credit to be applied against the outstanding balance owed by Byte. \end{tabular} \\ \hline 07. & \begin{tabular}{l} June 10: Check \# 5003 was used to make a $21,500.00 payment reducing the principal owed on the June 2 \\ purchase of computer equipment from Royce Computers. \end{tabular} \\ \hline 08. & \begin{tabular}{l} June 14: Check \# 5004 was used to purchase a one-year insurance policy covering its computer equipment \\ for $5,136.00 from Seth's Insurance. The effective date of the policy was June 16 and the invoice number \\ was 2387 . \end{tabular} \\ \hline 09. & June 16: A check in the amount of $6,750.00 was received for services performed for Pitman Pictures. \\ \hline 10. & \begin{tabular}{l} June 16: Byte purchased a building and the land it is on for $143,000.00 to house its repair facilities and to \\ store computer equipment. The lot on which the building is located is valued at $23,000.00. The balance of \\ the cost is to be allocated to the building. Check #5005 was used to make the down payment of $14,300.00. \\ A thirty year mortgage with an inital payement due on August 1 st, was established for the balance. \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 11. & June 17: Check \# 5006 for $$5,100.00 was paid for rent of the office space for June, July and August. \\ \hline 12. & \begin{tabular}{l} June 17: Received invoice number 26354 in the amount of $475.00 from the local newspaper for \\ advertising. \end{tabular} \\ \hline 13. & June 21: Billed various miscellaneous local customers $4,900.00 for consulting services performed. \\ \hline 14. & \begin{tabular}{l} June 21: Check \# 5008 was used to purchase a fax machine for the office from Office Machines Express for \\ $650.00. The invoice number was 975328. \end{tabular} \\ \hline 15. & June 21: Accounts payable in the amount of $480.00 were paid with Check \# 5007 . \\ \hline 16. & June 22: Check \# 5010 was used to pay the advertising bill that was received on June 17. \\ \hline 17. & \begin{tabular}{l} June 22: Received a bill for $1,190.00 from Computer Parts and Repair Co. for repairs to the computer \\ equipment. The invoice number was 43254 . \end{tabular} \\ \hline 18. & \begin{tabular}{l} June 22: Check \# 5009 was used to pay salaries of $960.00 to equipment operators for the week ending \\ June 18. Ignore payroll taxes. \end{tabular} \\ \hline 19. & June 23: Cash in the amount of $3,925.00 was received on billings. \\ \hline 20. & June 23: Purchased office supplies for $505.00 from Staples on account. The invoice number was 65498 . \\ \hline 21. & June 28: Billed \$5,700.00 to miscellaneous customers for services performed to June 25 . \\ \hline 22. & June 29: Cash in the amount of $5,400.00 was received for billings. \\ \hline 23. & June 29: Paid the bill received on June 22, from Computer Parts and Repairs Co with Check \# 5011. \\ \hline 24. & \begin{tabular}{l} June 29: Check \# 5012 was used to pay salaries of $960.00 to equipment operators for the week ending \\ June 25. Ignore payroll taxes. \end{tabular} \\ \hline 25. & \begin{tabular}{l} June 30: Received a bill for the amount of $915.00 from O&G Oil and Gas Co. The invoice number was \\ 784537 . \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 26. & \begin{tabular}{l} June 30: Check \# 5013 was used to pay for airline tickets of $1,900.00 to send the kids to Grandma Ellen \\ for the July 4th holiday. \end{tabular} \\ \hline & Adjusting Entries - Round to two decimal places. \\ \hline 27. & \begin{tabular}{l} The rent payment made on June 17 was for June, July and August. Expense the amount associated with \\ one month's rent. \end{tabular} \\ \hline 28. & A physical inventory showed that only $202.00 worth of office supplies remained on hand as of June 30 . \\ \hline 29. & \begin{tabular}{l} The annual interest rate on the mortgage payable was 7.50 percent. Interest expense for one-half month \\ should be computed because the building and land were purchased and the liability incurred on June 16 . \end{tabular} \\ \hline 30. & Record a journal entry to reflect that one half month's insurance has expired. \\ \hline 31. & \begin{tabular}{l} A review of Byte's job worksheets show that there are unbilled revenues in the amount of $9,250 for the \\ period of June 2830. \end{tabular} \\ \hline 32. & \begin{tabular}{l} The fixed assets have estimated useful lives as follows: \\ Building - 31.5 years \\ Computer Equipment - 5.0 years \\ Office Equipment - 7.0 years \\ Use the straight-line method of depreciation. Management has decided that assets purchased during a \\ month are treated as if purchased on the first day of the month. The building's scrap value is $8,500. The \\ office equipment has a scrap value of $350. The computer equipment has no scrap value. Calculate the \\ depreciation for one month. \end{tabular} \\ \hline 33. & \begin{tabular}{l} A review of the payroll records show that unpaid salaries in the amount of $576.00 are owed by Byte for \\ three days, June 2830. Ignore payroll taxes. \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline 34. & \begin{tabular}{l} The note payable to Royce Computers (transactions 04 and 07 ) is a five-year note, with interest at the rate \\ of 12 percent annually. Interest expense should be computed based on a 360 day year. \\ [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was \\ $112,000.00. On June 10 , eight days later, $21,500.00 was repaid. Interest expense must be \\ calculated on the $112,000.00 for eight days. In addition, interest expense on the $90,500.00 balance of the \\ loan ($112,000.00 less $21,500.00=$90,500.00) must be calculated for the 20 days remaining in the month \\ of June.] \end{tabular} \\ \hline & Closing Entries \\ \hline 35. & Close the revenue accounts. \\ \hline 36. & Close the expense accounts. \\ \hline 37. & Close the income summary account. \\ \hline 38. & Close the withdrawals account. \\ \hline \end{tabular} Building Blocks of Accounting .. A Financial Perspective Chart of Accounts \begin{tabular}{|c|c|c|} \hline Number & Name & Normal Balance \\ \hline 1110 & Cash & Debit \\ \hline 1120 & Accounts Receivable & Debit \\ \hline 1130 & Prepaid Insurance & Debit \\ \hline 1140 & Prepaid Rent & Debit \\ \hline 1150 & Office Supplies & Debit \\ \hline 1211 & Office Equip. & Debit \\ \hline 1212 & Accum. Depr.-Office Equip. & Credit \\ \hline 1311 & Computer Equip. & Debit \\ \hline 1312 & Accum. Depr.-Computer Equip. & Credit \\ \hline 1411 & Building & Debit \\ \hline 1412 & Accum. Depr.-Building & Credit \\ \hline 1510 & Land & Debit \\ \hline 2101 & Accounts Payable & Credit \\ \hline 2102 & Advanced Payments & Credit \\ \hline 2103 & Interest Payable & Credit \\ \hline 2105 & Salaries Payable & Credit \\ \hline 2106 & Income Taxes Payable & Credit \\ \hline 2201 & Mortgage Payable & Credit \\ \hline 2202 & Notes Payable & Credit \\ \hline 3100 & Hudson Bloom, Capital & Credit \\ \hline 3300 & Hudson Bloom, Withdrawals & Debit \\ \hline 3400 & Income Summary & Credit \\ \hline 4100 & Computer \& Consulting Revenue & Credit \\ \hline 5010 & Rent Expense & Debit \\ \hline 5020 & Salary Expense & Debit \\ \hline 5030 & Advertising Expense & Debit \\ \hline 5040 & Repairs \& Maint. Expense & Debit \\ \hline 5050 & Oil \& Gas Expense & Debit \\ \hline 5080 & Supplies Expense & Debit \\ \hline 5090 & Interest Expense & Debit \\ \hline 5100 & Insurance Expense & Debit \\ \hline 5110 & Depreciation Expense & Debit \\ \hline \end{tabular} A Byte of Accounting A Byte of Accounting A Byte of Accounting Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started