Answered step by step

Verified Expert Solution

Question

1 Approved Answer

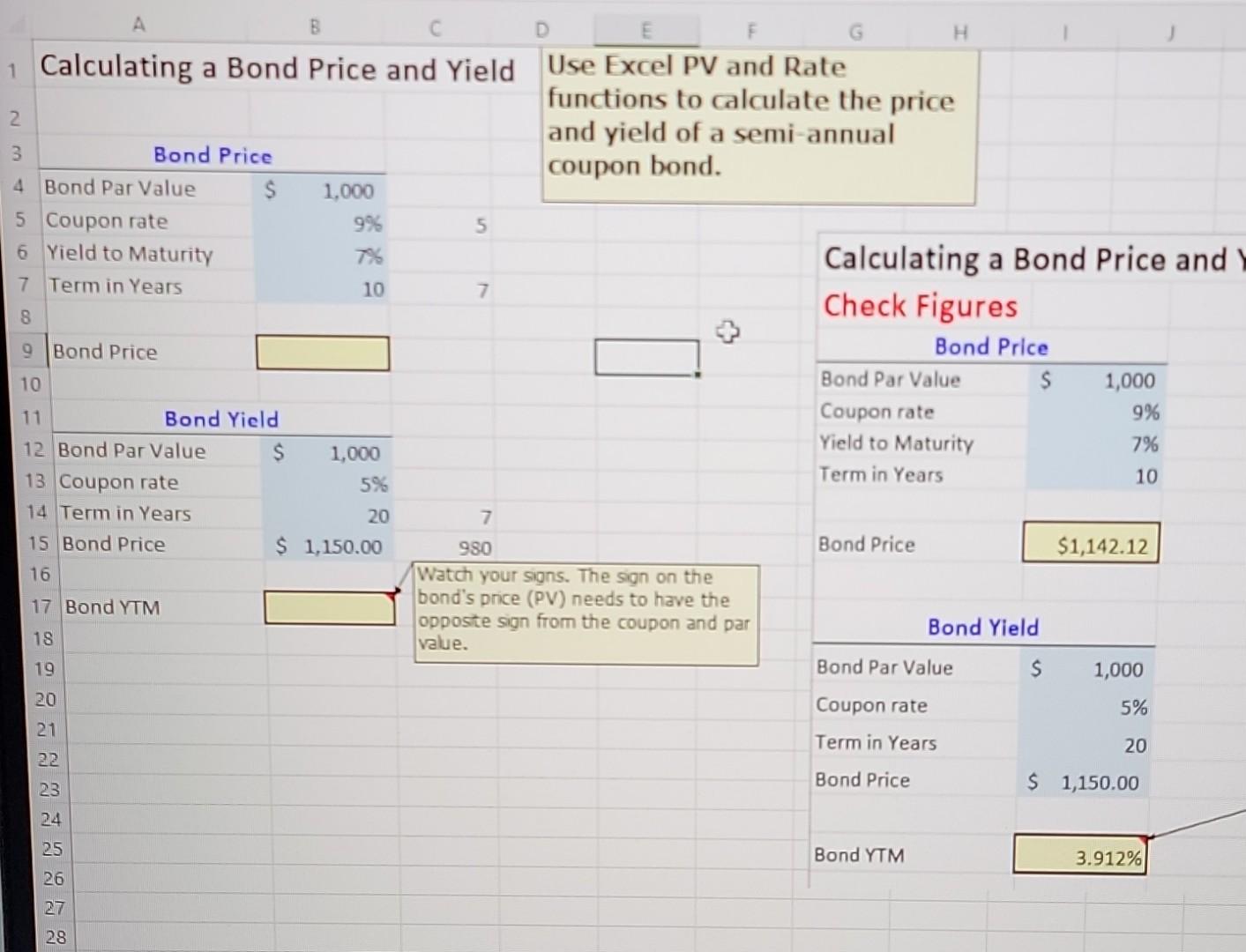

please help me write these functions. Thank you! A B 1 Calculating a Bond Price and Yield Use Excel PV and Rate 2 Bond Price

please help me write these functions. Thank you!

A B 1 Calculating a Bond Price and Yield Use Excel PV and Rate 2 Bond Price Bond Par Value $ 1,000 5 Coupon rate 5 6 Yield to Maturity 7 Term in Years 8 9 Bond Price 10 11 12 Bond Par Value 13 Coupon rate 14 Term in Years 15 Bond Price 16 17 Bond YTM 18 19 20 21 32 23 24 25 26 27 28 3 4 9% 7% 10 Bond Yield $ 1,000 5% 20 $ 1,150.00 7 H functions to calculate the price and yield of a semi-annual coupon bond. 7 980 Watch your signs. The sign on the bond's price (PV) needs to have the opposite sign from the coupon and par value. Calculating a Bond Price and Y Check Figures Bond Price Bond Par Value $ 1,000 Coupon rate 9% Yield to Maturity 7% Term in Years 10 Bond Price Bond Par Value Coupon rate Term in Years Bond Price Bond YTM $1,142.12 1,000 Bond Yield $ 5% 20 $ 1,150.00 3.912%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started