please help

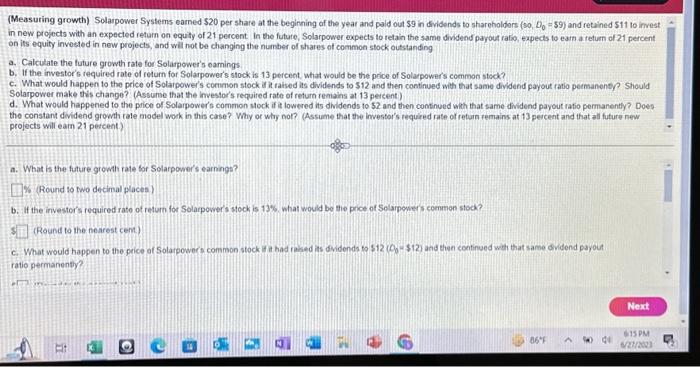

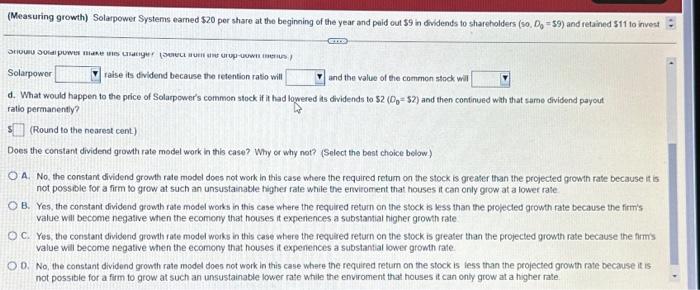

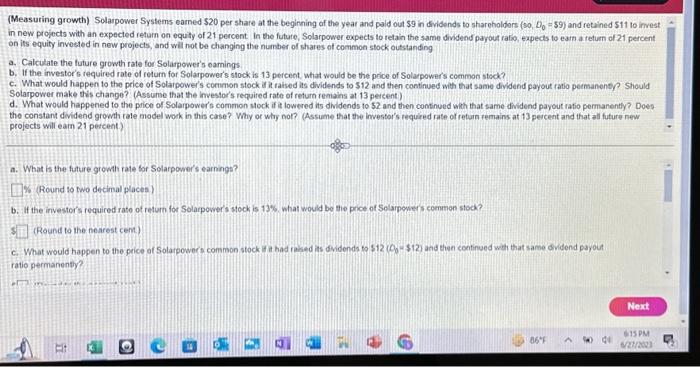

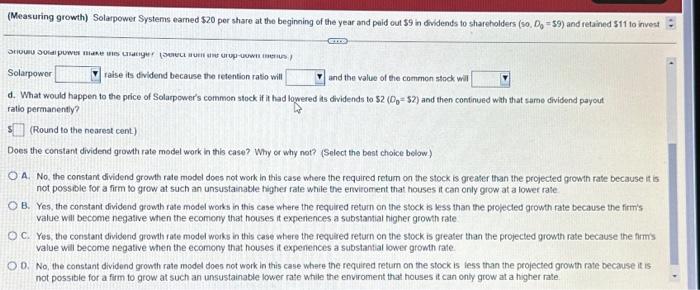

(Measuring growth) Solarpower Systems earned $20 per share at the beginning of the year and paid out $9 in dividends to sharcholders (s0, D0=$9 ) and retained $11 to invest in new projects with an expected return on equity of 21 percent. in the future, Solarpower expects to retain the same dividend pajout ratio, expects to earp a return of 21 percent. on its equity invested in new projects, and will not be changing the number of shares of common stock outstanding a. Calculate the future growth rate for Solarpower's eamings b. If the investor's required rate of return for Solarpower's stock is 13 percent what would be the price of Solarpower's coenmon stock? c. What would happen to the price of Solaipower's common stock a it taised its dividends to $12 and then continued with that same dividend payout fatio peemanenty? Should Solarpower make this change? (Assume that the investor's required rate of return remains at 13 percent) d. What would happened to the price of Solarpower's common stock if it lowered its dildends to $2 and then cominued wath that same dividend payout ratio permanently? Does the constant dividend growth rate model wodk in this case? Why or why nor? (Assume that the investor's required rate of refuin remains at 13 percent and that all future new projects will eain 21 petcent.) a. What is the future growh rate for Solarpower's earnings? Y Round to two decimal places) b. If the investor s required rate of return for Solarpover's steck is 13%. what would be the price of Solappesers common stock? (Round to the fearest cent) c. What would happen to the price of Solarpower s common stock t it had rained its dividends bo $12(Q0 - $12) and tien continued with that same ovidend payout ratio permanently? (Measuring growth) Solarpower Systems earned $20 per share at the beginning of the year and peid out $9 in dividends to shareholders (s0, D0=59 ) and retained $11 to invest Solarpowor raise its dividend because the retention ratio will and the value of the commen stock wil d. What would happen to the price of Solarpower's common stock if it had lowered is dividends to $2(D0=$2) and then continued with that sarme dividend payout ratio permanently? (Rlound to the nearest cent) Does the constant dividend growth rate model work in this case? Why or why not? (Select the bent choice below) A. No, the constant dividend growth rate model does not work in this case where the required retum on the stock is greater than the projected growth rate because it is not possible for a firm lo grow at such an unsustainatle higher rate while the envitorrent that houses it can only grow at a lower rate B. Yes, the constant dividend growh rate model works in this case where the required return on the stock is kess than the projected growh rate because the firm's value wil become negative when the ecomony that houses it expeniences a substantiat higher growh rate C. Yes, the constant dividend growth rate model works in this case where the required return on the stock is greater than the projected growth rate because the firms value will become negative when the ecomony that houses it expenences a substantial lower growh rate. D. No, the constant dividend growth rate model does not work in this case where the required retum on the stock is iess than the projected growth rate because it is not possible for a firm to grow at such an unsustainable lower rate while the enviroment that houses it can only grow at a higher rate