Answered step by step

Verified Expert Solution

Question

1 Approved Answer

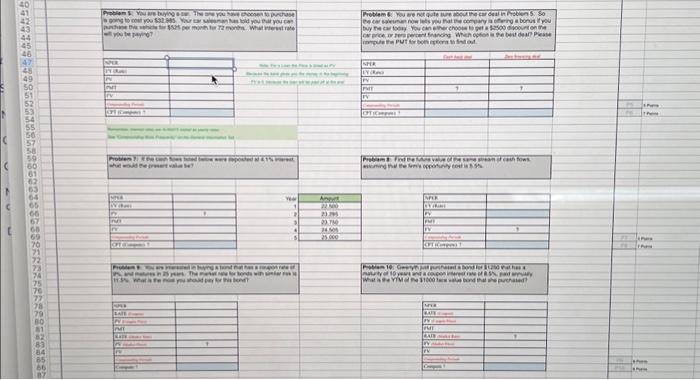

please help me!!!!Problem 5: You are buying a car. The one you have choosen to purchase is going to cost you $32,985. Your car salesman

please help me!!!!Problem 5: You are buying a car. The one you have choosen to purchase is going to cost you $32,985. Your car salesman has told you that you can purchase this vehicle for $525 per month for 72 months. What interest rate will you be paying? NPER VY (Rate) PV PMT FV Compounding Perinds CPT (Compute) ? Remember interest rates are ALWAYS stated as yearly rates. See "Compounding More Frequenty on the General Information Tab Problem 7: If the cash flows listed below were deposited at 4.1% interest, what would the present value be? NPER VY (Rate) PV PMT FV Componding Perind CPT (Compute) 7 NPER RATE (C PVP PMT RATE ad Bad PV (Make Pr FV ? Problem 9: You are interested in buying a bond that has a coupon rate of 9%, and matures in 25 years. The market rate for bonds with similar risk is 11.5%. What is the most you should pay for this bond? Compute? Note For a Loan the Price is listed as PV Because the bank gives you the money in the beginning FV is 0, because the loan will be paid off at the end ? Year 1 2 3 4 5 Amount 22,500 23,295 23,750 24,505 25,000 Problem 6: You are not quite sure about the car deal in Problem 5. So the car salesman now tells you that the company is offering a bonus if you buy the car today. You can either choose to get a $2500 discount on the car price, or zero percent financing. Which option is the best deal? Please compute the PMT for both options to find out. NPER LY (Rate) PV PMT FV Componding Periods CPT (Compute) ? Cash back deal ? NPER VY (Rate) PV PMT FV Problem 8: Find the future value of the same stream of cash flows, assuming that the firm's opportunity cost is 5.5%. Compounding Periodi CPT (Compute)? Zero financing deal NPER RATE (Coupon) PV (Coupon Price) PMT RATE (Marka Rate) PV (Macket Price FV Composending Perind Compute? ? Problem 10: Gwenyth just purchased a bond for $1250 that has a maturity of 10 years and a coupon interest rate of 8.5%, paid annually. What is the YTM of the $1000 face value bond that she purchased? 2 ? P5 P6 P7 PB PO P10 s Points 7 Points 5 Points 7 Points a Points 8 Points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started